The tech giant Meta disclosed this week that the company paid an effective federal income tax rate of just over 3.5 percent in 2025, the lowest it has recorded since the company went public as Facebook in 2012. This comes as Meta enjoyed a record $79 billion of U.S. income, a 20 percent boost from its previous earnings record in 2024.

The federal corporate tax rate is 21 percent but companies like Meta often pay less, as a share of their profits, because of the many special breaks and loopholes left in place by Congress, as well as some new ones created by the new One Big Beautiful Bill Act (OBBBA).

If Meta had paid 21 percent of its $79 billion in 2025 profits in federal corporate income taxes, that would have come to $16.5 billion. Instead, Meta reported a “current federal tax expense” (the company’s best estimate of its income tax bill for the year) of just $2.8 billion, or 3.5 percent of its profits.

This means that Mark Zuckerberg’s social media giant avoided $13.7 billion of federal income taxes in 2025 alone.

The story of Meta’s income tax avoidance is mostly straightforward—although the scale of the tax breaks is breathtaking.

Tax Subsidies for Research

- The company reports $3.9 billion in research and development tax breaks for 2025, which alone is about a sixth of the apparent annual cost of the federal R&D credit nationwide. (The Joint Committee on Taxation pegs the corporate R&D credit at a cost of $22 billion for fiscal year 2025.)

Tax Breaks for Stock Options Paid to Executives

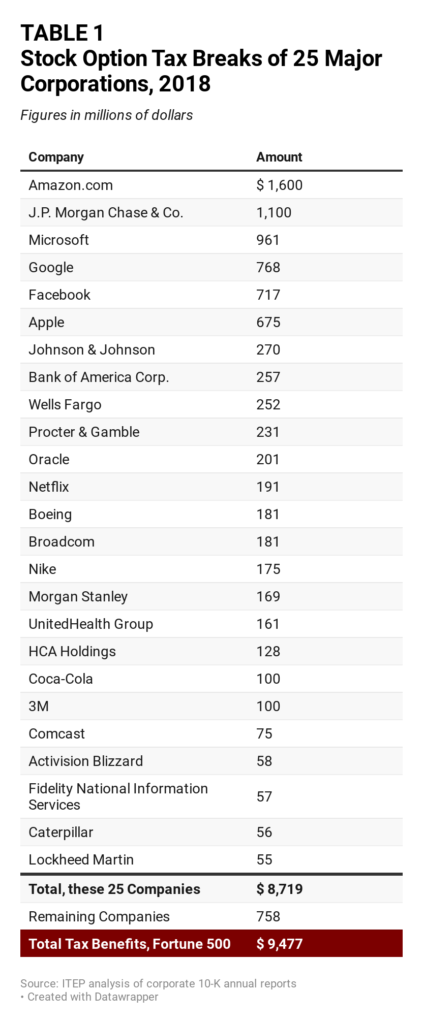

- Excess tax benefits from stock options added another $4.3 billion in tax breaks. An ITEP report explains how corporations are able to write off, for tax purposes, far more phantom stock option expense than they can on their financial statements.

Bonus Depreciation

- The biggest single tax benefit the company reports is from accelerated depreciation, which cut the company’s taxes by $5 billion in 2025. One of the most expensive corporate tax breaks in the new tax law is a permanent extension of “bonus depreciation,” which allows companies to immediately write off the cost of machinery and equipment, and a brand new depreciation break which allows the same immediate expensing for the buildings in which this machinery and equipment is housed.

While Meta has refused to quantify its expected payoff from the passage of last year’s tax cut, its leaders did say in a fall 2025 earnings call that “we will recognize significant cash tax savings for the remainder of the current year and future years under the new law.”

Meta avoided state taxes as well in 2025. The company’s state tax bill of $745 million means Meta paid a nationwide state income tax rate of just 0.9 percent, a fraction of the weighted average state corporate tax rate nationwide of around 6 percent. New expanded income tax disclosure rules required the company to disclose for the first time that a majority of that state tax bill was paid to California, but that alone doesn’t tell us whether the company paid anything close to the Golden State’s 8.84 percent corporate income tax rate on its California income. What’s clear is that somewhere in the U.S., Meta is paying virtually no state income tax at all on its rapidly growing U.S. profits.

Meanwhile, Meta’s effective federal tax rate for 2025 could ultimately be even less than the 3.5 percent it has reported. The company discloses that $2.8 billion of its reported tax expense for the year took the form of “uncertain tax benefits.” These are tax breaks that the company claimed on its tax return but, because the company believes the tax breaks are likely to be ruled illegal by tax administrators on audit, they aren’t allowed to claim for purposes of the annual financial report. If Meta ultimately gets to keep these $2.8 billion in probably-illegal tax breaks, as often happens, that current federal income tax expense (which is also, notably, $2.8 billion) will be reduced even further.

It’s hard to imagine feeling the need to prioritize giving even more tax breaks to a company in this position. Yet, astonishingly, that could yet transpire as a result of Trump administration regulatory decisions. As ITEP noted in October, Meta has disclosed that its future tax cuts from OBBBA will be reduced by as much as $15.9 billion by President Biden’s corporate Alternative Minimum Tax (CAMT), and the Treasury Department has sent signals that it might (illegally) write OBBBA regulations in a way that would negate some or all of this CAMT tax clawback. Such a move would further aggravate one of the largest-scale tax giveaways in federal tax history.