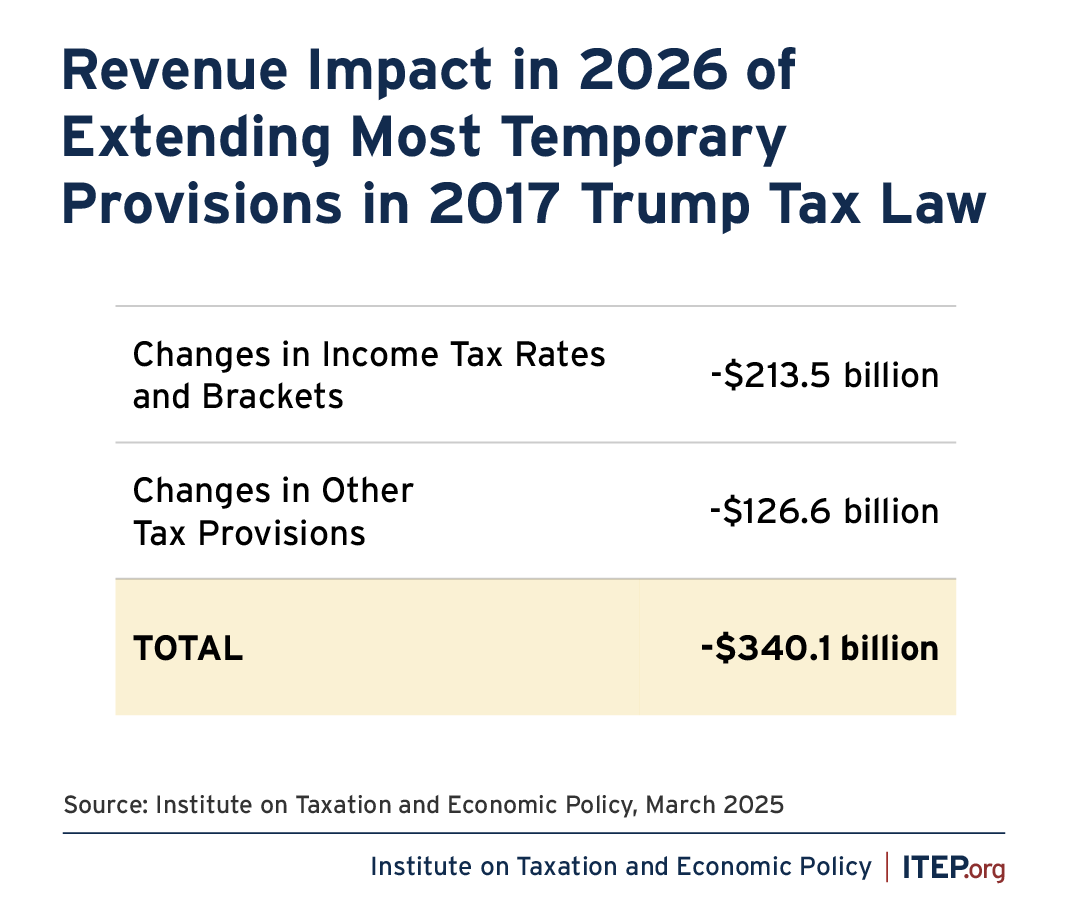

As Congressional Republicans prepare to extend and dramatically expand upon the deeply unpopular tax cuts they enacted in 2017, our new report shows how two cornerstone pieces of a 2025 tax bill would increase income and racial inequality while adding hundreds of billions of dollars to the nation’s debt every year.

Two parts of Trump’s 2017 tax law that are particularly expensive and beneficial to the richest individuals are the changes in income tax rates and brackets and the special deduction for “pass-through” business owners. Lawmakers should not extend these provisions for high-income households past the end of this year when they are scheduled to expire.

Trump’s Reduction in Federal Personal Income Tax Rates

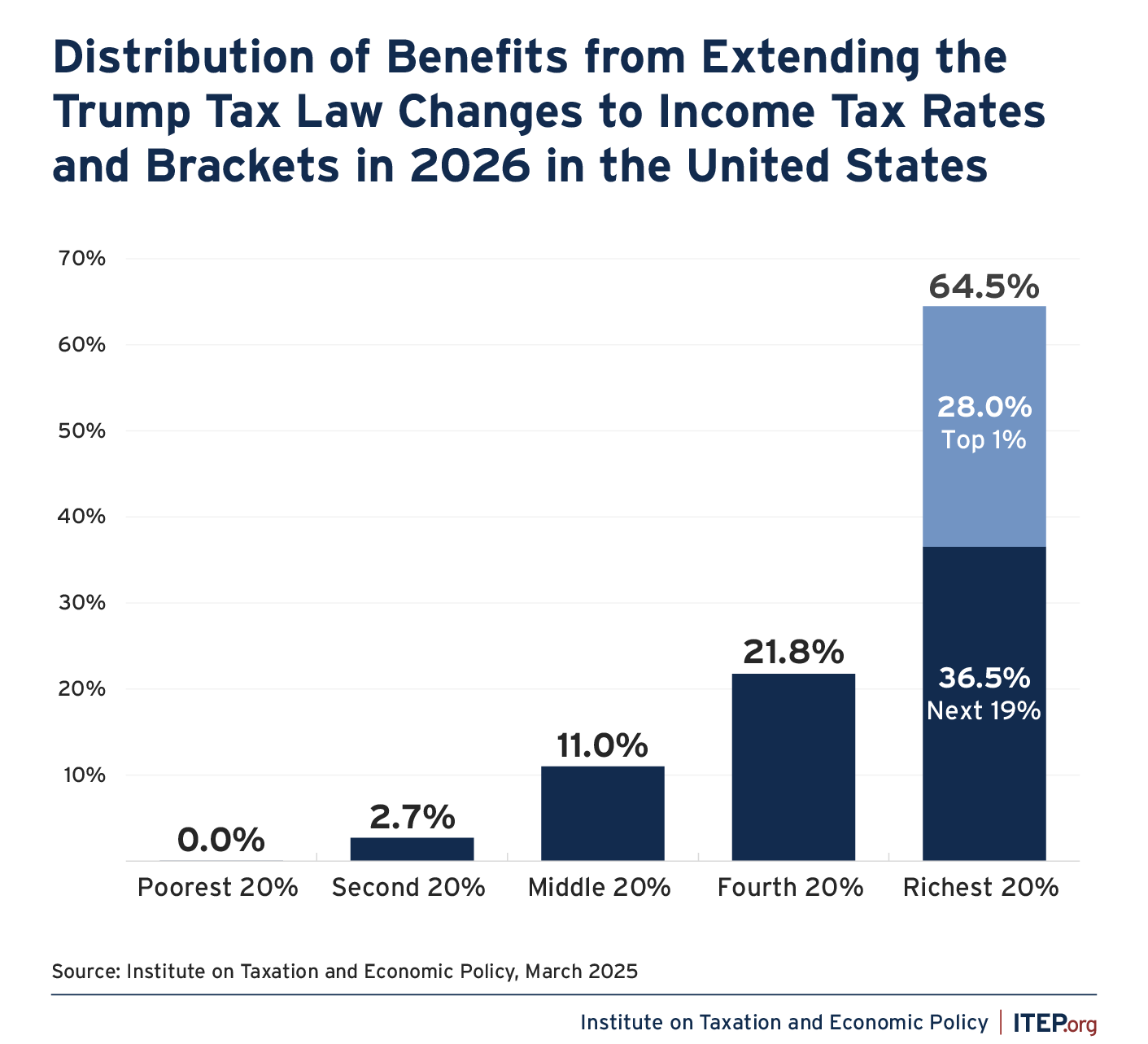

The figures shown here illustrate the effects of extending the rate and bracket changes in 2026, compared to what will happen if Congress does nothing and allows the provisions to expire as scheduled.

While these rate and bracket changes would result in a tax cut for some people in all income groups, nearly two-thirds of the benefits would go to the richest fifth of taxpayers, and more than a quarter would go to the richest 1 percent.

The greatest beneficiaries are very well-off households who pay the top personal income tax rate on most of their income. The 2017 law cut the top rate from 39.6 to 37 percent.

Meanwhile, many low- and middle-income people would not benefit at all. This includes working people who pay Social Security and Medicare payroll taxes but do not earn enough to owe any personal income tax. It also includes many people who receive Social Security, which is largely exempt from the personal income tax for most recipients.

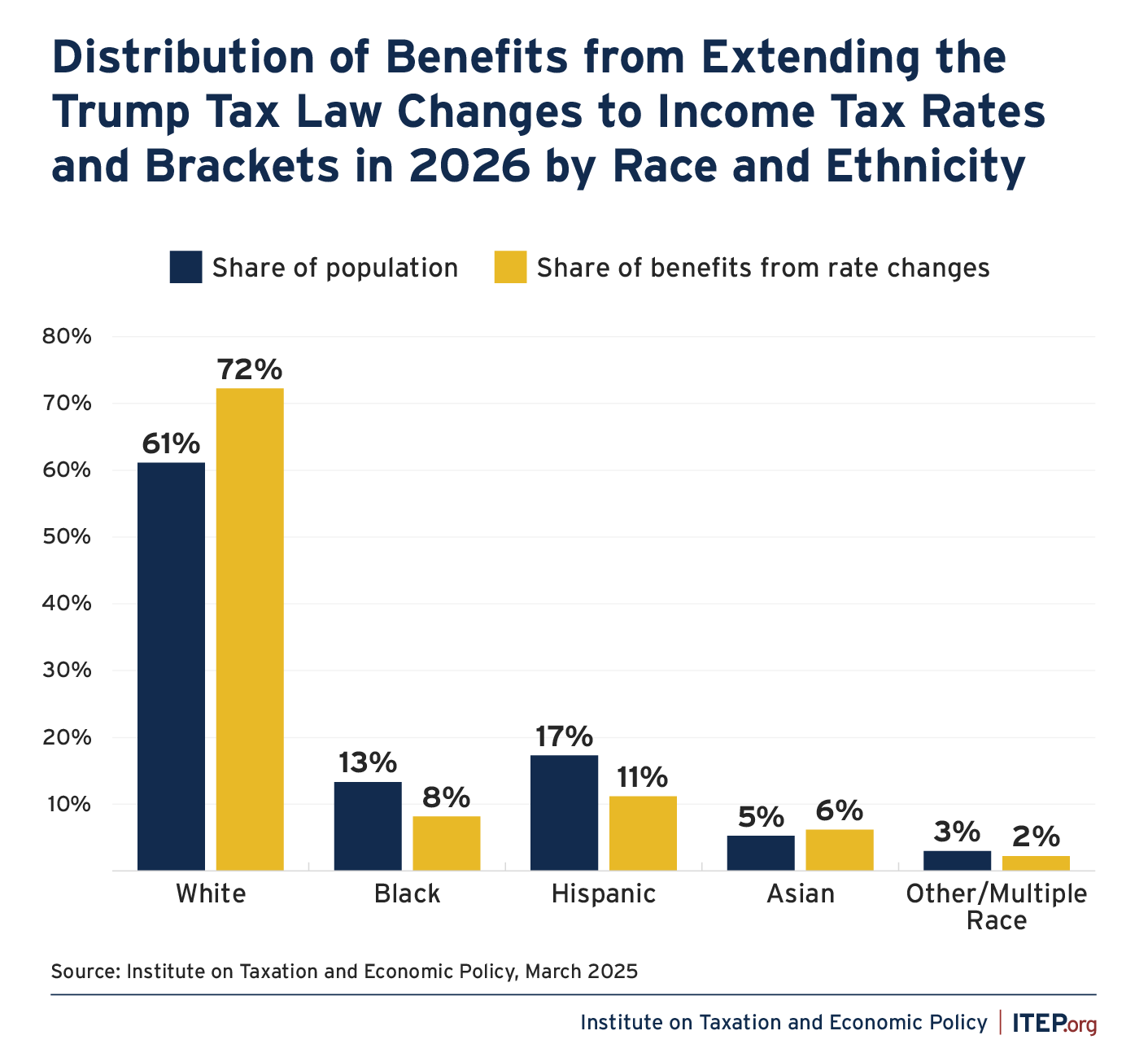

These rate and bracket changes also create more racial inequality in our tax system by disproportionately favoring white taxpayers at the expense of others

In 2026 Black taxpayers will make up 13 percent of the population but would receive only 8 percent of the benefits of extending the income tax rates and brackets, according to our estimates. Hispanic taxpayers will make up 17 percent of the population but would receive only 11 percent of the benefits.

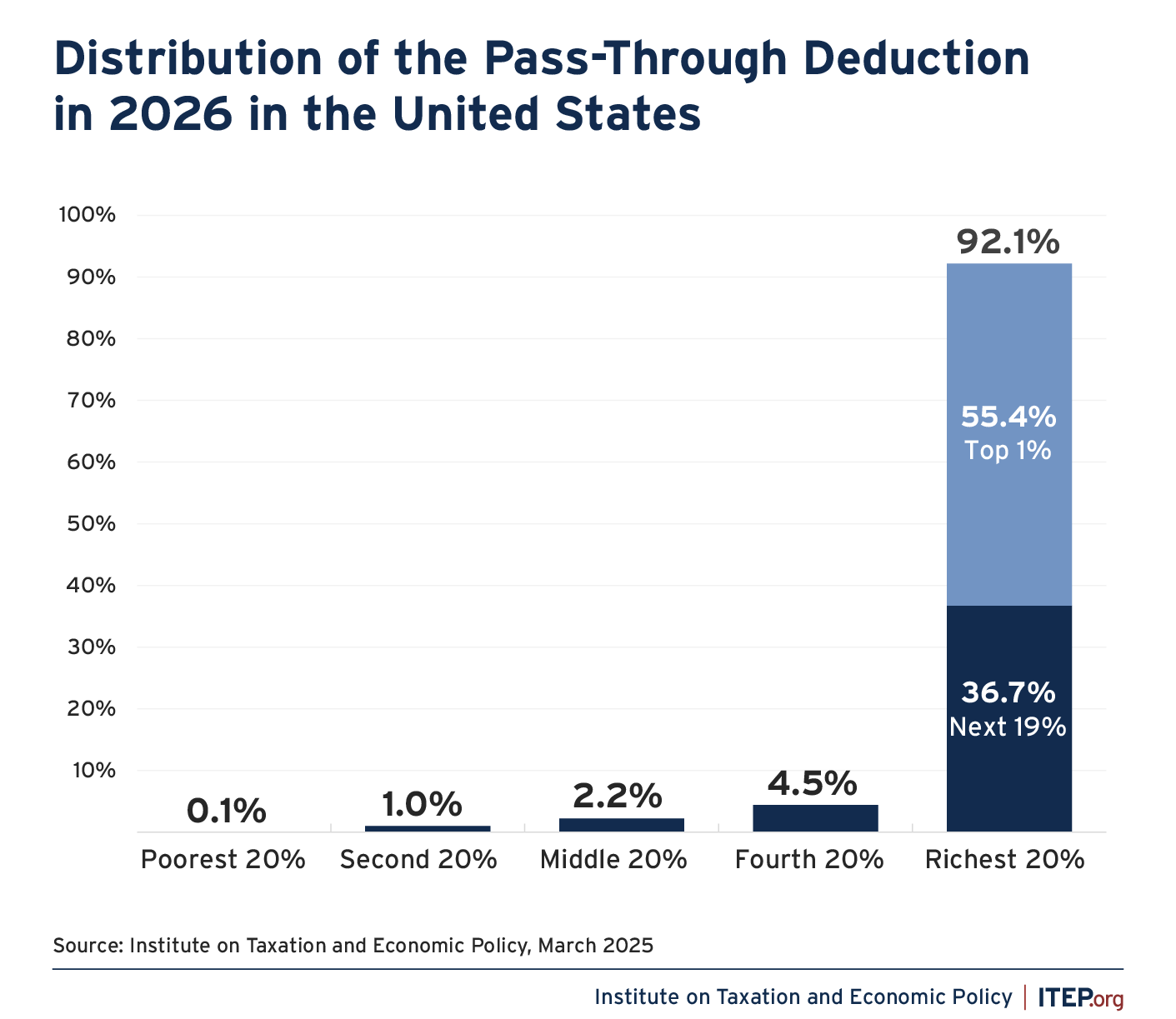

Trump’s Deduction for Pass-Through Business Owners

Another significant tax break for high-income people that was enacted as part of the 2017 Trump tax law is section 199A, the 20 percent deduction for income individuals receive from “pass-through” businesses. These businesses do not pay the corporate income tax because their profits are instead “passed through” to the individual owners and taxed as part of their personal income each year.

Proponents of section 199A sometimes characterize it as a break for “small” businesses but most of the benefits go to the richest 1 percent, as illustrated below.

If the expiring Trump tax provisions are extended, the pass-through deduction would be one of most costly and regressive features. We find that in 2026, 92 percent of the benefits would go to the richest 20 percent of Americans and 55 percent would go to the richest 1 percent.

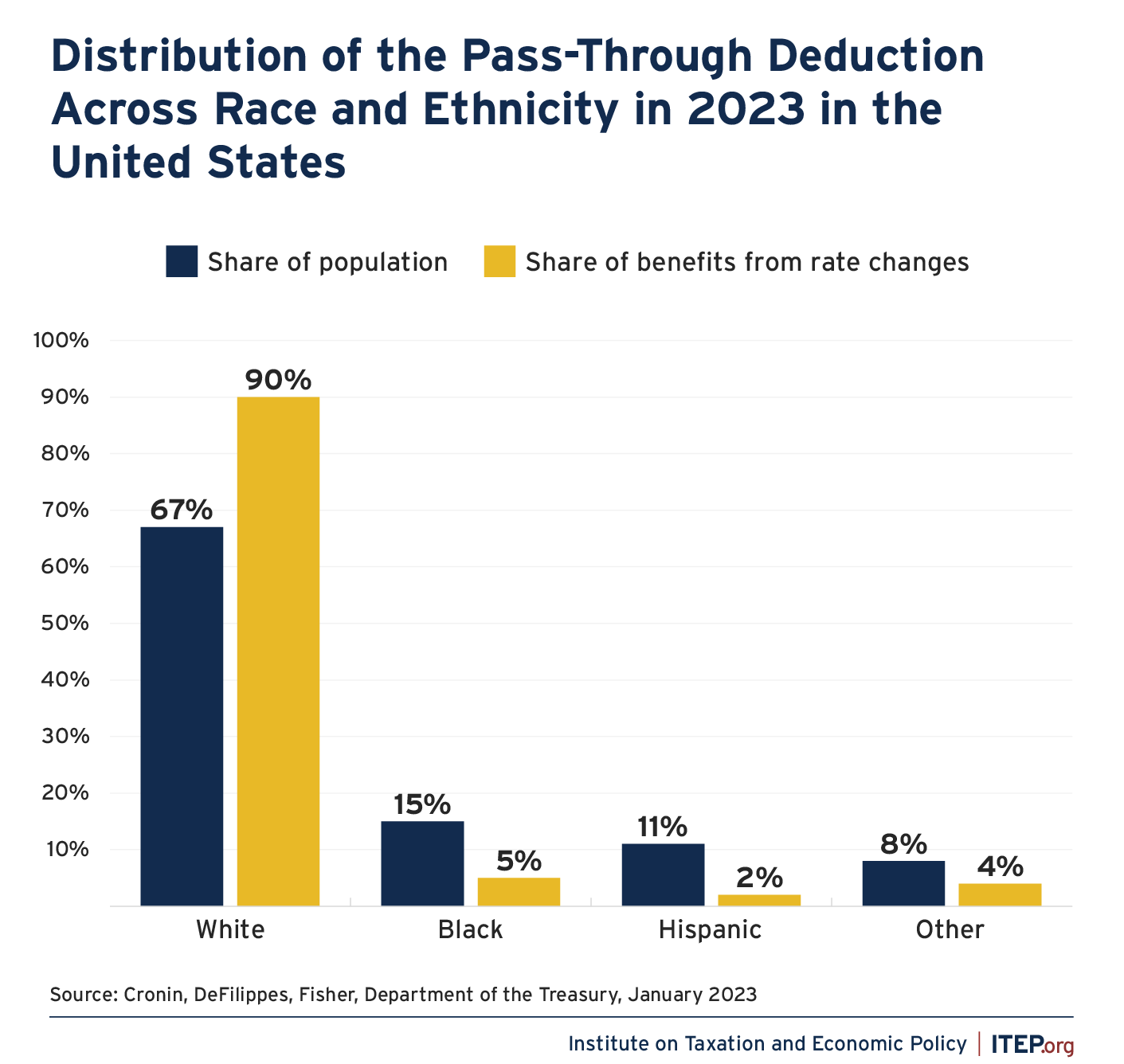

The distribution of business assets, like most kinds of wealth in the U.S., is racially skewed, so it is unsurprising the benefits of a tax break for business profits would be as well. The Treasury Department found that Hispanic and Black taxpayers make up 15 percent and 11 percent of the U.S. population but receive only 5 percent and 2 percent of the benefits from this special break for pass-through income, respectively. White taxpayers make up 67 percent of the population but receive a disproportionate 90 percent of the benefits.

As our new report explains, lawmakers who want to reduce income and racial inequality have several tax policy options to choose from. Extending the Trump tax law, and particularly these two parts of the Trump tax law, are not among them.