This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe.

There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and using temporary budget surpluses to hide the cuts’ true cost. Eight states have already significantly cut their income taxes this year, and debates over major tax changes continue in more than 20 states.

These tax cuts will deplete the funding available for schools, infrastructure, health care and other public services. They will worsen inequality by making state tax codes less equitable and enriching those at the very top of the income scale. Meanwhile, there will be cuts to public assets that are crucial for poor and middle-class families and less money for teachers in the classroom and for public safety personnel, which means longer wait times for emergency response.

But the impact of this anti-tax agenda goes beyond the bounds of budget policy, to the very core of our democracy.

The debate over tax cuts that’s happening in statehouses across the country is about much more than revenues and spending. It’s a fight over whether we will have an inclusive democracy where everyone—all races in all places—can thrive, or a system rigged for the rich and powerful, a group that, because of our long history of racial discrimination and oppression, is disproportionately white and male.

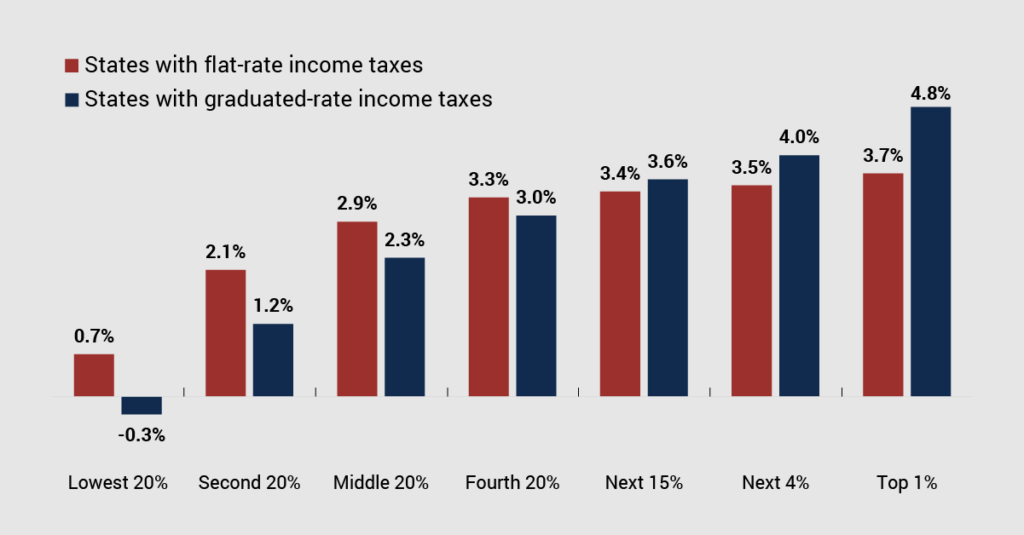

This year’s tax cut fever is part of a coordinated push to undermine state revenue systems and the people they support, especially low-income families and communities of color. We can see that in the wave of “flat tax” proposals designed to tilt tax systems more in favor of the rich, such as those pushed in Kansas and Ohio; in the proliferation of complicated “triggered” tax cut schemes designed to hide their full cost, such as in Oklahoma and Nebraska; and of course in the efforts in many states including Iowa, Kentucky, Mississippi and West Virginia to eliminate the income tax completely—a priority for anti-tax advocates that would obliterate state revenues.

The specific policies vary, but the outcome is the same: Windfalls for disproportionately white households at the top and less public funding for education, health care, public transit, emergency response, and other services that benefit all of us, but are particularly crucial to providing pathways to opportunity for low-income people of all races.

Tax cut campaigns are also increasingly running in tandem with other harmful policies that undermine the freedom, voice, and prosperity of poor and middle-class families. For example, after voters in Arizona approved raising taxes on millionaires to fund public schools, conservative lawmakers and judges ignored the public and cut taxes for the wealthy while passing laws to limit voters’ ability to tax the rich at the ballot box. This year, they have a plan to circumvent the governor and place a tax cut that would gradually eliminate their income tax on the ballot.

In Arkansas, Gov. Sarah Huckabee Sanders championed a skewed income tax cut alongside plans to divert huge sums of public money to private schools and homeschoolers. Similar efforts to undermine public schools were also among Gov. Ron DeSantis’ chief legislative priorities in Florida, where there’s no individual income tax and 99 percent of companies pay no corporate income tax at all.

The list goes on: In Kentucky, legislators this year both cut taxes for wealthy residents and passed sweeping restrictions on the rights of transgender youth. And in North Carolina, legislative leaders are advancing another round of costly tax cuts alongside harsh new limits on abortion access.

Tax cuts that undermine public services and funnel benefits to the top are deeply unpopular. Yet in far too many states, it’s clear that the will of the people is just not that important to lawmakers willing to distort democracy in pursuit of entrenching their power.

Some states are showing there’s a better path. In Minnesota, Gov. Tim Walz proposed an income tax surcharge on investment income, signed a bill providing free meals to all school children, and is leading an effort for paid family leave. In Massachusetts, voters in November approved a new millionaires’ tax to fund big new investments in education and transportation. In Kansas, lawmakers last week failed to override Gov. Laura Kelly’s veto of a damaging flat tax proposal, which would have—yet again—sent that state down a reckless tax cut path at the expense of public investments to bolster families and children. And more than a dozen other states are considering creating or expanding refundable tax credits for families and children, a policy that reduces poverty, improves student learning, and boosts people’s health and earning potential.

Tax debates are often reduced to dollars and cents. But they cut to the core of longstanding questions about the kind of country we aspire to be. Are we an inclusive, equitable society that comes together to ensure opportunity and abundance for all? Or are we a divided society of haves and have-nots, governed by laws crafted by and for the wealthy and special interests?

We know which future is best. It’s time to stop the tax-cutting spree and build a system that works for all of us.