On the Map

56 posts

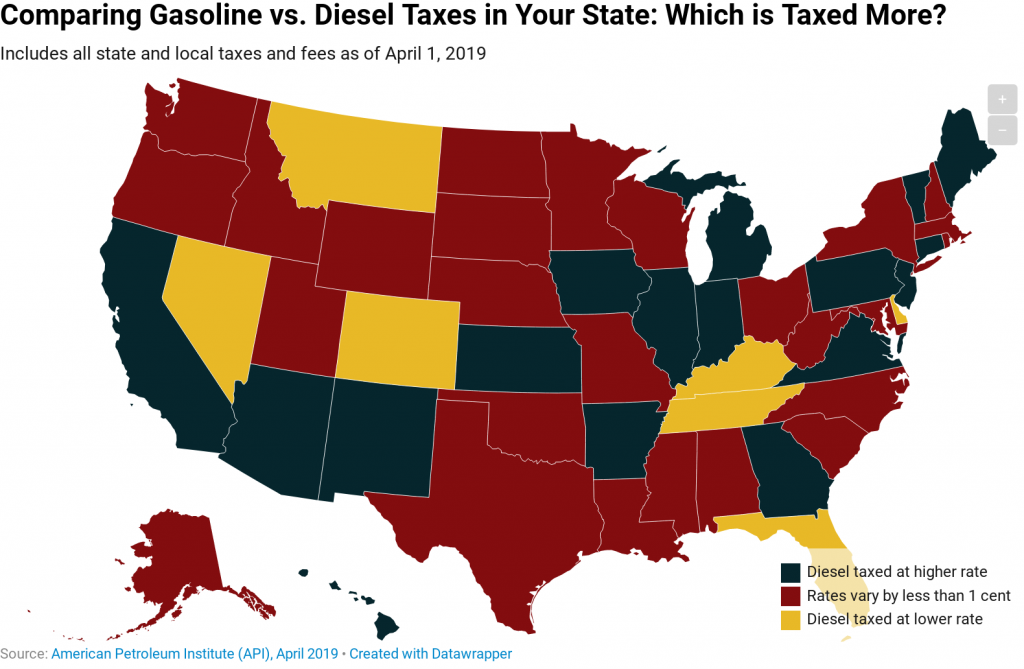

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

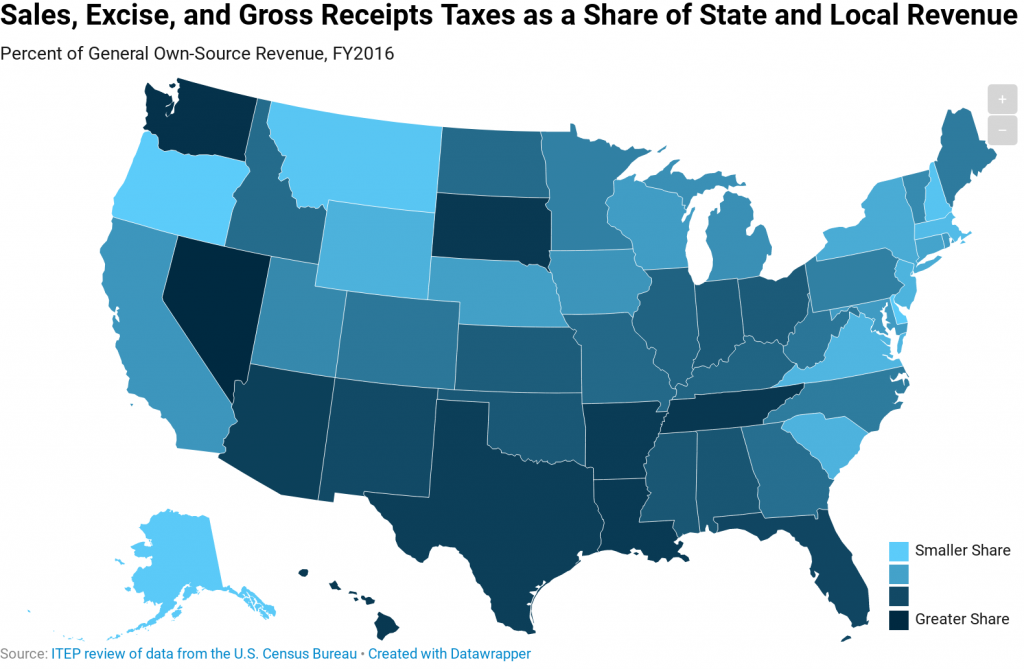

Consumption taxes (including general sales taxes, excise taxes on specific products, and gross receipts taxes) are an important revenue source for state and local governments. While five states lack state-level general sales taxes (Alaska, Delaware, Montana, New Hampshire, and Oregon), every state levies taxes on some types of consumption.

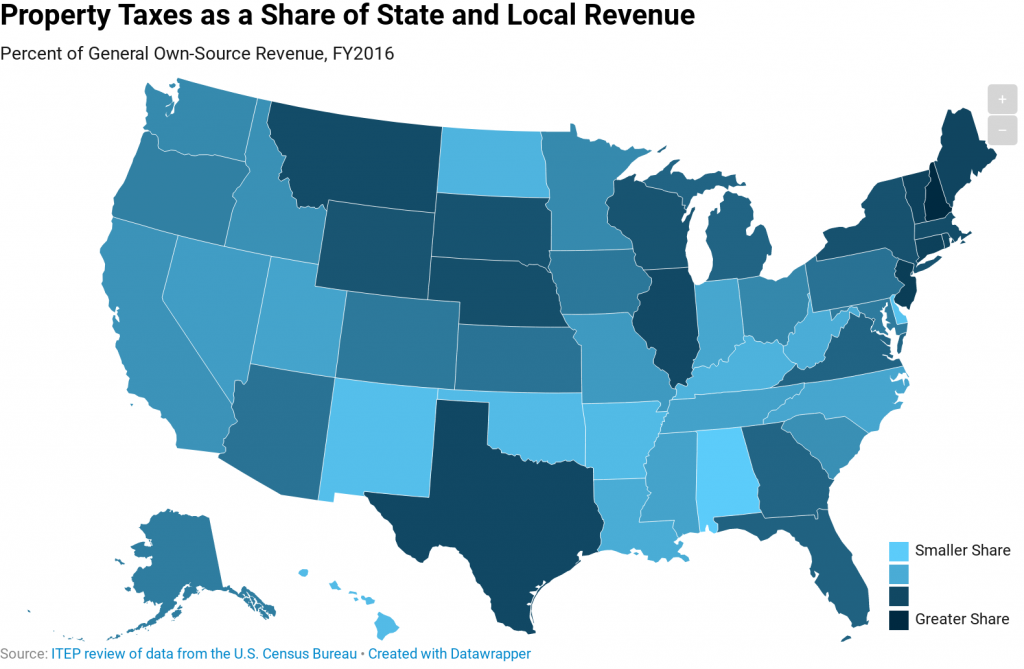

The property tax is the oldest major revenue source for state and local governments and remains an important mechanism for funding education and other local services. This map shows the share of state and local general revenue in each state that is raised through property taxes.

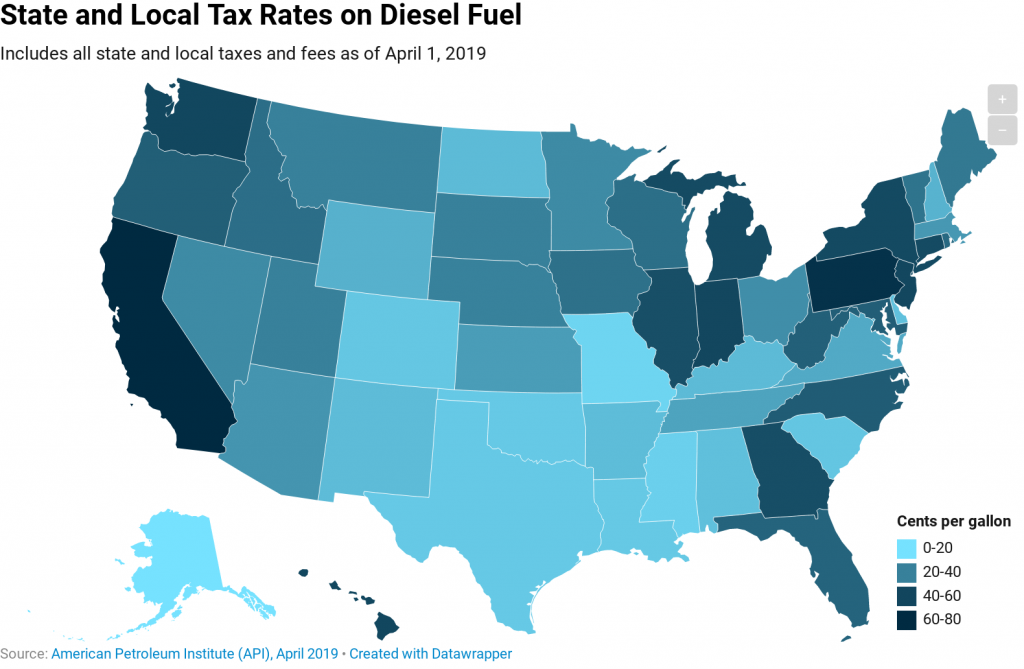

The tax rates identified in this map include state and local excise and sales taxes on diesel fuel, as well as various fees, as calculated by the American Petroleum Institute (API). These taxes are levied in addition to the federal government’s 24.4-cent-per-gallon diesel tax.

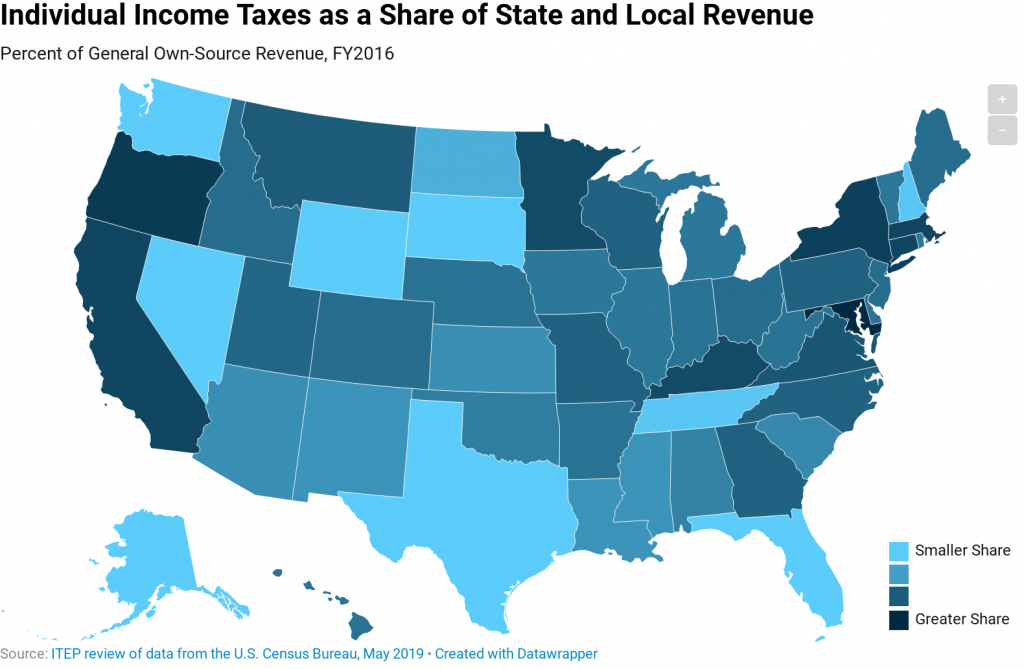

Income taxes vary considerably in their structure across states, though the best taxes are fine-tuned to taxpayers’ ability-to-pay.

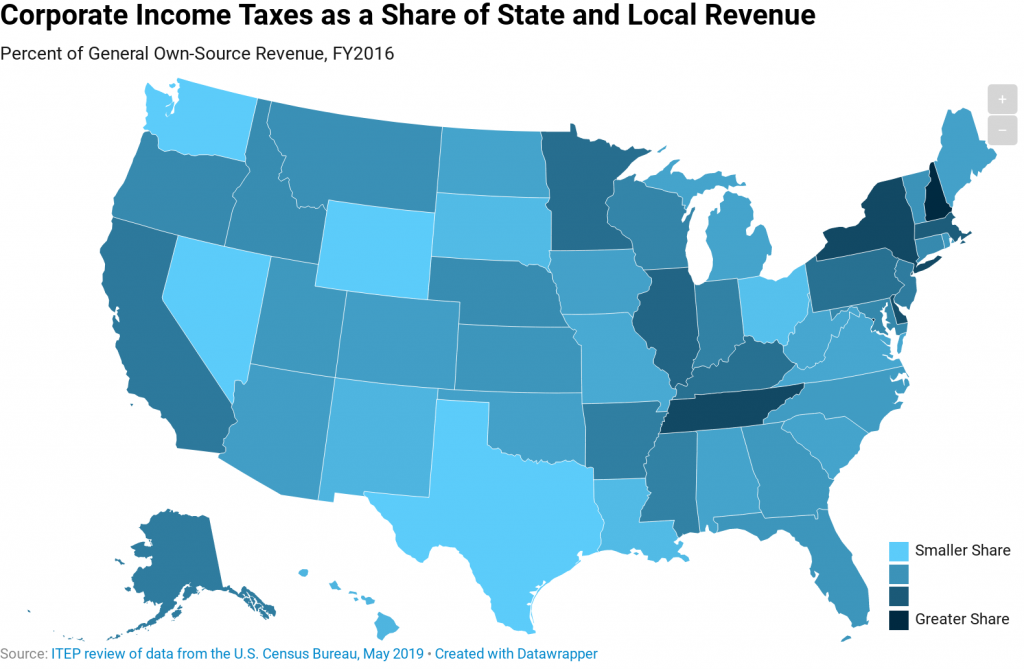

Corporate income taxes are an important source of revenue for state governments and ensure that profitable corporations benefiting from public services pay toward the maintenance of those services.