Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the COVID-19 relief bill that the U.S. House is expected to vote on this week.

“The revised House COVID-19 relief bill, a significant compromise from House Democrats’ initial HEROES act passed in May, is sorely needed to address the 2020 economic and health crisis. It contains crucial provisions that will help American families and communities survive economically and get the health care they need. As the economic recovery stalls and the pandemic continues to rage, the House is expected to vote in the coming days, and the White House and the Senate should move promptly to pass this $2.2 trillion package.

“Americans urgently need help with income, food and housing. Inequality is supercharged in 2020. New research confirms what we’ve long thought—this recession has been particularly devastating for low-income, young, female, Black, Asian, Hispanic, service sector and non-college-educated workers.

“State and local governments need fiscal assistance from the federal government to keep delivering essential services and to avoid laying off more public employees at a time when the unemployment rate is still higher than at the peak of many past recessions.

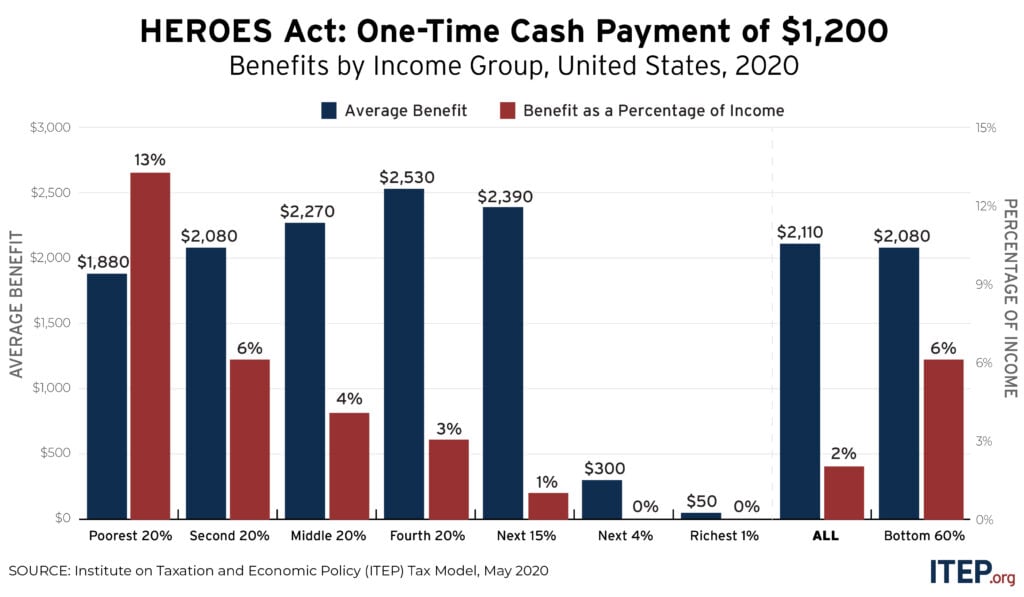

“The bill revives federal enhanced $600 weekly unemployment benefits, provides state and local fiscal relief, and delivers childcare and public health assistance. It would send another round of $1,200 stimulus checks to all Americans, including groups like undocumented immigrants and young adults who were left out of past relief.

“Help is desperately needed. About 33 million American workers have been laid off, furloughed, had their hours reduced or have left the labor market during this recession, according to the Economic Policy Institute. State and local governments confront dramatic new costs to deliver services during a pandemic, while their revenues have cratered because of the recession. They’ve laid off about 1.1 million public sector workers and will make further cuts unless they get federal assistance according to the Center on Budget and Policy Priorities. In the last recession, states that retained public sector workers had fewer overall job losses, fewer private-sector job losses, lower unemployment growth and faster job growth.

“The legislation temporarily expands two refundable tax credits. It removes the earnings requirement and makes the $2,000 Child Tax Credit fully refundable. It also extends the Earned Income Tax Credit to workers without minor children at home and to 19 to 24-year-old workers.

“The bill sensibly restores rules limiting how wealthy business owners can use their losses to offset other income and avoid taxes. These limits on business losses, which might block the kind of tax avoidance perfected by Donald Trump, were suspended under the CARES Act and Congress’s official revenue estimators have since found that millionaires are the main beneficiary.

“One problematic provision, which should be dropped, would temporarily repeal the $10,000 cap on federal deductions for state and local taxes. This would primarily benefit high-income people.

“In the most challenging year for the American economy and for public health in over a generation, the legislation proposed by the House provides essential assistance, and it should be approved without further delay.”