Washington

International Business Times: Amazon News: What Joe Biden, Bernie Sanders Said About The Retail Giant On Taxes And Its New Credit Card

June 15, 2019

On Thursday, Biden posted on Twitter how Amazon pays a “lower tax rate than teachers and firefighters.” The New York Times in April noted how Amazon paid no taxes in 2018, citing a study from the left-leaning Institute on Taxation and Economic Policy. The study showed the company actually paid a -1.2% in taxes due to a $129 million tax rebate. The […]

State Rundown 6/12: Progress in Taxing the Rich, Expanding EITCs, and Taming Tax Subsidies

June 12, 2019 • By ITEP Staff

This week saw lawmakers in Ohio propose significant harmful tax cuts, leaders in California and Oregon work toward strengthening the state Earned Income Tax Credits (EITCs), and governors in Missouri and Kansas declare a truce to end the practice of bribing businesses in the Kansas City area with tax cuts to move from one side of the state line to the other. Meanwhile, Massachusetts leaders are discussing ways of raising taxes on their richest households, which our latest Just Taxes blog post notes is a promising trend this year across many states.

Washington Post: Why the U.S. Economy Is Worse than It Seems

June 4, 2019

Even more remarkably, the top 1 percent of households now hold 31 percent of the nation’s wealth (assets minus liabilities), or $30 trillion, while the entire bottom half of the nation’s households hold only about 1 percent, or $1 trillion. That comes to $23 million per household for the top 1 percent and $18,000 in […]

Washington Post: The Trump Tax Cuts Are Failing Badly

June 1, 2019

Giving companies more incentive to invest, then, won’t do much if they don’t have a reason to invest in the first place — which they haven’t recently. This raises the possibility that the Trump tax cuts won’t just be regressive but almost cartoonishly so. Consider this: According to a separate analysis by the left-leaning Institute […]

New York Times: Democrats’ Tax Cuts Target Middle Class More Than Trump’s, Study Says

May 22, 2019

Tax plans from several Democratic candidates for president would cost less than President Trump’s signature tax cuts but deliver larger benefits to most low- and middle-income Americans, according to a new analysis by the Institute on Taxation and Economic Policy, a liberal think tank in Washington. The analysis is one of the first to examine […]

Allentown Morning Call: Fortune 500 company PPL not only paid no federal taxes last year, it got a $19 million rebate; it says it has invested those savings

May 8, 2019

Sixty of America’s Fortune 500 corporations paid nothing — or got refunds — for 2018, according to a report released last month by the Institute on Taxation and Economic Policy in Washington, described as a left-leaning think tank by the Washington Post and New York Times. In PPL’s case, the institute said the company received […]

Voice of America: In the US, Death Is More Certain Than Taxes

May 8, 2019

In the corporate world, however, with the tax overhaul pushed to passage by Trump and Republican lawmakers in 2017 that cut the basic federal corporate tax rate from 35% to 21%, 60 of the biggest U.S. corporations avoided paying any taxes last year, according to the Washington-based Institute on Taxation and Economic Policy. The research […]

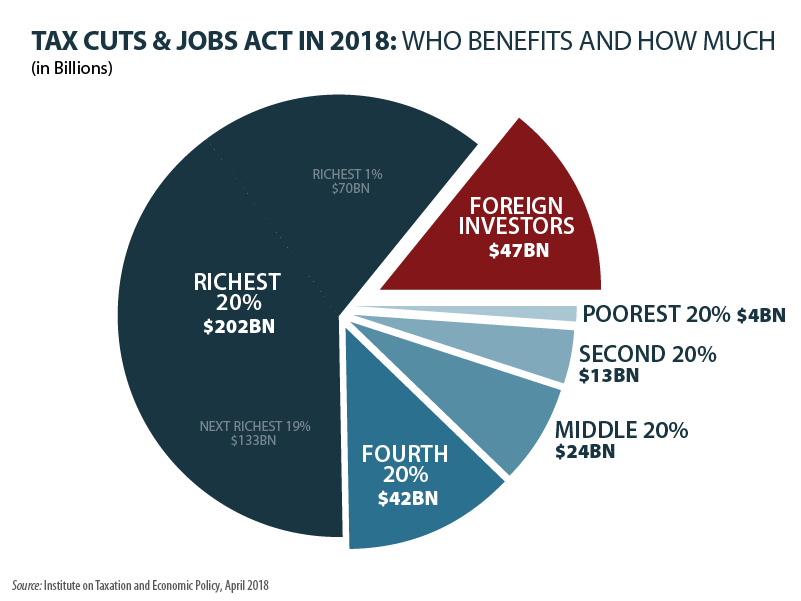

Proponents of Trump Tax Law Cite ITEP with Obvious Lack of Context

May 6, 2019 • By Steve Wamhoff

Sen. Chuck Grassley, the chairman of the Senate Finance Committee, today has an op-ed defending Trump-GOP tax law. “One of the most-covered falsehoods being spread about tax reform,” as he calls the law, “is that it’s a middle-class tax hike.” He cites ITEP’s estimates to back up his point that most people in every income group have lower taxes because of the law. As Sen. Grassley and his staff know full well, this leaves out the important point of our findings.

Teachers in North Carolina and South Carolina are walking out and rallying this week for increased education funding, teacher and staff pay, and other improvements to benefit students—if you’re unsure why be sure to check out research on the teacher shortage and pay gap under “What We’re Reading” below. Meanwhile, budget debates have recently wrapped up in Indiana, Iowa, Massachusetts, New Hampshire, and Washington. And major tax debates are kicking into high gear in both Louisiana and Nebraska.

New York Times: Apple Plans to Buy $75 Billion More of Its Own Stock

April 30, 2019

When it repatriated its cash under the new tax law, Apple paid $43 billion less than it would have under previous rates, bigger savings than any other American company, according to the Institute on Taxation and Economic Policy, a research group in Washington. Apple has also saved billions of dollars under the lower corporate tax rate. Apple says it is spending billions in the United States, hiring new workers, building data centers, expanding offices in Texas and investing in some outside manufacturers.

Washington Post: Democrats Said a GOP Tax Law Provision Would Devastate Blue States. That’s Not Happening.

April 30, 2019

“A lot of these claims were knee-jerk, political reactions,” said Carl Davis, a tax analyst for the Institute on Taxation and Economic Policy, a left-leaning think tank. “Some perspective is needed on some of the wild claims about how it would damage blue states’ economies.”

Washington Post: Elizabeth Warren Wants to Make It Simpler to File Taxes

April 12, 2019

Under current law, corporations can report large sums of annual profit to Wall Street and investors, while still using loopholes to pay no taxes to the feds. According to a study released Thursday by the Institute on Taxation and Economic Policy, at least 60 Fortune 500 companies paid nothing to the federal government in taxes […]

Huffington Post: 60 Top Corporations Paid $0 Federal Taxes Under Trump Tax Law

April 12, 2019

President Donald Trump’s new tax law aided corporations so radically that twice as many companies paid no federal taxes whatsoever in 2018, despite billions of dollars in profit, according to a new study. Amazon, Netflix, Chevron, Eli Lilly, Delta Airlines, General Motors, IBM and Goodyear were among the tax-free corporate titans, according to an analysis by […]

Washington Post: The Democrats new Tax Plan Is Their Clearest, Most Efficient Blueprint Yet

April 11, 2019

Just in time for Tax Day, we have new insight into the dueling partisan visions for the U.S. tax system. We already knew that the GOP’s 2017 tax law mostly benefited corporations and the wealthy; that’s old news. But on Thursday, we got some illustrative examples, courtesy of the Institute on Taxation and Economic Policy. The organization found that […]

State Rundown 4/11: An Estate Tax Win, Opioid Progress, and Teacher Uprising Updates

April 11, 2019 • By ITEP Staff

Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re…

Fast Company: Amazon and Netflix Are among Many Companies Paying Zero Federal Taxes under Trump’s Tax Law

April 11, 2019

Tax season is upon us–and by us, I mean everyone who is not Amazon, Netflix, Chevron, or pharmaceutical manufacturer Eli Lilly and Co., because they are among the 60 or so corporations that paid zero dollars in federal income taxes on the billions of dollars in profits they earned in 2018. That’s according to a new analysis, released […]

The Washington Post: Health Care Is Shockingly Expensive. Why Can’t You Deduct It?

April 10, 2019

My proposal won’t add much to the $22 trillion national debt, relatively speaking. According to an AARP fact sheet, the Institute on Taxation and Economic Policy estimated that lowering the threshold from 10 percent to 7.5 percent would cost $1.2 billion in 2019. It will unquestionably cost more than that to eliminate the threshold for […]

Crosscut: I’m Rich, I Should Pay More Taxes in Washington

April 10, 2019

But if you’re a working family, Washington is a different story. That’s because in Washington, our lowest-income families pay taxes that amount to a six times greater share of their income than what the wealthiest households pay. We have the most upside-down tax code in the country, according to the Institute on Taxation and Economic […]

The Columbian: Do We Care that the Tax System Is Unfair?

April 1, 2019

While our state is a bastion of progressive politics and liberal activism (for better or worse), it also has the most regressive tax system in the country. In other words, poor people in Washington pay a disproportionate amount of taxes. Last year, a report from the Institute on Taxation and Economic Policy determined that the […]

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

GQ: Local and State Taxes Are Making the Wealthy More Rich Now Too

March 12, 2019

According to a new report by the progressive think tank Institute on Taxation and Economic Policy (ITEP), as relayed in the Washington Post, state and local governments that are heavily reliant on sales and excise taxes, rather than income taxes, shift the economic burden onto low- and moderate-income taxpayers. At every level, those who work […]

KUOW: Why Washington Ranks as the Worst State for Poor Residents

March 12, 2019

Washington ranks as the worst state for low-income earners to live, and it’s notably worse than any other state. The Institute on Taxation and Economic Policy (ITEP) places Washington, Texas and Florida at the top of the “terrible 10” list in its annual report. The institute says these have the most regressive tax systems, in […]

Washington Post: State and Local Tax Laws Are Making the Rich Richer

March 6, 2019

State and local taxes effectively redistribute national income from the poor to the very rich, according to data released this week by the Institute on Taxation and Economic Policy, a progressive think tank. Many state and local governments are heavily reliant on sales taxes, rather than income taxes. Lower-income households tend to spend a greater […]

Bloomberg: Democrats In the Home of Hedge Funds Are Divided Over Tax Plans Sparing Rich

March 1, 2019

“Most public finance experts will tell you if you have sales tax it should be applied to a broad base,” said Carl Davis, the research director at the Institute on Taxation and Economic Policy in Washington. “If people are no longer going to Blockbuster and now they’re downloading movies, that’s created a gap in the […]

Bloomberg Tax: Tax Executives Fear Overhaul Impermanence as Dems Mull Tweaks

February 28, 2019

The GILTI income subject to the tax is the income earned through a controlled foreign corporation that exceeds 10 percent of the value of the CFC’s tangible, depreciable assets, such as machinery and other equipment. The Institute on Taxation and Economic Policy, a Washington think tank, said in a June 2018 post that this measurement […]