Read as PDF

View state-by-state analyses

|

Aidan Davis |

Sophie Collyera a. Columbia Center on Poverty & Social Policy |

|

Executive Summary

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce child poverty and deep poverty in all states while also addressing racial inequities that the current system has exacerbated. This report examines the poverty impacts, costs and beneficiaries of two options for a state-level CTC:

- State-Level Child Tax Credit Option 1: Bring Every Qualifying Child up to Full $2,000 Credit[1]

- State-Level Child Tax Credit Option 2: Bring Qualifying Children 6 and Under up to $3,600 and Older Children to $3,000[2]

Key Findings:

- The federal Child Tax Credit leaves out approximately one-third of children and families who earn too little to get the full credit. However, states do not need to wait for federal action to take state-level action.

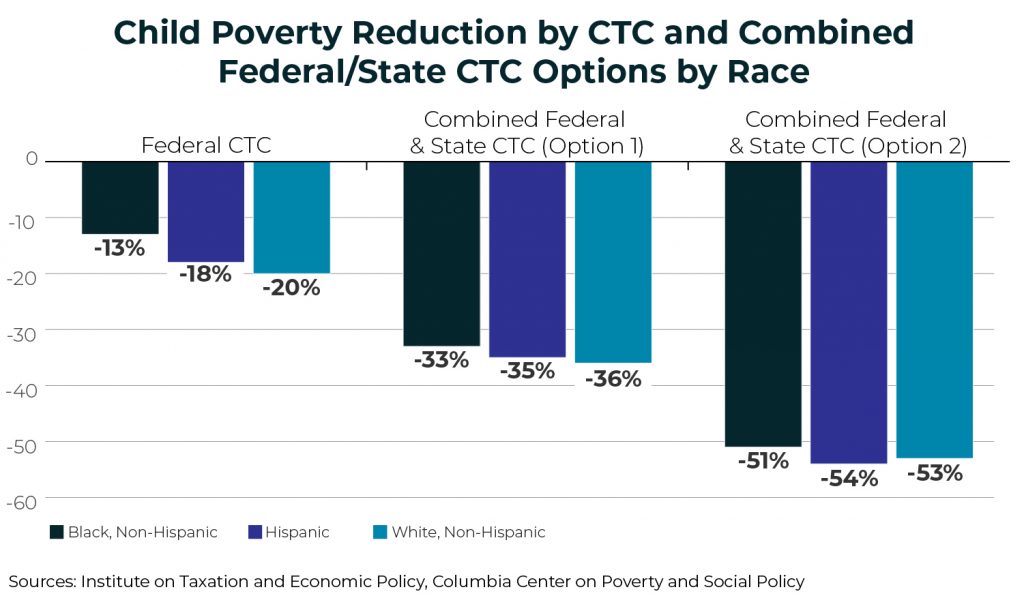

- The most recent expansion to the Child Tax Credit under the Tax Cuts and Jobs Act has a modest effect on child poverty, with even less impact for children of color. The state-level options proposed in this report would significantly reduce poverty for all children and would also help bring poverty reduction for black (non-Hispanic) and Hispanic children in line with white (non-Hispanic) children, who have experienced the greatest extent of poverty reduction under the current federal CTC.

- A state-level CTC would reduce a myriad of inequities that are exacerbated by the tax codes in many states. A refundable state-level CTC is among the most targeted and effective ways to reduce poverty via state-level credits. Indeed, the refundable state-level CTC options in this report would be even more progressive than state-EITC expansions tied to the current federal EITC structure because the benefits are highly targeted to the lowest-income families with children.

- Under our less-costly first option, all but four states would see child poverty reduced by over 15 percent, and 18 states would see child poverty reduced by over 25 percent. The biggest child poverty reductions would be in southern states and midwestern states. Many states would achieve major reductions in child deep poverty, with deep poverty among children declining by over 25 percent in 39 states.

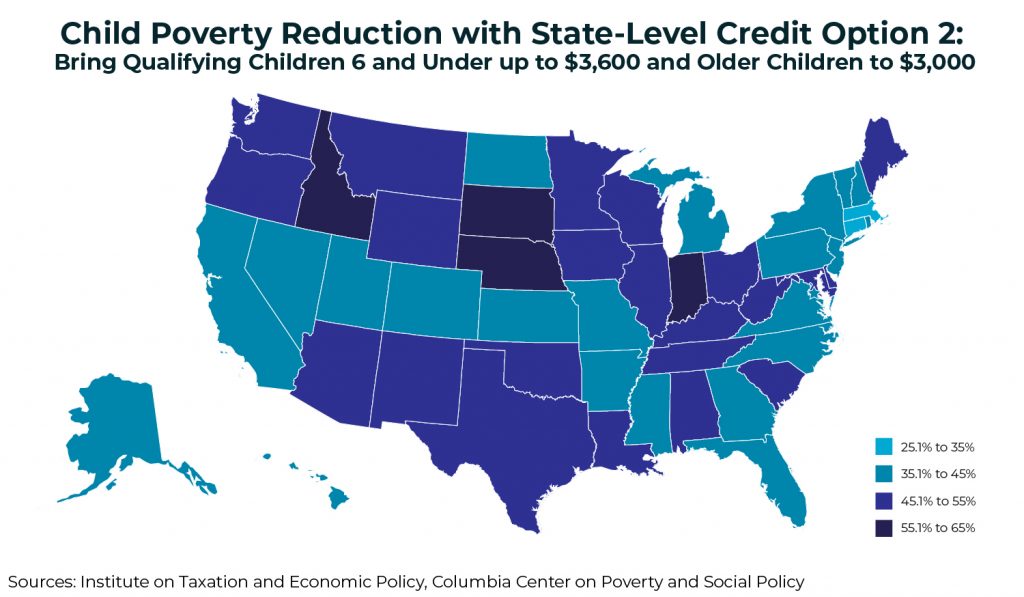

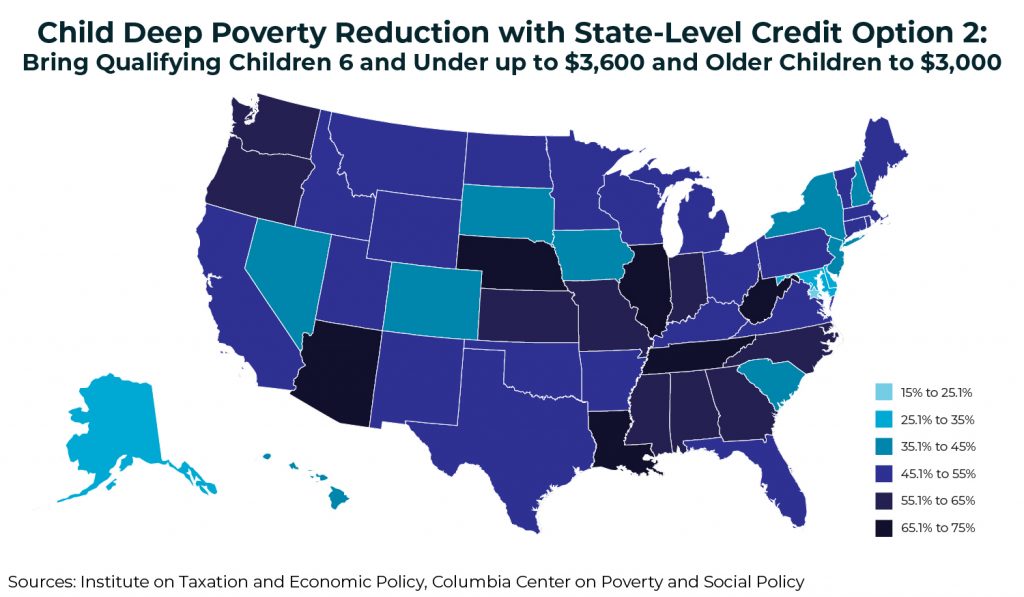

- Under a more-ambitious second option modeled after the newly proposed federal American Family Act, all states would see more than 25 percent reduction in child poverty. Twenty-seven states would see child poverty reduced by over 45 percent and 38 states would see child deep poverty reduced by over 45 percent. There would be steep reductions in child poverty in Idaho, South Dakota, Nebraska, and Indiana, and steep reductions in child deep poverty in Illinois, Louisiana, West Virginia, and Arizona.

We identify two state-level CTC options for consideration in this report. Note that these options are bold and come with a cost. They also come with the benefit of dramatic reductions in child poverty, steps to lessen existing racial inequalities and movement toward reversing upside-down state and local tax systems that ask more of low- and middle-income families than the wealthy. States can consider a range of options to fund these highly-effective credits with well-documented impacts on child poverty. Specific revenue raising options vary by state, but lawmakers should acknowledge and tap into the revenue potential of taxing their wealthiest residents and profitable corporations who receive preferential treatment under most states’ tax codes. That said, there are a series of policy design options that states could consider in creating a state CTC resulting in lower costs and poverty impacts, and other options that cost more and have larger impacts. These are discussed later in the report.

Introduction

Though child poverty in the United States has fallen substantially since the 1960s (Wimer, Nam, Waldfogel, and Fox, 2016), it remains high. As of 2017, the latest year available on record, the Census Bureau’s Supplemental Poverty Measure – an improved measure of income poverty that counts the value of tax credits and in-kind benefits, among other improvements – shows that 15.6 percent of children under age 18 are in poverty (Fox, 2018). This translates to 11.5 million children in 2017. In addition, 4.8 percent of children were in deep poverty–or under half the SPM poverty line–in 2017. This translates into approximately 3.5 million children across the United States. There is also tremendous variation across states in child poverty rates. Child poverty rates vary from a low of 7 percent, based on the SPM, in Minnesota to 21.1 percent in California (and in the District of Columbia, 24.3 percent).[3] In some states, roughly one in five children remain poor, despite a growing economy and low unemployment rates.[4] Across the nation, there is considerable room to continue to reduce child poverty. This report examines one such policy solution state lawmakers could implement to further reduce child poverty within their states: a refundable state-level Child Tax Credit (CTC).

The vast majority of state and local tax systems are inequitable and “upside-down,” taking a much greater share of income from low- and middle-income families than from wealthy families. And most state and local tax systems worsen income inequality by making incomes more unequal after collecting state and local taxes.[5] A refundable Child Tax Credit (CTC) is one tool that state and local governments have at their disposal to help narrow this gap.[6]

The current federal Child Tax Credit, which provides up to $2,000 per child, is designed to provide an income boost to parents or guardians of children and other dependents. However, many low-income families do not receive the full benefit of the federal credit due to an earnings requirement and lack of full refundability for families with low incomes. Children with parents or guardians who have less than $2,500 in earnings are ineligible for the federal CTC. Families above this earnings requirement receive a federal CTC worth 15 percent of each dollar of earnings over $2,500 until reaching a maximum credit of $2,000 per child. The CTC is also only partially refundable, so families can only receive $1,400 per child in the form of a tax refund.[7] For example, a married couple with two children and more than $2,500 in earnings receives a partial credit until their earnings reach $36,400. Thus, the current CTC has a “trapezoid like” structure, with some families too poor to receive any credit, some in the phase-in range, some benefitting from the full credit, some in the phase-out range, and some families who earn too much to receive the credit. Because of this, one-third of children are in families who earn too little to receive the full Child Tax Credit.

A state-level CTC could redress some of the shortcomings of the current federal credit. By eliminating the requirement for earnings, along with the phase-in, and making the credit fully refundable, families most in need would become eligible for the full benefit. By implementing full refundability at the state level, rather than partial refundability with a phase-in to the full credit, qualifying recipients whose credits exceed taxes owed would receive a refund for the portion of the credit that exceeds their income tax bill. Refundable credits therefore can be used to help offset all taxes paid–not just income taxes–thereby counteracting some of the regressive effects of state and local sales, excise, and property taxes paid by everyone. At the same time, refundable state Child Tax Credits could provide an income boost to the lowest-income families. Both of the proposed state-level CTC options in this paper are fully-refundable and involve eliminating the earnings requirement and phase-in, which would help achieve the goal of further reducing child poverty overall and within states, while also redressing inequities in state tax codes.

Changes to Federal Child Tax Credit Under the Tax Cuts and Jobs Act Left Millions of Children and Families Behind

Federal tax cuts under the 2017 Tax Cuts and Jobs Act (TCJA) are largely tilted toward high-income households and foreign investors, doing little to benefit low- and middle-income families. In 2018, 70 percent of tax cuts under TCJA will go to the top 20 percent of taxpayers.[8]

The TCJA included changes to the federal Child Tax Credit, but it partially or entirely left out more than 24 million low- and moderate-income children. The tax law increased the credit from $1,000 to $2,000 per child, but left in place an earnings requirement (lowered from $3,000 to $2,500). It capped refundability at $1,400 rather than $2,000 per child, and left the phase-in rate at 15 percent. More than 10 million children in the lowest-income working families—who currently receive a partial CTC or no credit at all—received either no benefit from the change or only a small increase valued between $1 and $75. Another 14 million children in low- and moderate-income working families received a CTC increase of more than $75, but less than the full $1,000 increase per child that families at higher income levels received.[9] TCJA also stripped working families with children born outside of the United States of the CTC by requiring children to have social security numbers to receive the credit.

The poverty impacts of the federal CTC increase under TCJA are also small relative to its cost, which will exceed $68 billion in 2019.[10] Data that allow us to isolate the TCJA’s impact on the poverty rate is not yet available, but it is possible to simulate the effect that the TCJA is likely to have using data from earlier years.[11] The results from this simulation show that the federal CTC’s increase under the TCJA is likely to marginally reduce poverty among children by roughly 5 percent – from 15.6 percent to 14.8 percent, moving 550,000 children above the poverty line. The increase also has a small impact on deep poverty among children, with the deep poverty rate falling from 4.8 percent to 4.6 percent.

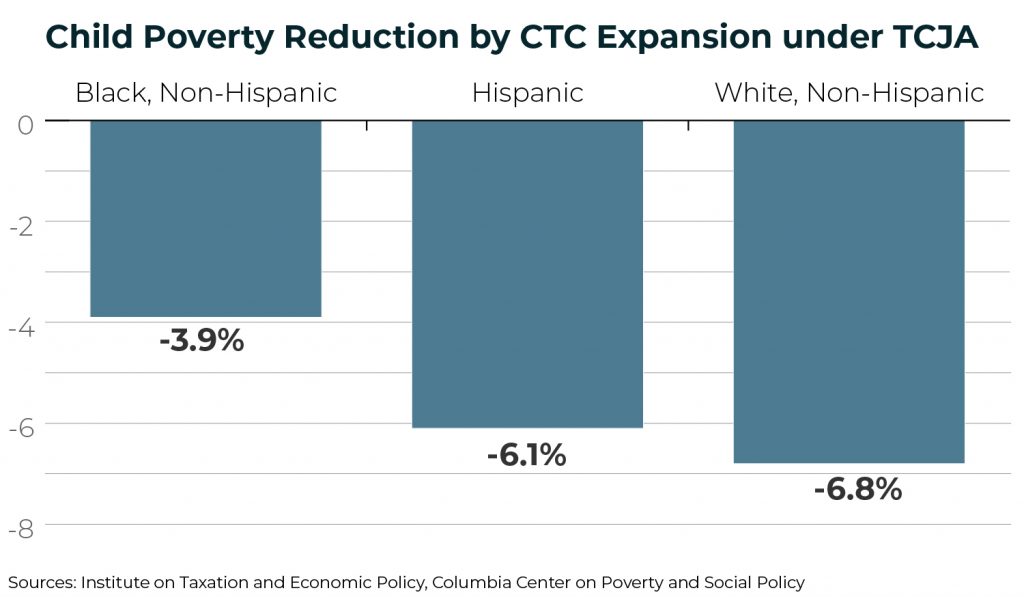

These impacts also vary considerably across children of different races and ethnicities. For example, Figure 1 shows the percent reduction in the child poverty rate associated with the federal CTC increase under the TCJA for black (non-Hispanic), white (non-Hispanic), and Hispanic children.[12] The federal CTC expansion under TCJA reduces poverty among white (non-Hispanic) children by nearly 7 percent, and its impact is slightly lower for Hispanic children (6.1 percent). But the TCJA’s CTC increase reduces poverty among black (non-Hispanic) children by only 3.9 percent (see Figure 1). The poverty reduction of the federal CTC increase under TCJA is, thus, quite modest overall and even more so for children of color, particularly when compared to the poverty impacts associated with a fully refundable CTC, such as options 1 and 2 proposed in this report.

FIGURE 1

Making the case for a state-level Child Tax Credit

On Feb. 28, 2019, the non-partisan National Academy of Sciences released a consensus plan to cut child poverty in half. The two policy proposals that had the biggest impact on poverty reduction were both versions of an expanded Child Tax Credit.

The federal CTC is the single largest federal expenditure for children, yet it leaves out approximately one-third of children and families who earn too little to get the full credit. Rural families, larger families (those with multiple children), families of color, military families, and families with young children are disproportionately left out. The simplest and most sweeping way to fix these inequities would be through federal legislation that made children in families who earn too little to get the full credit in its current form eligible for the credit (see text box below). Such current federal proposals that would accomplish this goal have been proposed, but their likelihood of passing into law in the immediate future remains unclear. In the meantime, individual states could take matters into their own hands.

Federal CTC expansion proposalsIn March of this year, Sens. Michael Bennet and Sherrod Brown and Reps. Rosa DeLauro and Suzan DelBene introduced the American Family Act, which would extend CTC eligibility to the one-third of children and families who earn too little to get the full credit, increase its value to $3,600 for children under age six and to $3,000 for older children, pay the credit to families in monthly installments, and extend the benefits to families in Puerto Rico and the other territories. The AFA was closely modeled after proposals from leading academics to make significant reductions in child poverty in the United States.[13] The Child Tax Credit proposed in the American Family Act (AFA) would cut child poverty by nearly 40 percent, deep child poverty by 50 percent, and essentially end $2 a day poverty for families with children. There are now 38 senate sponsors of the legislation and the House companion has over 175 sponsors.[14] A range of scholars, from Nobel Laureate Angus Deaton, to Harvard’s William Julius Wilson, to the heads of academic poverty centers across the country also support this proposal. While not as expansive as the AFA, the Working Families Tax Relief Act, introduced by Sens. Sherrod Brown, Michael Bennet, Richard Durbin and Ron Wyden in April 2019 would also expand the current federal CTC by making it fully refundable and boosting the credit to $3,000 for young children. |

State lawmakers do not need to wait for Congress to act. They have an opportunity to move immediately to address both the inequities embedded in the federal CTC by expanding eligibility to those left out and further reduce child poverty by increasing the value of the CTC. A recent California proposal demonstrates that expanding eligibility of the CTC to those left out of the federal CTC would cut deep child poverty by nearly one-third (Wimer, Collyer, and Harris, 2018). A recent analysis (Collyer, Wimer, and Harris, 2019) shows that for poverty reduction, expanding eligibility of the CTC to those left out has an even bigger impact than increasing the current value of the CTC alongside existing eligibility requirements.

In this paper, we expand on prior work in two ways. Since extending eligibility for the CTC to families who earn too little to get the full credit has the biggest impact on poverty reduction, we examine the cost and poverty reduction potential of a state-level CTC for families who are left out of the federal CTC in all 50 states and the District of Columbia (Option 1). And because increasing the value of the CTC has additional poverty impacts, we also show the cost and poverty reduction potential of a state-level CTC that builds on this initial proposal by increasing the CTC for young children to $3,600 and for older children to $3,000, as proposed in the American Family Act (Option 2).

Given the upside-down nature of state and local tax systems, it is important that lawmakers take steps to ensure that the wealthy pay their fair share and that low-income families are not faced with the highest effective tax rates. Each of the proposed state-level CTC options in this report provide the largest tax cut (as a percentage of income) to families at the bottom of the income scale, with the bulk of the benefit going to families in the bottom 80 percent in each state (see accompanying supplementary state pages at the end of the report).

A targeted, refundable state-level CTC should be of special interest in states that have coupled their tax law to the federal tax changes implemented under the TCJA. Many states with tax systems that closely mirror the federal system opted to implement changes made under TCJA in their state tax code. For example, some states eliminated their personal and dependent exemptions, which increased tax liabilities for taxpayers with children, but did not provide an offsetting refundable CTC. As a result, many low-income families with children in those states are likely to experience state income tax increases. These states include Colorado, New Mexico, North Dakota, South Carolina, and the District of Columbia (which lowered its exemption).

The current lack of widespread state-level Child Tax Credits, coupled with documented benefits of a fully-refundable CTC, make state-level investments all the more important and timely. In the remainder of this report, we present estimates of the potential for state-level CTCs to reduce child poverty in all 50 states, plus the District of Columbia.[15]

Existing state CTCs are limitedThirty states have Earned Income Tax Credits[16], yet only a handful have state Child Tax Credits. Existing state-level CTCs are limited in breadth and scope. Only two states, Oklahoma and New York, have credits directly tied to the federal Child Tax Credit. Oklahoma offers a choice between a nonrefundable credit worth 5 percent of the federal credit or a nonrefundable credit worth 20 percent of the federal Child and Dependent Care Tax Credit. The state limits the credit to taxpayers with incomes under $100,000. But like the federal CTC, the credit remains limited in its reach to families in or on the verge of poverty. New York has a refundable credit worth $100 per qualifying child or 33 percent of the taxpayer’s allowable federal credit, whichever is greater. Lawmakers in New York opted to decouple their state credit (the Empire State child credit)[17] from changes to the federal CTC, so they continue to maintain a maximum credit of $330 (the pre-TCJA maximum) and other pre-TCJA tax parameters. A handful of other states have Child Tax Credits that are best thought of as state CTCs in name only. Idaho and Maine recently added nonrefundable dependent credits to replace previously existing personal exemptions. Similarly, California offers personal credits in the place of exemptions. These states have a refundable, income-limited dependent credit that is higher than the state’s personal credit for filers. The majority of states offer a dependent exemption. Colorado approved a refundable, income-limited credit for children under 6, but the credit remains in limbo having not received funding from the state legislature. In 2018, Utah began to provide a limited CTC to account for some of the changes under TCJA while Wisconsin provided a one-time $100 child tax rebate with no certainty it will become permanent policy. Lawmakers in Idaho, Maine and Utah could build upon their limited Child Tax Credits by increasing their value and making them fully refundable. |

State-Level Child Tax Credit Option 1: Bring Every Qualifying Child up to Full $2,000 Credit[18]

In option 1, we create a state-level version of the Child Tax Credit, which provides a fully-refundable credit to those left out of the federal CTC. Doing so allows states to piggyback on the existing federal CTC. All families currently not receiving the full $2,000 per otherwise eligible child under the federal CTC–except for those whose earnings are too high to receive the credit–would receive a state-level credit that would bring their combined state and federal credits to a full $2,000 per child. Where the federal CTC falls short, the state would fill in the difference by eliminating the earnings requirement and eligibility phase-in and making the credit fully refundable. Doing so would create an incredibly progressive tax credit targeting the greatest benefits to the lowest-income families, with the credit tapering off as income increases. For example, families who are currently limited to receiving a federal credit of $1,400 per child would receive an additional $600 state credit. For the very lowest-income families with children, a targeted state-level CTC could be an even more effective tool for poverty reduction than an expansion of state-level Earned Income Tax Credits.

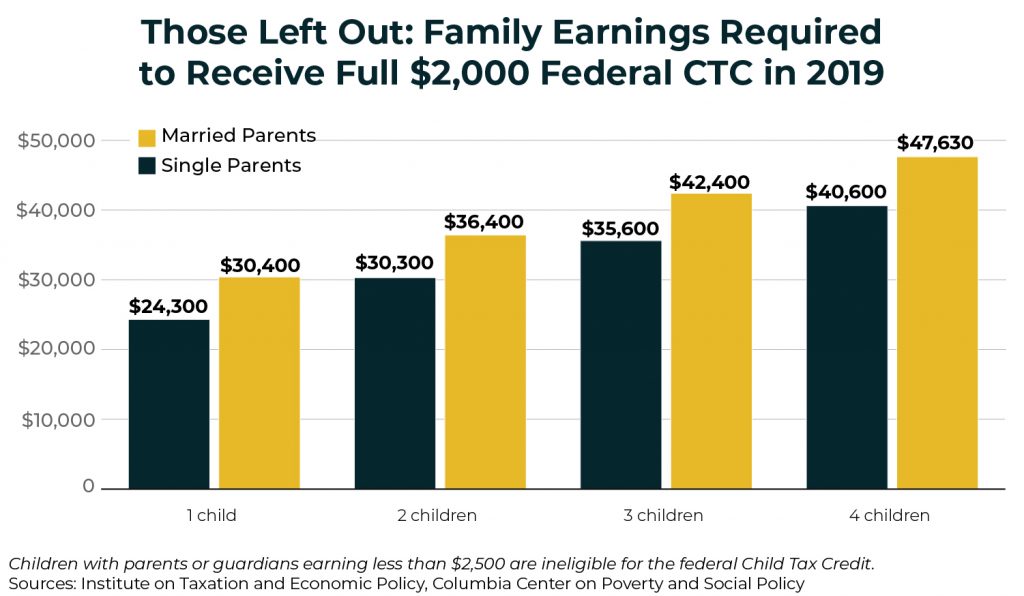

Figure 2 shows the amount of earnings that families of various filing status and size would need to earn in 2019 to receive the full $2,000 federal CTC. Thus, families with earnings under these amounts stand to benefit under Option 1.

FIGURE 2

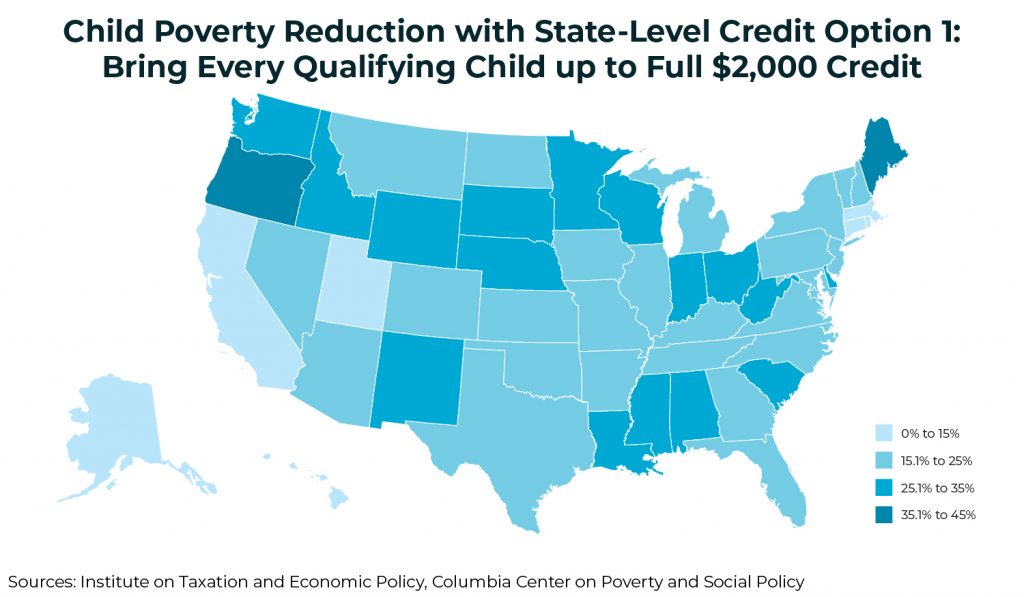

Creating a fully-refundable state-level CTC for those left out of the federal credit would have significant impacts on child poverty in all 50 states (and the District of Columbia). Figure 3 shows the poverty reduction for children that would occur (by state) if all children received the full $2,000 per child benefit that higher-income families receive under TCJA law. With this option, all but four states would see child poverty reduced by over 15 percent, and 18 states would see child poverty reduced by over 25 percent. The biggest child poverty reductions would occur in southern states like South Carolina, Louisiana, Mississippi, and Alabama, but also Midwestern states like Wisconsin, Indiana, Nebraska and Ohio, and other states like New Mexico, Oregon, Idaho and Maine.

FIGURE 3

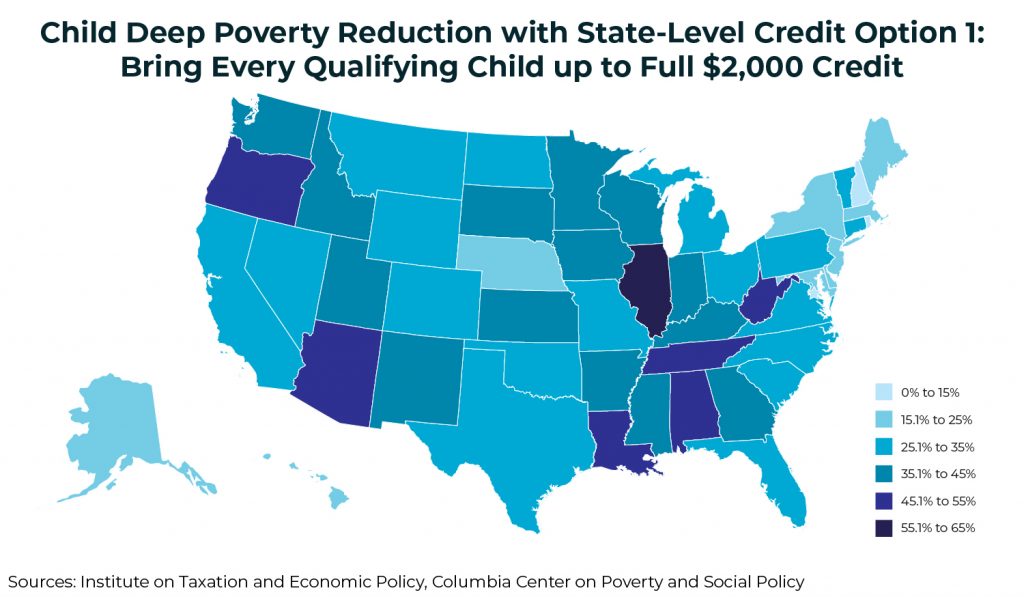

Many states would also achieve major reductions in child deep poverty. Deep poverty is defined as under half the poverty line. Figure 4 shows the reduction in child deep poverty across states. Thirty-nine states would see deep poverty among children reduced by more than 25 percent. Large states like Illinois and Arizona would especially benefit, as would southern states like Louisiana, Alabama, Tennessee and West Virginia.

FIGURE 4

The cost of this option would range from $38 million in New Hampshire to $3.4 billion in California, where it would benefit upwards of 6.4 million adults and children.

Tables 1A and 1B in Appendix A show option 1’s poverty and deep poverty reduction for each individual state along with the implications of the policy on tax equity. The supplemental 50-state pages that follow detail, for each state: (a) number of beneficiaries; (b) estimated costs in 2019 dollars;(c) average tax change as a percentage of income by income group; (d) average tax cut for beneficiaries; and (e) the share of taxpayers receiving a tax cut under this option.

State-Level Child Tax Credit Option 2: Bring Qualifying Children Six and Under up to $3,600 and Older Children to $3,000[19]

In option 2, we build on option 1 by also showing the effects of increasing the total combined federal and state credit to $3,600 for children under age six and to $3,000 for older children. Doing so creates a state equivalent of the federally proposed American Family Act. Costs here will clearly be higher–as will the impacts on poverty. For purposes of this analysis, we maintain the federal CTC phase out levels that existed until the recently passed Tax Cuts and Jobs Act. These earlier phase outs began at $110,000 for joint filers and $75,000 for single filers. Keeping these lower phase-out ranges allows our proposal to focus the tax benefit on low- and middle-income families, while maintaining the same poverty impacts and lowering the costs.

For example, a family earning $50,000 with two children ages five and eight currently receives a federal CTC of $4,000 ($2,000 per child). This family would not qualify for a state-level credit under Option 1. Under Option 2, the family would receive a state-level credit of $2,600 (a boost of $1,600 for their child under 6 and a $1,000 boost for the older child).

Option 2 has an even greater impact on child poverty reduction than option 1. Figure 5 shows the child poverty reduction by state under benefit levels specified by the AFA. With more generous levels all states would benefit greatly. Twenty-seven states would see child poverty reduced by more than 45 percent, with particularly steep reductions in Idaho, South Dakota, Nebraska and Indiana.

FIGURE 5

The policy would also make major dents in deep child poverty across the Midwest, South, and West as seen in Figure 6. Thirty-eight states would see child deep poverty reduced by over 45 percent, and 16 states would see child deep poverty reduced by over 55 percent.

FIGURE 6

The cost of this option would range from $171 million in Wyoming to $12.1 billion in California, where it would benefit upwards of 13 million adults and children. While the price tag of this option is steeper than that of Option 1, the impact on poverty reduction is also far greater.

Tables 2A and 2B in Appendix B show option 2’s poverty and deep poverty reduction for each individual state along with the implications of the policy on tax equity. The supplemental 50 state pages that follow detail: (a) number of beneficiaries; (b) estimated costs in 2019 dollars; (c) average tax change as a percentage of income by income group; (d) average tax cut for beneficiaries; and (e) the share of taxpayers receiving a tax cut under this option.

State-Level Options and Poverty Impacts by Race

As discussed earlier, the poverty impacts associated with the federal Child Tax Credit increase under the TCJA vary significantly between children of different racial and ethnic groups, and this difference is even more pronounced when looking at the impact of the total federal CTC that families receive under TCJA.[20] The federal CTC reduces poverty by 20 percent for white (non-Hispanic) children and just 13 percent for black (non-Hispanic) children, as shown in Figure 7 below. When the federal CTC is combined with the two versions of a state-level credit explored in this report, however, the antipoverty impacts are increased and are distributed more equally across racial and ethnic groups. With option 1, a maximum state credit of $2,000 per child, the combined federal/state credit reduces the poverty rate by 36 percent for white, non-Hispanic children, 35 percent for Hispanic children, and 33 percent for black, non-Hispanic children.[21] For option 2, a maximum state credit of $3,600 per young child and $3,000 per older child, the poverty impacts are further increased and the gap in the impacts for children of different races is similarly narrowed.

FIGURE 7

Other Considerations for Designing State-Level Child Tax Credits

For purposes of this report, we only model the two options described above. That said, there are a series of other policy design options that states could consider in creating a state-level Child Tax Credit with different costs and poverty impacts. States looking for a less expensive starting point could begin by limiting option 1 to children under age 6, where evidence shows the largest returns for children’s eventual outcomes, or even to children under age 3 where long-term gains might be largest. States looking for deeper poverty reductions could create a state-level CTC that specifically targets this group. Such options would maintain the progressivity of option 1, while allowing states to tailor their policies to their individual budgets and poverty-reduction goals.

The TCJA restricts CTC eligibility to children with Social Security Numbers, which has implications for who would benefit and who would be left out. States could continue such restrictions or choose to extend eligibility to children without legal status. We recognize that this is an area for further research and hope to examine the implications of such policy choices both in terms of costs and poverty reduction in future research.

While the focus of this report is on providing options to the 50 states and the District of Columbia to expand Child Tax Credits, localities could also create CTCs. We have not estimated the costs and impacts of such policies here, but the range of state estimates suggest that there are affordable options for localities that would boost the incomes of children and families and reduce poverty. Though not included in this analysis, Puerto Rico and other U.S. territories could also adopt their own Child Tax Credits in the absence of federal action.

Conclusion

Given the stubbornly high rate of child poverty, federal lawmakers are weighing a range of improvements to the existing federal Child Tax Credit. State lawmakers, however, do not need to wait for congressional action to make major strides in lifting thousands to millions of children within their states out of poverty. A state-level CTC is a tool that states can employ to remedy the inequities created by the current structure of the federal CTC, which leaves out approximately one-third of children and families who earn too little to receive the credit. Lawmakers can design a targeted and effective CTC to reduce child poverty while also addressing tax and racial inequities. This report identifies two options to do just that. Both options would result in steep reductions in both poverty and deep poverty among children in virtually all states. Alternative policy designs could accomplish the same goals at different costs alongside states’ specific budget and policy priorities.

Methodology

Determining the Poverty Impacts of a State-Level Child Tax Credit

Data and Measures

The poverty impacts of the state-level credit options modeled in this report were assessed using the Supplemental Poverty Measure (SPM). This measure account for benefits from the tax system and other non-cash sources, making it a more comprehensive measure of income poverty. The estimates are based on the three most recent years of data — 2016, 2017, and 2018 — from the Annual Social and Economic Supplement (ASEC) to the Current Population Survey (CPS), the national household dataset used to calculate annual poverty statistics. Three years of data provide more reliable estimates at the state level. When combined, these three years of data calculate the average poverty for calendar years 2015 to 2017. Importantly, tax filers in these survey years were subject to tax law before the recent Tax Cuts and Jobs Act. To adjust for changes to the tax code under TCJA, the tax data used in this analysis was updated using National Bureau of Economic Research’s TAXSIM 27 tax calculator.[22] These adjustments provide estimates of what federal tax credit values and the poverty rate would have been in calendar years 2015 to 2017 had TCJA been in effect in those years. For this reason, our baseline poverty estimates differ from published sources somewhat.

Modeling State-Level Credit Option 1

When combined with the federal Child Tax Credit, the first state-level CTC modeled in this report (option 1) guarantees a total credit of $2,000 per child for all individuals with dependent children who do not receive the full federal credit because of its credit’s earnings requirement, phase-in, and refundability cap. Under this option, the state-level credit would equal the difference between the maximum credit an individual with dependent children could receive ($2,000 per child) and their federal CTC.

The model that estimated of the impact of this state-level credit option on state-level child poverty rates first identified all individuals in the ASEC with dependents under age 17 and then calculated the value of their federal CTC using the National Bureau of Economic Research’s TAXSIM 27 tax calculator. The model then identified those individuals with dependent children (<17) who would be eligible for the state-level credit because they received a federal credit that was less than the maximum credit of $2,000 per dependent child and had adjusted gross incomes below the federal CTC’s phase-out thresholds.[23] The value of the state credit for these qualifying individuals was calculated as the difference between the maximum credit they could receive and their federal CTC. This state-level credit value was then added to the household resources used to determine poverty status, and each household’s poverty status was recalculated with the new credit to calculate the post-credit poverty rate for each state.

Modeling State-Level Credit Option 2

The second state-level credit modeled in this report builds on option 1 by guaranteeing a total credit of $3,000 per child ages 6 to 16 and $3,600 per child under 6 for single-filers with adjusted gross incomes (AGI) under $75,000 and joint filers with less than $110,000 in AGI. Above these thresholds, the additional credit portion (i.e., the portion that exceeds $2,000 per child credit that these families receive through the federal CTC) phases out at a rate of $50 per thousand dollars in earnings. Again, the state-level would be calculated as the difference between the maximum credit an individual with dependent children could receive and their federal CTC.

The model that estimated the poverty impacts of this state-level credit option was largely similar to the model for the first option, but the maximum credit values used to determine the state-level credit values were adjusted using the higher credit-values and the phase-out thresholds and rates specified in this option. Estimates of AGI were calculated using TAXSIM 27.[24]

Determining estimated costs, average benefit, and number of beneficiaries

The cost estimates and beneficiary information contained in this report are based on data from the ITEP Microsimulation Tax Model. The ITEP Model is based on a large database of tax return information created by the Internal Revenue Service (IRS) and is supplemented with data from the U.S. Census, Commerce Department, Congressional Budget Office, and numerous other sources. The result is a representative profile of the nation’s population, and of each state, against which both current tax laws and potential changes to those tax laws can be computed by running ITEP’s tax calculator on each observation contained inside the Model. Additional discussion of the model is available at: https://itep.org/itep-tax-model.

Appendix A

Table 1A: Poverty Reduction and Number of Children Moved out of Poverty by State-Level Credit Option 1

| State | Poverty Rate Pre-Credit | Poverty Rate Post Credit | % Reduction in Child Poverty | Number of Children Lifted out of Poverty | Deep Poverty Rate Pre-Credit | Deep Poverty Rate Post Credit | % reduction in Deep Child Poverty | Number of Children Lifted out of Deep Poverty |

| Alabama | 16.3% | 11.5% | 29% | 49,000 | 6.0% | 3.2% | 47% | 29,000 |

| Alaska | 11.4% | 9.7% | 15% | 3,000 | 4.7% | 3.7% | 20% | 2,000 |

| Arizona | 16.2% | 12.2% | 25% | 62,000 | 5.5% | 3.0% | 46% | 39,000 |

| Arkansas | 13.1% | 10.0% | 24% | 21,000 | 5.1% | 3.3% | 37% | 13,000 |

| California | 19.9% | 17.1% | 14% | 247,000 | 5.1% | 3.4% | 33% | 143,000 |

| Colorado | 10.3% | 7.9% | 24% | 29,000 | 3.1% | 2.3% | 26% | 10,000 |

| Connecticut | 15.2% | 13.4% | 12% | 13,000 | 5.4% | 3.5% | 35% | 13,000 |

| Delaware | 11.9% | 8.6% | 27% | 6,000 | 2.8% | 2.4% | 17% | 1,000 |

| District of Columbia | 22.8% | 17.9% | 22% | 6,000 | 4.6% | 4.1% | 11% | 1,000 |

| Florida | 19.6% | 15.8% | 20% | 152,000 | 6.1% | 4.2% | 31% | 75,000 |

| Georgia | 18.3% | 14.5% | 21% | 91,000 | 6.3% | 4.0% | 37% | 55,000 |

| Hawaii | 15.3% | 13.8% | 9% | 4,000 | 4.0% | 3.2% | 18% | 2,000 |

| Idaho | 8.4% | 5.7% | 32% | 11,000 | 1.9% | 1.2% | 38% | 3,000 |

| Illinois | 13.0% | 11.0% | 15% | 55,000 | 4.0% | 1.7% | 57% | 63,000 |

| Indiana | 12.7% | 9.2% | 28% | 52,000 | 3.8% | 2.4% | 36% | 20,000 |

| Iowa | 8.2% | 6.4% | 23% | 13,000 | 2.5% | 1.6% | 36% | 6,000 |

| Kansas | 9.0% | 7.1% | 21% | 13,000 | 2.9% | 1.9% | 36% | 7,000 |

| Kentucky | 13.4% | 10.3% | 23% | 30,000 | 4.3% | 2.5% | 43% | 18,000 |

| Louisiana | 19.1% | 13.7% | 28% | 57,000 | 6.5% | 3.5% | 46% | 31,000 |

| Maine | 9.2% | 5.8% | 36% | 8,000 | 2.5% | 2.0% | 19% | 1,000 |

| Maryland | 13.2% | 10.7% | 19% | 33,000 | 2.0% | 1.5% | 22% | 5,000 |

| Massachusetts | 11.7% | 10.0% | 15% | 22,000 | 3.7% | 2.9% | 21% | 10,000 |

| Michigan | 12.0% | 9.1% | 24% | 60,000 | 3.2% | 2.1% | 33% | 21,000 |

| Minnesota | 7.4% | 5.4% | 27% | 25,000 | 1.9% | 1.1% | 40% | 9,000 |

| Mississippi | 16.1% | 11.2% | 31% | 34,000 | 4.7% | 2.9% | 39% | 13,000 |

| Missouri | 11.8% | 8.9% | 24% | 38,000 | 4.5% | 3.2% | 29% | 18,000 |

| Montana | 10.0% | 8.3% | 18% | 4,000 | 3.8% | 2.8% | 26% | 2,000 |

| Nebraska | 10.5% | 6.9% | 34% | 16,000 | 2.1% | 1.6% | 23% | 2,000 |

| Nevada | 12.4% | 10.0% | 19% | 16,000 | 4.9% | 3.4% | 31% | 10,000 |

| New Hampshire | 8.4% | 7.1% | 16% | 3,000 | 2.4% | 2.3% | 3% | – |

| New Jersey | 16.0% | 13.3% | 17% | 52,000 | 4.3% | 3.5% | 20% | 17,000 |

| New Mexico | 15.0% | 10.6% | 29% | 20,000 | 4.2% | 2.6% | 39% | 8,000 |

| New York | 16.3% | 13.5% | 17% | 108,000 | 5.1% | 3.9% | 25% | 50,000 |

| North Carolina | 14.4% | 10.9% | 24% | 76,000 | 4.7% | 3.3% | 31% | 32,000 |

| North Dakota | 11.3% | 8.7% | 23% | 4,000 | 5.5% | 3.9% | 28% | 3,000 |

| Ohio | 12.9% | 9.3% | 28% | 89,000 | 4.0% | 2.9% | 28% | 27,000 |

| Oklahoma | 12.4% | 9.8% | 21% | 24,000 | 3.9% | 2.6% | 34% | 12,000 |

| Oregon | 12.9% | 8.3% | 35% | 38,000 | 4.4% | 2.0% | 54% | 20,000 |

| Pennsylvania | 13.7% | 11.2% | 18% | 63,000 | 5.6% | 3.7% | 34% | 48,000 |

| Rhode Island | 9.8% | 8.5% | 14% | 3,000 | 3.2% | 2.7% | 15% | 1,000 |

| South Carolina | 16.1% | 10.6% | 34% | 57,000 | 5.9% | 4.2% | 28% | 17,000 |

| South Dakota | 9.0% | 6.5% | 28% | 5,000 | 1.8% | 1.2% | 36% | 1,000 |

| Tennessee | 13.4% | 10.3% | 23% | 44,000 | 3.9% | 2.0% | 48% | 26,000 |

| Texas | 15.6% | 12.0% | 23% | 247,000 | 4.9% | 3.2% | 35% | 117,000 |

| Utah | 9.1% | 7.8% | 15% | 12,000 | 3.6% | 2.2% | 39% | 12,000 |

| Vermont | 10.8% | 8.5% | 21% | 3,000 | 3.4% | 2.4% | 31% | 1,000 |

| Virginia | 14.1% | 11.7% | 17% | 44,000 | 4.4% | 3.1% | 31% | 24,000 |

| Washington | 11.2% | 8.3% | 26% | 44,000 | 3.9% | 2.3% | 39% | 23,000 |

| West Virginia | 16.0% | 11.8% | 27% | 15,000 | 5.3% | 2.8% | 47% | 9,000 |

| Wisconsin | 9.5% | 6.4% | 33% | 39,000 | 2.3% | 1.4% | 38% | 11,000 |

| Wyoming | 10.1% | 7.4% | 27% | 4,000 | 3.1% | 2.1% | 31% | 1,000 |

Table 1B. Poverty Reduction and Number of People Moved out of Poverty by a Fully Refundable $2,000 State Child Tax Credit

| State | Poverty Rate Pre-Credit | Poverty Rate Post Credit | % Reduction in Poverty | Number of People Lifted out of Poverty | Deep Poverty Rate Pre-Credit | Deep Poverty Rate Post Credit | % Reduction in Deep Poverty | Number of People Lifted out of Deep Poverty |

| Alabama | 13.7% | 12.0% | 12% | 79,000 | 5.4% | 4.4% | 19% | 50,000 |

| Alaska | 11.3% | 10.5% | 8% | 6,000 | 4.7% | 4.3% | 9% | 3,000 |

| Arizona | 14.7% | 13.2% | 10% | 105,000 | 5.3% | 4.4% | 18% | 64,000 |

| Arkansas | 13.5% | 12.2% | 10% | 39,000 | 5.2% | 4.5% | 14% | 21,000 |

| California | 18.3% | 17.2% | 6% | 437,000 | 6.0% | 5.4% | 11% | 261,000 |

| Colorado | 10.7% | 9.8% | 9% | 50,000 | 3.8% | 3.5% | 7% | 15,000 |

| Connecticut | 12.0% | 11.3% | 6% | 24,000 | 4.2% | 3.5% | 15% | 23,000 |

| Delaware | 11.2% | 10.3% | 9% | 9,000 | 4.0% | 3.9% | 4% | 1,000 |

| District of Columbia | 19.8% | 18.5% | 6% | 9,000 | 6.5% | 6.4% | 3% | 1,000 |

| Florida | 17.4% | 16.1% | 8% | 279,000 | 6.4% | 5.8% | 10% | 128,000 |

| Georgia | 15.2% | 13.7% | 10% | 155,000 | 5.8% | 4.9% | 15% | 90,000 |

| Hawaii | 14.3% | 13.8% | 4% | 7,000 | 4.6% | 4.3% | 6% | 4,000 |

| Idaho | 9.6% | 8.5% | 11% | 18,000 | 3.8% | 3.5% | 8% | 5,000 |

| Illinois | 12.0% | 11.2% | 6% | 98,000 | 4.5% | 3.7% | 18% | 103,000 |

| Indiana | 11.5% | 10.2% | 11% | 86,000 | 3.8% | 3.3% | 13% | 32,000 |

| Iowa | 8.3% | 7.7% | 8% | 20,000 | 3.1% | 2.8% | 11% | 11,000 |

| Kansas | 9.8% | 8.9% | 9% | 26,000 | 3.8% | 3.5% | 10% | 11,000 |

| Kentucky | 13.3% | 12.0% | 10% | 57,000 | 4.5% | 3.8% | 17% | 33,000 |

| Louisiana | 17.6% | 15.6% | 11% | 92,000 | 6.9% | 5.7% | 17% | 54,000 |

| Maine | 9.7% | 8.6% | 12% | 15,000 | 2.9% | 2.8% | 5% | 2,000 |

| Maryland | 12.8% | 11.8% | 8% | 57,000 | 3.3% | 3.1% | 6% | 12,000 |

| Massachusetts | 12.5% | 11.9% | 5% | 40,000 | 4.7% | 4.4% | 5% | 17,000 |

| Michigan | 10.8% | 9.7% | 9% | 101,000 | 3.7% | 3.3% | 10% | 35,000 |

| Minnesota | 7.9% | 7.2% | 8% | 37,000 | 2.8% | 2.6% | 10% | 15,000 |

| Mississippi | 15.4% | 13.5% | 12% | 56,000 | 5.5% | 4.8% | 12% | 20,000 |

| Missouri | 10.5% | 9.5% | 10% | 62,000 | 4.4% | 3.9% | 11% | 28,000 |

| Montana | 9.8% | 9.1% | 7% | 7,000 | 4.0% | 3.6% | 10% | 4,000 |

| Nebraska | 9.2% | 7.9% | 14% | 25,000 | 3.2% | 3.0% | 7% | 4,000 |

| Nevada | 12.9% | 12.0% | 7% | 26,000 | 4.9% | 4.4% | 10% | 15,000 |

| New Hampshire | 8.4% | 7.9% | 6% | 6,000 | 2.6% | 2.5% | 3% | 1,000 |

| New Jersey | 14.3% | 13.3% | 7% | 93,000 | 4.5% | 4.1% | 8% | 31,000 |

| New Mexico | 14.7% | 12.9% | 12% | 37,000 | 5.1% | 4.4% | 13% | 14,000 |

| New York | 14.7% | 13.7% | 6% | 184,000 | 4.9% | 4.4% | 8% | 81,000 |

| North Carolina | 13.5% | 12.2% | 10% | 131,000 | 5.1% | 4.6% | 10% | 50,000 |

| North Dakota | 10.3% | 9.3% | 9% | 7,000 | 4.8% | 4.2% | 11% | 4,000 |

| Ohio | 11.0% | 9.8% | 12% | 147,000 | 3.7% | 3.3% | 11% | 48,000 |

| Oklahoma | 11.7% | 10.6% | 9% | 42,000 | 4.1% | 3.6% | 13% | 21,000 |

| Oregon | 12.3% | 10.7% | 13% | 66,000 | 4.7% | 3.9% | 17% | 33,000 |

| Pennsylvania | 11.5% | 10.6% | 8% | 115,000 | 4.5% | 3.8% | 15% | 85,000 |

| Rhode Island | 9.8% | 9.4% | 5% | 5,000 | 3.4% | 3.3% | 5% | 2,000 |

| South Carolina | 13.5% | 11.7% | 14% | 90,000 | 5.6% | 5.0% | 11% | 29,000 |

| South Dakota | 9.7% | 8.6% | 11% | 9,000 | 3.2% | 3.0% | 7% | 2,000 |

| Tennessee | 12.7% | 11.6% | 9% | 73,000 | 4.7% | 4.0% | 14% | 42,000 |

| Texas | 14.2% | 12.7% | 10% | 411,000 | 5.1% | 4.4% | 13% | 189,000 |

| Utah | 9.1% | 8.5% | 7% | 19,000 | 3.9% | 3.2% | 18% | 22,000 |

| Vermont | 9.9% | 9.2% | 7% | 4,000 | 3.8% | 3.5% | 8% | 2,000 |

| Virginia | 14.1% | 13.2% | 7% | 78,000 | 5.6% | 5.1% | 9% | 42,000 |

| Washington | 10.0% | 8.9% | 11% | 80,000 | 3.6% | 3.1% | 13% | 35,000 |

| West Virginia | 13.3% | 11.8% | 12% | 28,000 | 5.0% | 4.2% | 16% | 15,000 |

| Wisconsin | 8.7% | 7.6% | 12% | 61,000 | 3.1% | 2.8% | 10% | 18,000 |

| Wyoming | 10.2% | 9.3% | 9% | 5,000 | 4.1% | 3.7% | 9% | 2,000 |

Appendix B

Table 2A: Poverty Reduction and Number of Children Moved out of Poverty by State-Level Credit Option 2

| State | Poverty Rate Pre-Credit | Poverty Rate Post Credit | % Reduction in Child Poverty | Number of Children Lifted out of Poverty | Deep Poverty Rate Pre-Credit | Deep Poverty Rate Post Credit | % Reduction in Deep Child Poverty | Number of Children Lifted out of Deep Poverty |

| Alabama | 16.3% | 8.3% | 49% | 82,000 | 6.0% | 2.4% | 60% | 38,000 |

| Alaska | 11.4% | 6.7% | 41% | 8,000 | 4.7% | 3.3% | 29% | 2,000 |

| Arizona | 16.2% | 8.5% | 48% | 119,000 | 5.5% | 1.8% | 67% | 57,000 |

| Arkansas | 13.1% | 7.5% | 43% | 38,000 | 5.1% | 2.5% | 52% | 18,000 |

| California | 19.9% | 12.3% | 38% | 659,000 | 5.1% | 2.5% | 51% | 225,000 |

| Colorado | 10.3% | 6.3% | 39% | 48,000 | 3.1% | 1.9% | 39% | 14,000 |

| Connecticut | 15.2% | 10.0% | 34% | 37,000 | 5.4% | 2.6% | 52% | 20,000 |

| Delaware | 11.9% | 5.9% | 51% | 11,000 | 2.8% | 2.0% | 31% | 2,000 |

| District of Columbia | 22.8% | 13.0% | 43% | 12,000 | 4.6% | 3.5% | 23% | 1,000 |

| Florida | 19.6% | 11.4% | 42% | 324,000 | 6.1% | 3.1% | 49% | 117,000 |

| Georgia | 18.3% | 10.3% | 44% | 190,000 | 6.3% | 2.6% | 59% | 88,000 |

| Hawaii | 15.3% | 9.4% | 38% | 17,000 | 4.0% | 2.4% | 39% | 5,000 |

| Idaho | 8.4% | 3.4% | 60% | 21,000 | 1.9% | 1.0% | 50% | 4,000 |

| Illinois | 13.0% | 7.1% | 45% | 162,000 | 4.0% | 1.1% | 73% | 80,000 |

| Indiana | 12.7% | 5.6% | 56% | 105,000 | 3.8% | 1.5% | 61% | 35,000 |

| Iowa | 8.2% | 3.8% | 54% | 31,000 | 2.5% | 1.5% | 41% | 7,000 |

| Kansas | 9.0% | 5.1% | 43% | 27,000 | 2.9% | 1.1% | 62% | 13,000 |

| Kentucky | 13.4% | 7.0% | 47% | 60,000 | 4.3% | 2.2% | 48% | 20,000 |

| Louisiana | 19.1% | 10.4% | 45% | 91,000 | 6.5% | 2.2% | 67% | 46,000 |

| Maine | 9.2% | 4.5% | 51% | 11,000 | 2.5% | 1.2% | 51% | 3,000 |

| Maryland | 13.2% | 6.8% | 48% | 81,000 | 2.0% | 1.3% | 32% | 8,000 |

| Massachusetts | 11.7% | 7.8% | 33% | 50,000 | 3.7% | 2.0% | 46% | 22,000 |

| Michigan | 12.0% | 6.6% | 45% | 110,000 | 3.2% | 1.5% | 52% | 33,000 |

| Minnesota | 7.4% | 3.8% | 49% | 45,000 | 1.9% | 0.9% | 53% | 12,000 |

| Mississippi | 16.1% | 8.2% | 49% | 54,000 | 4.7% | 2.1% | 56% | 18,000 |

| Missouri | 11.8% | 6.7% | 43% | 67,000 | 4.5% | 1.9% | 57% | 34,000 |

| Montana | 10.0% | 5.3% | 47% | 10,000 | 3.8% | 1.7% | 54% | 4,000 |

| Nebraska | 10.5% | 4.2% | 60% | 28,000 | 2.1% | 0.7% | 68% | 6,000 |

| Nevada | 12.4% | 7.5% | 39% | 31,000 | 4.9% | 2.8% | 43% | 14,000 |

| New Hampshire | 8.4% | 5.4% | 36% | 7,000 | 2.4% | 1.4% | 40% | 2,000 |

| New Jersey | 16.0% | 10.2% | 37% | 110,000 | 4.3% | 2.8% | 36% | 29,000 |

| New Mexico | 15.0% | 6.9% | 54% | 38,000 | 4.2% | 2.0% | 54% | 11,000 |

| New York | 16.3% | 10.4% | 36% | 231,000 | 5.1% | 2.9% | 44% | 89,000 |

| North Carolina | 14.4% | 8.0% | 44% | 138,000 | 4.7% | 2.1% | 56% | 58,000 |

| North Dakota | 11.3% | 6.9% | 39% | 7,000 | 5.5% | 2.8% | 49% | 4,000 |

| Ohio | 12.9% | 6.5% | 49% | 157,000 | 4.0% | 1.9% | 54% | 53,000 |

| Oklahoma | 12.4% | 6.2% | 50% | 57,000 | 3.9% | 1.9% | 51% | 18,000 |

| Oregon | 12.9% | 5.8% | 55% | 59,000 | 4.4% | 1.7% | 62% | 23,000 |

| Pennsylvania | 13.7% | 8.0% | 41% | 142,000 | 5.6% | 2.7% | 52% | 73,000 |

| Rhode Island | 9.8% | 5.9% | 40% | 8,000 | 3.2% | 1.6% | 48% | 3,000 |

| South Carolina | 16.1% | 8.4% | 48% | 80,000 | 5.9% | 3.6% | 39% | 24,000 |

| South Dakota | 9.0% | 4.0% | 56% | 10,000 | 1.8% | 1.2% | 36% | 1,000 |

| Tennessee | 13.4% | 7.0% | 47% | 90,000 | 3.9% | 1.2% | 70% | 38,000 |

| Texas | 15.6% | 8.5% | 45% | 487,000 | 4.9% | 2.4% | 50% | 167,000 |

| Utah | 9.1% | 5.6% | 38% | 31,000 | 3.6% | 1.8% | 49% | 15,000 |

| Vermont | 10.8% | 6.2% | 42% | 5,000 | 3.4% | 1.7% | 50% | 2,000 |

| Virginia | 14.1% | 8.5% | 40% | 100,000 | 4.4% | 2.3% | 49% | 38,000 |

| Washington | 11.2% | 6.1% | 45% | 78,000 | 3.9% | 1.7% | 55% | 33,000 |

| West Virginia | 16.0% | 8.7% | 46% | 26,000 | 5.3% | 1.8% | 66% | 12,000 |

| Wisconsin | 9.5% | 4.6% | 52% | 61,000 | 2.3% | 1.2% | 45% | 13,000 |

| Wyoming | 10.1% | 5.1% | 50% | 7,000 | 3.1% | 1.4% | 55% | 2,000 |

Table 2B. Poverty Reduction and Number of People Moved out of Poverty by a Fully Refundable $3,000/$3,600 State Child Tax Credit

| State | Poverty Rate Pre-Credit | Poverty Rate Post Credit | % Reduction in Poverty | Number of People Lifted out of Poverty | Deep Poverty Rate Pre-Credit | Deep Poverty Rate Post Credit | % Reduction in Deep Poverty | Number of People Lifted out of Deep Poverty |

| Alabama | 13.7% | 9.5% | 31% | 202,000 | 5.4% | 3.6% | 33% | 87,000 |

| Alaska | 11.3% | 7.8% | 32% | 25,000 | 4.7% | 3.6% | 23% | 8,000 |

| Arizona | 14.7% | 9.7% | 34% | 342,000 | 5.3% | 3.5% | 34% | 125,000 |

| Arkansas | 13.5% | 9.5% | 30% | 119,000 | 5.2% | 3.5% | 32% | 49,000 |

| California | 18.3% | 13.3% | 27% | 1,969,000 | 6.0% | 4.2% | 31% | 734,000 |

| Colorado | 10.7% | 7.6% | 29% | 170,000 | 3.8% | 3.0% | 21% | 44,000 |

| Connecticut | 12.0% | 8.8% | 27% | 116,000 | 4.2% | 2.8% | 34% | 50,000 |

| Delaware | 11.2% | 7.6% | 32% | 34,000 | 4.0% | 3.3% | 19% | 7,000 |

| District of Columbia | 19.8% | 15.3% | 23% | 31,000 | 6.5% | 5.3% | 18% | 8,000 |

| Florida | 17.4% | 12.7% | 27% | 973,000 | 6.4% | 4.5% | 29% | 377,000 |

| Georgia | 15.2% | 10.5% | 31% | 481,000 | 5.8% | 3.7% | 36% | 210,000 |

| Hawaii | 14.3% | 10.1% | 30% | 59,000 | 4.6% | 3.5% | 25% | 16,000 |

| Idaho | 9.6% | 6.2% | 35% | 57,000 | 3.8% | 2.9% | 23% | 15,000 |

| Illinois | 12.0% | 8.3% | 31% | 467,000 | 4.5% | 2.9% | 35% | 203,000 |

| Indiana | 11.5% | 7.2% | 37% | 281,000 | 3.8% | 2.5% | 34% | 84,000 |

| Iowa | 8.3% | 5.3% | 36% | 93,000 | 3.1% | 2.0% | 37% | 36,000 |

| Kansas | 9.8% | 7.0% | 29% | 81,000 | 3.8% | 2.8% | 28% | 31,000 |

| Kentucky | 13.3% | 9.6% | 28% | 164,000 | 4.5% | 3.0% | 33% | 66,000 |

| Louisiana | 17.6% | 12.4% | 30% | 238,000 | 6.9% | 4.3% | 38% | 120,000 |

| Maine | 9.7% | 6.1% | 37% | 48,000 | 2.9% | 1.7% | 41% | 16,000 |

| Maryland | 12.8% | 8.6% | 33% | 248,000 | 3.3% | 2.5% | 25% | 49,000 |

| Massachusetts | 12.5% | 9.6% | 23% | 198,000 | 4.7% | 3.7% | 21% | 67,000 |

| Michigan | 10.8% | 7.3% | 32% | 340,000 | 3.7% | 2.5% | 33% | 119,000 |

| Minnesota | 7.9% | 5.4% | 32% | 138,000 | 2.8% | 2.0% | 28% | 44,000 |

| Mississippi | 15.4% | 10.3% | 33% | 150,000 | 5.5% | 3.8% | 30% | 49,000 |

| Missouri | 10.5% | 7.6% | 28% | 175,000 | 4.4% | 2.9% | 34% | 88,000 |

| Montana | 9.8% | 6.6% | 33% | 33,000 | 4.0% | 2.5% | 38% | 16,000 |

| Nebraska | 9.2% | 5.8% | 37% | 64,000 | 3.2% | 1.8% | 45% | 27,000 |

| Nevada | 12.9% | 9.3% | 28% | 107,000 | 4.9% | 3.6% | 28% | 40,000 |

| New Hampshire | 8.4% | 6.3% | 25% | 27,000 | 2.6% | 1.9% | 26% | 9,000 |

| New Jersey | 14.3% | 10.5% | 27% | 345,000 | 4.5% | 3.3% | 27% | 108,000 |

| New Mexico | 14.7% | 9.7% | 34% | 103,000 | 5.1% | 3.5% | 31% | 32,000 |

| New York | 14.7% | 10.9% | 25% | 733,000 | 4.9% | 3.4% | 29% | 279,000 |

| North Carolina | 13.5% | 9.6% | 29% | 394,000 | 5.1% | 3.5% | 31% | 163,000 |

| North Dakota | 10.3% | 7.5% | 28% | 21,000 | 4.8% | 3.4% | 29% | 11,000 |

| Ohio | 11.0% | 7.3% | 34% | 427,000 | 3.7% | 2.5% | 32% | 137,000 |

| Oklahoma | 11.7% | 7.5% | 36% | 162,000 | 4.1% | 2.9% | 29% | 46,000 |

| Oregon | 12.3% | 7.9% | 35% | 179,000 | 4.7% | 3.1% | 33% | 64,000 |

| Pennsylvania | 11.5% | 8.1% | 29% | 425,000 | 4.5% | 2.9% | 35% | 198,000 |

| Rhode Island | 9.8% | 6.8% | 31% | 32,000 | 3.4% | 2.5% | 27% | 10,000 |

| South Carolina | 13.5% | 9.3% | 31% | 206,000 | 5.6% | 3.9% | 30% | 83,000 |

| South Dakota | 9.7% | 6.4% | 33% | 28,000 | 3.2% | 2.5% | 22% | 6,000 |

| Tennessee | 12.7% | 8.9% | 30% | 259,000 | 4.7% | 3.0% | 35% | 110,000 |

| Texas | 14.2% | 9.8% | 31% | 1,228,000 | 5.1% | 3.6% | 30% | 422,000 |

| Utah | 9.1% | 6.4% | 29% | 81,000 | 3.9% | 2.5% | 36% | 44,000 |

| Vermont | 9.9% | 7.4% | 25% | 15,000 | 3.8% | 2.8% | 28% | 7,000 |

| Virginia | 14.1% | 10.3% | 27% | 317,000 | 5.6% | 4.3% | 24% | 108,000 |

| Washington | 10.0% | 6.9% | 31% | 228,000 | 3.6% | 2.4% | 34% | 91,000 |

| West Virginia | 13.3% | 9.3% | 30% | 73,000 | 5.0% | 3.3% | 34% | 30,000 |

| Wisconsin | 8.7% | 5.6% | 36% | 181,000 | 3.1% | 2.2% | 28% | 51,000 |

| Wyoming | 10.2% | 7.1% | 31% | 18,000 | 4.1% | 2.9% | 29% | 7,000 |

Download the State-by-State Pages

|

|

Endnotes

[1] Qualifying children are those whose parents or guardians earn too little to receive the full federal CTC.

[2] Qualifying children include those whose parents or guardians have earnings below set phase-out thresholds of $110,000 for joint filers and $75,000 for single and head-of-household filers.

[3] Authors’ calculations using the most recent three years of the Annual Social and Economic Supplement to the Current Population Survey, accessed via IPUMS (Flood et al., 2018).

[4] Note that state variation under the SPM is quite different than under the official measure of poverty, as the SPM allows for higher poverty thresholds in costlier places, whereas official statistics rely on poverty thresholds that do not vary geographically.

[5] The Institute on Taxation and Economic Policy: A Distributional Analysis of the Tax Systems in All 50 States, Sixth Edition, October 2018. https://itep.org/whopays/

[6] While the focus of this report is on state-level Child Tax Credits, localities could also create CTCs that would boost the incomes of children and families and reduce poverty in meaningful ways.

[7] This means that families with a CTC that exceeds their tax liability can only receive $1,400 per child in the form of a tax refund.

[8] Wamhoff, Steve. Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy, Institute on Taxation and Economic Policy. April 10, 2018. https://itep.org/tcja20182026/

[9] Huang, Chye-Ching. Final CTC Changes Don’t Alter Tax Bill Basics: 10 Million Working Family Children Get Little or Nothing, Center on Budget and Policy Priorities. December 15, 2017. https://www.cbpp.org/blog/final-ctc-changes-dont-alter-tax-bill-basics-10-million-working-family-children-get-little-or

[10] The TCJA also included a $500 non-refundable credit for dependents who are ineligible for the Child Tax Credit (for example, dependents who exceed the age requirement). The $68 billion estimate includes the cost of this credit.

[11] The most recent year of data available to calculate national poverty statistics comes from the 2018 Annual Social and Economic Supplement to the Current Population Survey, which calculated poverty for calendar year 2017. Individuals filing taxes in 2018 for their 2017 income were not yet subject to the Tax Cuts and Jobs Act. To isolate the impact of the TCJA’s CTC increase on the child poverty rate, we simulated the TCJA tax laws in the 2018 CPS-ASEC data, determined what the child poverty rate would have been had TCJA been in effect in that year, and compared this estimate to the official child poverty rate for 2017 (14.8 percent and 15.6 percent, respectively).

[12] Sample sizes preclude a full accounting for children of other races and ethnicities, but future work should further examine these potential inequities.

[13] See: Shaefer, H. Luke, Sophie Collyer, Greg Duncan, Kathryn Edin, Irwin Garfinkel, David Harris, Timothy M. Smeeding, Jane Waldfogel, Christopher Wimer, and Hirokazu Yoshikawa. “A universal child allowance: a plan to reduce poverty and income instability among children in the United States.” RSF: The Russell Sage Foundation Journal of the Social Sciences 4, no. 2 (2018): 22-42; Garfinkel, Irwin, David Harris, Jane Waldfogel, and C. Wimer. “Doing more for our children.” NY, New York: Century Foundation (2016).

[14] https://www.congress.gov/bill/116th-congress/senate-bill/690/cosponsors and https://www.congress.gov/bill/116th-congress/house-bill/1560/cosponsors

[15] It is important to note that a territory-level CTCs would also reduce child poverty. Tax policy currently serves families in these areas unevenly relative to the broader federal (and state) tax codes. From an equity perspective, it is crucial that expansions to CTCs also include residents of Puerto Rico and other U.S. territories.

[16] Twenty-nine states plus the District of Columbia.

[17] https://www.tax.ny.gov/pit/credits/empire_state_child_credit.htm

[18] Qualifying children are those whose parents or guardians earn too little to receive the full federal CTC.

[19] Qualifying children include those whose parents or guardians have earnings below set phase-out thresholds of $110,000 for joint filers and $75,000 for single and head-of-household filers.

[20] The total federal CTC that a family receives is equal to the CTC they would have received pre-TCJA plus the TCJA increase.

[21] Note that these are the average results at the national level.

[22] We calculated taxes under TCJA using the National Bureau of Economic Research’s TAXSIM 27. For details, see https://www.nber.org/taxsim/, or Feenberg, D.R., and Coutts, E. (1993), “An Introduction to the TAXSIM Model”, Journal of Policy Analysis and Management, 12(1), 189-194.

[23] The federal CTC begins to phase out at $200 thousand in earnings for single/head-of-household filers and $400 thousand for joint filers.

[24] For details, see https://www.nber.org/taxsim/, or Feenberg, D.R., and Coutts, E. (1993), “An Introduction to the TAXSIM Model”, Journal of Policy Analysis and Management, 12(1), 189-194.