Worldwide Combined Reporting

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Colorado Lawmakers Help Fill Trump-Induced Shortfall by Tackling Offshore Corporate Tax Avoidance

August 26, 2025 • By ITEP Staff

As the Trump megabill blows holes in state budgets, Colorado is leading with reforms to curb offshore tax avoidance and roll back wasteful corporate subsidies.

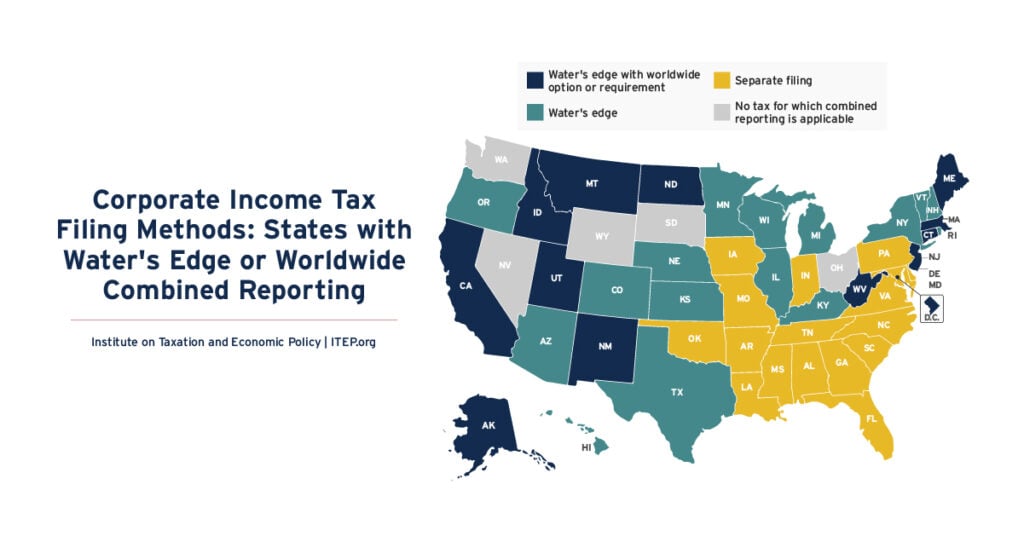

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Five Things to Know About Tax Foundation’s Critique of Maryland’s Worldwide Combined Reporting Proposal

April 1, 2024 • By Carl Davis, Matthew Gardner

Maryland lawmakers are considering enacting worldwide combined reporting (WWCR), also known as complete reporting. This policy offers a more accurate, and less gameable, way to calculate the amount of profit subject to state corporate tax. Enacting WWCR in Maryland would represent a huge step toward eliminating state corporate tax avoidance as it neutralizes a wide […]

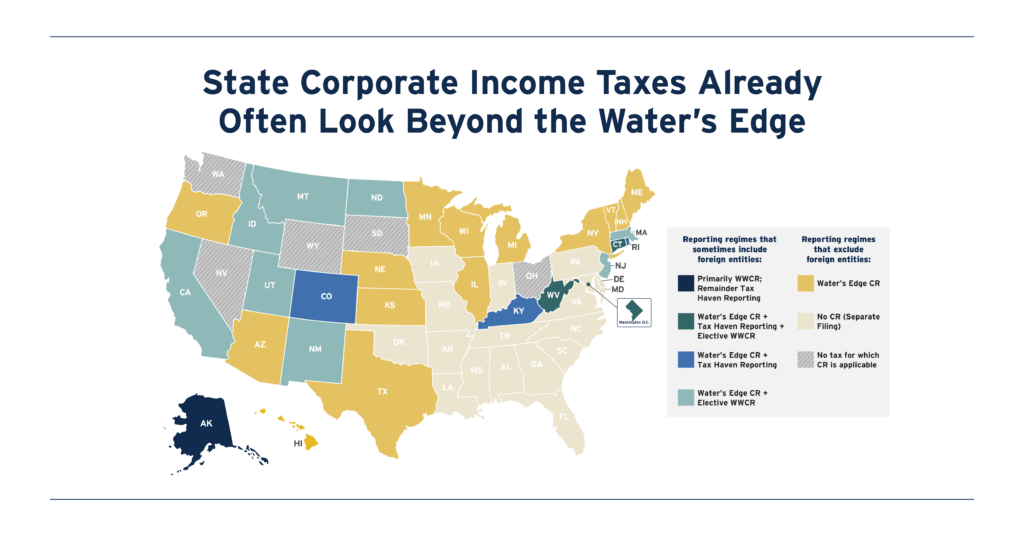

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.