On the Map - Local Policy

4 posts

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

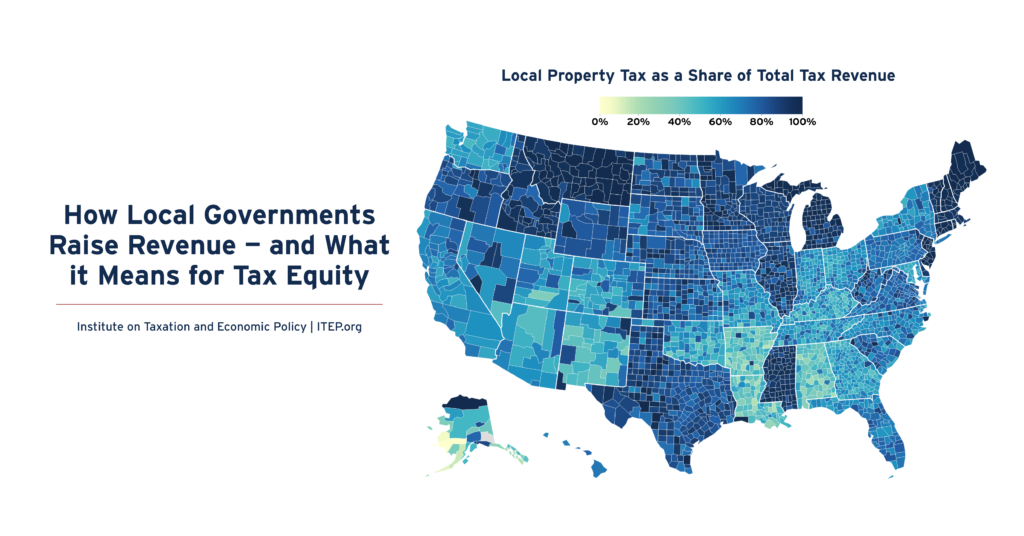

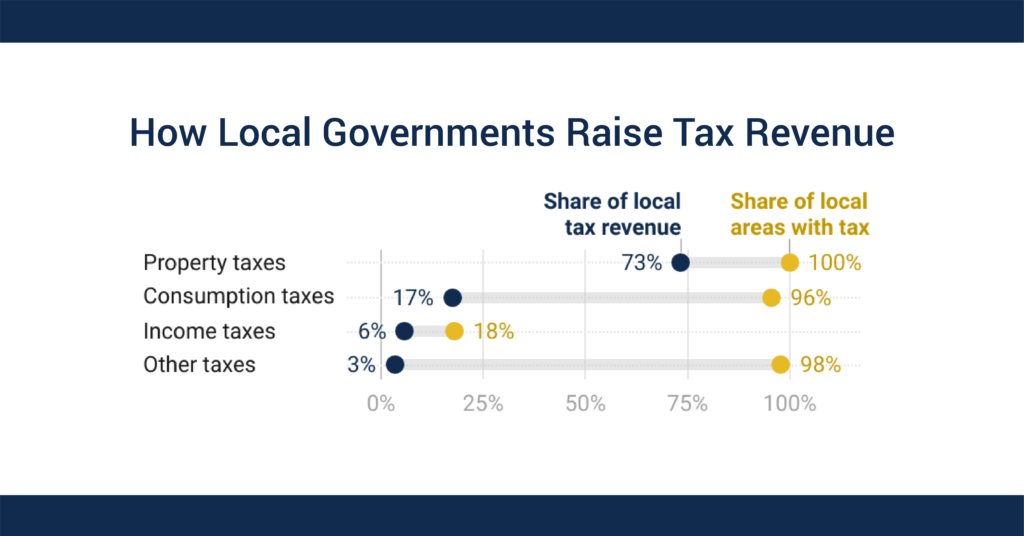

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

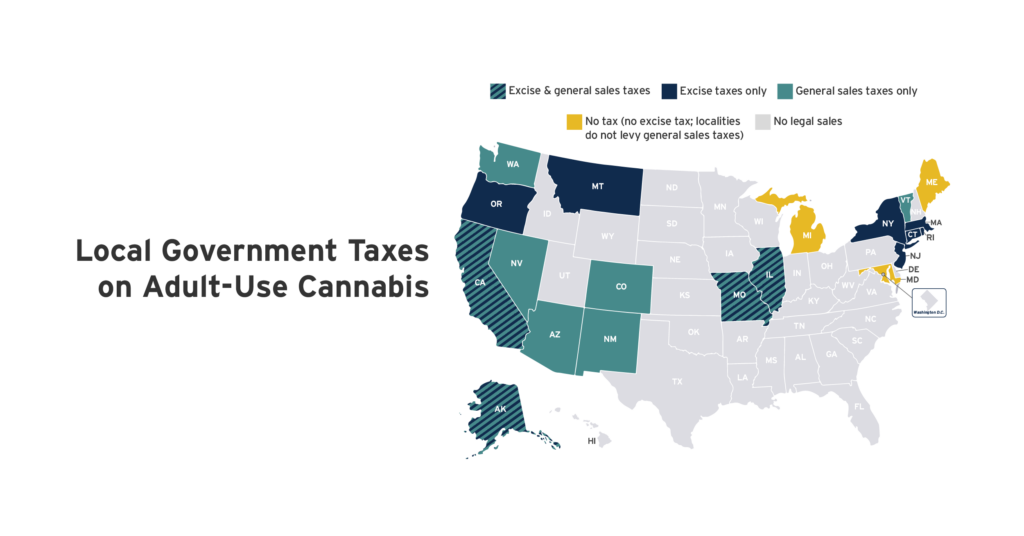

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

How Local Governments Raise Revenue—and What it Means for Tax Equity

March 30, 2023 • By Andrew Boardman, Kamolika Das

Most local tax systems are falling short of their potential. Well-structured local tax policies support communities by facilitating important investments and advancing fairness, but the tax revenue sources most utilized by local governments tend to disproportionately weigh on households with fewer resources. Learning from these realities can inform the path to improved tax policies and stronger communities.

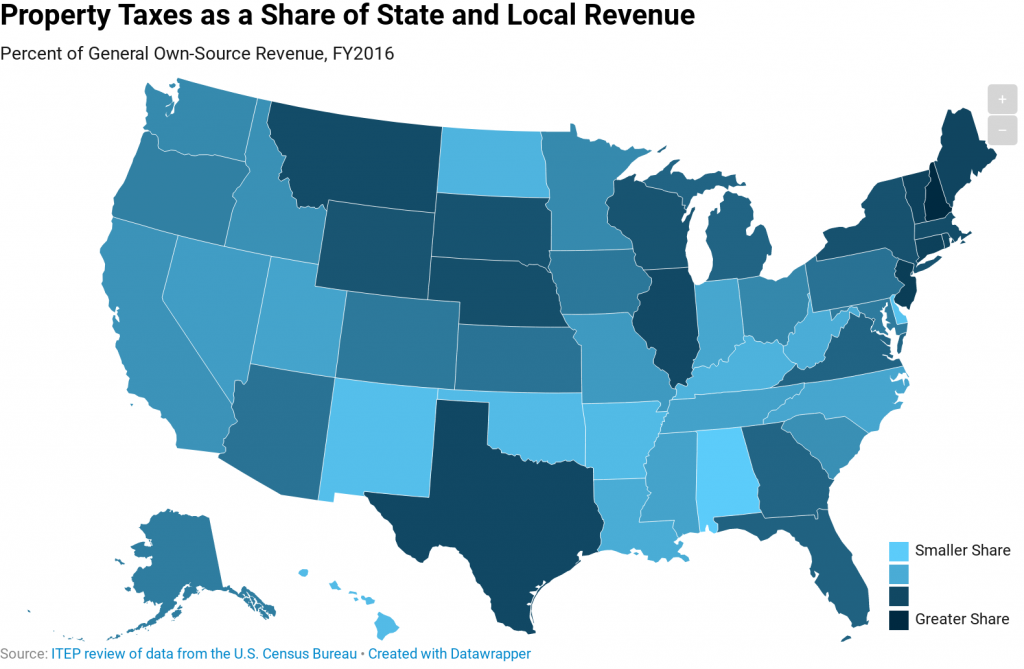

The property tax is the oldest major revenue source for state and local governments and remains an important mechanism for funding education and other local services. This map shows the share of state and local general revenue in each state that is raised through property taxes.