For better or worse, one of the most prominent arguments in favor of legalizing cannabis is that taxes on the drug can fund schools, roads, and other public investments. So far this is most obvious at the state and local levels, where excise and sales taxes in the seven states with legal sales underway will generate at least $1.6 billion in revenue in 2019.[1] But it is also true at the federal level where, despite federal illegality, state-legal cannabis businesses are paying substantial amounts of federal income tax revenue.[2]

In fact, because an unusual federal tax law (section 280E) denies many routine deductions to cannabis businesses, the industry is paying higher effective federal income tax rates than comparable businesses selling other products. This point is critical to keep in mind when evaluating the tax impact of proposals to legalize cannabis at the federal level.

It is likely that federal legalization would include both a tax cut (allowing the industry to claim many or all routine business expense deductions) and a tax increase (a new excise tax on cannabis, comparable to taxes already levied on alcohol and tobacco). Whether the net effect is a tax cut or a tax increase for the industry would depend on the cannabis excise tax rate Congress chooses to set. Viewed through this lens, two of the three most significant federal proposals under consideration appear to be structured as net tax cuts for the industry.

The Tax Cut: Addressing Section 280E

Since 1982, section 280E has prevented individuals and businesses that are “trafficking in controlled substances” from writing off many of their selling expenses such as rent, utilities, wages, and benefits paid at retail storefronts as well as marketing, legal, and accounting expenses. Only the cost of goods sold is deductible.

Because of this provision, the cannabis industry tends to face significantly higher effective tax rates than other businesses, and even unprofitable retailers, with no actual net income, can incur sizeable federal tax bills on phantom profits. In other cases, retailers that might otherwise be profitable can see those profits wiped out by section 280E and end up operating at a loss after paying federal taxes.

Because section 280E targets selling expenses, the effect is felt most acutely at the retail level where selling is the core function of the business. Growers and processors are affected much less, at least if they engage only in wholesale commerce, where selling expenses tend to be secondary to cost of goods sold. The discussion and estimates in this article therefore focus largely on the retail sector.

The way the federal government taxes the cannabis industry now is an anomaly that deviates from the general consensus about how the income tax is supposed to work. The federal income tax is intended to apply to net income, which for businesses means revenue minus expenses. Although there are sound policy justifications for denying deductions for some types of business expenses that help generate income, such as lobbying expenses, deductions for expenses as basic as employees’ wages and benefits are uncontroversial — regardless of the product sold.[3] By denying deductions for a large swath of expenses, the federal government is collecting more income tax revenue from cannabis businesses than it collects from other business activities.

If the federal government decides to legalize cannabis, the cannabis industry should be allowed to write off most of the same expenses that other legal industries have long taken for granted. One possible exception, noted by Pat Oglesby of the Center for New Revenue, is that the federal government could continue to deny deductions for cannabis marketing expenses, such as branding and advertising, to raise the after-tax cost of advertising campaigns and discourage those advertisements. (Banning them outright could raise constitutional concerns.) Oglesby argues that doing this could reduce the number of cannabis advertisements seen by children and adolescents — groups that are “uniquely susceptible to advertising” and that most people would prefer not to be subjected to messaging that urges them to consume cannabis.[4] Oglesby has also suggested expanding nondeductibility to the “deadlier duo” of alcohol and tobacco as well, for the sake of consistency.

Perhaps surprisingly, in 2017 one of the most influential groups working for the legalization of cannabis, the consumer lobby National Organization for the Reform of Marijuana Laws (NORML), specifically advocated maintaining the nondeductibility of advertising expenses.[5] Lawmakers considering this approach would have to weigh the potential benefits (fewer cannabis advertisements) against the costs (additional complexity and inconsistent tax treatment of advertisements across industries). So far, this approach has not been suggested in any of the highest-profile legalization bills under consideration in the current Congress.

The Tax Hike: A Cannabis Excise Tax

Although it is likely, and appropriate, that federal legalization will trigger an income tax cut, it is also within Congress’s authority to levy an excise tax on cannabis that would offset some or all of that cut. Alcohol and tobacco are already subject to federal excise taxes, for example. But excise taxation is one of the areas where federal proposals for cannabis legalization diverge most sharply.

The Marijuana Revenue and Regulation Act (MRRA) would impose a tax starting at 10 percent of price and ramping up to 25 percent by the fifth year.[6] The Marijuana Opportunity Reinvestment and Expungement Act (MORE Act), by contrast, would impose a much lower 5 percent tax.[7] And the Strengthening the Tenth Amendment Through Entrusting States Act (STATES Act) lacks an excise tax entirely.[8]

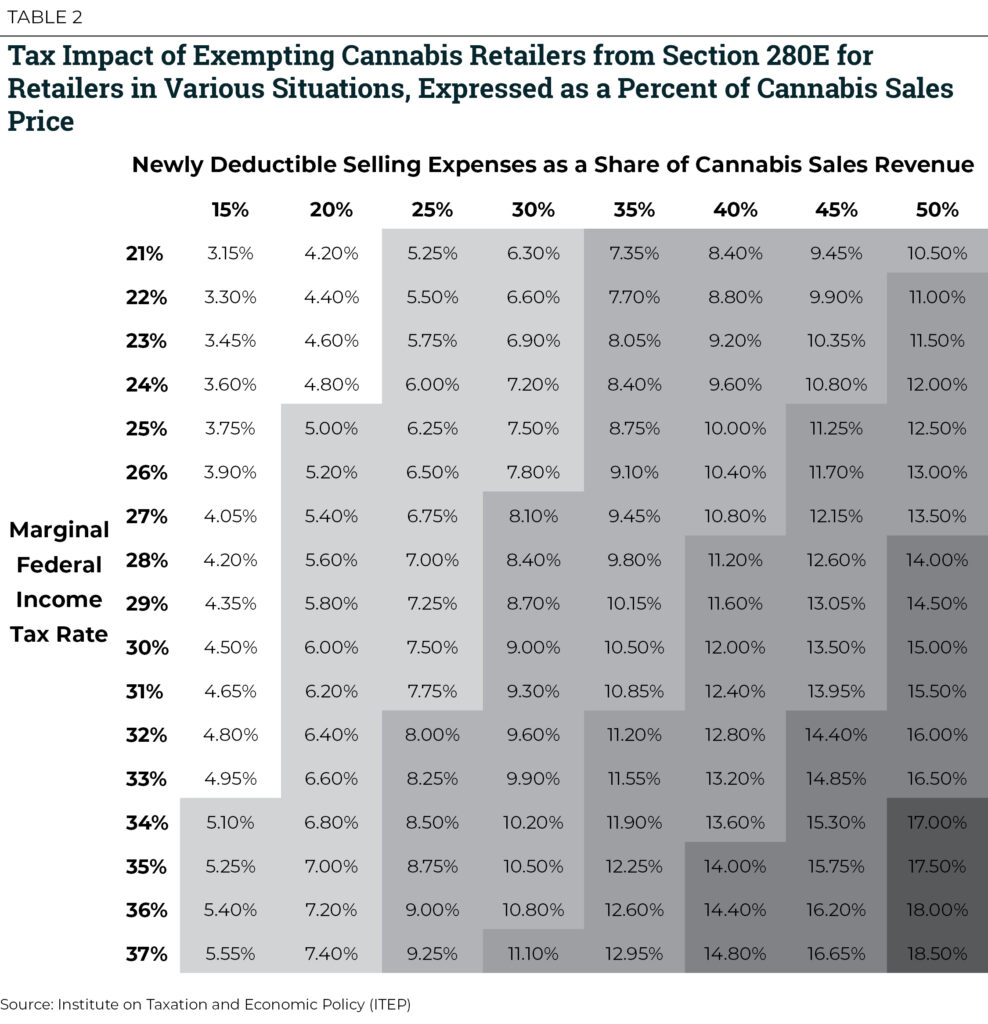

In evaluating the tax rates proposed by the MORE Act and the MRRA, one place to start is with the excise tax rates that the federal government already applies to tobacco and alcohol. A common refrain among cannabis legalization proponents has long been that cannabis should be regulated and taxed like alcohol or tobacco. But this recommendation does not provide much guidance in choosing a cannabis tax rate. Effective tax rates on alcohol and tobacco are widely divergent.

Table 1 shows that although federal taxes on cigarettes average about 32 percent of the pretax price per pack, federal alcohol tax rates are often between half and one-tenth that amount. Calculating an exact tax rate, as a percentage of price, is complicated by the fact that those excise taxes are applied on the basis of quantity (for example, per pack, per barrel, or per gallon) and with alcohol can vary based on alcohol content and the size of the producer. But for less expensive brands produced by large companies, Figure 1 shows that effective tax rates can range from 2.1 percent on a $10 bottle of wine up to 14.3 percent on a $15 bottle of spirits. (The percentage tax rates are lower for premium brands because the tax amount charged per unit remains constant even as price rises.)

The 25 percent cannabis tax in the MRRA would fall somewhere between the typical tax rates applied to cigarettes and alcohol. The 5 percent tax in the MORE Act would clearly be lower than the tax rate applied to cigarettes and would also fall below the rates applied to many alcohol purchases. In the preceding examples, only wine containing less than 16 percent alcohol would be taxed at an effective rate below 5 percent of price.

But while comparisons to current alcohol and tobacco tax rates provide a useful point of reference, there are limitations in viewing cannabis taxation through this lens. For instance, many public health scholars argue that alcohol is severely undertaxed, which means that current alcohol tax rates may not offer much guidance in trying to determine the ideal tax rate on cannabis.[9]

More fundamentally, federal tax rates applied to alcohol, tobacco, and cannabis should ideally bear some resemblance to the comparative public health risks and harms arising from consumption of each of those products. If one of them is significantly more dangerous than the other two, for example, it would make sense for tax rates to be higher on that product. But quantifying and comparing the public health effects of cannabis, alcohol, and tobacco is beyond the scope of this article. That task is complex and controversial, and has been made even more difficult by federal laws that have stifled scientific research into the effects of cannabis.

Finally, the fact that the most prominent federal proposals would tax cannabis based primarily on its price, rather than quantity or potency, makes it impossible to reliably evaluate the actual tax that will be charged to consumers. Nobody knows what the price of cannabis will be five, 10, or 20 years from now, but it is very likely that a loosening of federal and state restrictions will drive the price much lower than it is today.[10]

A 25 percent tax would amount to perhaps 56 cents per intoxicating session if cannabis prices remain at $200 per ounce, but just 14 cents per session if prices fall to $50 per ounce.[11] Alcohol and tobacco taxes, by contrast, are based on the quantity purchased and are therefore not vulnerable to erosion from price cuts.[12]

The uncertain trajectory of cannabis prices provides a compelling reason to consider basing the tax at least partly on the weight or potency of cannabis sold, as opposed to exclusively on price.[13]

Assessing the Net Impact: Tax Cut or Tax Hike?

Whether Congress should structure legalization as a tax cut or a tax increase for the industry is another complex issue beyond the scope of this article. Regardless of how Congress ultimately decides that question, however, it will be helpful to know where the tipping point is located.

Calculating a break-even sales or excise tax rate, at which the amount of tax charged on cannabis sales equals the amount of additional federal income tax paid because of section 280E, requires determining two features of the cannabis retail sector:

- the share of retail cannabis sales revenues that go toward paying nondeductible selling expenses (for example, rent, utilities, wages, benefits, and advertising); and

- the marginal federal income tax rate of the average retailer in the absence of section 280E.

No authoritative data are available on either of those topics, but it is possible to make an educated guess at both.

On the first issue, most retailers are likely to incur selling expenses equal to at least 15 percent of revenues and potentially as high as 50 percent.[14] The industry average should fall somewhere between those two extremes. The headline example in a white paper circulated by the National Cannabis Industry Association is 20 percent of revenue while New Frontier Data assumes 30 percent in its cannabis industry calculations.[15] In the absence of data on the industrywide average, we will take the midpoint of the two estimates, or 25 percent, to illustrate the potential significance of changing section 280E.

On the second issue, the marginal income tax rate paid by the average cannabis retailer likely falls somewhere between 21 percent (the tax rate charged to C corporations) and 37 percent (the top tax rate for passthrough businesses paying under the individual income tax).

The 37 percent rate is undoubtedly too high as an industry average for at least three reasons. First, some smaller retailers earn too little to be subject to the top individual income tax rate, which in 2019 only applies to incomes in excess of $612,350 for married couples and $510,330 for single taxpayers. Second, some cannabis retailers are making use of section 199A, which offers a 20 percent deduction for specified business income and cuts the actual top marginal tax rate for those businesses to 29.6 percent. And third, some retailers are organized as C corporations and therefore are taxed at just 21 percent.[16]

Given this context, we will assume that a typical retailer is subject to a 25 percent federal tax rate before considering the effect of section 280E. This is slightly below the midpoint between the 21 percent corporate rate and the 29.6 percent top individual rate of a retailer claiming the section 199A deduction.

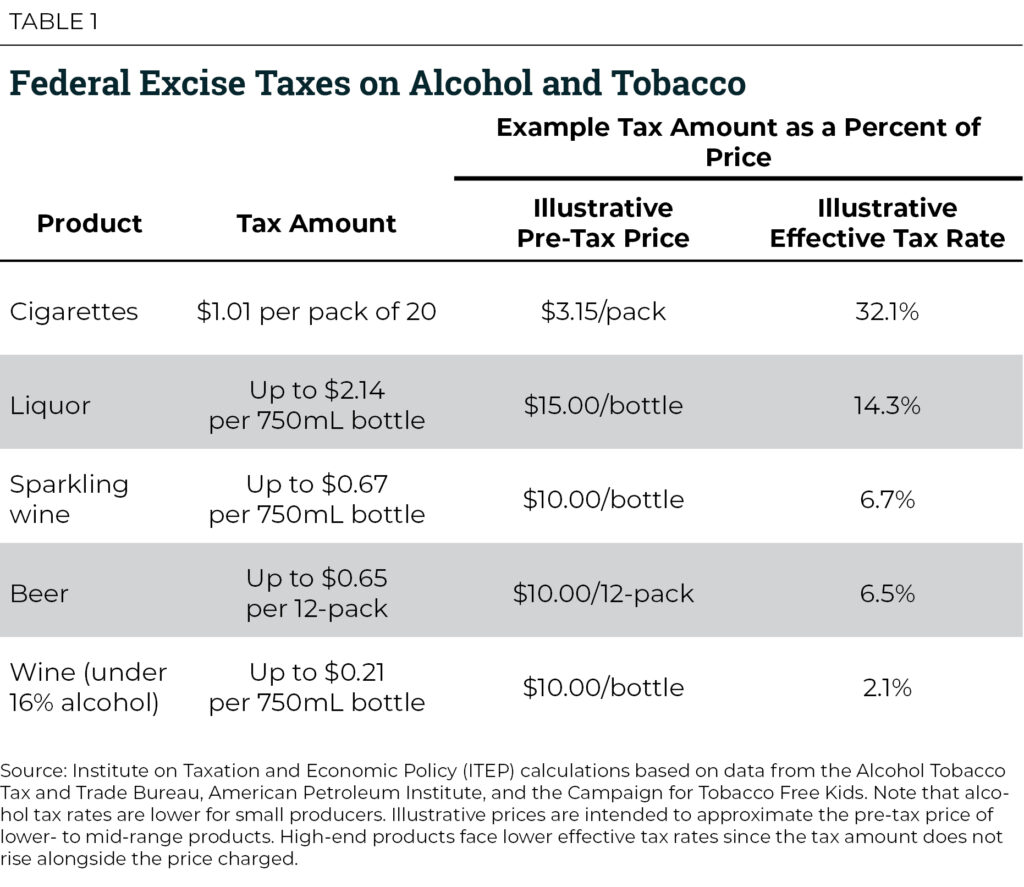

If the average retailer is spending 25 percent of its cannabis sales revenue on selling expenses and those expenses are being taxed at a 25 percent rate because of section 280E, the additional federal income tax charged as a result of section 280E equals 6.25 percent of the value of the cannabis sold. For example, a retailer with $1 million in sales revenue and $250,000 in nondeductible selling expenses is paying $62,500 in additional federal tax because of section 280E, or 6.25 percent of the value of cannabis it sold. In other words, if these assumptions are accurate, holding the tax contribution of the average retailer constant would require imposing a 6.25 percent tax on cannabis sales.

Table 2 provides the same calculation for retailers in all financial and tax situations just described — selling expenses ranging from 15 to 50 percent of revenues and tax rates ranging from 21 to 37 percent. It illustrates that for specific retailers in those various situations, the actual tax impact of section 280E could plausibly range from 3.15 to 18.5 percent of the price of cannabis sold. And it shows, for example, that if the same retailer spends 30 percent rather than 25 percent of its revenues on selling expenses, the break-even excise tax rate would rise from 6.25 to 7.5 percent.

This analysis suggests that the long-run, 25 percent tax contained in the MRRA would undoubtedly represent a net tax increase on the cannabis industry even after considering that section 280E would no longer apply. The short-run, 10 percent tax under that bill is likely to be a tax increase as well.

The MORE Act and its 5 percent tax, by contrast, is likely to be a net tax cut when one considers the combined effect of a section 280E exception and the new excise tax. And the STATES Act, of course, is an unambiguous tax cut because it lacks an excise tax entirely.

The Full Revenue Picture

The break-even estimate in this article is intended to illustrate the tax level needed to achieve a neutral tax impact on a typical cannabis retailer and its customers. It should not be interpreted as the rate needed to draft a revenue-neutral legalization bill. Calculating the net revenue effect of full federal legalization is complex because it would include not just an excise tax and changes to section 280E, but also highly significant changes to the industry’s competitive landscape such as allowing for the interstate movement of cannabis and possibly expanding access to basic financial services.[17]

Federal legalization is likely to accelerate the movement toward legalization in statehouses around the country. If state lawmakers respond as expected, the federal government would realize income, payroll, and excise tax revenues from the industry more quickly than would otherwise be the case. On the other hand, federal legalization is also likely to lead to substantial reductions in cannabis prices. This will undercut the revenue potential of the price-based excise taxes currently being considered.

The Impact on State Governments

This discussion so far has focused only on federal taxes, but there are at least two ways in which the federal tax policy developments contemplated in this article could matter to state governments.

First, because most states base their income tax rules on the federal code, allowing cannabis businesses to claim more business expense deductions on their federal returns would allow many of those businesses to claim the same deductions for state tax purposes as well. This effect would vary by state, depending on the ways in which each state chooses to conform to federal law, whether the state has already implemented a state-level exception to section 280E, and whether the state levies an income tax at all. But in many states the impact of this change would be to reduce the effective income tax rates charged to cannabis businesses.

Second, swapping section 280E for a federal excise tax on cannabis has the potential to significantly lower taxable cannabis prices, which would lead to declines in excise and sales tax revenues in states that tax legal sales by percentage of price. Currently, much of the effect of section 280E is likely reflected in cannabis prices, meaning that an exemption from section 280E could lead to a price reduction of 6 percent or more. Because most states with legal sales base their tax regimes partly or wholly on cannabis prices, these developments have the potential to negatively affect revenue collections.[18]

The susceptibility of cannabis prices to changes in federal policy is one of the main reasons that we have previously recommended that states base their tax systems at least partly on the weight of cannabis sold, rather than structuring the entire system around the product’s price.[19]

Conclusion

The analysis in this article suggests that for a typical retailer, denying selling expense deductions under section 280E might have an impact roughly equivalent to a 6.25 percent tax on the sales price of cannabis. This calculation is sensitive to assumptions about retailers’ average marginal tax rate and the share of revenues spent on selling expenses, however. Of the most significant legalization bills under consideration in the current Congress, one contains a tax rate (25 percent) above that level, another levies a tax below that level (5 percent), and a third lacks an excise tax entirely.

Understanding the full tax consequences of cannabis legalization requires evaluating not only the excise taxes proposed in most legalization bills, but also the effects on the federal income tax liability of cannabis businesses.

[1] Carl Davis, “State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019,” Institute on Taxation and Economic Policy Just Taxes Blog (Aug. 7, 2019).

[2] Although there are no official figures for federal revenue collections associated with cannabis, New Frontier Data estimated a revenue contribution of $2.02 billion in 2019. See New Frontier Data, “Cannabis in the U.S. Economy: Jobs, Growth & Tax Revenue, 2018 Edition,” at 16 (Mar. 2018).

[3] In one study, researchers found that firms lobbying in favor of the 2004 tax holiday on repatriated earnings enjoyed “a return in excess of $220 for every $1 spent on lobbying, or 22,000 percent.” See Raquel Meyer Alexander, Stephen W. Mazza, and Susan Scholz, “Measuring Rates of Return for Lobbying Expenditures: An Empirical Case Study of Tax Breaks for Multinational Corporations,” 25(401) J. L. Pol. (Apr. 8, 2009).

[4] Oglesby, “How Bob Dole Got America Addicted to Marijuana Taxes,” Brookings FixGov Blog (Dec. 18, 2015).

[5] NORML, “Federal: Legislation Pending to Cease Penalizing State- Compliant Marijuana Businesses Under the Federal Tax Code” (Sept. 16, 2019).

[6] Starting in the sixth year, the tax would be administered based on weight of product for raw plant material and THC content for processed material, but annual adjustments would be made to continue approximating a 25 percent tax. See Marijuana Revenue and Regulation Act, S. 420, 116th Cong. (2019).

[7] Marijuana Opportunity Reinvestment and Expungement Act of 2019, H.R. 3884, 116th Cong. (2019).

[8] Strengthening the Tenth Amendment Through Entrusting States Act, S. 1028, 116th Cong. (2019).

[9] German Lopez, “The Case for Raising the Alcohol Tax,” Vox, Dec. 13, 2018.

[10] Davis, Misha Hill, and Richard Phillips, “Taxing Cannabis,” Institute on Taxation and Economic Policy (Jan. 23, 2019).

[11] This assumes that an intoxicating session involves consuming 0.32 grams, which is equivalent to the average amount of cannabis found in a joint, and that an ounce of cannabis therefore allows for 89 intoxicating sessions (see Greg Ridgeway and Beau Kilmer, “Bayesian Inference for the Distribution of Grams of Marijuana in a Joint,” 165 Drug and Alcohol Dependence 175-180 (Aug. 1, 2016)).

[12] Because they are not indexed for inflation, however, the real value of tobacco and alcohol taxes tends to decline over time.

[13] See Davis, Hill, and Phillips, supra note 10.

[14] Oglesby reviewed sources suggesting that payroll costs alone amount to at least 13 percent of revenue for retailers (see Oglesby, “Estimating 280E Revenue — Data Dump,” Center for New Revenue (Feb. 2, 2017)). In its research, New Frontier Data uses an example in which the cost of goods sold equals 50 percent of the final selling price, suggesting that in order to break even before taxes, a retailer cannot spend more than 50 percent of its cannabis revenue on selling expenses (see New Frontier Data, supra note 2).

[15] National Cannabis Industry Association, “Internal Revenue Code Section 280E: Creating an Impossible Situation for Legitimate Businesses” (2015). New Frontier Data, supra note 2, at 16.

[16] It is unclear what fraction of retailers are subject to individual as opposed to corporate income tax rates. Data from the California Bureau of Cannabis Control (Aug. 27, 2019) indicate that very few retailers in the Golden State are organized as sole proprietorships or partnerships. Instead, 73 percent of legal cannabis retailers in California are organized as corporations while 24 percent are limited liability companies. But the data do not distinguish between C corporations and S corporations, or between LLCs electing to pay tax under the corporate tax as opposed to the individual income tax. So although this information leaves open the possibility that a significant number of retailers in California are subject to corporate rather than individual tax rates, we cannot say this with certainty. It is also worth noting that California’s income tax structure may have encouraged retailers to incorporate because it allows C corporations and some LLCs to deduct cannabis selling expenses for state income tax purposes that other businesses cannot (although Chapter 792, Statutes of 2019, now allows these deductions for all businesses for the next five years, starting in 2020). Given this fact, one should not assume the landscape of retail business structures in other states resembles the landscape in California.

[17] As of this writing, Congress is considering addressing the financial services question in a separate bill before starting debate of full legalization.

[18] This will remain true even if the federal government replaces section 280E with a sales or excise tax because states are unlikely to apply their own taxes to that federal tax amount. In other words, section 280E drives up taxable prices but a federal sales or excise tax would increase prices in a manner outside the reach of state tax systems.

[19] Davis, Hill, and Phillips, supra note 10.