The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive.

Initially enacted in 1997, the federal CTC has undergone numerous revisions that have altered its amount, refundability, and claimants. But a large, temporary expansion in 2021 that made the credit much more accessible to low- and moderate-income households inspired states across the country to create their own credits.

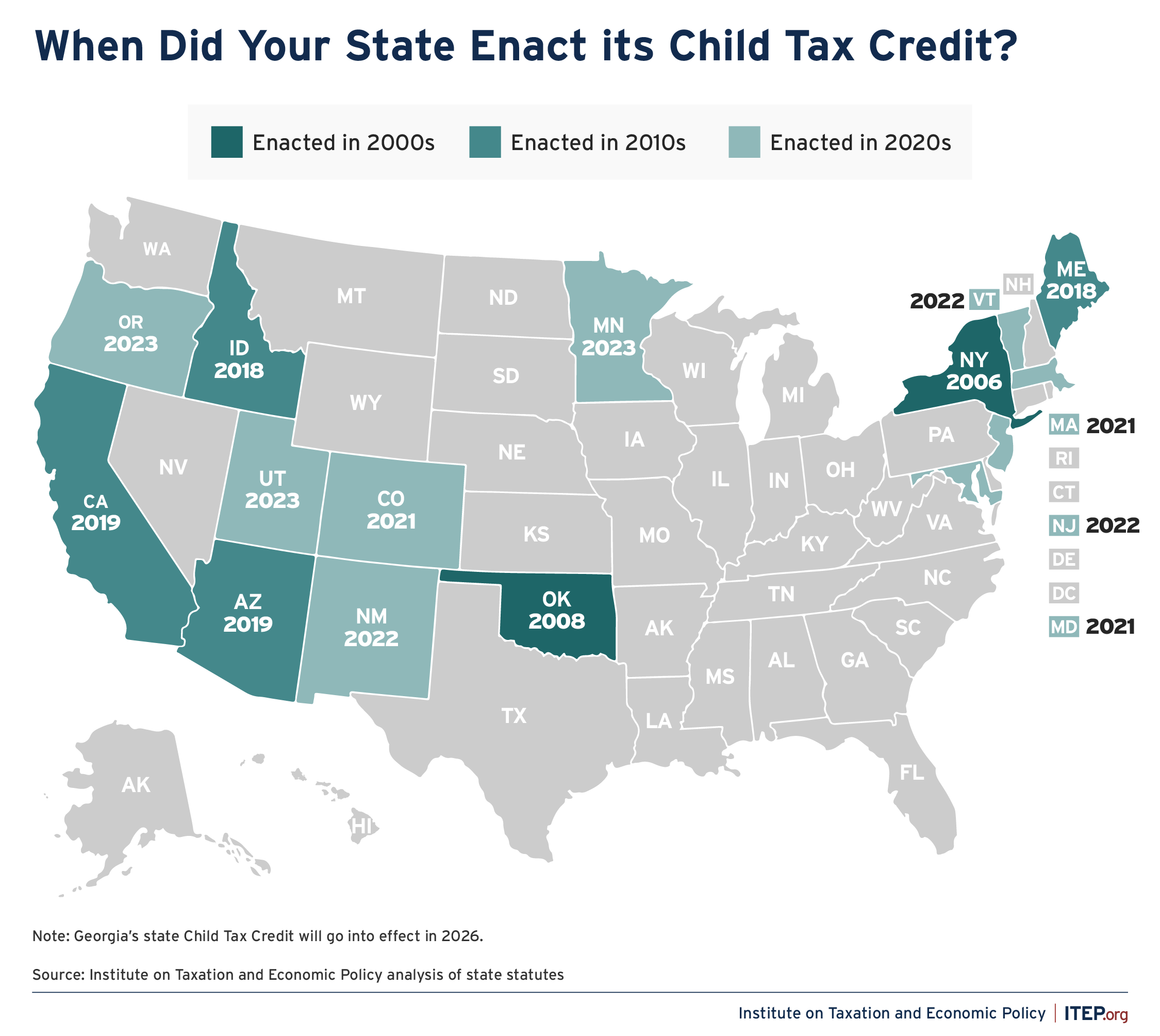

As of 2020, only six states had CTCs. Most credits were small and many were nonrefundable. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child. Additionally, Georgia is set to enact a CTC in 2026.

State and local taxes are overwhelmingly regressive, requiring low and middle-income families to pay more of their income in taxes than wealthier taxpayers. This makes the CTC a helpful tool at the state level. Refundable tax credits can help offset the upside-down nature of state and local tax systems, which often rely heavily on regressive sales, excise, and property taxes.

The map below shows which states have a CTC, as well as the year their CTC was first enacted.