Today, the Koch brothers held a kick-off event with Treasury Secretary Steven Mnuchin to promote the tax giveaway supported by the White House, congressional leadership and being pushed by Americans for Prosperity, the Chamber of Congress and other anti-tax interest groups. Another Koch-sponsored event will follow on Wednesday.

Three weeks ago, supply-side economist Arthur Laffer and Heritage Foundation scholar Stephen Moore penned an op-ed in the Wall Street Journal calling on state lawmakers to support federal tax cut proposals because, they claim, such cuts would stimulate state economies.

In late July, President Trump gave a wide-ranging interview with the Wall Street Journal in which he claimed his tax plan would benefit the middle-class. Last week, GOP leaders laid out a set of tax principles claiming their pending tax cut plan would focus on the middle-class.

Clearly, this is a coordinated effort to ensure so-called tax reform doesn’t meet the same fate as health care legislation.

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

During the 2000 general election campaign, then candidate George Bush was able to sell across-the-board tax cuts that mostly benefited the wealthy as a sound policy idea in part because the nation was running annual budget surpluses and anti-tax advocates could easily avoid talking about the consequences of sizable tax cuts. But times have changed.

Plans proposed by President Trump and Speaker Ryan both would add $4 trillion or more to the national debt over the next decade unless lawmakers make dramatic cuts to domestic programs. And budget proposals released by the White House and Congress reveal that GOP leaders intend to cut subsidies for education, Medicaid, food assistance, disability insurance, housing assistance, job training and other critical services. In other words, in exchange for a pittance, working people (particularly low-wage working people) could lose access to resources that help alleviate poverty.

But just as the public was well aware that the GOP health proposal meant millions would lose access to health care while the rich would receive a tax break, they are equally aware that the tradeoff for a tax cut annually worth hundreds of thousands to the rich (and $100 to $700 for low- and middle-income families) could be the loss of resources that help millions put food on the table, keep a roof over their heads or access education and health care.

ITEP will analyze upcoming congressional and administration tax proposals. Meanwhile, here are resources on plans released thus far:

- Read ITEP’s national and state-by-state distributional analysis of the Trump tax plan: https://itep.org/trumptaxprelim/

- Read The 35 Percent Corporate Tax Myth . This report examines eight years of data on the tax habits of Fortune 500 companies. From 2008 to 2015, the average effective rate paid by profitable corporations was 21.4 percent.

- Read an ITEP explanation of how President Trump’s proposed tax cuts would least benefit states where he has the greatest support: https://itep.org/trump-tax-cuts-vary-by-state-but-mainly-benefit-the-rich/

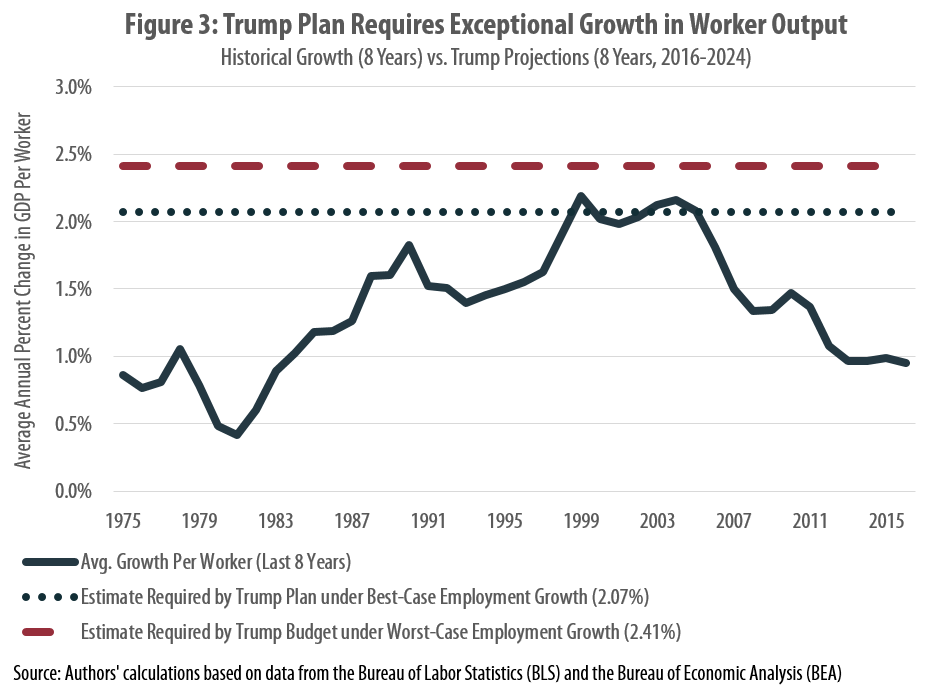

- Read an analysis that dismantles Arthur Laffer and Stephen Moore’s case for tax cuts: https://itep.org/art-laffer-and-stephen-moores-misleading-case-for-the-trump-tax-cuts/