Like everyone else in America, immigrants pay taxes, whatever their legal status. The income taxes, property taxes, and sales and excise taxes paid by both documented and undocumented immigrants help sustain American public schools, services, and infrastructure.

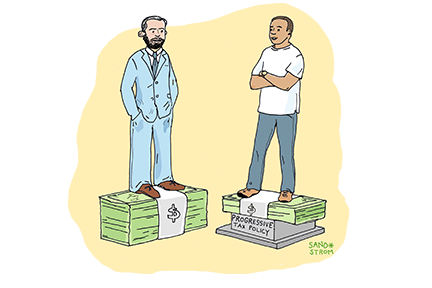

Undocumented immigrants paid more than $37 billion to states and localities in 2022, and they pay higher effective state and local tax rates as a share of their incomes than our wealthiest citizens.

Of the almost 48 million immigrants living in the United States, roughly 11 million are considered undocumented. Some of these individuals were previously authorized to be in the country but overstayed their visas or otherwise lost legal status. Others crossed the border without permission, usually in search of economic opportunity or out of fear of persecution in their home countries.

Most adult undocumented immigrants have been in the U.S. for over 15 years, and many have family members who are citizens or legal residents. The vast majority are working.

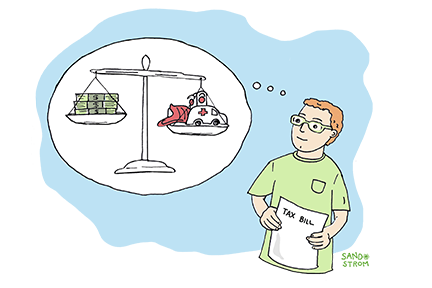

Living here without legal status prevents immigrants from using some public services, such as some health care coverage and food assistance programs. But it has less of an effect on whether they pay taxes that help fund those services.

Sales and excise taxes

Undocumented immigrants shop in the same stores as everyone else and pay sales and excise taxes on clothing, gasoline, household items, and other items as other shoppers do. The largest share of state and local taxes paid by undocumented immigrants are those levied on everyday purchases of goods and services. In 2022, undocumented immigrants paid an estimated $15 billion in sales and excise taxes in their respective home states combined.

Property taxes

Undocumented immigrants, whether they rent or own the places they live, also pay property tax. Two in five households with undocumented immigrants own their own homes and pay property taxes directly. The remainder are renters and pay some property taxes via their rent. Altogether, undocumented immigrants paid an estimated $11.3 billion in property taxes in 2022.

Income taxes

Immigrants who do not have U.S. work authorization are still supposed to pay income taxes. In practice, most of these payments occur through automatic tax withholding from their paychecks by their employers—as also happens with U.S. citizen workers.

Immigrants also often file income tax returns. The federal government allows anyone ineligible for a Social Security number to obtain an Individual Taxpayer Identification Number (ITIN) to assist with filing tax returns. This number does not grant work authorization, nor does it allow filers to claim things like the federal Earned Income Tax Credit (EITC). At the state level, undocumented immigrants use the same ITIN when filing state income tax returns.

In 2022, undocumented immigrants paid more than $7 billion in state and local income taxes across the country. If they had been granted legal status and no longer forced to work “off the books” or in sectors where they are underpaid compared to their counterparts with legal status, their income tax payments would have increased to over $11 billion.

Undocumented immigrants may pay more taxes and receive fewer services than many legal residents

Undocumented immigrants face a harsher tax code than similarly situated legal residents. Not only do they help fund programs they cannot access, they also are barred from important federal family and anti-poverty tax credits like the EITC and (as of 2025) the Child Tax Credit (CTC). They are also barred from claiming many state tax credits.

Taken together, the taxes paid by undocumented immigrants to state and local governments in 2022 totaled 10 percent of their incomes, and they would have paid an even higher percentage if they were granted legal status. As a point of comparison, that’s a higher share of income than what the wealthiest 1 percent of families and individuals pay in state and local taxes. It is quite possible that changes in federal immigration enforcement practices are undermining the aggregate tax contribution from immigrants, because paying taxes could expose some immigrants to greater risk of deportation. Nonetheless, immigrants’ payments to help fund infrastructure, education, and social insurance programs that help millions of Americans are one of the clearest ways that immigrants contribute to their communities.

Related Entries

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

Read More

- Azari, Shabnam Shenasi, et al (2024). The Foreign-Born Population in the United States: 2022. U.S. Census Bureau.

- American Immigration Council (2024). Mass Deportation: Devastating Costs to America, Its Budget and Economy.

- Batalova, Jeanne (2025). “Frequently Requested Statistics on Immigrants and Immigration in the United States.” Migration Policy Institute.

- Davis, Carl, et al (2024). Tax Payments by Undocumented Immigrants. ITEP.

- Davis, Carl, and Sarah Austin (2025). “House Tax Bill Would Create a Parallel, Harsher Tax Code for Immigrant Filers and their Citizen Family Members.” ITEP.

- Whiten, Jon, and Carl Davis (2025). “Turning IRS Agents to Deportation Will Reduce Public Revenues. ITEP.