Note: Estimates for the Working Families Tax Relief Act were revised on September 10, 2019.†

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

The maximum EITC for families with children would increase by up to 25 percent in some situations. Working people without children would receive an EITC that is four times the size of the small EITC that they are allowed under current law.

The CTC would be $2,000 for each child age six and older and $3,000 for each child younger than age six. The proposal would remove limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

For more information, see the ITEP report, Understanding Five Major Federal Tax Credit Proposals.

Lead Sponsor/Proponent |

General Explanation |

Share Going to Bottom 60% |

Share Going to Richest 20% |

Total Cost CY 2020 |

| Sen. Sherrod Brown | Moderate expansions of EITC and Child Tax Credit |

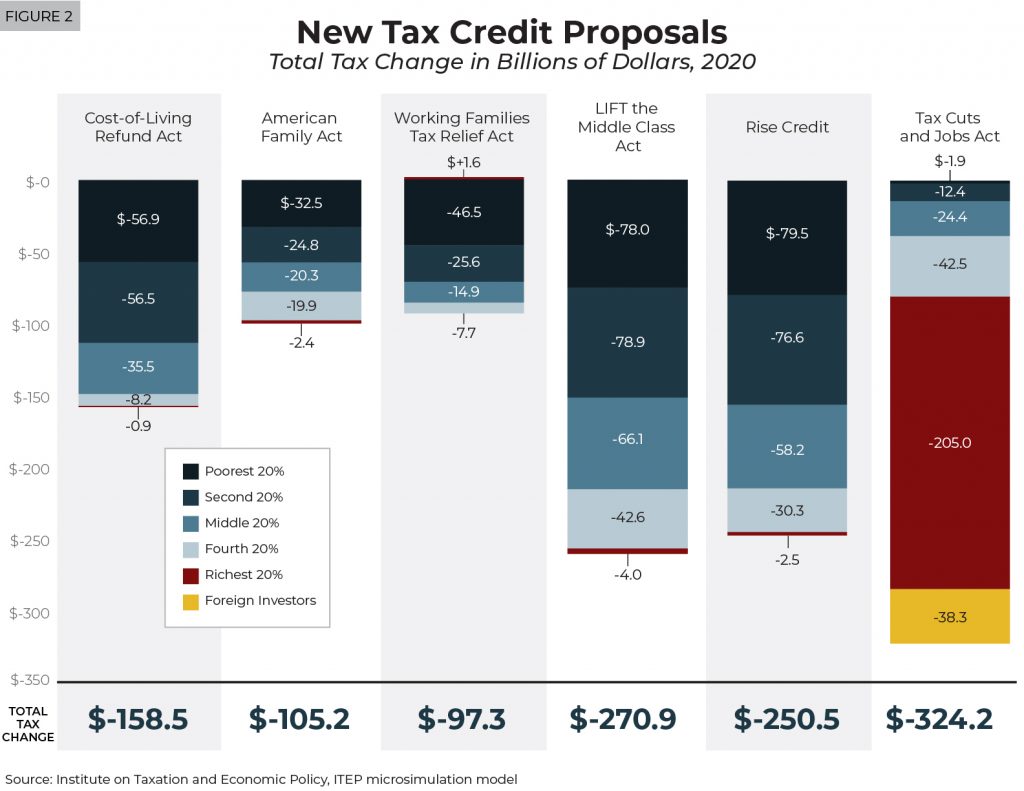

89% | -1% | $97.3 billion |

State Impact National Impact Who Benefits? Distribution by Race

† The revisions made on September 10 for the Working Families Tax Relief Act were relatively small. For example, our estimate of the bill’s cost in 2020 changed from $99.2 billion to $97.3 billion.