Washington

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

The Washington Post: Biden Wants to Crack Down on Corporate Tax Loopholes, Resuming a Battle His Predecessors Lost

April 20, 2021

More than 60 percent of U.S. multinationals’ reported foreign income is booked in seven small countries that promise to only nibble at corporate profits, about twice the share as in 2000, according to Bank of America. The tax avoidance efforts — entirely legal under U.S. law — resulted in 55 of the nation’s largest corporations […]

Washington Post: Biden proposals may not guarantee all Fortune 500 corporations pay federal income taxes, experts say

April 15, 2021

Of the 55 corporations that did not pay federal income taxes in 2020, only five had more than $2 billion in net income, according to the report by the Institute for Taxation and Economic Policy, a left-leaning think tank. That means the overwhelming majority of them would not be subject to the book tax. Matt […]

Washington Post: Opinion: Americans are liberals on taxes, living under a conservative system

April 15, 2021

When you combine all the kinds of taxes people pay, you see the system is almost flat. As this report from the Institute on Taxation and Economic Policy shows, in 2018, Americans in the middle of the income distribution paid 25.4 percent of their income in taxes, while those in the top 1 percent paid […]

The Cap Times: Plain Talk: It’s time to fix America’s infrastructure — and make corporations help pay for it

April 14, 2021

The Institute on Taxation and Economic Policy, a Washington-based research group that keeps tabs on such things, reported earlier this month that at least 55 of America’s largest corporations paid no federal income taxes last year. While the 2017 Trump administration’s tax “reform” reduced the federal corporate tax rate from 35% to 21%, dozens of […]

The Sacramento Bee: Rich Californians have most to gain if Congress lifts cap on local tax deductions, report says

April 11, 2021

State residents earning more than $992,800, California’s wealthiest 1%, could see an average savings of $98,650 in 2022, according to data from the Institute on Taxation and Economic Policy, a Washington-based economic analysis firm. Overall, Californians would save $33.4 billion next year if the SALT limits are lifted—with $17.4 billion of that going to people […]

Washington Post: Biden Says He’s Open to Compromise With Republicans on $2 Trillion Infrastructure Plan

April 8, 2021

Fifty-five corporations saw zero federal tax liability in 2020, according to a report this week by the Institute on Taxation and Economic Policy, a left-leaning think tank. The amount of corporate tax revenue raised by the government has fallen from above 2 percent of the United States’ gross domestic product before the GOP tax law […]

Washington Post: Biden Says He’s Open to Compromise with Republicans on $2 Trillion Infrastructure Plan

April 7, 2021

Fifty-five corporations saw zero federal tax liability in 2020, according to a report this week by the Institute on Taxation and Economic Policy, a left-leaning think tank. The amount of corporate tax revenue raised by the government has fallen from above 2 percent of the United States’ gross domestic product before the GOP tax law […]

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

New York Times: Jeff Bezos says Amazon, a Notable Tax Avoider, Supports Raising Corporate Taxes.

April 7, 2021

For years, Amazon has been a model for corporate tax avoidance, fielding criticism of its tax strategies from Democrats and former President Donald J. Trump. In 2019, Amazon had an effective tax rate of 1.2 percent, which was offset by tax rebates in 2017 and 2018, according to the Institute on Taxation and Economic Policy, […]

Washington Post: Dozens of America’s Biggest Businesses Paid No Federal Income Tax Again

April 5, 2021

Fifty-five of the nation’s largest corporations paid no federal income tax on more than $40 billion in profits last year, according to an analysis by the Institute on Taxation and Economic Policy, a progressive think tank. In fact, they received a combined federal rebate of more than $3 billion, for an effective tax rate of […]

Washington Post: Republicans Struggle to Defend Corporate Tax Windfall (Opinion)

April 5, 2021

Corporations are hard-pressed to scream poverty. The Institute on Taxation and Economic Policy found 55 big companies that paid no federal income taxes at all last year: “The tax-avoiding companies represent various industries and collectively enjoyed almost $40.5 billion in U.S. pretax income in 2020, according to their annual financial reports.” Had they actually paid […]

MSNBC: Many Corporate Giants (Once Again) Paid No Federal Income Taxes

April 5, 2021

A couple of years ago, the Institute on Taxation and Economic Policy released the results of a detailed study that found of the Fortune 500 companies, about 400 paid an average tax rate of about 11% — roughly half of the current rate of 21% — thanks to a series of loopholes, exemptions, and giveaways […]

Washington Post: What Americans Will Get from Biden’s $2 Trillion Infrastructure Plan (Opinion)

April 4, 2021

In addition, a new report from the Institute of Taxation and Economic Policy underscores how well corporations did over the last four years, with 55 big corporations paying no federal corporate income tax. ITEP reports: The tax-avoiding companies represent various industries and collectively enjoyed almost $40.5 billion in U.S. pretax income in 2020, according to […]

Washington Post: Republicans Draw a Blank on Basic Governance (Opinion)

April 4, 2021

But one suspects that Blunt, Wicker and others are protesting this proposed tax increase because of the narrow portion of Americans for whom the 2017 cut did work: the wealthiest. The dividends and stock buybacks benefited rich investors. Meanwhile, according to a new study from the Institute on Taxation and Economic Policy, “At least 55 […]

Washington Post: The Daily 202: Biden Infrastructure Push Could Face SALT-y Democratic Challenge

April 2, 2021

A report by the Institute on Taxation and Economic Policy found that companies like Salesforce, Consolidated Edison, FedEx and Nike “were able to avoid paying any federal income tax for the last three years even though they reported a combined income of $77 billion. Many also received millions of dollars in tax rebates.” Read more

Quartz: Nike And FedEx Haven’t Paid Federal Income Tax in Three Years

April 2, 2021

Despite raking in billions in earnings, Nike, FedEx, and two dozen other public companies have paid no federal corporate income tax in the US since 2018, according to a study by the Institute on Taxation and Economic Policy, a Washington-based research organization. The behavior continues what ITEP describes as a decades-long trend of companies finding […]

Associated Press: Even with Pretax Profits, Many Big Companies Pay Zero US Tax

April 2, 2021

Just as President Joe Biden is pushing to raise taxes on companies to help pay for his infrastructure plan, a report from a Washington policy group is highlighting how many firms pay zero despite making big pretax profits. More than 50 of the largest U.S. companies paid nothing in federal income taxes last year, with […]

New York Times: No Federal Taxes for Dozens of Big, Profitable Companies

April 2, 2021

Just as the Biden administration is pushing to raise taxes on corporations, a new study finds that at least 55 of America’s largest paid no taxes last year on billions of dollars in profits. The sweeping tax bill passed in 2017 by a Republican Congress and signed into law by President Donald J. Trump reduced […]

Washington Post: Power Up: Unions, liberal groups urge Biden to go even bigger on tax hikes for infrastructure plan

March 31, 2021

Some tax experts, however, estimate that the benefits of restoring the deduction would go to the richest Americans: “House Democrats included a provision suspending the cap for 2020 as part of a COVID relief package last year. [The Institute on Taxation and Economic Policy] estimated that this would cost more than $90 billion in a […]

Washington Post: Fact-checking President Biden’s first news conference

March 26, 2021

Biden loves this statistic, but he usually is careful to say “federal taxes.” Simply saying “taxes” makes it wrong, because no matter what the federal tax liability, these companies certainly pay a variety of payroll, real estate and local or state taxes. In a 2019 report, the left-leaning Institute on Taxation and Economic Policy (ITEP) […]

Connecticut Post: State Rep. Sean Scanlon (opinion): State child tax credit would ease burden on families

March 24, 2021

The good news for families is that President Biden’s recently passed stimulus bill features a provision long championed by my Congresswoman Rosa DeLauro that not only makes the tax credit fully refundable but also expands the credit from $2,000 to $3,000 for children 6 to 17 and to $3,600 per child under the age of […]

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

GeekWire: Capital Gains Tax in Washington State: Is it about Fairness and Funding, or Will it Drive Away Startups?

March 16, 2021

Dylan Grundman O’Neill, a senior state tax policy analyst with the Institute on Taxation and Economic Policy, said that research shows that in Washington, more so than in any other state, “the higher your income, the lower your tax rate.” “The top 1% pay an effective rate of only about 3%,” O’Neill said. “While middle-income […]

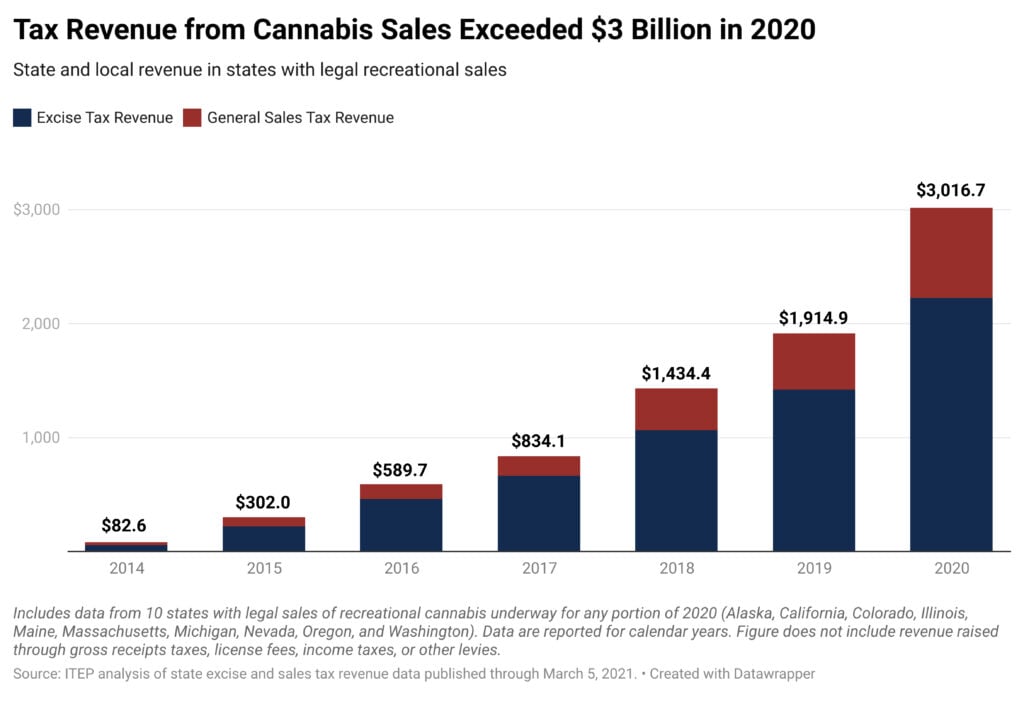

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]