Local Income Taxes

Local income taxes can be an important progressive revenue raiser, as they ask more of higher-income households and are connected to ability to pay. They can raise substantial revenue to fund key public services to make cities and regions better off.

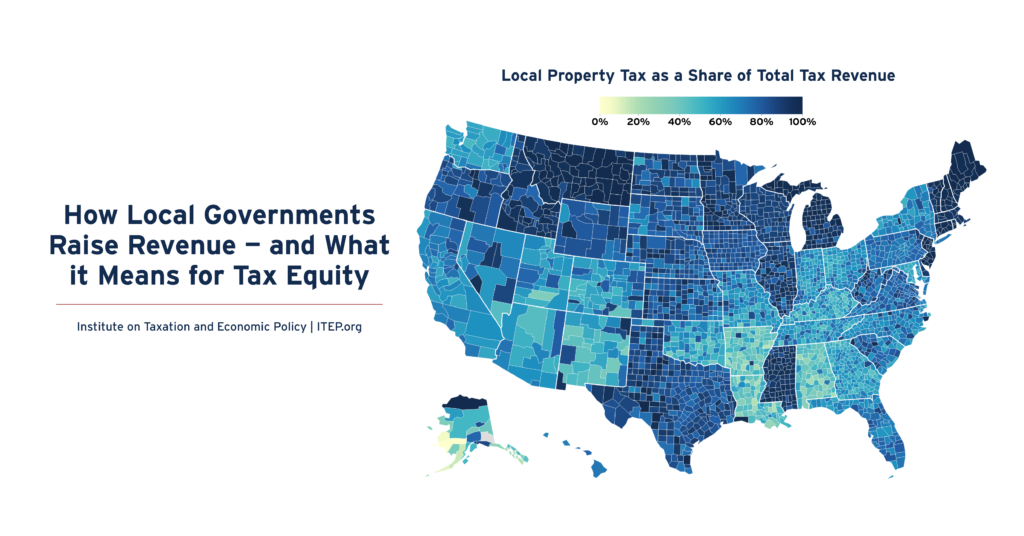

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

These Three Local EITCs Are Boosting Family Incomes at Tax Time

April 10, 2024 • By Andrew Boardman

This tax season more than 800,000 households in New York City, Maryland's Montgomery County, and San Francisco are set to receive a boost through local refundable EITCs. These credits put dollars directly into the pockets of low-income households, equipping families with resources to better make ends meet and invest in their futures. In turn, they can help build stronger, fairer, and more resilient communities.

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

2023’s State and Local Tax Ballot Measures: Voters to Weigh in on Property Taxes, Wealth Taxes, and More

October 24, 2023 • By Jon Whiten

Even in this slow year for candidate elections, the decisions that voters in states and cities make could strengthen or weaken revenue for needs in their communities and could change how taxes are distributed across the income spectrum. In the places where tax fairness is on the ballot, much is at stake.

At nearly every turn, Oregon’s tax policies widen inequality; as a result, the top 1 percent pay less state and local taxes as a share of income than the poorest residents. Taxing capital gains at the local level is an important and exciting move in the other direction – to tax income from wealth and use it to address crucial needs.

A month ago, the Seattle City Council passed an income tax measure, which has garnered a lot of attention as well as volumes of supportive and opposition commentary. Haven’t had a chance to dive into the details yet? We’ve got you covered. What is the new income tax law and who does it impact? The […]