President Trump has declared a payroll tax cut must be part of the next COVID-19 relief package, even though this would not help the more than 30 million people who are currently not working. Multiple White House officials have publicly touted a payroll tax cut, but a clear plan has yet to emerge. One report, for example, suggests that the proposal would not be a tax cut but would only allow workers to delay making the payments for some time.

Even if lawmakers enacted a genuine payroll tax holiday, meaning a complete suspension of payroll taxes for a defined period with no requirement that workers pay back the money back, this would not be well-targeted to those most affected by the economic crisis.

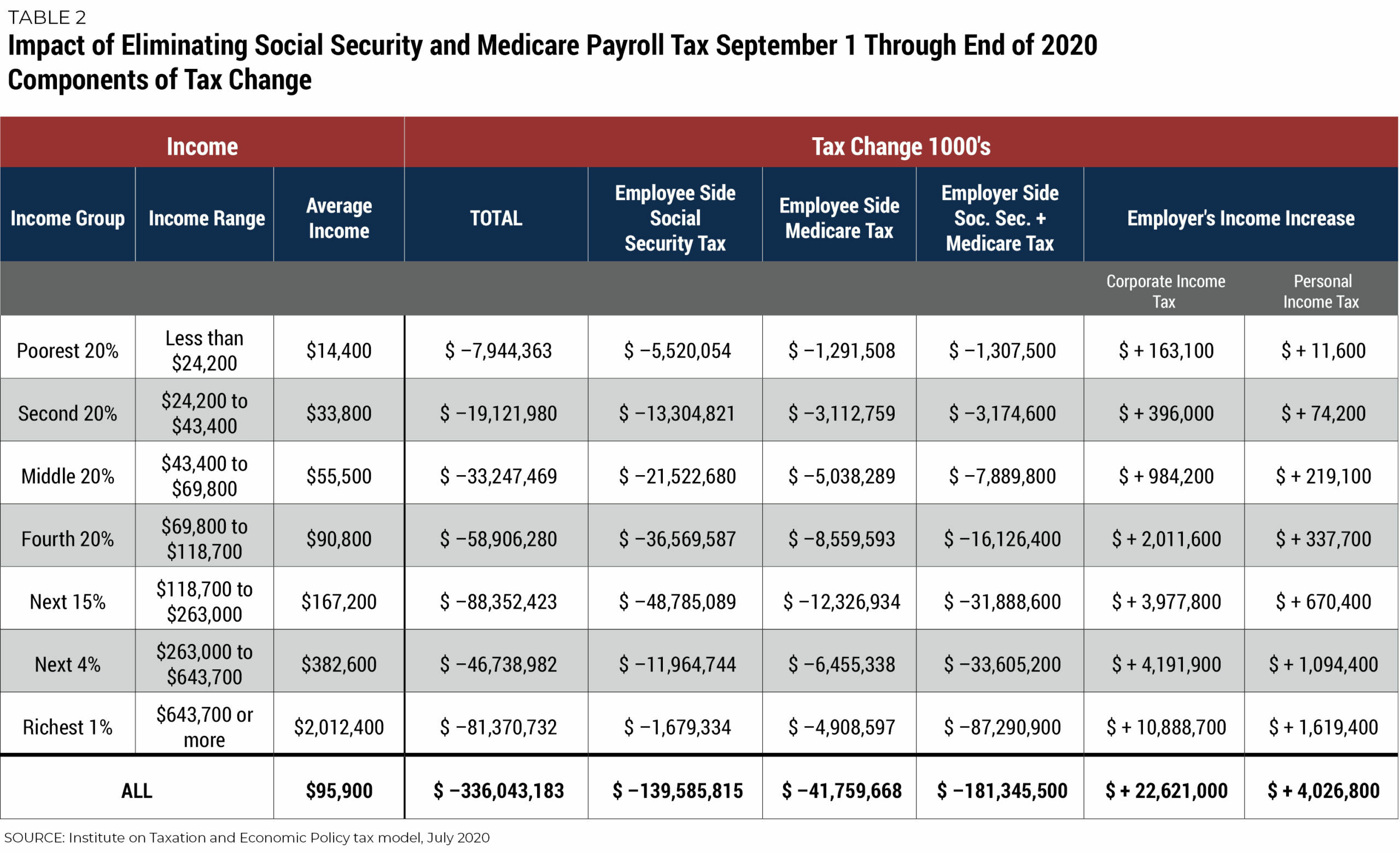

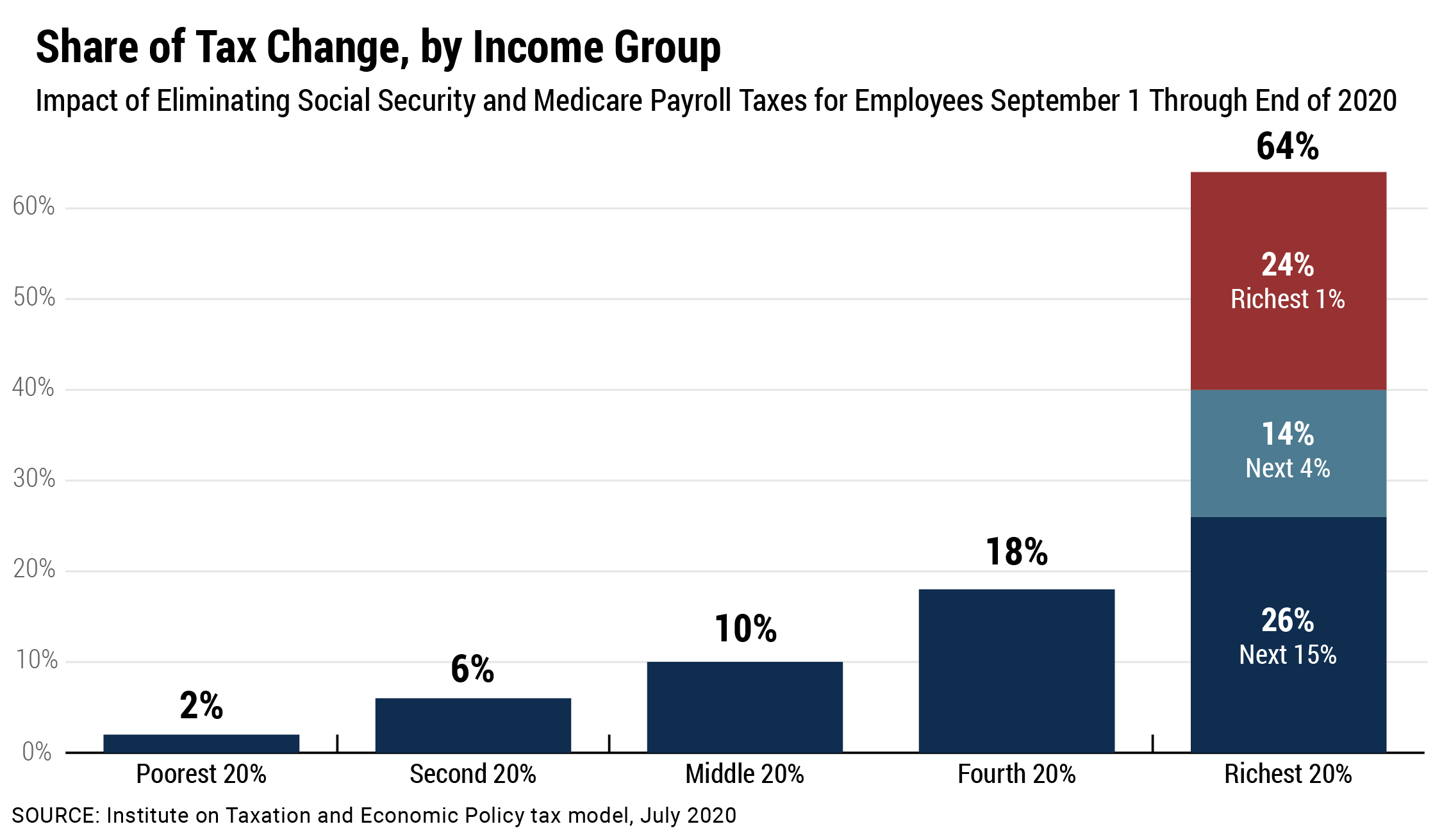

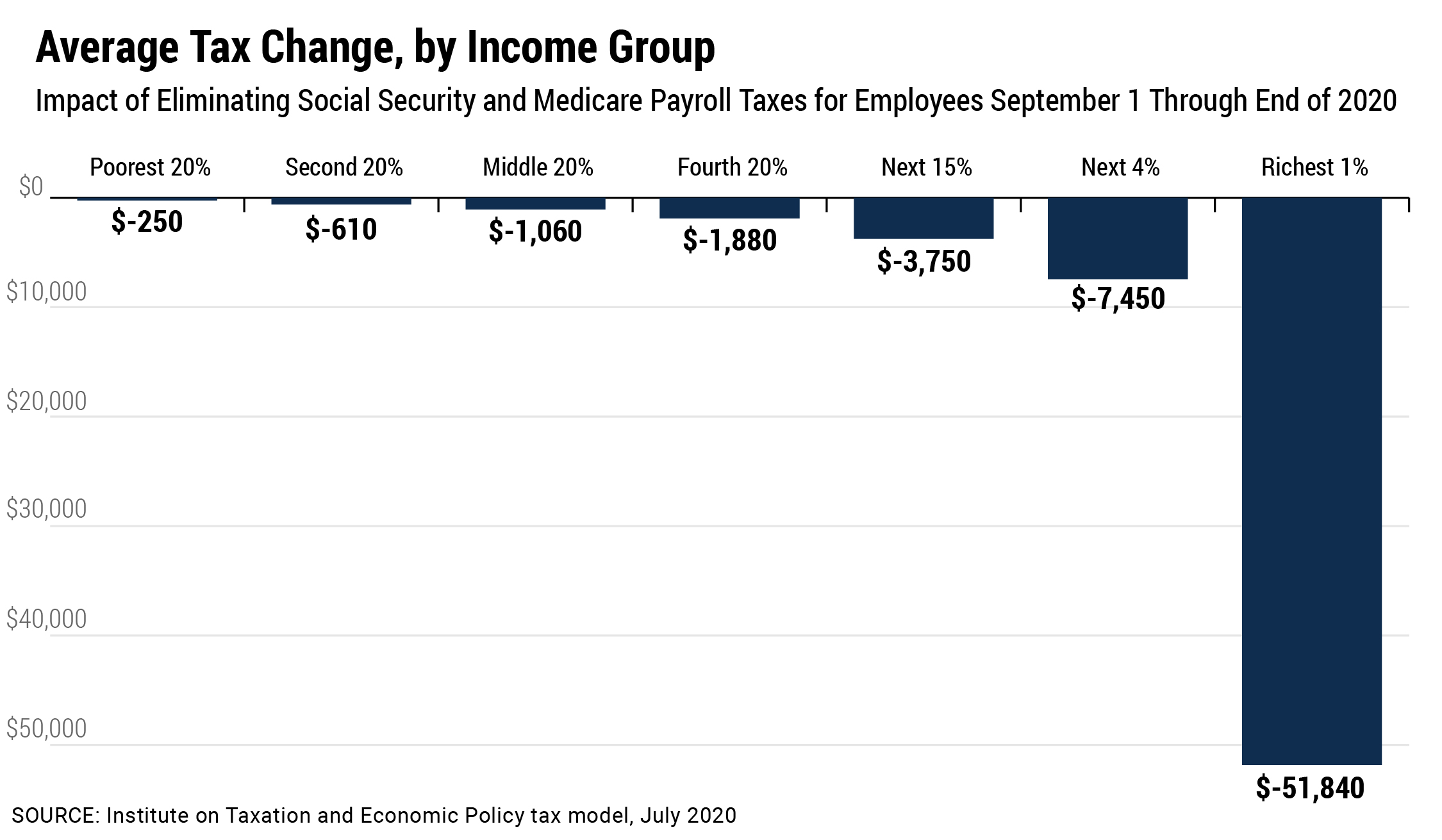

ITEP estimates that if Congress and the president eliminated all Social Security and Medicare payroll taxes paid by employers and employees from Sept. 1 through the end of the year, 64 percent of the benefits would go the richest 20 percent of taxpayers and 24 percent of the benefits would go to the richest 1 percent of taxpayers, as illustrated in the table below. The total cost of this hypothetical proposal would be $336 billion.

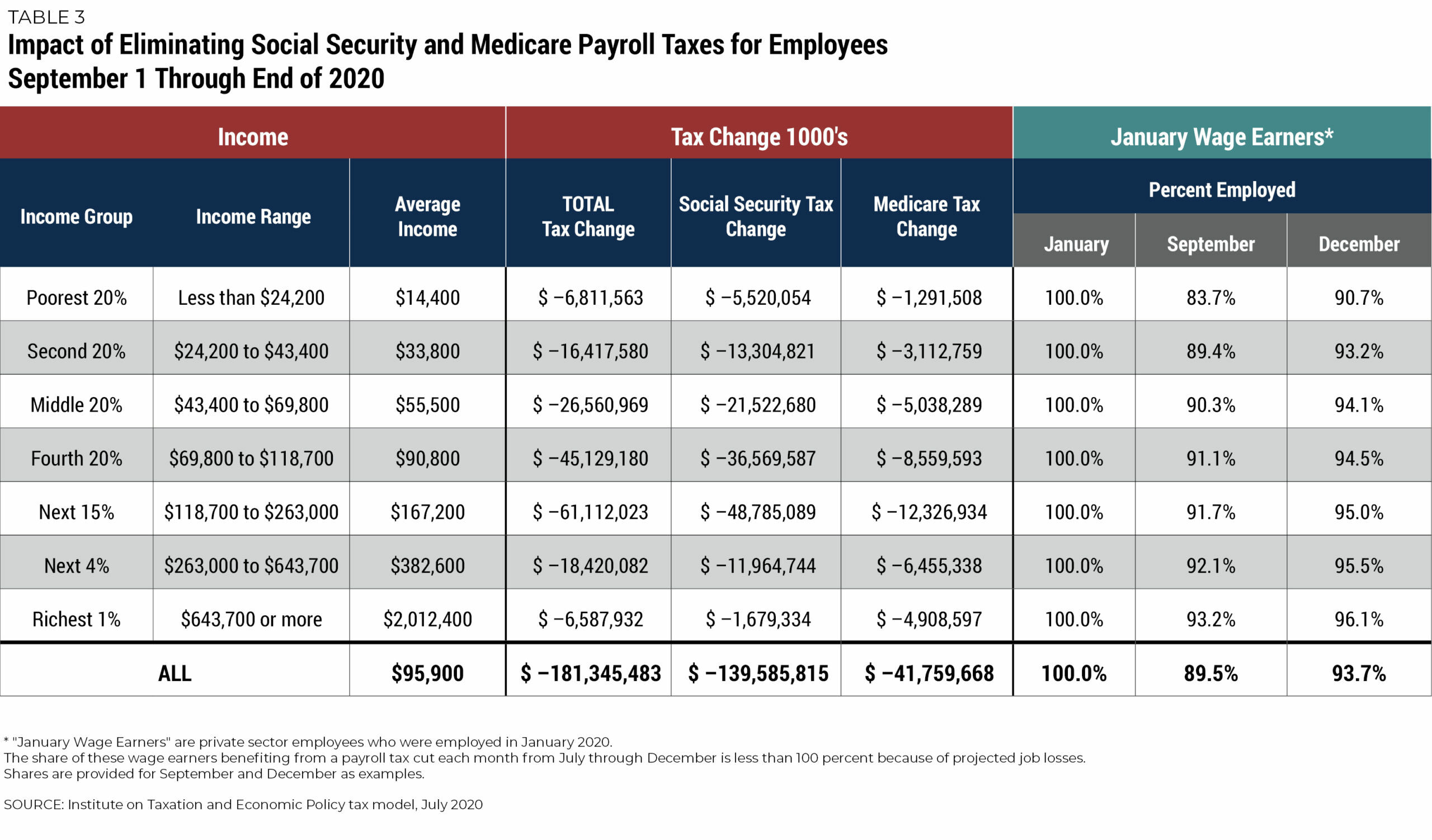

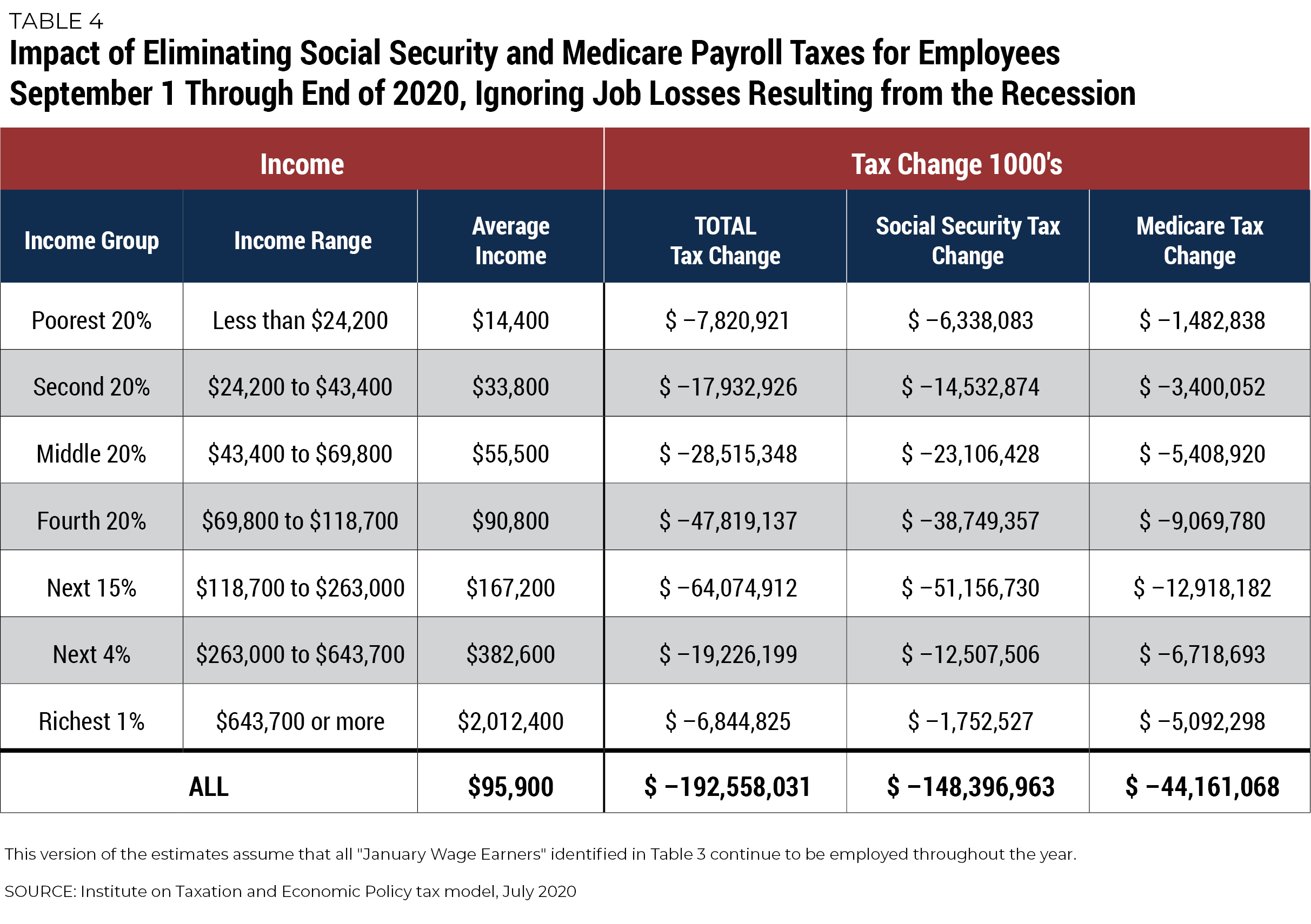

ITEP’s latest analysis considers massive job losses that have occurred since the pandemic took hold in March, incorporating unemployment data from the Bureau of Labor Statistics. The analysis also assumes a partial recovery of jobs in the coming months based on economic projections from the Congressional Budget Office, as explained further in the appendix.[1]

Employees pay half of payroll taxes and employers pay the remainder. The table below illustrates the different ways this proposal would affect revenue.

Employees would benefit directly from suspending the employee share of Social Security and Medicare taxes, although the benefits would not be well targeted to those who need help the most.

Eliminating the employer half of these taxes would provide a windfall to corporations and other businesses. There is no reason to believe that employers would pass the benefits to workers, as explained below. ITEP, therefore, assumes that eliminating employers’ payroll taxes would be distributed the same as income from business assets (capital gains, dividends, business profits, etc.).

Some of this increased business income would become an increase in corporate profits. Some would become an increase in income to pass-through businesses, whose profits are subject to the personal income tax paid by their owners. The resulting increase in corporate income taxes and personal income taxes would offset a portion of the cost of the payroll tax cut.

Download Share of Tax Change by Income Group

Download Share of Tax Change by Income Group

Download Average Tax Change by Income Group

Download Average Tax Change by Income Group

More Details

The president proposes to temporarily repeal payroll taxes that fund Social Security and Medicare. The Social Security tax is 12.4 percent of earned income up to a maximum, which is $137,700 for 2020. Employees pay half (6.2 percent) and employers pay the other half.

The Medicare tax, also evenly split between employers and employees, is 2.9 percent of earned income with no maximum.

ITEP assumes that the proposal would eliminate payroll taxes through the end of 2020. For illustrative purposes, ITEP’s analysis assumes the proposal would go into effect on Sept. 1.

Employee Side Payroll Taxes

For most working people, eliminating the employee side of the Social Security payroll tax starting on Sept. 1 would equal a third of the benefits of eliminating the tax for the entire year. The maximum earnings subject to the tax is $137,700. Anyone with annual earnings below that in 2020 will receive one-third of the benefit of a full-year payroll tax holiday.

However, someone who earns $206,550 spread evenly throughout the year of 2020 will have already earned the maximum $137,700 by Sept. 1 and, therefore, will have already paid the maximum Social Security taxes by then. (By Sept. 1, two-thirds of the year will be over and two-thirds of $206,550 is $137,700.) We, therefore, assume that any worker with earnings more than $206,550 this year will receive no benefit from elimination of the employee side of the Social Security tax.

For people with earnings between $137,700 and $206,550, the benefit will be somewhere between 0 and one-third of a full year elimination of the tax.

Eliminating the employee side of the Medicare tax starting on Sept. 1 is more straightforward because there is no cap on earnings subject to this tax. This analysis assumes that everyone with earnings would receive one-third of the benefit they would receive from a full-year elimination of the tax.

Personal income taxes are not affected by eliminating the employee side of the payroll taxes because income used to calculate personal income taxes is not adjusted to take payroll taxes into account.

Employer Side Payroll Taxes

While workers nominally only pay half of the payroll tax, most analysts believe that, in the long-run, workers also bear the employer side of the tax in the form of reduced compensation. However, this does not mean that workers would immediately benefit from a temporary cut in employer payroll taxes. In the case of a change that is in effect for only a few months, it is unlikely that workers would be able to immediately and successfully compel employers to pay them in wages what the employers normally contribute to their Social Security and Medicare. A temporary cut in the employer side payroll taxes would, therefore, provide a windfall to corporations and other businesses.

ITEP assumes that this windfall is distributed like business assets. As a proxy for this, this analysis models the benefits of the employer side payroll taxes as if they are distributed the way capital income (the income from business assets) is distributed.

This results in increased income for the business owners, which results in increased income taxes that partly offset revenue lost from eliminating payroll taxes.

It is not entirely clear how eliminating employer payroll taxes would be allocated to C corporations and pass-through businesses. The Joint Committee on Taxation (JCT) finds that 59.4 percent of net business profits were generated by C corporations in 2014. This analysis assumes that the same share of the benefits of eliminating employer side payroll taxes goes to C corporations and is therefore subject to the 21 percent corporate income tax. (Of course, it is very possible that the increased corporate profits would be taxed at a lower effective rate, offsetting less of the cost of the payroll tax cuts and resulting in a more expensive proposal.)

We assume that the other 40.6 percent of the benefits from the employer side payroll tax cut go to pass-through businesses and are therefore subject to personal income taxes paid by owners of those businesses.

Appendix

Alternate assumptions about economic conditions

Job losses have disproportionately hit workers with lower wages and in certain industries, especially leisure and hospitality, meaning that the people who would be shut out of a payroll tax cut are not equally represented in all income groups.

Due to longstanding structural inequities, Black and Hispanic workers face significantly higher unemployment rates than white workers. This disparity is hidden right now by the fact that Black workers are disproportionately likely to be deemed essential, meaning they will not be counted as unemployed if safety concerns keep them from working. Similarly, evidence shows women are disproportionately hard hit during the current downturn. These disparate impacts reflect how the current crisis has been more severe in lower-wage industries and reflects embedded labor market discrimination.

This analysis has applied job loss numbers from the Bureau of Labor Statistics and projected job losses forward using economic updates from the Congressional Budget Office (CBO). It arrives at the estimated job loss by decile following a methodology similar to an imputation used by Ben Zipperer here, ranking industries by wages and then weighting by industry employment. We then apply the change in jobs by decile to tax data. For future months, the trajectory of the recovery in jobs, as well as the distribution of those jobs, is shaped by CBO projections.

The magnitude of these layoffs will affect Social Security and Medicare revenues, and so reduce the impact of a payroll tax cut. Whereas a payroll tax cut would generally reduce taxes for all wage-earners, as well as the self-employed, only 89.5 percent of tax units earning wages in January would benefit from a payroll tax cut in September (see Table 3). Given that workers in the lowest-wage industries have been some of the hardest hit during this downturn, they would be disproportionately left out of the benefits of a payroll tax cut.

Overall, accounting for job loss projections means that a payroll tax cut starting in September would provide 5.8 percent less in benefits to workers that began the year with a job when job losses are taken into account. This decline in the value of a payroll tax cut is exacerbated at lower incomes. By contrast, the same proposal would provide 12.9 percent less in benefits to tax units in the bottom 20 percent of filings compared to the impact of the same payroll tax cut in an economy not experiencing the current crisis.

[1] ITEP provided a similar analysis the last time the president publicly suggested temporarily suspending the payroll tax. That analysis and this one both assume that legislation would eliminate Social Security and Medicare taxes through the end of the year. The previous analysis assumed a payroll tax holiday would begin on April 1 and last through the end of the year, meaning payroll taxes would be suspended for three-fourths of the year. This analysis assumes a payroll tax holiday would begin on Sept. 1 and last through the end of the year, meaning payroll taxes would be suspended for a third of the year. This distribution of benefits projected in this analysis is very similar to the one in our previous analysis. On one hand, fewer low-wage workers benefit under this analysis because they are disproportionately affected by job losses. On the other hand, fewer high-wage workers benefit under this analysis because they are more likely to have already paid the maximum Social Security taxes at this point in the year. The net result of these differences is a distribution of benefits not much different from our previous analysis.