Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

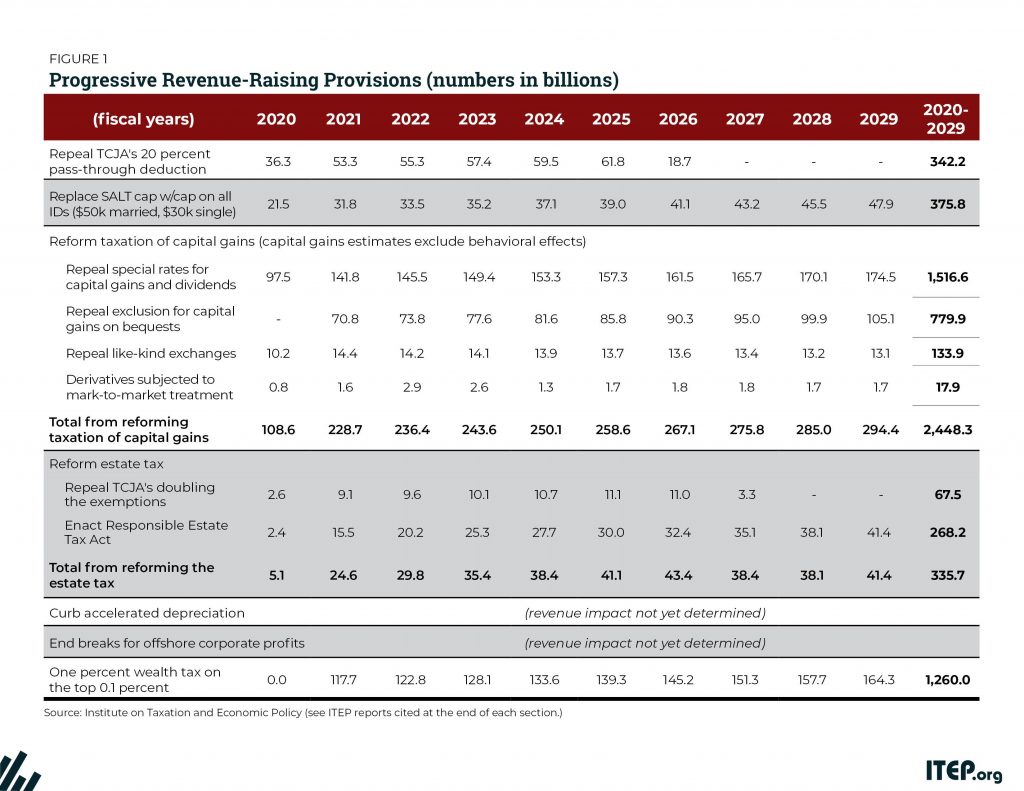

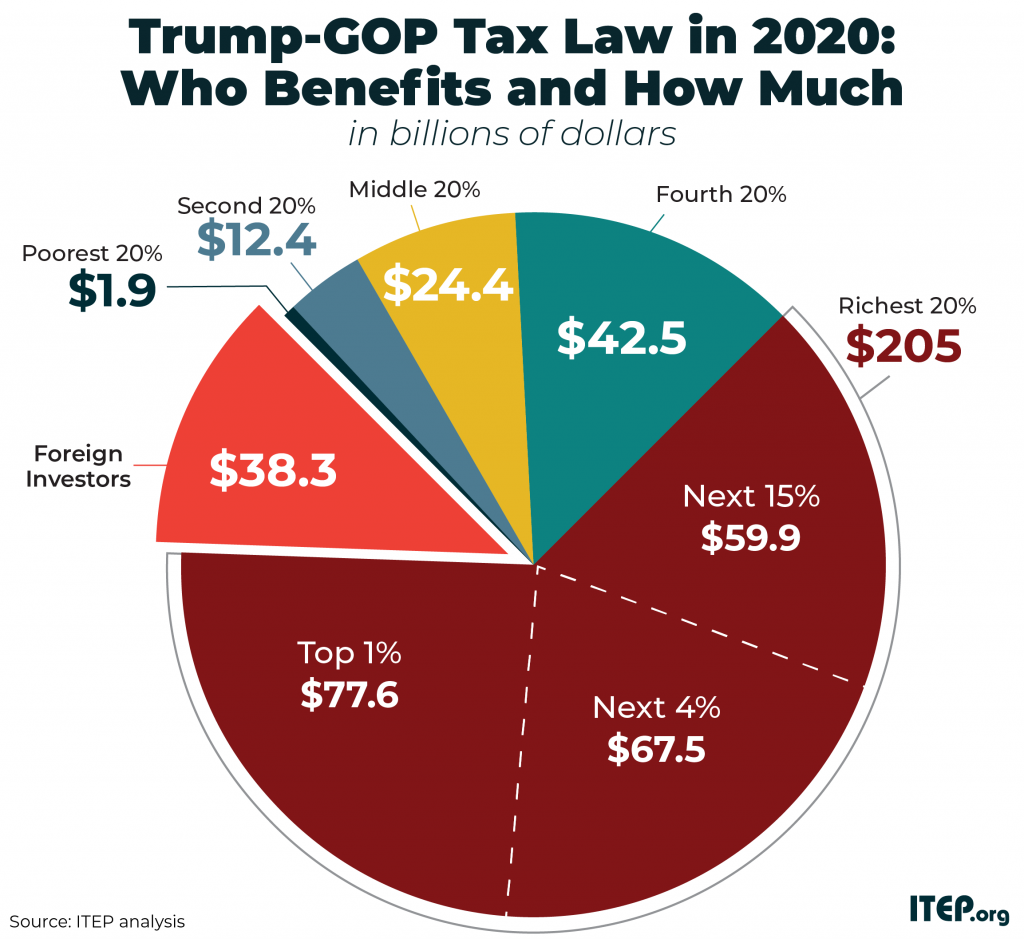

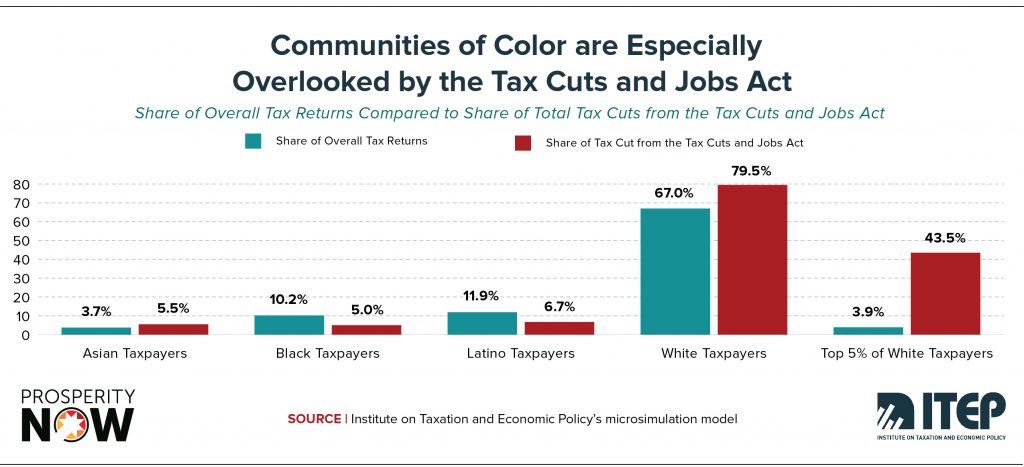

Progressive Revenue-Raising Options provides examples of policy solutions that raise significant revenue from high-income households and reverse the damage from the 2017 Tax Cuts and Jobs Act (TCJA) and other tax cuts that disproportionately benefited the well-off. The TCJA, of course, is a critical part of the national conversation on poverty and income in part because it boosted the after-tax income of the top 1 percent of households more than any other group. Check out ITEP’s numbers on the 2020 distributional impact of the TCJA and also its report (Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Gap) with Prosperity Now that outlines how the tax law provided more than 80 percent of its benefit to white families.

As pronounced as income inequality is, the wealth gap is far worse. In The U.S. Needs a Federal Wealth Tax, ITEP researchers outline how a wealth tax on households with net worth of $32 million or more could raise $1 trillion in revenue over the next decade and also address income inequality.

The federal tax code is also an effective tool for boosting family economic security. This year, several lawmakers have introduced tax credit proposals that vary in scope, approach and cost, but all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have annual household income of $70,000 or less.

State Tax Policy and Its Impact on Poverty and Income Inequality

ITEP’s signature state report, Who Pays?, is a distributional analysis of average effective tax rates in each of the 50 states. This in-depth analysis explains how state and local tax systems exacerbate poverty. In fact, when all the taxes levied by state and local governments are taken into account, all but five states and the District of Columbia assess higher effective tax rates on their poorest families than the richest 1 percent of taxpayers. The report Moving Toward More Equitable State Tax Systems distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to state lawmakers, advocates, and others seeking to improve their state’s tax codes.

ITEP provides a clear explanation of how tax codes contribute to inequality in A Tale of Two States: How State Tax Systems Perpetuate Income Inequality.

State Child Tax Credits also could pick up where the federal CTC falls short and lift millions of children across the country out of poverty. Earlier this year, ITEP and partners at the Center on Poverty & Social Policy at Columbia University released The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis. The report outlines two bold options for creating state-level CTCs. The first would reduce child poverty by at least 15 percent in all but four states. The second, more ambitious option would reduce child poverty by at least 25 percent in all states and up to 45 percent in more than half of states.