Washington

The Washington Post: GOP Pushes for New $2 Trillion Round of Tax Cuts

September 11, 2018

Democrats said the GOP’s second round of tax cuts would punish the poor and the middle class, arguing that they will provide a pretext for later spending cuts to entitlement programs that help the elderly. The richest 1 percent of Americans would see an average $24,130 cut from extending the individual tax cuts, compared with […]

Seattle Times: Is a State Like Washington with No Income Tax Better or Worse?

September 11, 2018

These taxes place an unfair burden on the poor, according to research from the Institute on Taxation and Economic Policy. The reason is the lowest earners in the state devote the lion’s share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their […]

Atlanta Journal Constitution: IRS Proposal Could Hurt Georgia Rural Hospital, School Tax Credits

August 25, 2018

The change will have no impact on many Georgians because they don’t itemize their deductions when they file their tax returns. “For about 90 percent of people who are just claiming the standard deduction, this (rule) isn’t going to have any impact at all,” said Carl Davis, the research director with the Institute on Taxation […]

Washington Post: New Treasury Proposal Would Stop Attempts to Weaken Tax Law

August 24, 2018

Read more

State Rundown 8/16: November Ballots and 2019 Debates Coming into Focus

August 16, 2018 • By ITEP Staff

Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for…

Washington Post: IRS Outsources Debt Collection to Private Firms, and the Poor Feel the Sting

July 23, 2018

“The private firms appear, at least in some cases, to be ignoring this constraint,” said Matt Gardner, an analyst at the left-leaning Institute on Taxation and Economic Policy. “When they farm this out to private debt collectors, those debt collectors are not legally bound by the same standards. It’s utterly inconsistent.” Read more

New York Times: $111 Billion in Tax Cuts for the Top 1 Percent

July 11, 2018

Think of it this way: Income inequality has soared in recent decades, with the wealthy pulling away from everyone else and the upper-middle-class doing better than the working class or poor. Yet our federal government has responded by aggravating these trends. It has handed huge tax cuts to the small segment of Americans who need […]

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

Washington Post: At State Level, GOP Renews Push to Require ‘supermajorities’ for Tax Hikes, Imperiling Progressive Agenda

July 9, 2018

In three additional states — Florida, Oregon and North Carolina — conservative lawmakers and business groups are currently advancing similar measures, said Meg Wiehe, a tax analyst at the Institute on Taxation and Economic Policy, a left-leaning think tank. Read more

Seattle Times: Fight Heats up over Washington State Carbon ‘Fee’ Likely to Make Fall Ballot

July 2, 2018

Opponents criticize the measure as a regressive tax on Washingtonians. They note that the state — with a sales tax but no income tax — already is considered to have the most regressive tax system in the nation, according to a study by the Institute on Taxation and Economic Policy. Read more

Washington Post: N.J. Approaches a Government Shutdown as Democrats Feud Over Tax on Millionaires

June 28, 2018

New Jersey is just days away from a government shutdown over a plan to raise taxes on the rich that has divided Democrats and revealed the political difficulty of raising funds for the party's ambitious social spending goals.

Wall Street Journal: As Treasury Targets Workarounds to Tax Law, Impact May Extend Beyond High-Tax States

June 27, 2018

Tax experts say the federal government will find it difficult if not impossible to write rules to stop the workarounds in New York, New Jersey and Connecticut without also limiting existing tax credits in Georgia, Alabama, South Carolina and elsewhere. According to a recent paper from law professors, 33 states currently have more than 100 […]

New York Times: Supreme Court Widens Reach of Sales Tax for Online Retailers

June 22, 2018

The decision, in South Dakota v. Wayfair Inc., was a victory for brick-and-mortar businesses that have long complained they are put at a disadvantage by having to charge sales taxes while many online competitors do not. And it was also a victory for states that have said that they are missing out on tens of […]

Buffalo News: Sales Tax Ruling Will Help Stores Compete Against Online Retailers

June 22, 2018

Carl Davis, research director at the Institute on Taxation and Economic Policy, a Washington think tank, was quoted in The New York Times saying, “State and local governments have really been dealing with the nightmare scenario for several years now.” He added that “this is going to allow state and local governments to improve their […]

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.

Washington Post: Seattle Council Votes to Repeal Tax to Help Homeless Amid Opposition from Amazon, other Businesses

June 12, 2018

“There’s a bargaining power problem here, and cities are on the wrong side of it,” said Matthew Gardner, a tax policy analyst at the Institute on Taxation and Economic Policy, a left-leaning think tank. “When Amazon decides to be bullies and make this kind of threat, it’s really hard for officials to know how seriously […]

Springfield (Mass) Republican: Tax Breaks That Help Students Attend Private School Could Be Repealed

June 9, 2018

“This is a brand new tax break that was created automatically by an obscure linkage to federal law, and whether lawmakers want to offer it or not is worth discussing,” said Carl Davis, research director at the Institute on Taxation and Economic Policy, a Washington-based tax think tank that tends to favor liberal policies. “It’s […]

New York Times: I.R.S. Warns States Not to Circumvent State and Local Tax Cap

May 24, 2018

Carl Davis, the research director for the Institute on Taxation and Economic Policy in Washington, said that Alabama provides a 100 percent state tax credit for taxpayers who donate money to organizations that give children vouchers to attend private school. Under its new law, New York gives an 85 percent state tax credit to residents […]

Washington Post: NJ Democrats Loved the Idea of Taxing the Rich Until They Could Actually Do It

May 24, 2018

A spokesman for Sweeney, the state Senate president, said families earning over $1.1 million in New Jersey already face an average $738 tax hike under the GOP law, citing data from the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank. That number accounts only for the GOP tax law’s changes for households […]

Washington Times: Treasury Department Warns States over SALT Workarounds

May 24, 2018

The Institute on Taxation and Economic Policy, a left-leaning think tank, issued a new report Wednesday warning the Treasury not to single out the blue states, saying if they’re going to tackle charitable donations they could also target private school voucher programs. “Long before the tax law passed, some states abused the idea of charitable […]

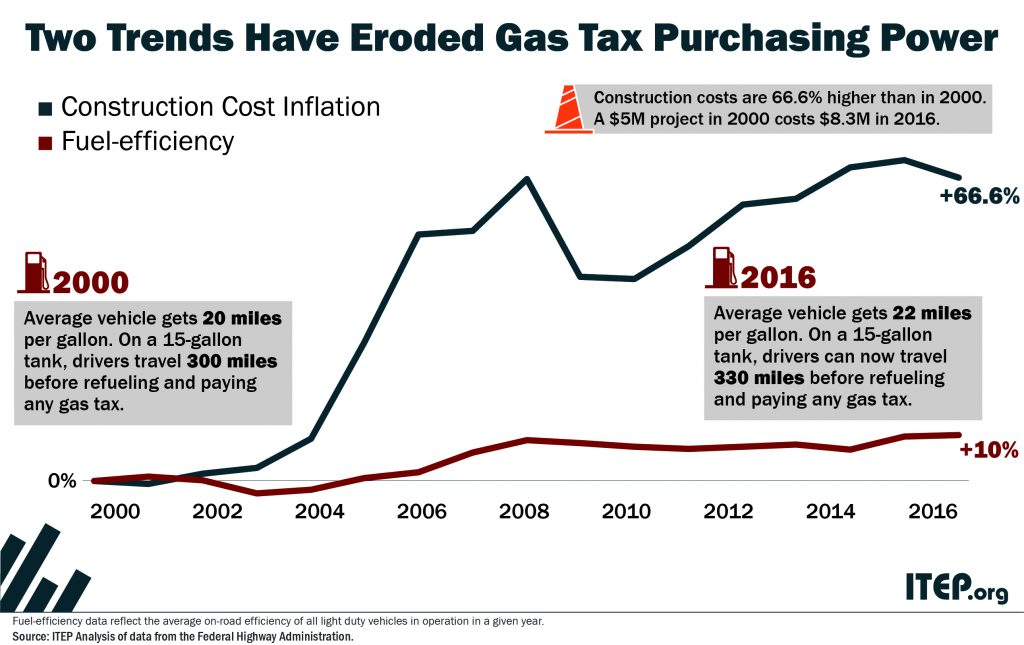

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Seattle Weekly: Seattle City Council Passes Reduced Head Tax

May 14, 2018

This comes on the heels of a 2015 Institute on Taxation and Economic Policy report that showed Washington has the most regressive tax system in the country because of its high reliance on sales taxes. Read more

Associated Press: Arizona Voters May Be Asked Whether They Want to Tax High Earners to Fund Education

May 11, 2018

Ballot initiatives to hike taxes on the rich are rare but not unheard of. A measure in Washington state in 2010 to adopt an income tax for individuals who make more than $200,000 was overwhelmingly voted down. Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, said the public could be more […]

Washington Post: Iowa Republicans pitch ‘crisis-proof’ tax cuts. Democrats see another Kansas in the making.

May 8, 2018

"The trigger is a politically expedient way for lawmakers to claim they’ve cut your taxes without having to do anything immediately to make up for the consequences of reducing revenue," said Meg Wiehe, of the Institute on Taxation and Economic Policy, a left-leaning think tank.