For additional information on state tax changes and policy trends in 2023, visit ITEP’s State Tax Watch.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. These steps toward more equitable, progressive tax systems will help create more just and inclusive economies in those states.

Another third of states, however, lost ground, continuing a three-year (and, in some cases, decades long) trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable. These cuts make it harder for states to create the strong, healthy, vibrant communities that we all desire and deserve.

The vast majority of state and local tax systems are already inequitable and upside-down, asking more of low- and middle-income families than wealthy taxpayers. Lawmakers should take steps to reverse these inequities, not deepen them with top-heavy tax cuts.

Prioritizing Revenue, Equity, and Public Investments

Minnesota stands out for good tax policy this year, with a slate of changes that advance tax equity and reduce inequality. North Star State lawmakers raised more than $1 billion in new revenue to fund critical public investments, largely from high-income households and profitable corporations. They also created and enhanced targeted, inclusive, and refundable credits that will boost family economic security and reduce poverty.

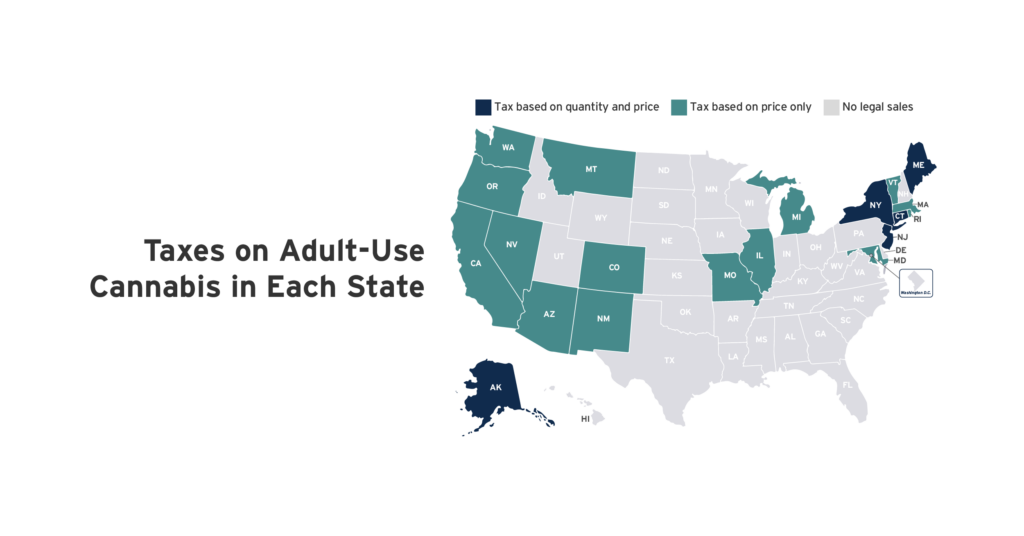

Minnesota added a 1 percent tax on high-earners’ investment income, becoming the first state with a broad-based income tax to tax long-term capital gains income at a higher rate than wages. Lawmakers also strengthened taxes on multinational corporations. And they pared back the benefits of their standard and itemized deductions for high-income families; adjusted their gas tax to inflation to keep up with rising costs; became the 12th state in the nation to enact paid family leave, which will be paid for with a modest payroll tax; and joined 20 other states in legalizing cannabis, with a 10 percent tax on cannabis sales.

Minnesota policymakers also boosted low-income families’ incomes by enacting the state’s first Child Tax Credit, which will provide families earning less than $35,000 up to $1,750 per child (the credit gradually phases out above that income threshold). This reform is estimated to reduce child poverty in the state by up to one third. Lawmakers also increased the state’s renter’s credit and made the state’s EITC, renter’s credit, and new CTC more inclusive by extending them to individuals filing taxes without Social Security numbers.

The push to prioritize low- and middle-income families with robust state tax credits was not limited to Minnesota this year. To date, 12 states have enhanced existing Earned Income Tax Credits and ten have enacted or improved Child Tax Credits.

Other key revenue victories stand out this year as well. Washington state’s tax on capital gains exceeding $250,000, for instance, was deemed constitutional by the state’s Supreme Court. The tax, which will support public schools and childcare, was initially introduced in 2012, passed the legislature in 2021, and made it through a recall attempt in 2022. Meanwhile, in Vermont, lawmakers overrode the governor’s veto to enact a payroll tax, levying a 0.44 percent tax on employers and a 0.11 percent tax on self-employment income that will boost childcare funding in the state. And Maine lawmakers are currently considering a 1 percent payroll tax to help fund paid family and medical leave. In other positive news, Connecticut and New York lawmakers extended temporary corporate tax surcharges through 2025 and 2026, respectively.

Maintaining Progressive, Sustainable Taxes

A costly and top-heavy flat tax proposal in Kansas was defeated not once, but twice when the Senate failed to override the governor’s veto. The whole package would have pushed nearly two-thirds of its tax cuts to the top 20 percent of Kansas households, with the top 1 percent getting an average tax cut of more than $8,000.

The plan’s major structural change, moving to a flat income tax, would have guaranteed that wealthy Kansans pay a lower overall state and local tax rate than lower-income families after regressive taxes like the sales tax are taken into account. This would also have limited the state’s ability to raise progressive revenue in the years ahead.

Kansas, like most states (two-thirds of those with broad-based personal income taxes), has a graduated income tax structure that is based on one’s ability to pay – an essential component of an equitable state tax system. While there was once again a concerted nationwide effort this year to move more states toward flat taxes, the so-called flat tax “revolution” fizzled as lawmakers in Kansas, North Dakota, Ohio, and Wisconsin all chose a different path.

Pursuing Deep, Permanent Tax Cuts

While there were plenty of bright spots this year, far too many states used temporary surpluses as justification to enact permanent tax cuts that will harm their ability to fund vital services. To date, more than a dozen states have made significant cuts to their personal income taxes.

- Thirteen states cut income tax rates (Arkansas, Connecticut, Indiana, Kentucky, Michigan, Montana, Nebraska, New Hampshire, North Dakota, Ohio, Utah, West Virginia, and Wisconsin).

- Six states cut income taxes by providing new or expanded senior tax subsidies. These policies often come with a big price tag, tend to be skewed toward the rich, and will grow more unsustainable over time due to our aging population (Connecticut, Michigan, Minnesota, Missouri, Nebraska, and Utah).

- Four states sped up existing tax cut phase outs or triggers on the books (Indiana, Kentucky, Nebraska, and New Hampshire).

- Three states cut corporate income tax rates (Arkansas, Nebraska, and Utah), Ohio reduced its Commercial Activities Tax, and Oklahoma cut its franchise tax.

While nearly all legislative sessions have ended, lawmakers in a few states, like North Carolina and Virginia, are still considering deep tax cuts to their personal income taxes.

Many of these tax cuts prioritize the well-being of high-income households over public goods that benefit everyone. This will exacerbate already-wide economic and racial inequities while putting undue strain on state budgets as revenue growth appears to be slowing. Over the last couple of years rosy budget pictures have helped some lawmakers claim big tax cuts have no consequences and will involve no tradeoffs. But the reality is that every dollar lost to a tax cut is a dollar that can’t be put toward education, health care, infrastructure, libraries, parks, and all of the things that help our communities thrive. Simply put, the “cut now, reckon later” mentality must come to an end.