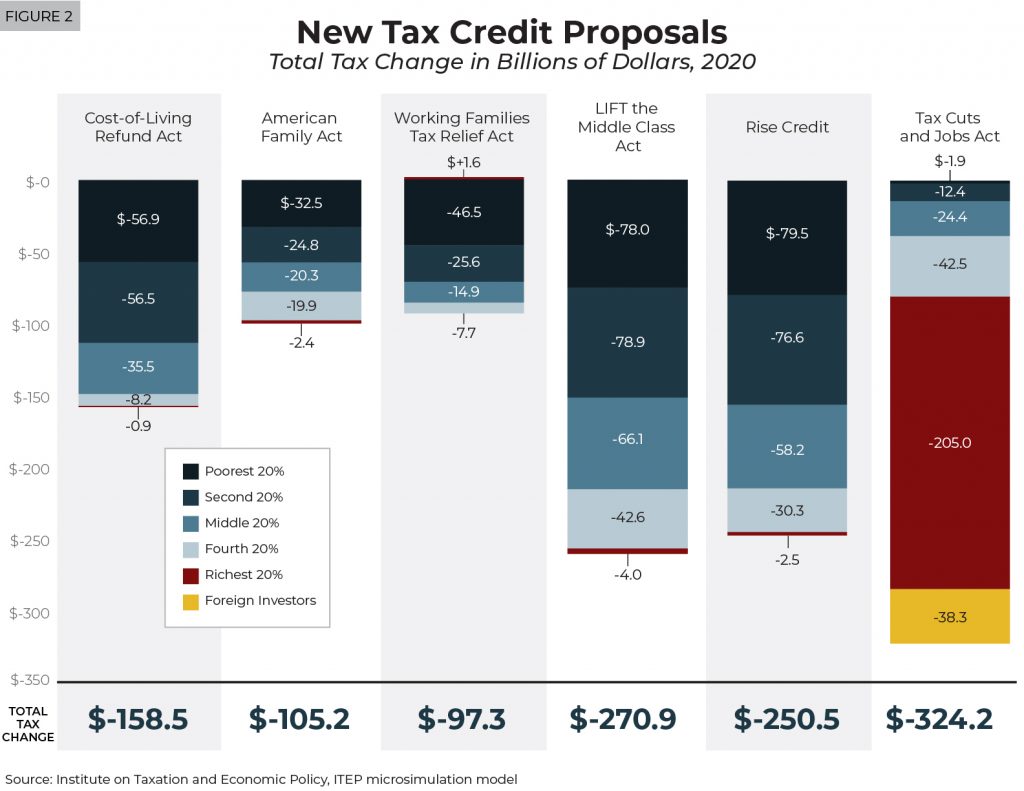

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

Learn more about ITEP analyses of these major federal tax credit proposals and how they compare to the existing Tax Cuts and Jobs Act below.

RELATED: Policymakers have several tools to address economic inequality, stagnating wages & child poverty. A May 2019 ITEP analysis examines how five major tax credit proposals could help address these complex challenges.