Why the Estate Tax Is Important

For years, wealth and income inequality have been widening at a troubling pace. One study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation’s wealth in 2012, up from 28 percent in 1989.[1] Lawmakers have exacerbated this trend by dramatically cutting federal taxes on inherited wealth, most recently by doubling the estate tax exemption as part of the 2017 Tax Cuts and Jobs Act. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether. This report explains how the percentage of estates subject to the federal estate tax has dropped dramatically from 2.16 percent in 2000 to just 0.06 percent in 2018, a 34-fold decrease in 19 years.

Inheritances account for 40 percent of all wealth and 4 percent of annual household income.[2] Researchers estimate that differences in inheritances explain about 30 percent of the correlation between parent and child incomes—more than IQ, schooling and personality combined.[3] The estate tax is one key tool to moderate the accumulation of dynastic wealth and level the playing field between those who inherit wealth and those who depend primarily on earned income.

In the end, the estate tax is about fairness. The wealthiest families benefit the most from what the government provides: public investments such as roads that make commerce possible, public schools that provide a productive workforce, the stability provided by our legal system and armed forces, the protection of private property. These public investments make America a place where families can earn and sustain huge fortunes.

Tax is Concentrated on the Wealthiest Estates

The most recent estate tax data from the IRS covers estates of those who died in 2013.[4] Combined with data from the Center for Disease Control and Prevention (CDC), the IRS figures show that only 0.18 percent—just two-tenths of 1 percent—of deaths in the United States in 2013 resulted in federal estate tax liability. Under the rules in effect at that time, an individual could leave behind more than $5 million (twice that amount for married couples) without triggering the estate tax. Other provisions allowed even larger estates to avoid the tax in certain circumstances.

Only 0.18 of estates paid federal estate tax in 2013, but many lawmakers nonetheless vowed to shrink it further.

At the end of 2017, Congress enacted the Tax Cuts and Jobs Act (TCJA), which doubled the exemption for the estate tax. In 2018, the first $11.2 million of an estate’s value is exempt ($22.4 million for a married couple). Estates valued at less than this owe no tax at all.[5] These changes are in effect through 2025. If Congress does nothing, the estate tax rules in effect before TCJA will come back into effect.

According to an estimate from the Joint Committee on Taxation (JCT), only 1,800 estates are likely to owe any estate tax in 2018.[6] This would mean that just 0.06 percent of the deaths likely to occur in the U.S. in 2018 will result in estate tax liability.[7]

Put another way, an estimated 99.94 percent of estates will be exempt from paying even a penny in federal estate tax in 2018.

As illustrated in Appendix 1 at the end of this report, the proportion of estates affected by the federal tax in each state is similar to the nationwide percentage.

While the statutory estate tax rate is 40 percent, the effective federal rate (taking into account exemptions and deductions) for those few estates subject to the tax averaged 20.5 percent in 2013. Figure 1 shows that 2.4 percent of the value of taxable estates went to state taxes, 12.6 percent went to charity, and 64.5 percent of the value of those estates went to heirs.

Legislative Changes and the Dwindling Reach of the Estate Tax

While the estate tax has always been limited to a relatively small number of estates, the percentage of deaths resulting in estate tax liability has fluctuated over time due to inflation (as the exemption amounts were not indexed to inflation until recently) and legislative changes to the parameters of the tax. From the time the U.S. enacted the estate tax one century ago, the portion of estates subject to the tax grew until it reached a peak in the mid-1970s at more than 7 percent. The number then fell throughout the 1980s as lawmakers increased the exemption, and the number rose again through the next decade.

The estate tax exemption was $600,000 from the late 1980s until legislation enacted in 1997 allowed for its incremental increase. Then, in 2001, the first round of President Bush’s tax cuts included the gradual repeal of the federal estate tax over several years. The amount of estate value exempt from the tax increased over time, and the tax rate decreased over time, until the federal estate tax disappeared in 2010.

Like all the Bush tax cuts, this break from the estate tax was scheduled to expire at the end of 2010, at which time the pre-Bush rules were scheduled to come back into effect. President Obama and Congress agreed to a compromise at the end of 2010 to (among other things) extend the Bush income tax cuts and partially extend Bush’s estate tax cuts. As part of this deal, lawmakers reinstated the estate tax but with a higher basic exemption of $5 million per spouse and a rate of just 35 percent in 2011 and 2012. Just 0.17 percent of deaths in 2011 resulted in estate tax liability. As part of the fiscal cliff deal reached at the end of 2012, Congress permanently extended the higher base exemption level, indexed it to inflation, and increased the rate from 35 percent to 40 percent. At the end of 2017, the Tax Cuts and Jobs Act doubled the exemption to $11.2 million of an estate’s value ($22.4 million for a married couple). As written, the estate tax changes in TCJA expire after 2025. This means that if Congress does nothing, the rules enacted in the Fiscal Cliff deal will come back into effect.

These changes have led the tax to be far weaker than in the past. Only an estimated 0.06 percent of estates are projected to pay the tax in 2018, but the historical average is 1 to 2 percent. In fact, the tax applies to 34 times fewer estates than it did as recently as 2000. For a more detailed breakdown, see Figure 2.

Debunking Estate Tax Myths

Proponents of repealing the estate tax have put forward several arguments. Some claim that because the deceased has already paid income and payroll taxes on his or her accumulated wealth, the estate tax constitutes double-taxation. Another argument is that the estate tax hinders economic growth. And perhaps the most commonly cited objection is that the tax imposes large burdens on heirs inheriting small family farms and businesses.

The Double Taxation Argument

The double taxation argument is problematic for a number of reasons. The most obvious is that while the tax technically targets estates, it falls for all practical purposes on heirs, who have not paid any previous taxes on these assets and for whom the inheritance is basically a windfall of unearned income.

Equally important is that a large portion of the value of many estates consists of unrealized capital gains that are never taxed. Capital gains (appreciation of assets) are subject to personal income tax when assets are sold. But when an asset is held until its owner dies and then passed on to heirs, the “unrealized” capital gains are exempt from the personal income tax. This is sometimes called the “stepped-up basis” rule because heirs’ basis in such assets is the value when they inherit them, meaning they can sell the assets and only pay income tax on appreciation that occurred after they inherited the asset.

In fact, for estates worth more than $100 million, unrealized capital gains make up around 55 percent of the total value.[8] Without the estate tax, wide swaths of capital gains income would be 100 percent tax-free.

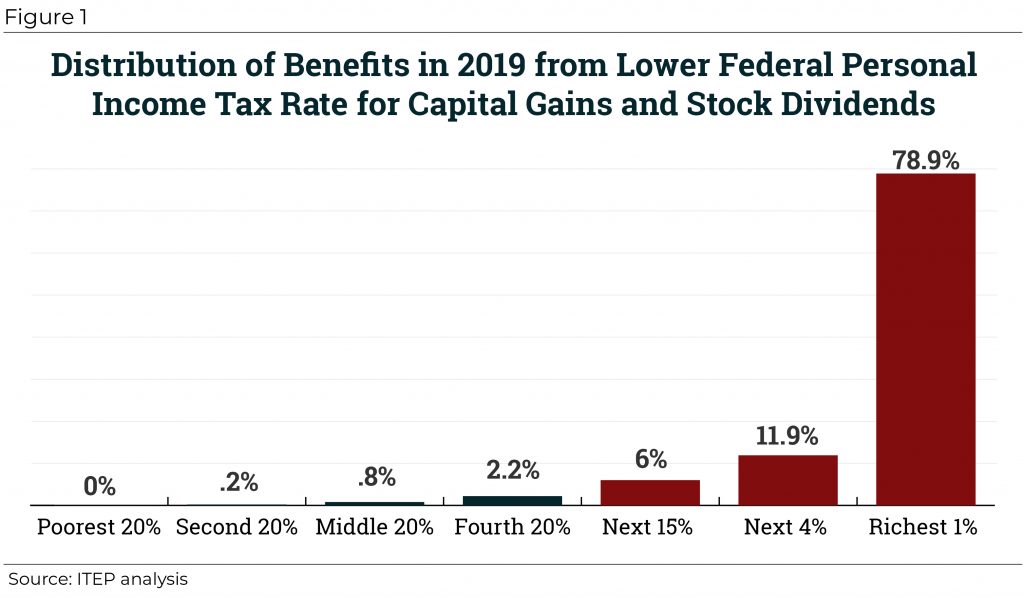

Finally, even the portion of estates that have been previously taxed were likely taxed largely at preferential rates, since much of the income of wealthy taxpayers is in the form of investment income like capital gains and dividends.

The Economic Growth Argument

Another popular talking point among opponents is that the estate tax leads to a lower rate of capital accumulation and creates a drag on economic growth. The reasoning is that if people believe a tax will reduce the estate they can leave to heirs, they will work less and save less to build up that estate. In other words, they are claiming the estate tax results in a bias away from savings and investment and toward greater consumption. A reduction in savings, they argue, leads to a reduction in capital accumulation, which in turn leads to an increase in the return to capital and a decrease in wages.

This argument assumes that the goal of leaving a bequest to heirs has a huge influence on people’s choice between labor and leisure, and between savings and consumption. But empirical research suggests that the desire to leave a bequest to heirs accounts for just 20 percent of the typical person’s decision to save and invest.[9] In other words, most estates are accumulated simply because people earn and save money during their lifetime for all sorts of reasons that are unrelated to any desire to leave wealth to others. [10]

In addition, to the extent that the size of the bequest motivates individuals, it is equally plausible that the estate tax could increase the incentive for them to work and save to achieve a set bequest level. In other words, if an individual wants to leave behind $50 million dollars after taxes to their heirs, then a higher estate tax could increase the amount of value they need to create to achieve that goal.

Another economic consideration is how the size of an inheritance influences heirs’ labor supply decisions. Research has shown that those who receive larger inheritances work less over the course of their lifetimes.[11] Thus, to the extent that the estate tax reduces the amount of wealth left to heirs, this will create an incentive to work more. This increase in productivity will then positively influence economic growth.

The Small Business and Family Farm Argument

Supporters of estate tax repeal argue that heirs to family-owned businesses or farms may be forced to liquidate to cover the tax liability on an inherited estate. However, most Americans probably do not think of a “small business” person as someone whose net worth exceeds $5 million, which was the estate tax exemption for an unmarried person before TCJA doubled it. Of course, a “small business” or “small farm” could be part of a much larger estate that is subject to the estate tax, but there is no evidence that this would threaten their viability. An analysis found that just 20 small farms or businesses (defined as those with $5 million in assets or less and making up at least half the value of an estate) were subject to the federal estate tax in 2017.[12]

The estate tax law includes special provisions to mitigate any harm to family-owned farms and business, including an option to value a property at its “current-use value” rather than its fair-market value and an option to pay the tax in installments over 14 years. In 2013, only 3 percent of estates with positive estate tax liability used this deferral option and only 1.4 percent opted for the alternative property valuation.[13] In 2001, when the exemption amount was much lower and the top estate tax rate stood at 55 percent, the American Farm Bureau Federation—a leading advocate of repealing the estate tax—could not cite a single case of a family losing a farm due to the estate tax.[14]

Moving Forward

The Congressional Budget Office estimates that the estate tax will raise $249 billion over the next 10 years.[15] While the estate tax makes up a relatively small portion of federal receipts, it is one of the most progressive sources of revenue in the federal code and the loss of this revenue would mean either offsetting cuts to federal spending or further deficit increases. Despite the significant revenue cost and the fact that 99.94 percent of estates are already exempt, many lawmakers and special interest groups are continuing to push for repeal of the tax.

One robust approach to restoring the estate tax is the Responsible Estate Tax Act, proposed by Sen. Bernie Sanders (I-VT). His bill would reinstate the $3.5 million exemption and apply graduated tax rates depending on the size of the estate, ranging from 45 percent to 65 percent, and close loopholes in the tax. The bill would raise an estimated $314.8 billion in revenue over the next 10 years.

Former President Obama also included in his budget proposals the restoration of the parameters that were in effect in 2009, including a per-spouse exemption of $3.5 million and a top rate of 45 percent.[16] His proposals also mirrored Sanders in proposing to close various estate tax loopholes.

Restoring the exemption level to $3.5 million would still exempt the vast majority of estates from estate tax. The $3.5 million threshold would mirror the parameters of the tax in 2009 in which only 0.23 percent of estates paid any tax, meaning that 99.77 percent of estates were exempt. See Appendix I for the national and state-by-state impacts.

The Sanders plan would also narrow a major loophole in the estate and gift taxes relating to the use of a vehicle known as the Grantor Retained Annuity Trust (GRAT). A person owning an asset with a quickly rising value may want to “lock in” its current value for purposes of calculating estate and gift taxes before it rises any further. One way is to place the asset in a GRAT, which pays an annuity for a certain time and then leaves the remaining assets to the trust’s beneficiaries. The gift to the beneficiaries is valued when the trust is set up rather than when it’s received by the beneficiaries. This benefit is particularly difficult to justify when the trust has a very short term, and wealthy people have used such short-term trusts to aggressively reduce or even eliminate any tax on gifts to their children. The proposals would require a GRAT to have a minimum term of 10 years, increasing the chance that the grantor will die during the GRAT’s term and the assets will be included in the grantor’s estate and thus subject to the estate tax. An estimate from the Office of Management and Budget found that closing this loophole would raise $18.4 billion over 10 years.[17]Another significant loophole that Sanders proposed to close was the minority discount loophole. Under this tax scheme, estates artificially lower their valuation for tax purposes by claiming that having only a minority interest in a family partnership, even one where no one has a majority control, should substantially devalue that stake. An estimate from the Office of Management and Budget found that disallowing this practice would raise $18.1 billion over 10 years.[18]Changes to the estate tax have also been proposed recently to pay for major spending legislation. In the American House and Economic Mobility Act, Sen. Elizabeth Warren (D-MA) proposed to restore the estate tax exemption to $3.5 million per spouse, raise the rate on larger estates, and close loopholes in order to pay for a massive expansion in affordable housing.[19] In the American Opportunity Accounts Act, Sen. Corey Booker (D-NJ) proposed to restore the estate tax to its 2009 parameters as part of the way it pays for the creation of subsidized savings accounts that would be given to every child at birth.[20]

Ending Stepped Up BasisPolicymakers should also eliminate the rule that exempts unrealized capital gains on assets left to heirs from the personal income tax. Eliminating this so-called “stepped-up basis” rule would mean that unrealized capital gains on assets would be reported as income on the final personal income tax return of the decedent. According to an ITEP analysis, taxing capital gains at death would raise an estimated $876.9 billion in revenue over the next 10 years.[21] A less effective reform would be to replace the stepped-up basis rule with a carryover basis rule, so that when an heir sold an inherited asset, personal income tax would be owed on the appreciation since the asset was originally acquired by the decedent. However, this would be administratively more complex, and would perpetuate the “lock-in effect” where individuals hold onto assets until death to avoid income taxes. |

At a time when wealth is highly concentrated at the top and the nation is facing substantial annual deficits, a robust estate tax serves as a critical device to mitigate growing levels of inequality and provides a stable revenue stream to support necessary public investments.

[1] Emmanuel Saez and Gabriel Zucman, “Wealth Inequality in the United States Since 1913: Evidence From Capitalized Income Tax Data,” Quarterly Journal of Economics, vol. 131, no. 2 (May 2016), pp. 519–578, http://dx.doi.org/10.1093/qje/qjw004.

[2] Lily Batchelder, “The ‘silver spoon’ tax: how to strengthen wealth transfer taxation,” Washington Center for Equitable Growth, October 31, 2016, http://equitablegrowth.org/tax-finance/silver-spoon-tax/.

[3] Ibid.

[4] These data include the estates of individuals who died in 2013 and which were subject to the estate tax rules in effect that year. The IRS has released estate data for later years but only based on the year in which the estate tax is filed, which can be used as a proxy for the year of death. (The estate tax is usually filed the year after one’s death.)

[5] This exemption amount is offset by gifts made during one’s lifetime above an annual exclusion amount. Current law also allows for a handful of deductions, such as transfers to a surviving spouse, bequests to charity, funeral expenses, and state inheritance or estate taxes.

[6] Heather Long, “3,200 wealthy individuals wouldn’t pay estate tax next year under GOP plan,” Washington Post, November 5, 2017. https://www.washingtonpost.com/news/wonk/wp/2017/11/05/3200-wealthy-individuals-wouldnt-pay-estate-tax-next-year-under-gop-plan/

[7] The projected number of deaths for 2018 in the United States is from the Center for Disease Control and Prevention (CDC). To make the projection, we start with 2016 national and state-by-state estimates and then grow these numbers by two years based on the average yearly increase in deaths from 2012-2016.

[8] Center on Budget and Policy Priorities, “Policy Basic: The Federal Estate Tax,” November 7, 2018. https://www.cbpp.org/research/federal-tax/policy-basics-the-federal-estate-tax

[9] Lily Batchelder, “What Should Society Expect from Heirs? A Proposal for a Comprehensive Inheritance Tax,” New York University Law and Economics Working Papers, Paper 152, September 2008, pp. 41-44, https://core.ac.uk/download/pdf/13524456.pdf.

[10] William G. Gale and Joel Slemrod, “Overview,” in Rethinking Estate and Gift Taxation, (William G. Gale, James R. Hines Jr., and Joel Slemrod eds.), 2001, pp. 19-23.

[11] Wojciech Kopczuk, “Taxation of Intergenerational Transfers and Wealth,” NBER Working Paper 18584, National Bureau of Economic Research, November 2012, pp. 41-43, http://www.nber.org/papers/w18584.pdf.

[12] Small business or farms are defined as those with assets that total no more than $5 million and represent at least half of the value of the estate.

Center on Budget and Policy Priorities, “Policy Basic: The Federal Estate Tax,” November 7, 2018. https://www.cbpp.org/research/federal-tax/policy-basics-the-federal-estate-tax

[13] Joint Committee on Taxation, “History, Present Law, and Analysis of the Federal Wealth Transfer System,” JCX-52-15, March 16, 2015, https://www.jct.gov/publications.html?func=startdown&id=4744.

[14] David Cay Johnston, “Talk of Lost Farms Reflects Muddle of Estate Tax Debate,” The New York Times, April 8, 2001, http://www.nytimes.com/2001/04/08/us/talk-of-lost-farms-reflects-muddle-of-estate-tax-debate.html.

[15] https://www.cbo.gov/publication/53651

[16] Joint Committee on Taxation, “Estimated Budget Effects of the Revenue Provisions Contained in the President’s Fiscal Year 2017 Budget Proposal,” March 24, 2016, https://www.jct.gov/publications.html?func=startdown&id=4902.

[17] Jane Gravelle, “Recent Changes in the Estate and Gift Tax Provisions,” Congressional Research Service, January 11, 2018. https://fas.org/sgp/crs/misc/R42959.pdf

[18] Jane Gravelle, “Recent Changes in the Estate and Gift Tax Provisions,” Congressional Research Service, January 11, 2018. https://fas.org/sgp/crs/misc/R42959.pdf

[19] National Low Income Housing Coalition, “Senator Warren Introduces Bold Affordable Housing Bill,” October 1, 2018. https://nlihc.org/article/senator-warren-introduces-bold-affordable-housing-bill

[20] Senator Cory Booker, “Booker Announces New Bill Aimed at Combating Wealth Inequality,” October 22, 2018. https://www.booker.senate.gov/?p=press_release&id=861

[21] Institute on Taxation and Economic Policy, “Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains,” August 1, 2018. https://itep.org/congress-should-reduce-not-expand-tax-breaks-for-capital-gains/