Click here for a pdf of this page

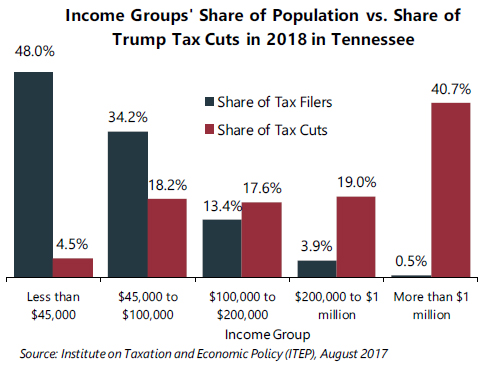

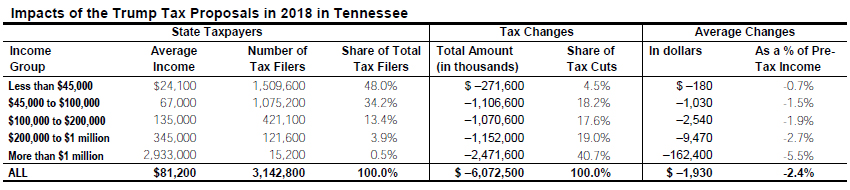

A tiny fraction of the Tennessee population (0.5 percent) earns more than $1 million annually. But this elite group would receive 40.7 percent of the tax cuts that go to Tennessee residents under the tax proposals from the Trump administration. A much larger group, 48.0 percent of the state, earns less than $45,000, but would receive just 4.5 percent of the tax cuts.

A tiny fraction of the Tennessee population (0.5 percent) earns more than $1 million annually. But this elite group would receive 40.7 percent of the tax cuts that go to Tennessee residents under the tax proposals from the Trump administration. A much larger group, 48.0 percent of the state, earns less than $45,000, but would receive just 4.5 percent of the tax cuts.

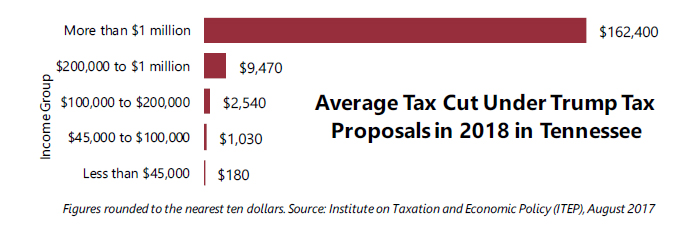

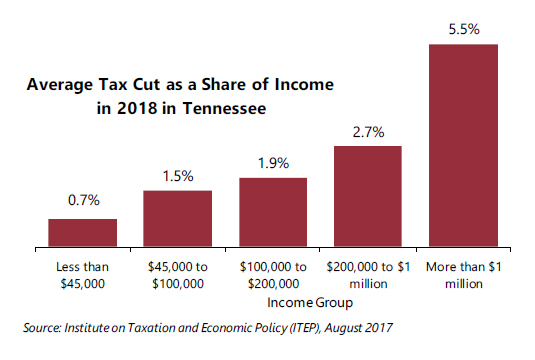

The first group, the millionaires, would receive an average tax cut of $162,400 in 2018, equal to 5.5 percent of their income. The second group, those making less than $45,000, would receive an average tax cut of just $180, equal to 0.7 percent of their income.

The figures in this brief have been calculated by the Institute on Taxation and Economic Policy (ITEP) based on broad principles for tax policy released by the Trump administration on April 26 as well as subsequent statements by administration officials. Because the principles and statements left many unanswered questions, the estimates required some assumptions. ITEP’s longer report explains these assumptions and each tax proposal in detail. That report concludes that the Trump tax principles would reduce revenue by at least $4.8 trillion over 10 years.

The table below provides more detail about the effects of the administration’s tax proposals on households at different income levels.

The Trump tax proposals included in these figures are the following, which are described in more detail in ITEP’s longer report.

Repeal of the 3.8 percent tax on investment income for the rich.

Repeal of the Alternative Minimum Tax.

Repeal of personal exemptions and doubling of the standard deduction.

Replacement of current income tax brackets with three brackets, 10 percent, 25 percent, and 35 percent.

Elimination of all itemized deductions except those for charitable giving and home mortgage interest.

Special tax rate (15 percent) for businesses that do not pay the corporate income tax.

New deduction and tax credit for child care.

Repeal of special tax breaks for businesses and reduction in the corporate income tax rate from 35 percent to 15 percent.

Repeal of the estate tax.