The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

For more information, see the ITEP report, Understanding Five Major Federal Tax Credit Proposals.

Lead Sponsor/Proponent |

General Explanation |

Share Going to Bottom 60% |

Share Going to Richest 20% |

Total Cost CY 2020 |

| Sen. Michael Bennet Rep. Rosa DeLauro |

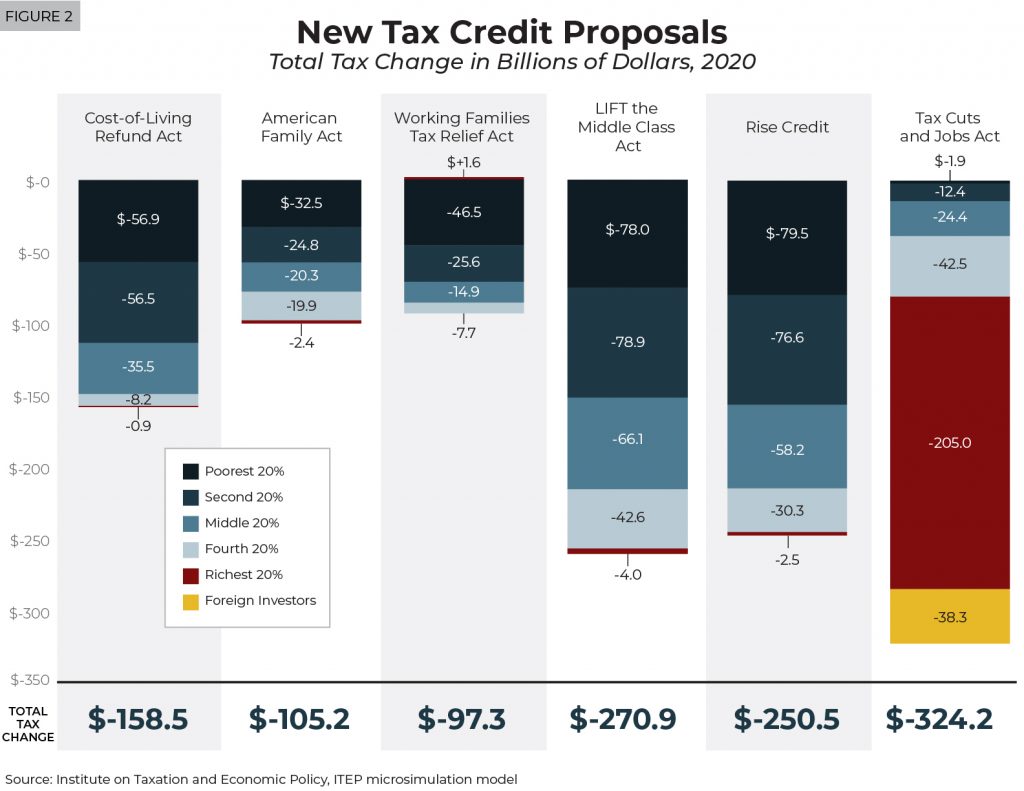

Major expansion of Child Tax Credit | 74% | 2% | $105.2 billion |

State Impact National Impact Who Benefits? Distribution by Race