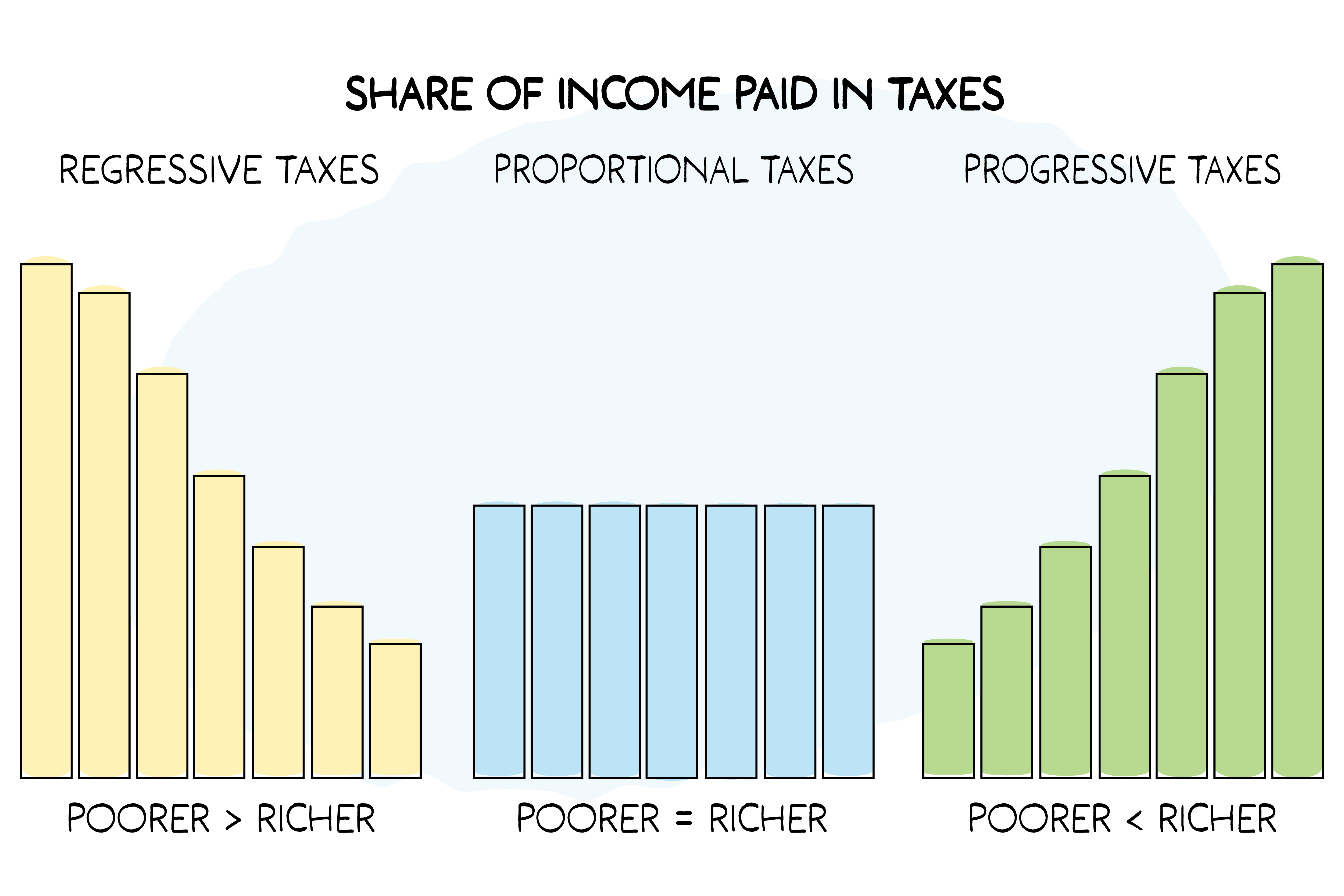

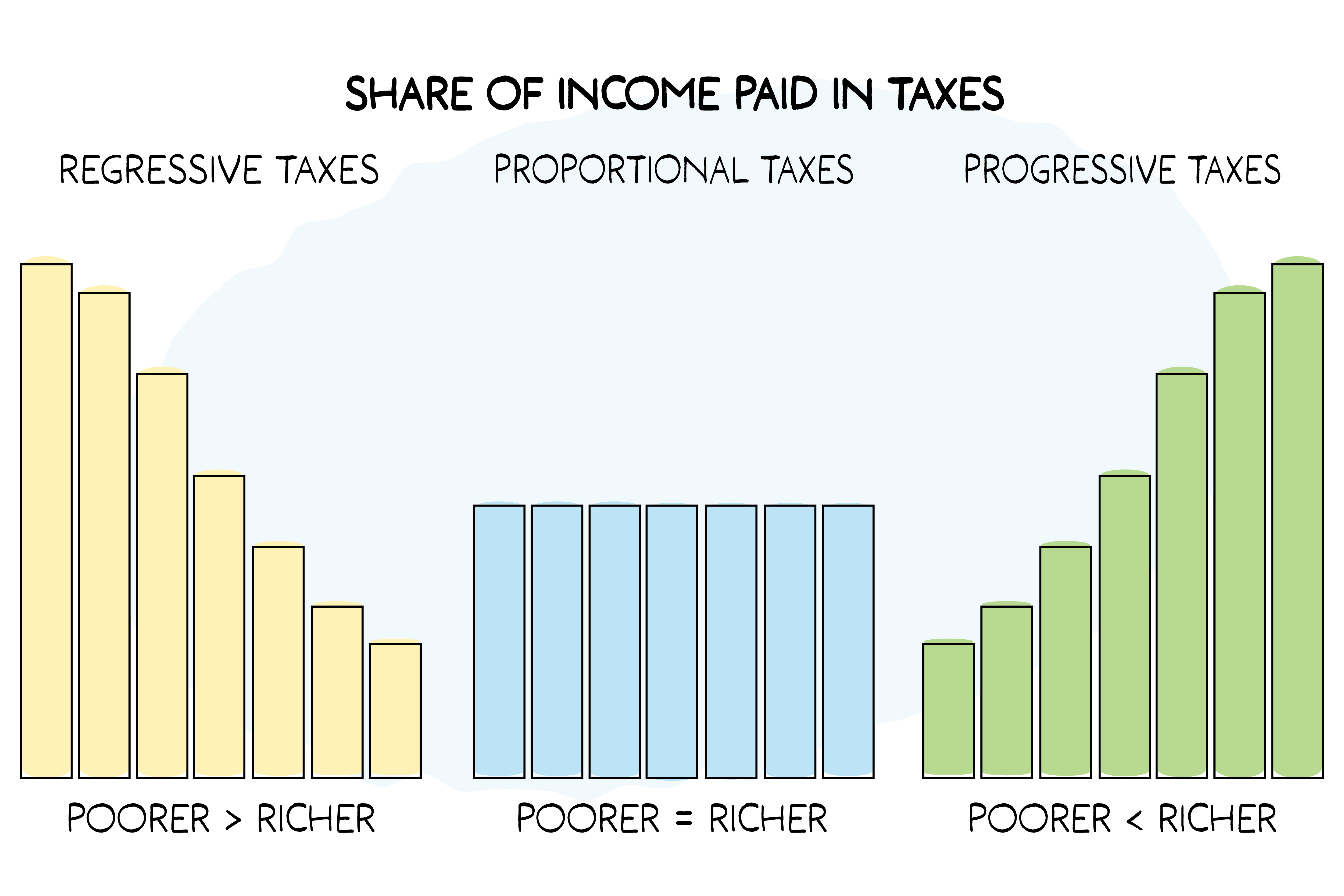

Tax incidence shows who pays taxes and how much they pay. In studying tax fairness, tax incidence specifically looks at how much people at different income levels pay.

Tax incidence analysis is a critical tool for assessing the fairness of tax systems and in showing the equity or inequity of tax policy proposals.

Analyzing How Taxes Affect Different Households

To know whether a tax proposal is fair, it’s not enough to know how it will affect just one household. It’s not even enough to know how it will affect a few hypothetical households that may have been cherry-picked by the proposal’s advocates. To assess fairness, policymakers and the public need to know how that proposal will affect many different taxpayers, and then they need to compare the impact with those taxpayers’ ability to pay.

The best tool for this kind of analysis is what’s known as a “microsimulation model.” Such models are essential to tax policy analysis because they can account for overlapping and interacting tax provisions, and because they can produce results that are representative of the full population.

At the Institute on Taxation and Economic Policy (ITEP), for example, we have built such a model to estimate the amount of federal, state, and local taxes paid by residents of every state at different income levels. The model can show both how much taxes are paid under current law, and how that would be affected by alternative tax proposals.

The ITEP model uses federal tax and U.S. Census data to create a valid representation of each state’s population. It also incorporates many other statistical sources showing personal income, consumer spending, the value of real and personal property, and a wide range of other tax items and demographic and social characteristics.

While our model is uniquely comprehensive and powerful, the basic structure is well-established; other independent organizations and government agencies have constructed models with similar approaches.

The Incidence of Direct and Indirect Taxes

Most state and local taxes are paid directly by state residents—the sales taxes people pay on their purchases, the property taxes they pay on their homes, and the income taxes they pay on their income. A full picture of tax incidence, however, also requires us to consider indirect taxes that initially fall on businesses.

When a business pays a tax, it passes the cost to shareholders in the form of smaller dividends, to consumers through higher prices, to workers through lower wages, or some combination of the three. In other words, while the direct incidence is on the business itself, the economic incidence is on the shareholders, consumers, and/or workers.

There’s a large body of economic literature on the question of how taxes shift. The ITEP model generally reflects the research consensus that the taxes most closely related to business investments tend to affect capital investors; payroll taxes tend to be shifted onto employees; and taxes on overall sales tend to be ultimately paid by consumers.

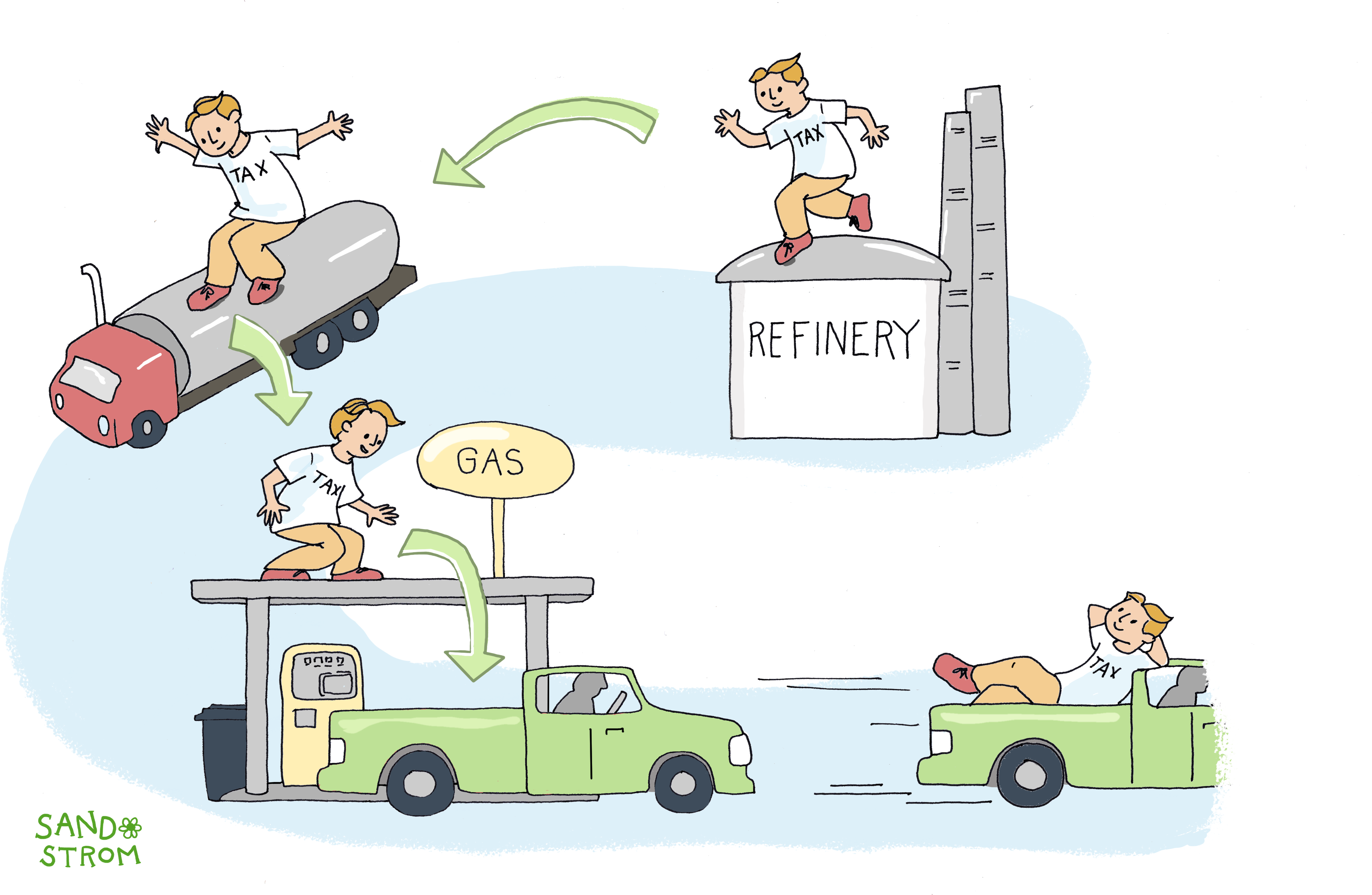

Consider a state that raises taxes on gasoline by 20 cents per gallon. Gasoline suppliers or distributors typically have the direct responsibility to pay this tax, but they pass it through to gas station owners, who then shift it to drivers in the form of higher pump prices. The economic incidence, then, falls primarily on drivers. This shifting occurs because businesses and individuals respond to taxes by changing their behavior—raising prices, adjusting wages, or modifying consumption patterns.

But market conditions matter, too. When consumers have other options, such as buying gas on the other side of a state line where taxes are lower, business owners may have to eat some added cost just to stay in business. The ITEP model incorporates these market conditions in determining economic incidence.

Using Incidence Analysis in Policy Debates

The ITEP model uses a sample of hundreds of thousands of real, anonymized, tax returns and census responses that are representative of the population of the country and each state. The model calculates federal, state, and local tax liability for each representative individual or family. We then combine the population into groups, by income, to show tax incidence. Important patterns emerge from this analysis. Sales taxes, for instance, typically consume a larger percentage of income for lower-income individuals and families because they must spend rather than save most of their earnings. Property taxes can be progressive or regressive depending on how housing costs relate to income in different areas and how the tax is structured.

Incidence analysis can also help us see the disparate impact of tax policies on different racial and ethnic groups. ITEP analysis, for example, found that regressive tax policies used by the state of Tennessee worsened the economic gap separating Black and Hispanic families in that state from white families, but less regressive policies used in Minnesota were helping to reduce the gap.

Tax incidence analysis provides a powerful tool for evaluating competing policy proposals, but it requires careful interpretation. When politicians argue a tax cut benefits working families, for example, incidence analysis can show which income groups truly get the most benefit.

Exporting Tax Costs to Other Jurisdictions

Tax incidence analysis can also help us see how states and localities can sometimes export tax costs by imposing taxes that fall primarily on out-of-state residents or businesses. A ski resort town might levy high hotel taxes that tourists pay, effectively shifting tax costs to visitors rather than residents. Similarly, oil-producing states often tax extraction heavily, knowing that most major oil companies’ shareholders and consumers live in other states or countries.

Tax exporting can be politically attractive because it allows governments to fund services without directly taxing their own constituents. However, the ability to export varies dramatically by location and tax type. States with unique tourist attractions, natural resources, or major transportation hubs have specific opportunities for tax exporting that other states may not, and tax incidence analysis can help illuminate these differences across states.

Related Entries

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

Why should states and localities have progressive tax systems?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

Learn More

- Davis, Carl, Misha Hill, and Meg Wiehe (2021). Taxes and Racial Equity: An Overview of State and Local Policy Impacts.

- ITEP (accessed 2025). “ITEP Tax Microsimulation Model Overview.”

- ITEP (2024). “Who Pays? Methodology and Discussion.” In Who Pays? A Distributional Analysis of the Tax Systems in All 50 States. Seventh Edition.

- ITEP (accessed 2025). “ITEP’s approach to modeling taxes by race and ethnicity.”