Trump-GOP Tax Law

In Connecticut 60.2 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Connecticut population (0.9 percent) earns more than $1 million annually. But this elite group would receive 60.2 percent of the tax cuts that go to Connecticut residents under the tax proposals from the Trump administration. A much larger group, 38.6 percent of the state, earns less than $45,000, but would receive just 1.9 percent of the tax cuts.

In South Carolina 25.8 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the South Carolina population (0.2 percent) earns more than $1 million annually. But this elite group would receive 25.8 percent of the tax cuts that go to South Carolina residents under the tax proposals from the Trump administration. A much larger group, 49.4 percent of the state, earns less than $45,000, but would receive just 6.4 percent of the tax cuts.

In South Dakota 48.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the South Dakota population (0.4 percent) earns more than $1 million annually. But this elite group would receive 48.3 percent of the tax cuts that go to South Dakota residents under the tax proposals from the Trump administration. A much larger group, 47.7 percent of the state, earns less than $45,000, but would receive just 4.5 percent of the tax cuts.

In Colorado 37.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Colorado population (0.4 percent) earns more than $1 million annually. But this elite group would receive 37.5 percent of the tax cuts that go to Colorado residents under the tax proposals from the Trump administration. A much larger group, 40.4 percent of the state, earns less than $45,000, but would receive just 4.1 percent of the tax cuts.

In California 53.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the California population (0.6 percent) earns more than $1 million annually. But this elite group would receive 53.9 percent of the tax cuts that go to California residents under the tax proposals from the Trump administration. A much larger group, 38.3 percent of the state, earns less than $45,000, but would receive just 3.8 percent of the tax cuts.

In Arkansas 40.0 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Arkansas population (0.3 percent) earns more than $1 million annually. But this elite group would receive 40.0 percent of the tax cuts that go to Arkansas residents under the tax proposals from the Trump administration. A much larger group, 53.2 percent of the state, earns less than $45,000, but would receive just 7.1 percent of the tax cuts.

In Arizona 38.6 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Arizona population (0.4 percent) earns more than $1 million annually. But this elite group would receive 38.6 percent of the tax cuts that go to Arizona residents under the tax proposals from the Trump administration. A much larger group, 47.8 percent of the state, earns less than $45,000, but would receive just 4.0 percent of the tax cuts.

In Kentucky 35.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Kentucky population (0.4 percent) earns more than $1 million annually. But this elite group would receive 35.7 percent of the tax cuts that go to Kentucky residents under the tax proposals from the Trump administration. A much larger group, 48.1 percent of the state, earns less than $45,000, but would receive just 7.4 percent of the tax cuts.

In Louisiana 41.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Louisiana population (0.3 percent) earns more than $1 million annually. But this elite group would receive 41.5 percent of the tax cuts that go to Louisiana residents under the tax proposals from the Trump administration. A much larger group, 45.6 percent of the state, earns less than $45,000, but would receive just 3.1 percent of the tax cuts.

In Washington 43.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Washington population (0.5 percent) earns more than $1 million annually. But this elite group would receive 43.7 percent of the tax cuts that go to Washington residents under the tax proposals from the Trump administration. A much larger group, 38.5 percent of the state, earns less than $45,000, but would receive just 4.0 percent of the tax cuts.

In New Jersey 57.2 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the New Jersey population (1.2 percent) earns more than $1 million annually. But this elite group would receive 57.2 percent of the tax cuts that go to New Jersey residents under the tax proposals from the Trump administration. A much larger group, 37.4 percent of the state, earns less than $45,000, but would receive just 3.7 percent of the tax cuts.

In Maine 28.6 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Maine population (0.3 percent) earns more than $1 million annually. But this elite group would receive 28.6 percent of the tax cuts that go to Maine residents under the tax proposals from the Trump administration. A much larger group, 47.5 percent of the state, earns less than $45,000, but would receive just 8.1 percent of the tax cuts.

In West Virginia 18.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the West Virginia population (0.1 percent) earns more than $1 million annually. But this elite group would receive 18.3 percent of the tax cuts that go to West Virginia residents under the tax proposals from the Trump administration. A much larger group, 55.9 percent of the state, earns less than $45,000, but would receive just 9.3 percent of the tax cuts.

In Wisconsin 46.0 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Wisconsin population (0.5 percent) earns more than $1 million annually. But this elite group would receive 46.0 percent of the tax cuts that go to Wisconsin residents under the tax proposals from the Trump administration. A much larger group, 42.7 percent of the state, earns less than $45,000, but would receive just 5.6 percent of the tax cuts.

In Maryland 61.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Maryland population (0.7 percent) earns more than $1 million annually. But this elite group would receive 61.9 percent of the tax cuts that go to Maryland residents under the tax proposals from the Trump administration. A much larger group, 37.7 percent of the state, earns less than $45,000, but would receive just 4.1 percent of the tax cuts.

In New York 57.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the New York population (0.6 percent) earns more than $1 million annually. But this elite group would receive 57.9 percent of the tax cuts that go to New York residents under the tax proposals from the Trump administration. A much larger group, 44.8 percent of the state, earns less than $45,000, but would receive just 3.6 percent of the tax cuts.

In Massachusetts 56.1 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Massachusetts population (0.8 percent) earns more than $1 million annually. But this elite group would receive 56.1 percent of the tax cuts that go to Massachusetts residents under the tax proposals from the Trump administration. A much larger group, 40.0 percent of the state, earns less than $45,000, but would receive just 3.4 percent of the tax cuts.

In Wyoming 57.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Wyoming population (0.5 percent) earns more than $1 million annually. But this elite group would receive 57.3 percent of the tax cuts that go to Wyoming residents under the tax proposals from the Trump administration. A much larger group, 39.4 percent of the state, earns less than $45,000, but would receive just 2.6 percent of the tax cuts.

The Problems with the Multi-Million-Dollar Effort to Secure Millionaire and Corporate Tax Cuts

July 31, 2017 • By Alan Essig

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

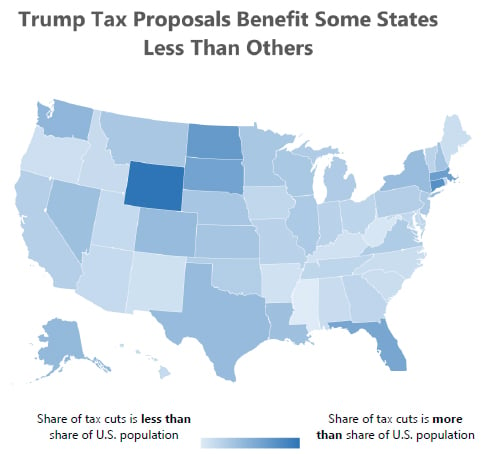

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in Alaska with 45.9 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Alaska would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,400,500 in 2018. They would receive 45.9 percent of the tax cuts that go to Alaska’s residents and would enjoy an average cut of $134,060 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Indiana with 46.1 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Indiana would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,511,600 in 2018. They would receive 46.1 percent of the tax cuts that go to Indiana’s residents and would enjoy an average cut of $95,940 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Iowa with 44.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Iowa would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,164,200 in 2018. They would receive 44.7 percent of the tax cuts that go to Iowa’s residents and would enjoy an average cut of $84,860 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Nebraska with 52.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Nebraska would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,572,200 in 2018. They would receive 52.6 percent of the tax cuts that go to Nebraska’s residents and would enjoy an average cut of $128,300 in 2018 alone.