By: Carl Davis, ITEP’s Research Director

Read this report in PDF form here.

In recent months, the Tax Foundation has used its Taxes and Growth Model (TAG Model) to estimate the impact that a variety of tax policy changes would have on the nation’s economy—including tax plans proposed by current presidential candidates.

The Tax Foundation describes the underlying “logic” of its TAG Model as being rooted in the assumption that “taxes have a major impact on economic growth.” More specifically, the TAG Model has concluded that proposals to lower taxes for high-income individuals and businesses would dramatically grow the economy, and that proposals to raise taxes would significantly slow economic growth.

Before deciding to trust the results coming from any economic model, it is important to understand whether the model offers a reasonable approximation of the nation’s economy and its fiscal policies. Unfortunately, a review of numerous TAG Model analyses suggests that it does not.

Two fundamental shortcomings are apparent across most of the TAG Model’s dynamic analyses. First, the TAG Model currently views government investments in infrastructure, education, and other services as economically worthless. Second, the TAG Model assumes that certain tax policy changes would produce unrealistically large economic effects. In some cases, the TAG Model portrays tax cuts as a “free lunch” with economic effects so large that any negative impact on federal revenues is ultimately negated through faster growth. In others, the model ventures even further into the territory of “economic voodoo” by depicting tax cuts as a means of raising federal revenues, and tax increases as ineffective at achieving that same goal.

The Spending Blind Spot

Buried in the appendix of the Tax Foundation’s more recent TAG Model analyses is an admission that “the Taxes and Growth Model does not take into account … the potential macroeconomic or distributional effects of any changes to government spending” required by tax changes being modeled. In other words, the TAG Model fails to consider the most fundamental reason that taxes exist: to fund the public investments in infrastructure, education, and other services that matter hugely to the economy and society at large.

In the TAG Model, higher tax collections are a damaging drain on the economy and public investments funded through taxes have no economic value whatsoever. Without a mechanism for considering the value of new tax revenues, the TAG Model is set up so that nearly all plans to raise taxes will be found to be wasteful and economically damaging, while plans to cut taxes will produce economic benefits with no budgetary tradeoffs required.

This design goes a long way toward explaining why even a modest increase in the gasoline tax, for example, is depicted by the TAG Model as shrinking the nation’s GDP by $16 billion. In the real world, a gas tax increase is one of the most reliable options for funding economically crucial infrastructure projects and is supported by groups such as the Chamber of Commerce, the trucking industry, labor unions, and to some extent, even the Tax Foundation itself.

To its credit, the Tax Foundation seems to have recognized the serious problems that arise from ignoring the linkage between government spending and the economy, and at least two of its staff are now working on a solution. Until that happens, however, readers of TAG Model analyses should be aware that the model has a major blind spot that is skewing its conclusions.

Economic Voodoo

Capital gains tax: The TAG Model depicts efforts to raise tax rates on investment income as economically damaging to the point that they would often reduce federal tax revenues. A modest 4.2 percent increase in capital gains and dividends tax rates, for example, has been predicted by the TAG Model to drain $11.8 billion from the nation’s coffers annually. Even more dramatically, raising tax rates on this income to match those currently applied to most workers’ salaries and wages would allegedly result in $122.1 billion in lost revenue.

Perversely, according to the TAG Model, lawmakers seeking to raise revenue through changes in capital gains taxes should actually follow the Tax Foundation’s preferred route of cutting tax rates. A modest 2 percent rate cut could allegedly result in as much as $11 billion in additional revenue collections and wiping out taxes for half of all capital gains would raise closer to $25 billion per year.

Direct email correspondence with the Tax Foundation recently revealed that the economic impact of capital gains taxes is somewhat more muted in the current version of the model (with capital gains tax cuts now being close to revenue neutral), but that upcoming model revisions will soon cast capital gains tax cuts as revenue raisers yet again.

Simply put, the TAG Model’s portrayal of capital gains taxes is unrealistic. Numerous researchers have concluded that capital gains tax rates have no meaningful relation to economic growth—much less a negative relationship so strong that it could flip conventional tax policy on its head and cause lower tax rates to result in higher tax revenues. In sharp contrast with the TAG Model, the Congressional Research Service (CRS), Congressional Budget Office (CBO), and President George W. Bush’s former chief economist are all in agreement that capital gains tax cuts do, in fact, reduce tax revenues.

Corporate tax: As recently as March 2015, the TAG Model concluded that cutting the top corporate income tax rate would actually raise additional federal revenues. In four different studies, the Tax Foundation concluded that corporate tax rate cuts could generate between $3 billion and $11 billion of new revenue per year, with the largest revenue gains actually coming from the lowest corporate income tax rates. Sometime in mid-2015, however, the Tax Foundation quietly abandoned its view that corporate tax rate cuts can be used as a tool for raising revenue. As of August 2015, the TAG Model concluded that a staggering 70 to 76 percent of the revenue loss resulting from a corporate tax rate cut would be eliminated through faster economic growth—and email correspondence since then reveals that number could rise to 90 percent or more in the weeks ahead. These findings contrast sharply with the 5 to 6 percent estimate (PDF) from the CRS, and even the highly optimistic 11.8 to 27.5 percent estimate (PDF) from the Joint Committee on Taxation.

Estate tax: Similar to its findings on capital gains taxes, the TAG Model concludes that the estate tax is so economically damaging that it has destroyed more than 100,000 jobs and shrunk the economy by a factor roughly seven times the size of the tax itself. As a result of this alleged economic catastrophe, the TAG Model has concluded that the estate tax actually reduces overall federal revenue by $8 billion—revenue that could be recouped if this tax were repealed.

This view of the federal estate tax is far outside the mainstream. The CBO explains in detail (PDF), for example, that there are reasons to doubt whether the estate tax actually discourages work and investment at all. Similarly, researchers at the Brookings Institution have concluded that “the supposed negatives of the estate tax—its effects on saving, compliance costs, and small businesses—lack definitive supporting evidence and in some cases appear to be grossly overstated.”

Personal Income Tax: While not as dramatic as for the other taxes just described, the TAG Model views taxes on ordinary personal income as having an astounding degree of influence over the economy. In June 2015, the TAG Model concluded that while increasing the nation’s top income tax rate could raise some revenue, over half (51 to 56 percent) of the potential gain would never actually materialize because the economy would slow dramatically in the wake of such a change. Email correspondence with the Tax Foundation confirms that this finding holds true in the current version of the TAG Model as well.

These types of sensational claims about the linkage between income tax rates and economic growth do not withstand scrutiny (as documented in numerous studies and confirmed by recent experience). And while the Tax Foundation has published a literature review in an effort to defend its extreme position, researchers at the Center on Budget and Policy Priorities (CBPP) discovered that “the Tax Foundation mischaracterized, exaggerated, or selectively described the findings of six of those 19 [national studies it cited].” Reviewing the same studies more generally, economists at the Brookings Institution also found that “the evidence presented in those studies [is] relatively unconvincing of the view that tax cuts promote growth.”

Conclusion

The TAG Model takes an exaggerated view of the impact that taxes have on the economy, while at the same time assuming that the public investments funded through those taxes have no economic value whatsoever.

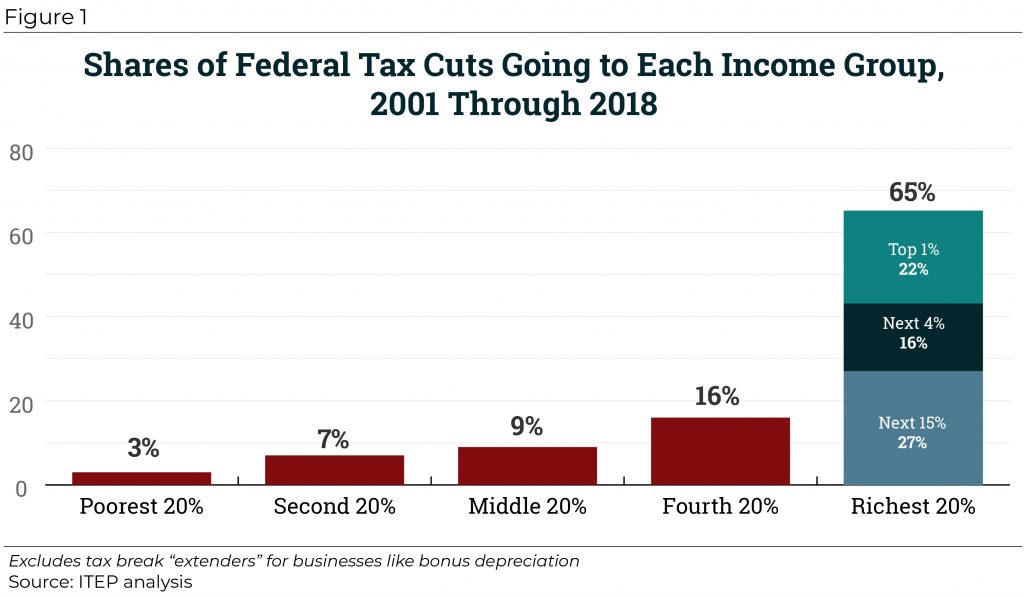

In the TAG Model, tax cuts are often found to be a “free lunch” or, even more implausibly, a tool for actually boosting overall tax collections. Moreover, these findings are most closely linked to tax cuts for high-income taxpayers, meaning that the model assumes tax policy changes that widen economic inequality are economically beneficial, while those that narrow inequality are often a drag on economic growth.

Ultimately, the TAG Model’s extreme findings strongly suggest that the model is unreliable.