Local Sales Taxes

Not-So-Free Kick: How the 2026 FIFA World Cup Will Cost Cities Millions

December 5, 2025 • By Page Gray

FIFA demanded sales tax breaks on World Cup Tickets. That means millions in lost revenue for host cities already shouldering the costs on providing infrastructure, security and logistics.

Policymakers Unwisely Propose Cutting Property Taxes in Favor of Sales Taxes

January 14, 2025 • By Rita Jefferson

Lawmakers across the country are taking aim at property taxes with a new strategy: raising sales taxes instead. Doing so would create a regressive tax shift that puts unfair burdens on renters and reduces the strength of local government revenues.

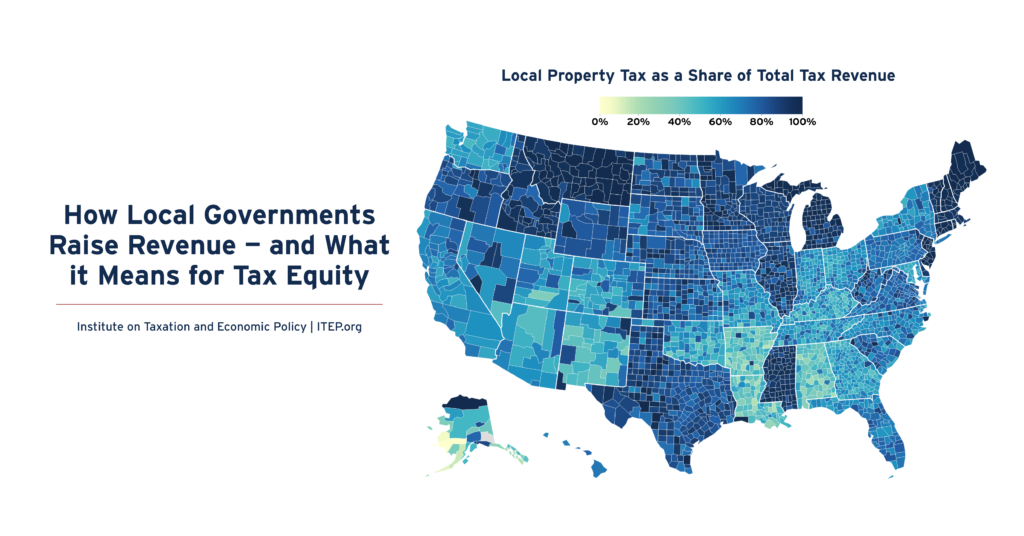

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

On Election Day, Voters Across the Country Chose to Invest in Their States & Communities

November 19, 2024 • By Kamolika Das

On election day, voters across the country — in states red and blue and communities rural and urban — approved a wide range of state and local ballot measures on taxation and public investment. The success of these measures clearly shows that voters are willing to invest in public priorities that feel tangible and close to home.

2024 Local Tax Ballot Measures: Voters in Dozens of Communities Will Shape Local Policy

October 17, 2024 • By Rita Jefferson

Next month, voters across the country will weigh in on many local ballot measures that will have a profound effect on the adequacy of our local tax systems and whether cities and communities can fund public needs. These are in addition to statewide ballot questions, many of which have local implications this year.

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

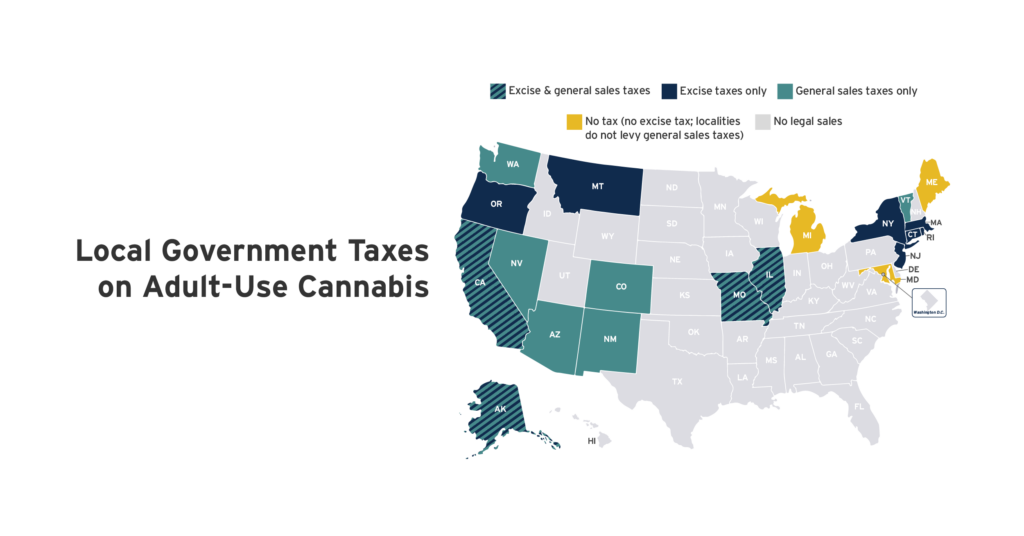

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

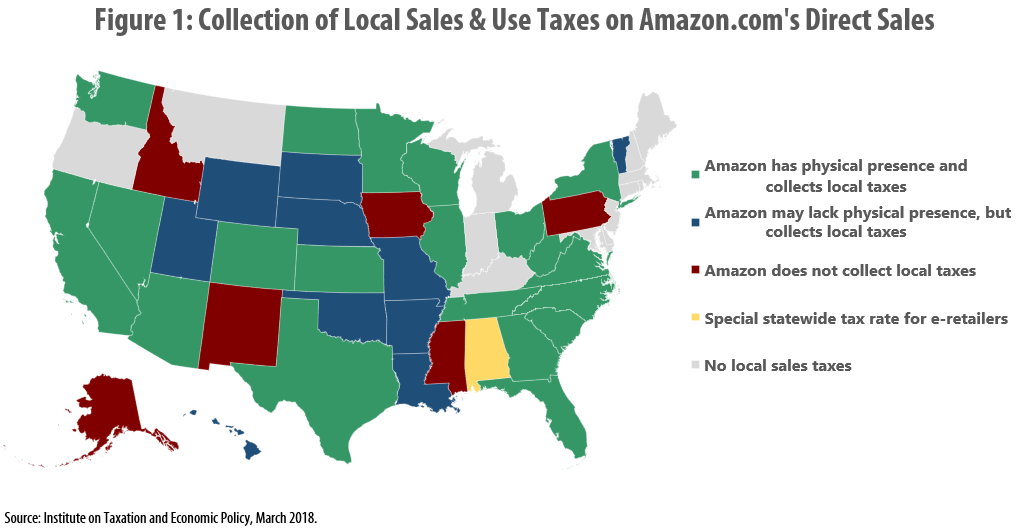

Many Localities Are Unprepared to Collect Taxes on Online Purchases: Amazon.com and other E-Retailers Receive Tax Advantage Over Local Businesses

March 26, 2018 • By Carl Davis

Online retailer Amazon.com made headlines last year when it began collecting every state-level sales tax on its direct sales. Savvy observers quickly noted that this change did not affect the company’s large and growing “marketplace” business, where it conducts sales in partnership with third-parties and rarely collects tax. But far fewer have noticed that even on its direct sales, Amazon is still not collecting some local-level taxes.