This report is a modified version of an earlier report ITEP published in collaboration with Liberation in a Generation.

Key Findings

1. Corporate tax cuts and corporate tax avoidance worsen income inequality.

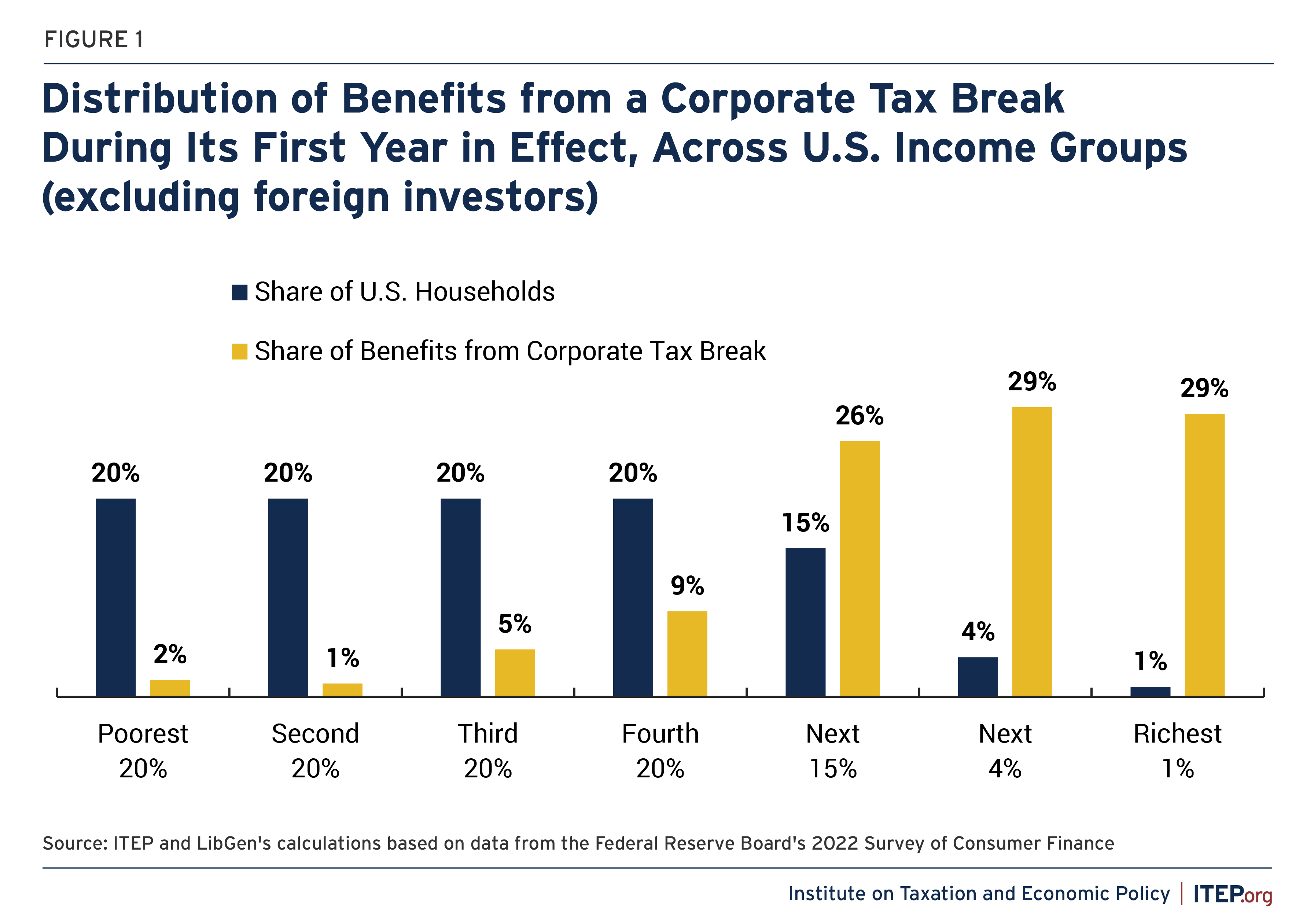

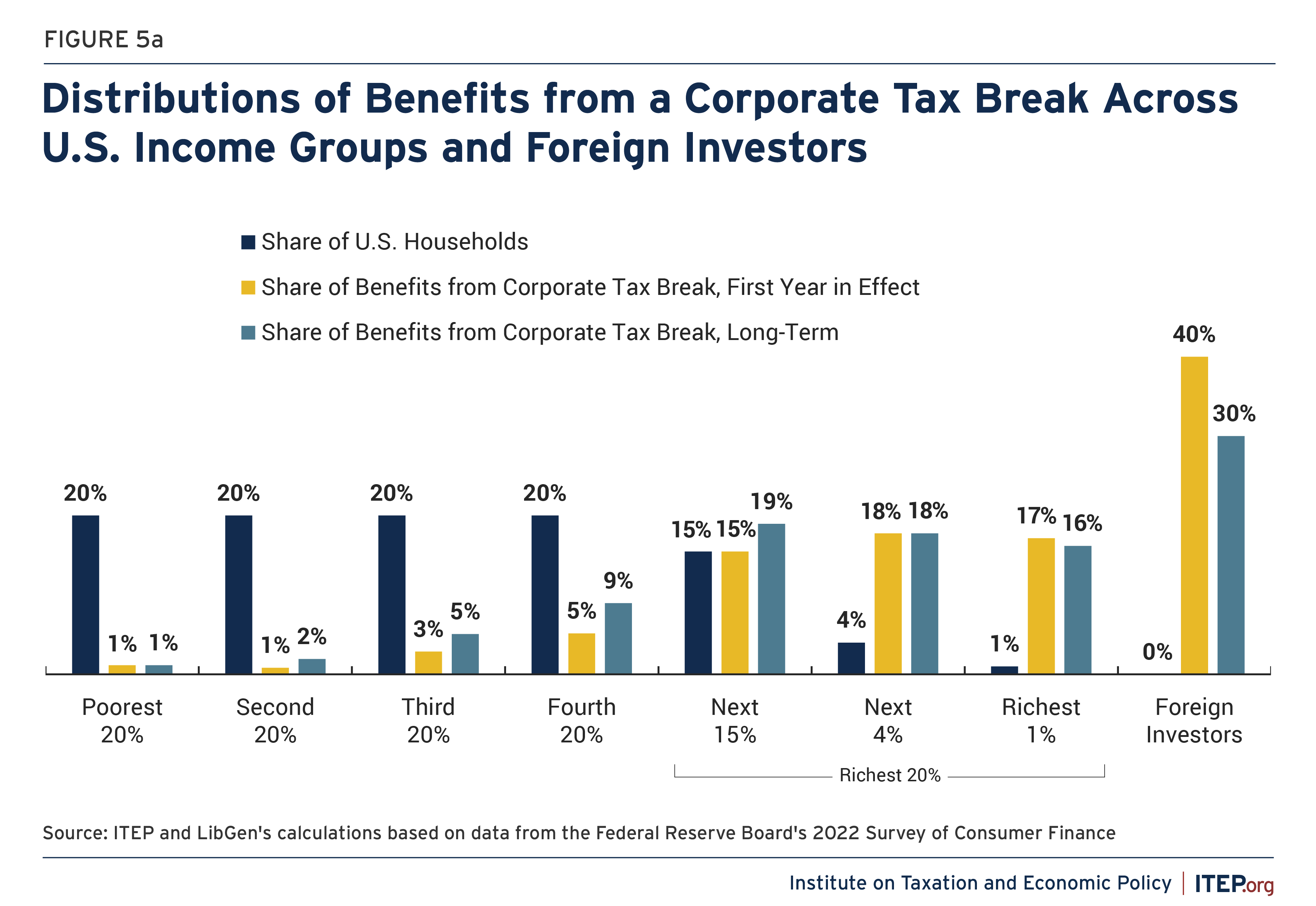

When corporations are allowed to pay less in taxes, the ultimate beneficiaries are mainly the owners of corporate stocks, who are concentrated among the wealthiest households. Aside from the benefits that flow to foreign investors, 29 percent of the benefits flows to the richest 1 percent of households in the U.S. and another 29 percent flows to the next richest 4 percent. In all, 84 percent of the benefits from corporate tax breaks go to the richest 20 percent of households.

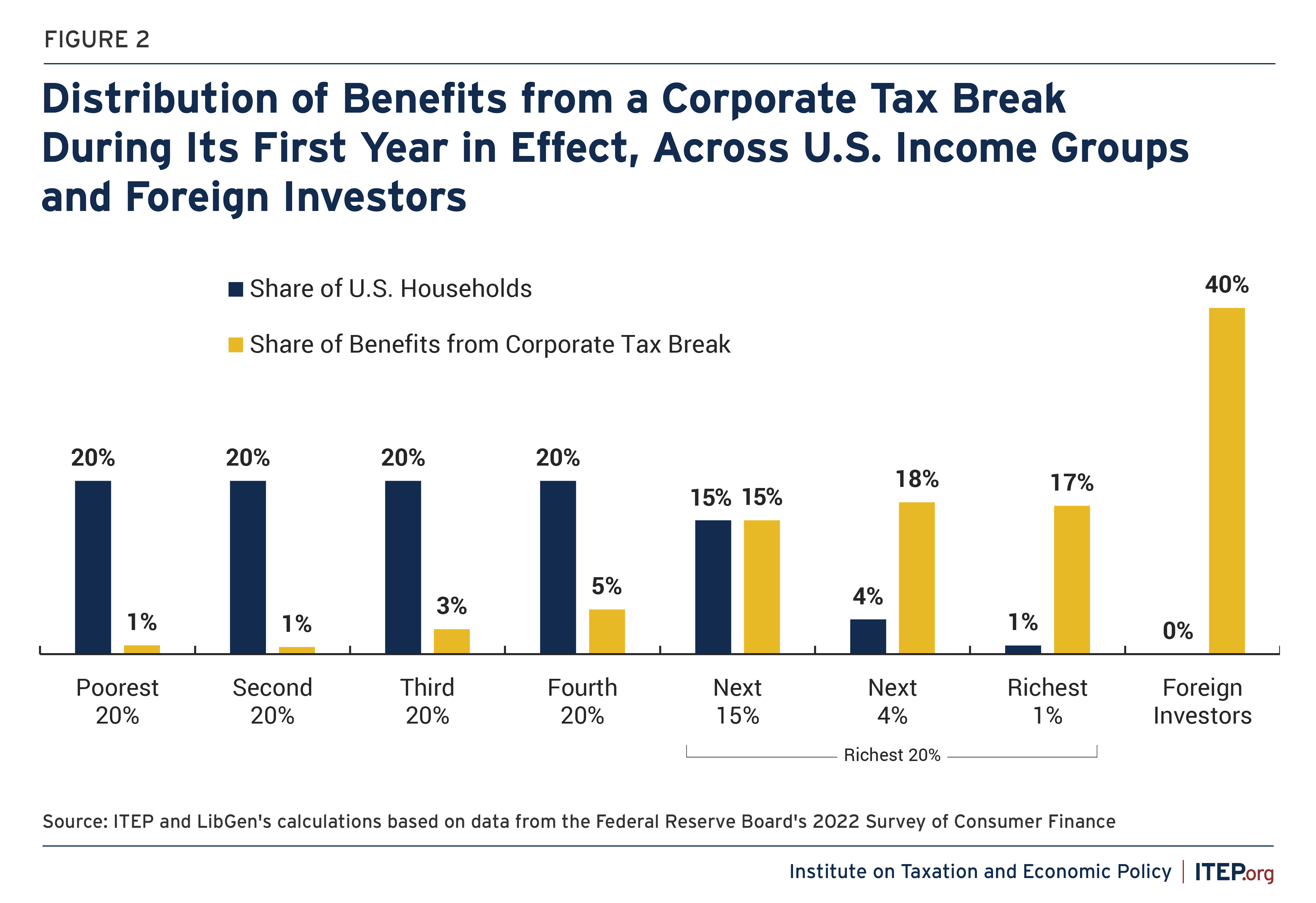

2. Corporate tax cuts and corporate tax avoidance provide even smaller benefits to most Americans when we account for the benefits to foreign investors.

The largest shares of benefits flow to foreign investors (who receive 40 percent of the benefits because they own 40 percent of the shares in U.S. corporations), the richest 1 percent of households in the U.S. (who receive 17 percent of the benefits), and the next richest 4 percent of households in the U.S. (who receive 18 percent of the benefits). In all, 90 percent of the benefits from corporate tax breaks go to foreign investors and the richest 20 percent of households.

3. Corporate tax cuts and corporate tax avoidance worsen racial inequity in our tax code.

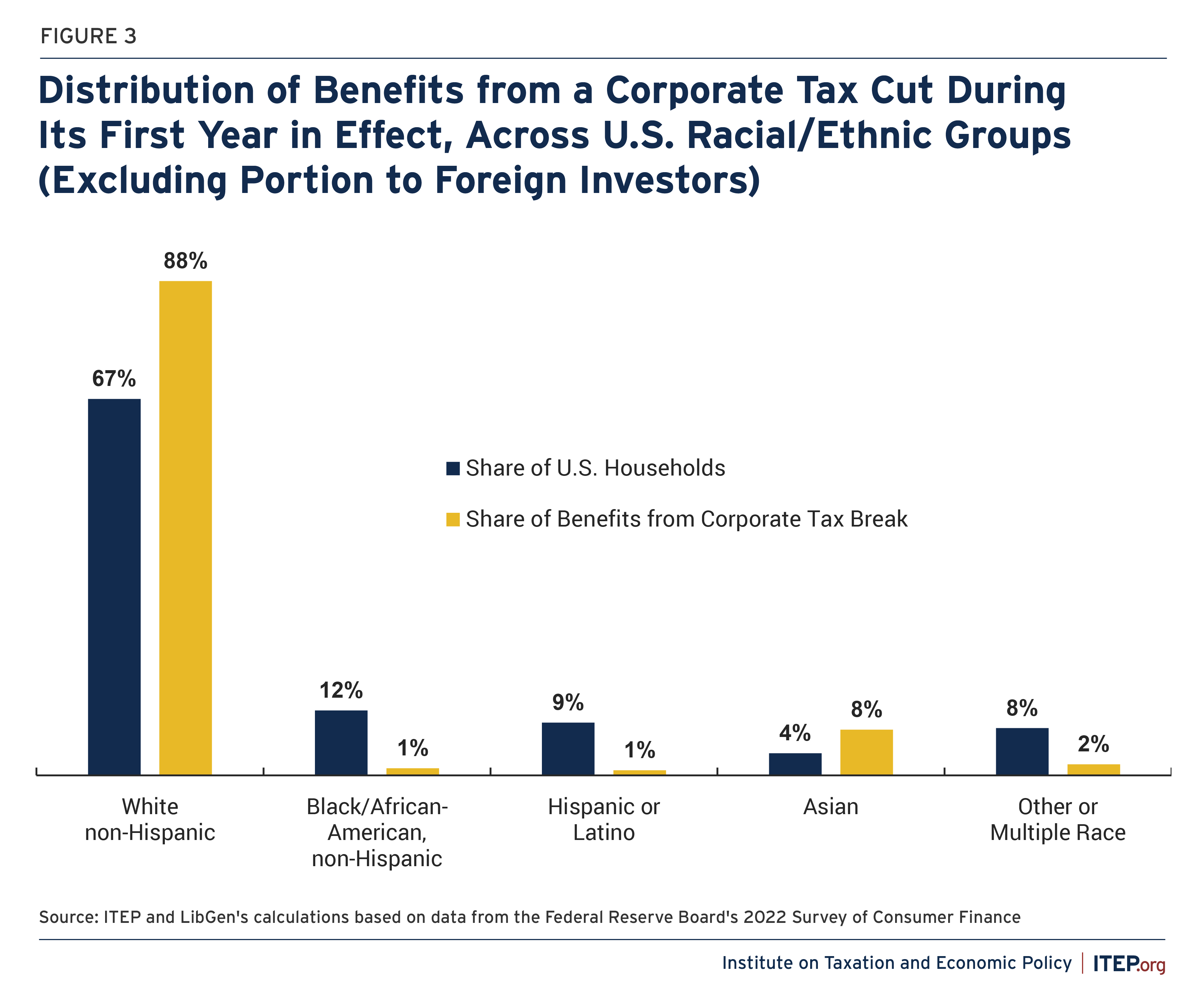

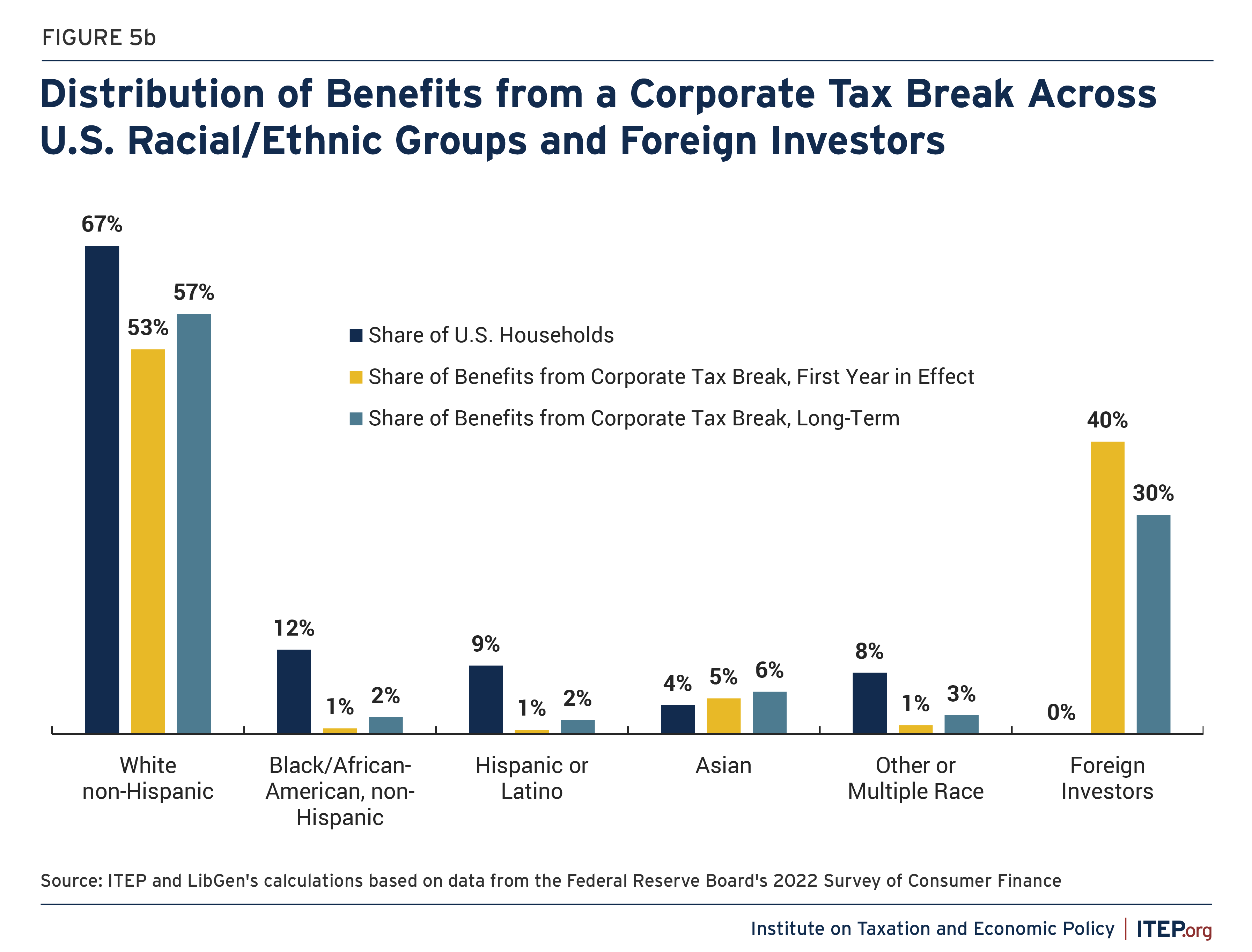

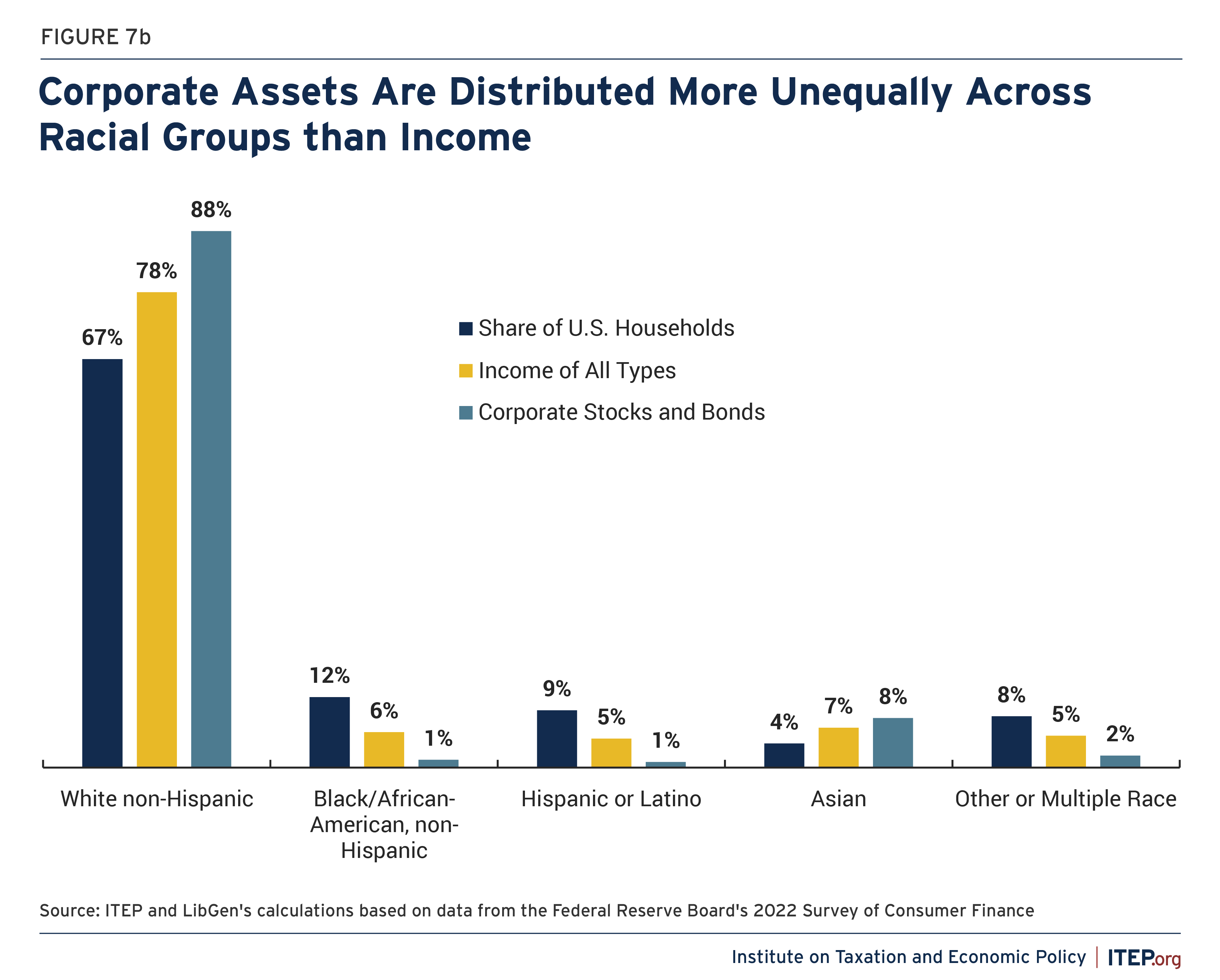

When corporations are allowed to pay less in taxes, the ultimate beneficiaries are mainly the owners of corporate stocks. Because white households own a disproportionate share of corporate stocks, they disproportionately benefit. White Americans receive 88 percent of the benefits that remain in the U.S. even though they make up only 67 percent of U.S. households. In contrast, Black and Hispanic households each receive just 1 percent of the benefits despite making up 12 percent and 9 percent of households respectively.

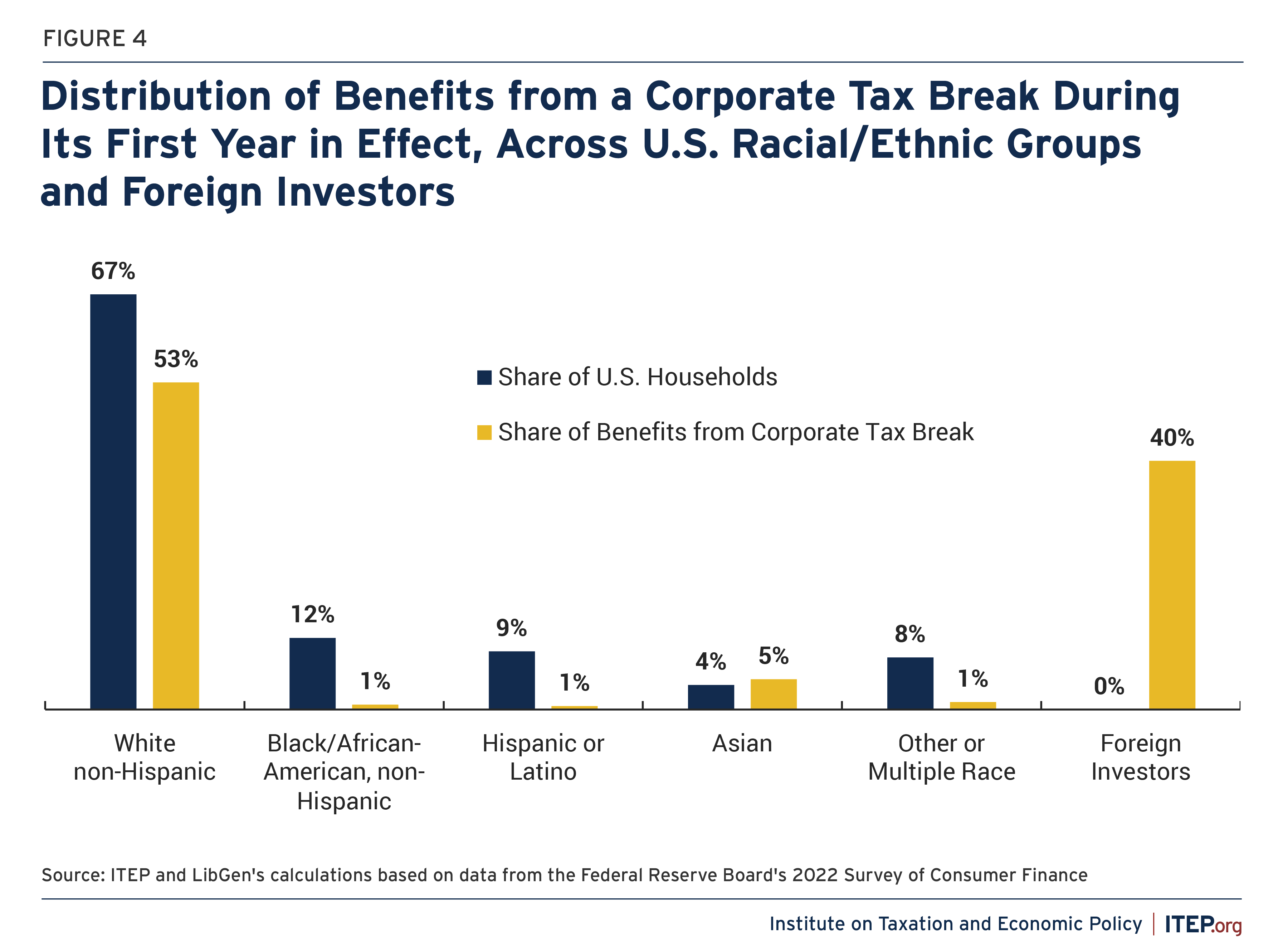

4. Even white Americans lose when we account for how corporate tax cuts and corporate tax avoidance benefit foreign investors.

A huge portion of stock in American corporations (more than 40 percent according to one prominent estimate) is owned by foreign investors. This means a huge share of the benefits from lower corporate taxes flows out of the U.S. to foreign investors, and Americans overall lose out as a result. When foreign investors are taken into account, the share of benefits flowing to nearly all the major racial/ethnic groups is noticeably below their share of U.S. households.

5. Even if we assume a portion of the benefits from a corporate tax break eventually flow to labor, our conclusions do not change.

For example, Congress’ official revenue estimators assume that in the long run, a fourth of the benefits of a corporate tax break will flow to labor, meaning a fourth of the benefits will flow to workers in the form of increased compensation. Even if this is true, our conclusions are the same: the largest shares of benefits flow to foreign investors and the richest 20 percent of Americans, and the benefits flow disproportionately to white Americans. Figures 5a and 5b are the same as Figures 2 and 4, respectively, except they both include numbers showing how the distribution would change modestly in the long-term based on this approach. In all, 83 percent of the benefits from corporate tax breaks would eventually go to foreign investors and the richest 20 percent of households.

Background

Americans have long told pollsters they believe corporations should pay more in taxes.[1] While this may be an intuitive response for many, it is also supported by data demonstrating the corporate income tax has an underappreciated role in enhancing class mobility and racial justice.

Reforms that limit corporate tax breaks and corporate tax avoidance to raise revenue can enhance class mobility and racial justice for two reasons. First, and most obviously, the revenue can be used to finance public investments that benefit everyone and reduce economic and racial inequality.

The second, less obvious, reason is the subject of this report. Corporate tax breaks mostly benefit the owners of corporate capital assets. These assets include corporate stocks owned directly and indirectly (for example, stocks held in retirement savings vehicles). They also include, to a smaller extent, corporate bonds.

The latest data on wealth and income from the Federal Reserve Board, which covers the year 2022, shows these assets are disproportionately owned by the richest 5 percent, who have benefited more than anyone else from the public investments that made their fortunes possible, and white individuals. Limiting corporate tax breaks could therefore reduce economic and racial inequality regardless of what the resulting revenue is put towards.

At the same time, such reforms would help all Americans by keeping resources in the U.S. rather than funneling them to the foreign investors who own a large portion of shares in U.S. corporations.

The Debate Over Who Ultimately Pays the Corporate Income Tax

All taxes are ultimately paid, even if indirectly, by people. The same is true of the corporate income tax, even though it is technically paid directly by companies on their annual profits. Who, then, ultimately pays this tax, or to ask the same question a different way: Who benefits when corporations do not pay taxes?

Congress’ official revenue estimator, the Joint Committee on Taxation (JCT), takes the mainstream, commonsense view that most of the corporate tax is ultimately, albeit indirectly, paid by the owners of the companies paying the taxes – the corporate shareholders (and, to a lesser extent, corporate bondholders).

Reduced corporate income taxes mean companies have higher after-tax profits to pay dividends or finance stock buybacks (which can be another way to transfer wealth to shareholders). They also make companies more valuable, so shareholders who sell their stock will enjoy larger capital gains on those stock sales.

The corporate income tax only affects a specific type of company – what are known as “C corporations.” (Other companies are structured as “pass-through” businesses, which do not pay the corporate income tax because their profits are included as taxable income on the personal income tax returns of their owners.)

Some economists believe a portion of the corporate income tax is ultimately borne by workers, which would mean lower corporate taxes help workers to some degree if we do not consider spending cuts that result from the reduced revenue. The most extreme version of this was pushed by White House economists during the Trump administration, who argued the corporate tax cuts enacted in 2017 would flow immediately to workers in the form of annual compensation increases averaging $4,000 to $9,000.[2]

Nothing like this happened. In fact, the Congressional Research Service (CRS) found corporations generally spent their tax savings (from both the lower rate and from any offshore profits they repatriated) on stock buybacks, which are a way of enriching shareholders.[3] Stock buybacks reached a record-breaking $1 trillion the year the new law went into effect.

The argument that corporate tax breaks help workers is based on a speculative theory. It claims lower taxes will result in more investment in American companies, which will increase or enhance equipment and other things that make employees more productive, and this will result in higher wages.

If any one of these things fails to come true, the whole theory breaks down. After-tax profits of corporations historically have not correlated with investments that enhance productivity, and in any event, higher productivity does not always lead to higher wages, particularly in the decades since unionization declined.[4]

And even among economists who believe workers will benefit from a corporate tax cut, most assume that benefit will be small. This is true, for example, of Congress’s official revenue estimators at the Joint Committee on Taxation (JCT).

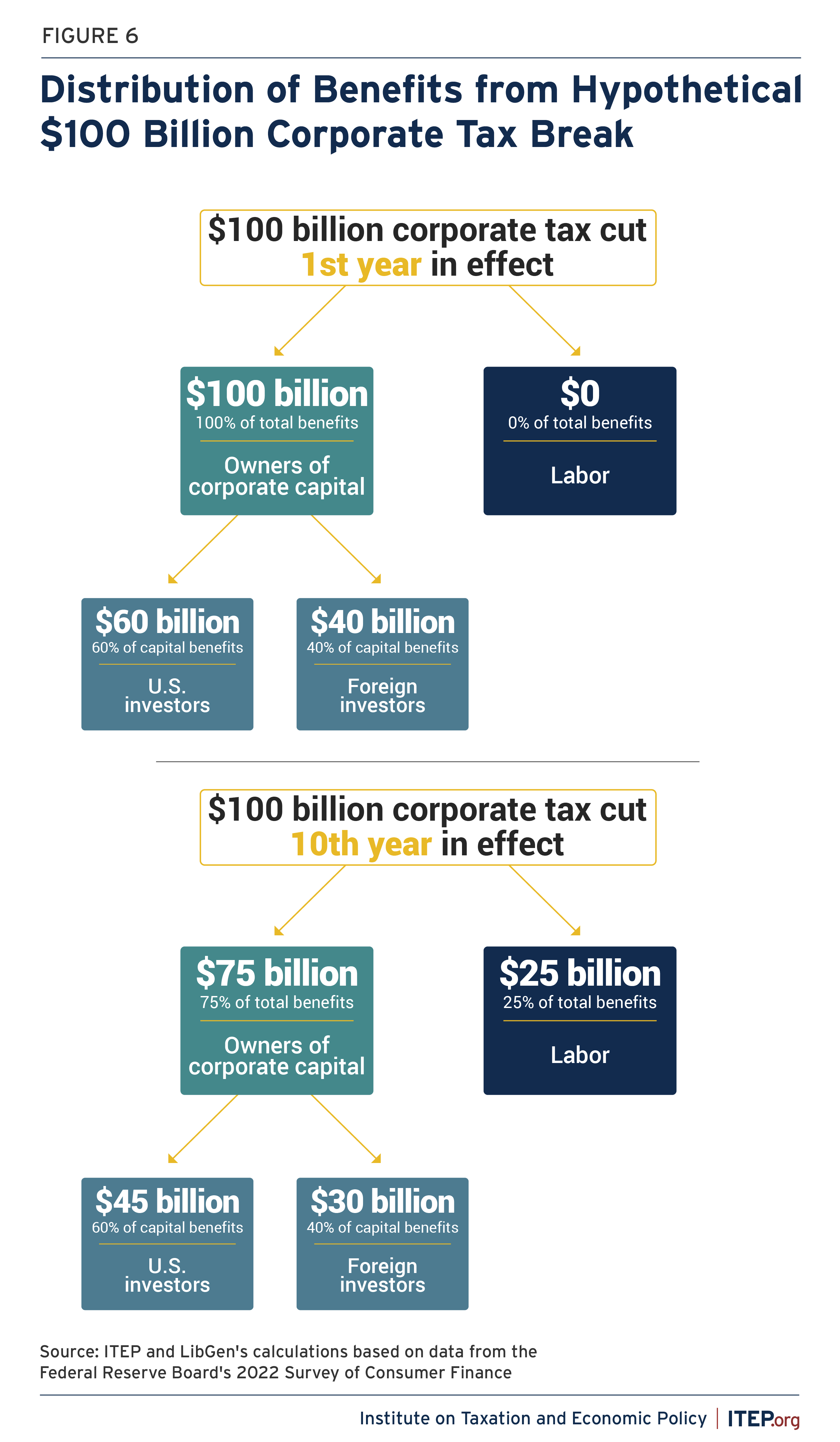

The JCT and the Congressional Budget Office both assume all the benefits of a corporate tax cut flow to the owners of corporate stocks the first year after it is enacted, but in the long run (which JCT and CBO assume is 10 years) 25 percent of the benefits flow to labor.[5]

Even if this is true (which seems doubtful), it would mean the corporate income tax is a progressive tax even in the long run because three-fourths of the tax is borne by the owners of corporate stocks and other business assets, who are concentrated among the wealthy.

In addition to being disproportionately wealthy, many of the owners of these corporate stocks are foreign investors, which means some of the benefits do not flow to Americans at all. In 2013, JCT estimated 10.8 percent of shares of American corporations were owned by foreign investors.[6]

It is unclear what the foreign-owned fraction is today under JCT’s analyses, but others find it is now much higher. Steve Rosenthal and Theo Burke at the Tax Policy Center estimate in 2019 foreign investors owned 40 percent of the shares in American corporations.[7] (This figure has recently been updated to 42 percent, but this report uses the 40 percent estimate for simplicity and because the difference between these figures is small.)[8]

Measuring the Impact of Corporate Tax Changes Among Americans Across Different Income Levels and Different Races

The analysis presented in this report uses data from the Federal Reserve’s most recent Survey of Consumer Finances (SCF) for 2022 and follows the general structure of JCT’s analysis. It assumes the effects of a corporate tax change fall entirely on corporate capital (on the owners of corporate stocks and corporate bonds) in the first year the change is in effect. Then over time (by the tenth year the change has been in effect) the share falling on corporate capital falls from 100 percent to 75 percent. Meanwhile, the share falling on labor rises from 0 percent in the first year to 25 percent in the tenth year.

To provide estimates that are helpful to policymakers, this analysis uses a similar approach. This analysis therefore assumes the share of corporate taxes ultimately borne by corporate capital (whatever that share happens to be in a given year) is itself split into a part borne by American investors and a part borne by foreign investors. While it is unclear exactly what JCT is now assuming in this regard, this analysis assumes 40 percent of the capital share of the corporate income tax is borne by foreign investors because they own 40 percent of the shares in U.S. corporations.

For example, if Congress enacted legislation reducing corporate taxes by $100 billion in the first year it was in effect, we would therefore assume the entire $100 billion flows to the owners of corporate capital that year, with $60 billion flowing to American owners of capital and $40 billion flowing to foreign investors. The $60 billion for Americans would be distributed the way corporate stocks and corporate bonds are distributed in America. The remaining $40 billion would, of course, not benefit Americans at any income level.

In the tenth year the policy is in effect, we assume a fourth of the benefits flow to labor. If the policy in the tenth year reduced revenue by $100 billion, this analysis assumes $25 billion of that would flow to labor and therefore be distributed across income groups the way labor income (wages, salaries and other earned income) is distributed across income groups.

The other $75 billion would flow to capital, and 60 percent of this (which comes to $45 billion) would be distributed to Americans based on their capital income while 40 percent of this (which comes to $30 billion) would flow to foreign investors.

JCT uses this approach to distribute the effects of corporate tax changes across income groups, based on the distribution of corporate assets and labor income across income groups. This analysis does the same, but it also uses this approach to distribute the effects across racial groups, based on the distribution of corporate assets and labor income across racial groups. The SCF data from the Federal Reserve allows us to do both.

Distribution of Corporate Assets Is Particularly Unequal

Many people may find it intuitive that corporate tax breaks disproportionately benefit wealthy and white households. Black Americans overall have proportionately less income than white Americans because of historic discrimination and other current and historic factors. It is therefore not surprising that tax cuts benefiting high-income people tend to benefit white Americans more than black Americans.

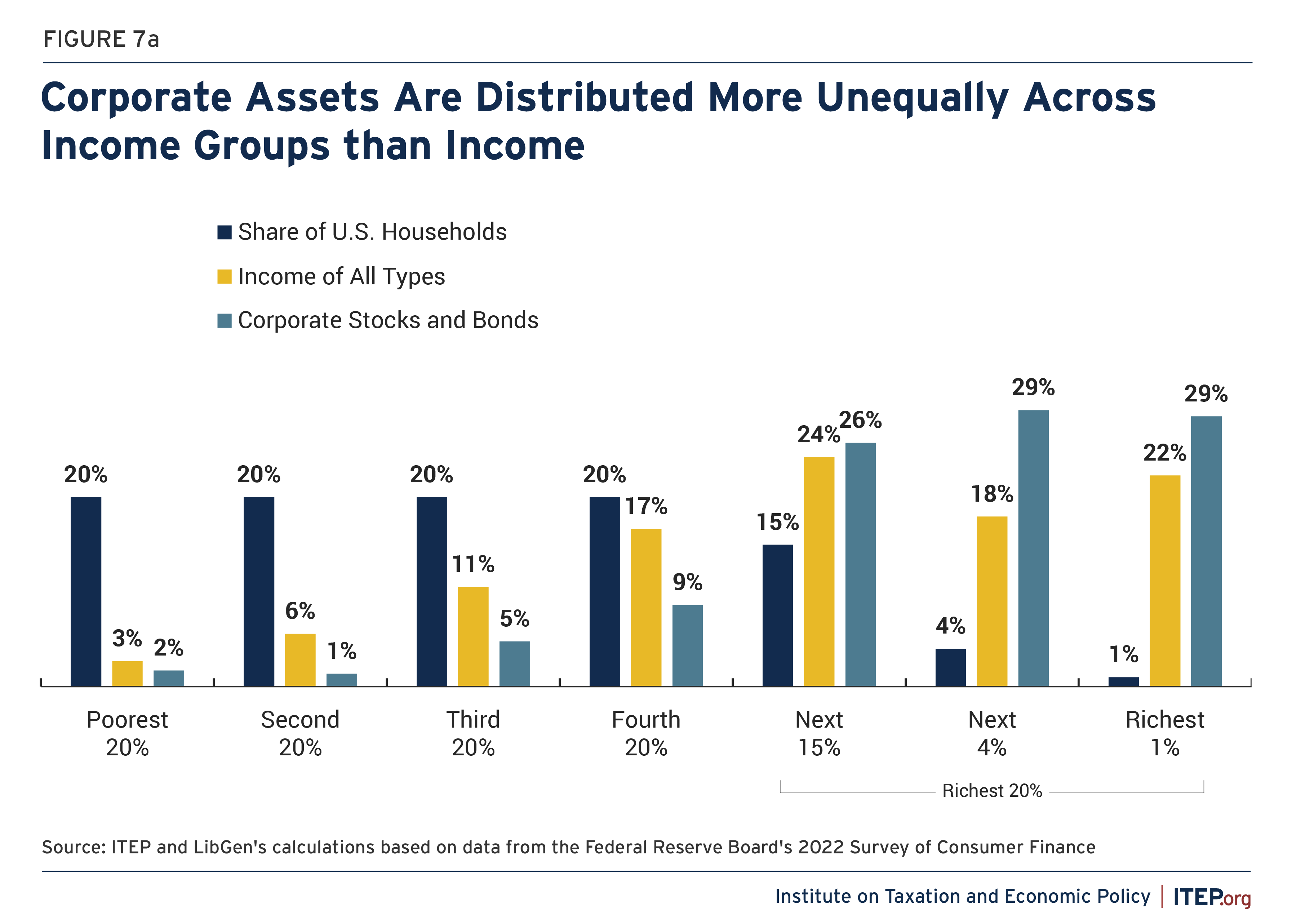

But the inequitable effects of corporate tax cuts go beyond this because corporate assets (corporate stocks and bonds) are distributed even more unequally in the U.S. than income. This is true across income groups and across racial groups.

For example, according to the SCF data for 2022 which is used in this analysis, the richest 1 percent of Americans received 22 percent of the total income. That means the richest 1 percent received 22 times their proportionate share of the total income in the U.S. But the share of corporate assets owned by the richest 1 percent was even greater, at 29 percent.

The same is true of the distribution of income and corporate assets across racial groups. White Americans make up 67 percent of households in the SCF data but received 78 percent of total income. But their share of corporate assets is even greater, at 88 percent.

In other words, even among households with the same income, white Americans would be more likely to benefit from corporate tax cuts than households of most other racial groups because white Americans are likely to own more corporate assets.

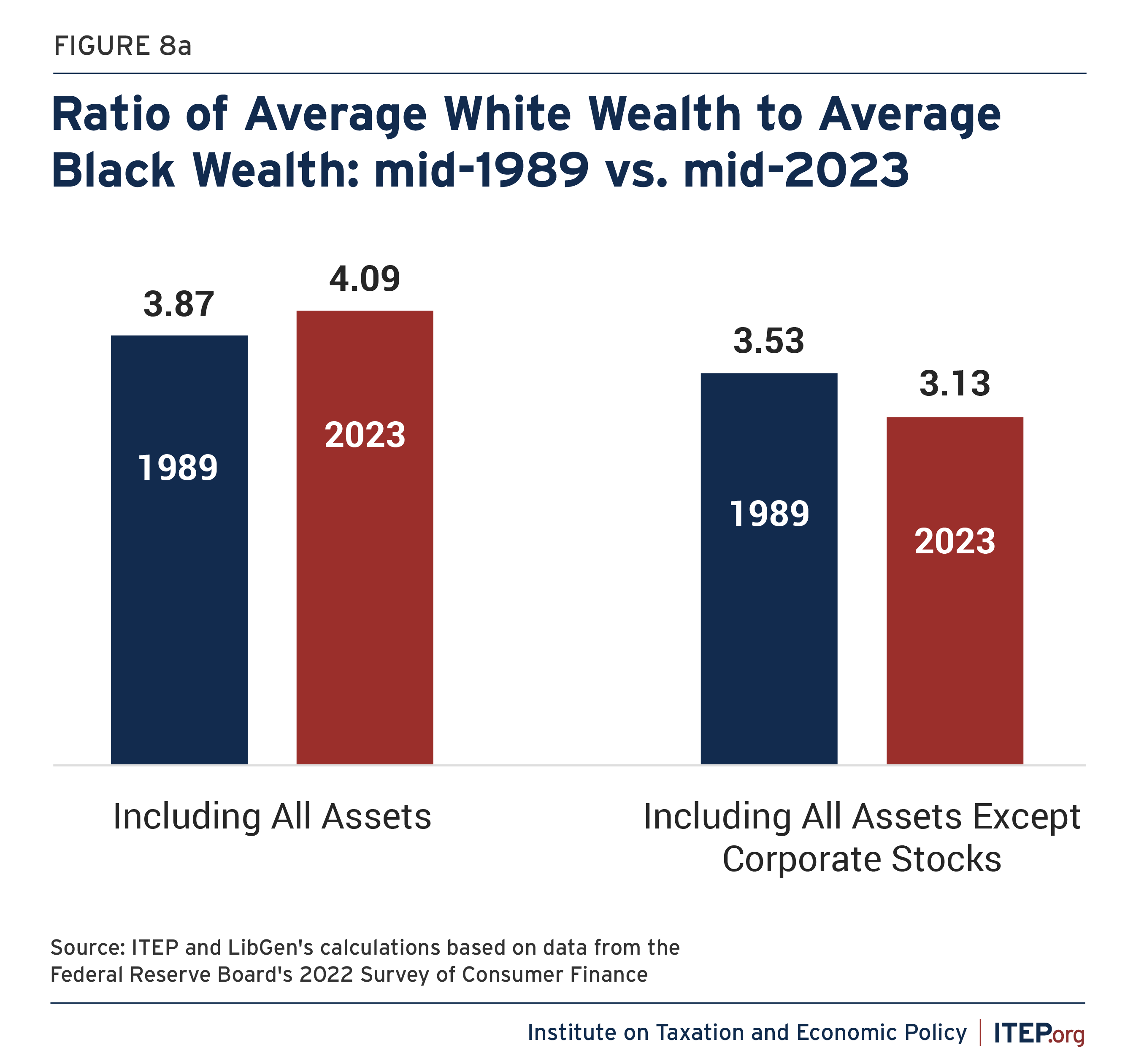

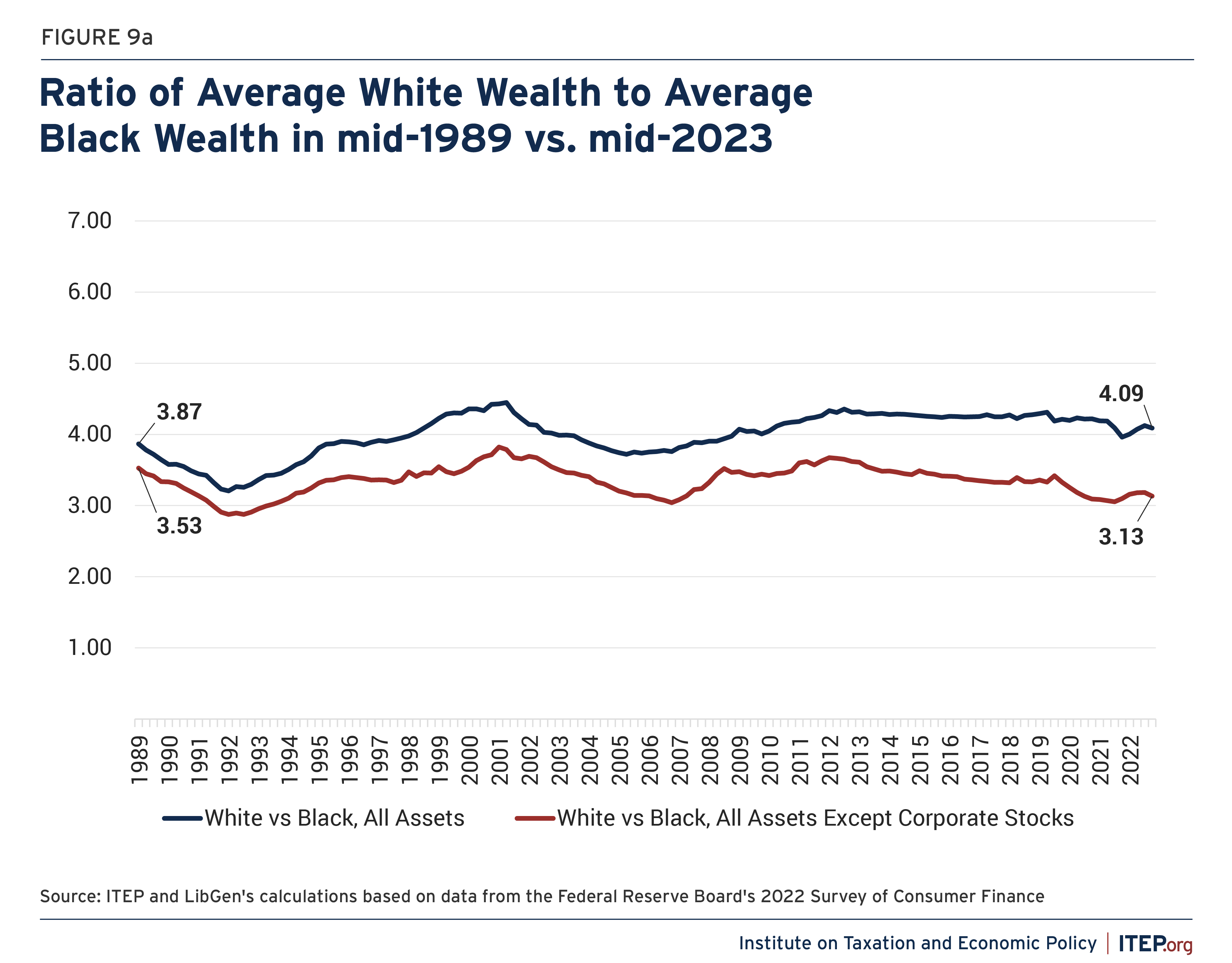

Corporate tax breaks and corporate tax avoidance contribute to and perpetuate racial inequality because they reward the ownership of corporate stock—an asset that significantly contributes to the racial wealth gap. For example, in the middle of 1989, the average net worth of white households was 3.87 times that of Black households and this gap grew over time. By the middle of 2023, the average net worth of white households was 4.09 times that of Black households. But as illustrated in the figures below, this racial wealth gap would have declined if not for the part of household net worth made up of corporate stocks. If we consider households’ average net worth but exclude corporate stocks, we find the white to Black ratio actually falls over this time period, from 3.53 to 3.13.

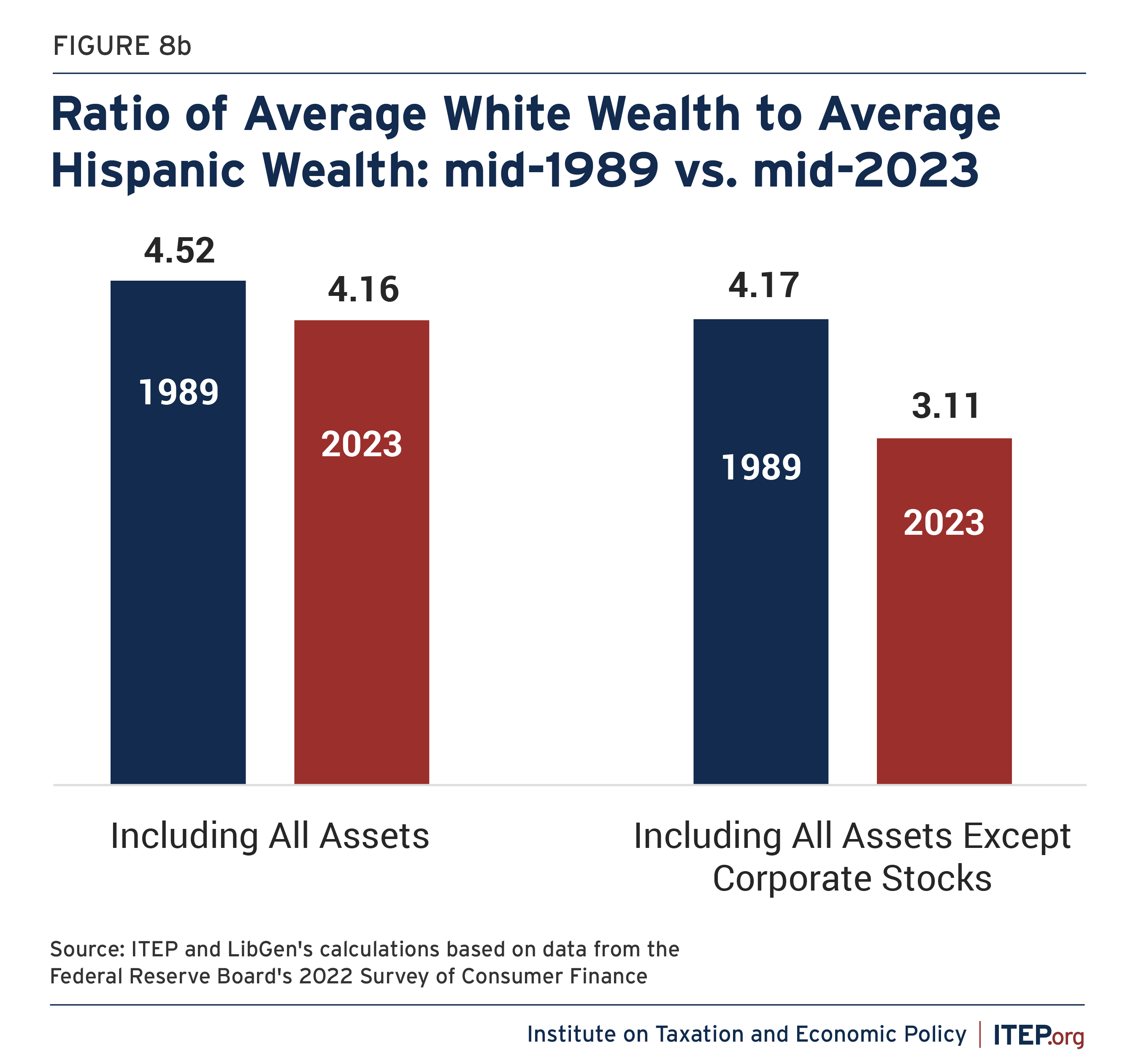

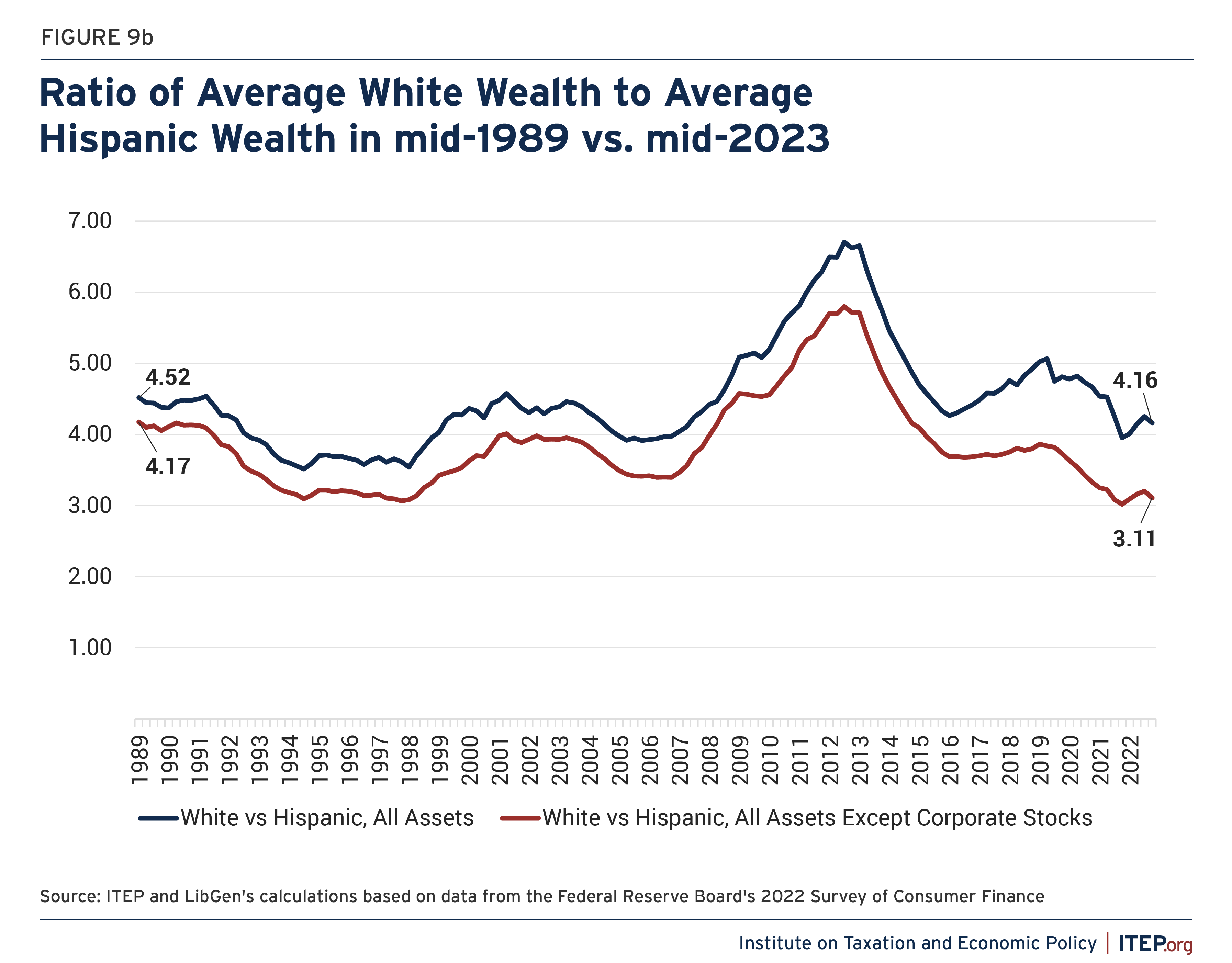

A similar dynamic appears in comparing average net worth between white and Hispanic households. This ratio dropped from 4.52 in mid-1989 to 4.16 in mid-2023. But we find it drops even more, from 4.17 to 3.11, when we exclude corporate stocks, as illustrated below.

Endnotes

[1] Gallup, In Depth: Taxes. https://news.gallup.com/poll/1714/taxes.aspx

[2] Heather Long, “The Average American Family Will Get $4,000 from Tax Cuts, Trump Team Claims,” New York Times, October 16, 2017. https://www.washingtonpost.com/news/wonk/wp/2017/10/16/the-average-american-family-will-get-4000-from-tax-cuts-trump-team-claims/

[3] Jane G. Gravelle and Donald J. Marples, “The Economic Effects of the 2017 Tax Revision: Preliminary Observations,” Congressional Research Service, May 22, 2019. https://www.everycrsreport.com/files/20190522_R45736_8a1214e903ee2b719e00731791d60f26d75d35f4.pdf

[4] Josh Bivens, “Cutting corporate Taxes Will Not Boost American Wages,” Economic Policy Institute, October 25, 2017. https://www.epi.org/publication/cutting-corporate-taxes-will-not-boost-american-wages/

[5] Joint Committee on Taxation, “Modeling the Distribution of Taxes on Business Income,” October 16, 2013, JCX-14-13. https://www.jct.gov/publications/2013/jcx-14-13/

[6] Joint Committee on Taxation, “Modeling the Distribution of Taxes on Business Income,” October 16, 2013, JCX-14-13. https://www.jct.gov/publications/2013/jcx-14-13/

[7] Steve Rosenthal and Theo Burke, “Who’s Left to Tax? US Taxation of Corporations and Their Shareholders,” Tax Policy Center, October 27, 2020. https://www.law.nyu.edu/sites/default/files/Who%E2%80%99s%20Left%20to%20Tax%3F%20US%20Taxation%20of%20Corporations%20and%20Their%20Shareholders-%20Rosenthal%20and%20Burke.pdf

[8] Steven M. Rosenthal and Livia Mucciolo, “Who’s Left to Tax? Grappling With a Dwindling Shareholder Tax Base,” Tax Notes, April 1, 2024. https://www.taxnotes.com/featured-analysis/whos-left-tax-grappling-dwindling-shareholder-tax-base/2024/03/29/7j9cr