State Corporate Taxes

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

How States Can Help Shut Down Tax Havens by Cracking Down on Profit Shifting

January 17, 2019 • By Richard Phillips

A core problem with our corporate income tax laws at the federal and state levels is that they allow companies to use accounting gimmicks to shift significant amounts of their profits into low or zero-tax jurisdictions. Federal lawmakers had an opportunity to address this with the 2017 tax law, but they failed to do so, and, in fact, the law may incentivize more offshore tax avoidance. State lawmakers, however, can buck the federal trend and crack down on profit shifting themselves.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

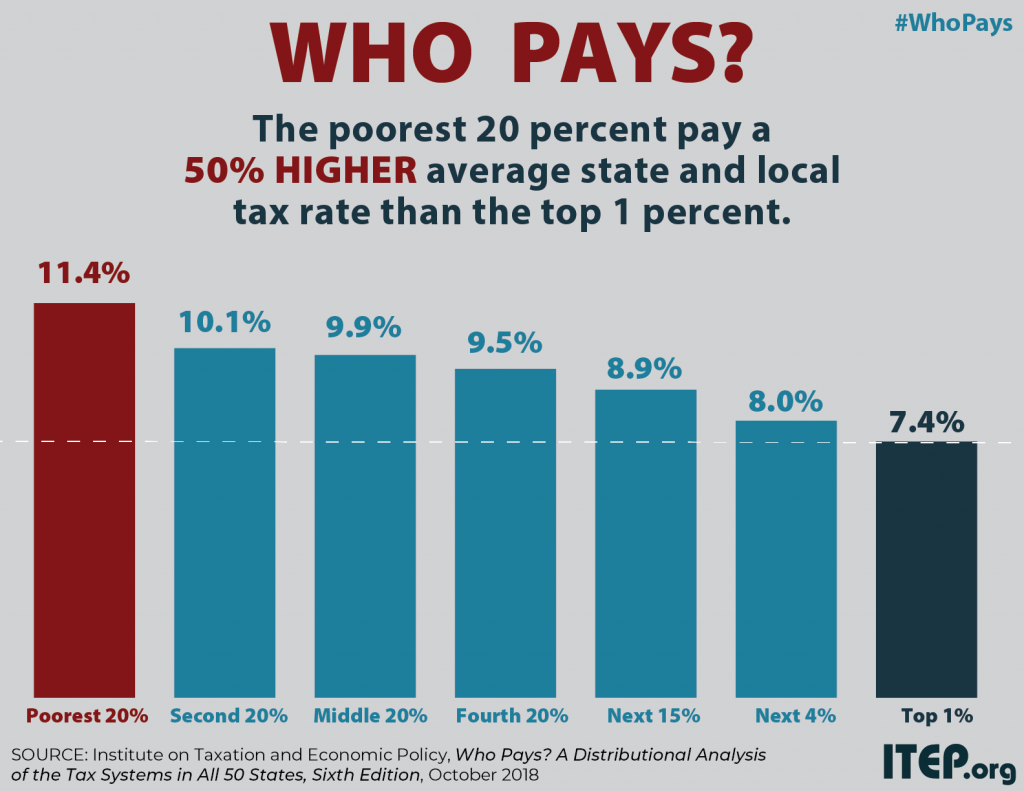

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

ITEP Testimony “Regarding the Final Report of the Arkansas Tax Reform and Relief Legislative Task Force”

August 23, 2018 • By Lisa Christensen Gee

Read the testimony in PDF WRITTEN TESTIMONY SUBMITTED TO: THE ARKANSAS TAX REFORM AND RELIEF TASK FORCE Lisa Christensen Gree, Senior State Tax Policy Analyst Institute on Taxation and Economic Policy Regarding the Final Report of the Arkansas Tax Reform and Relief Legislative Task Force August 22, 2018 Thank you for the opportunity to submit these […]

Profitable Fortune 500 Companies Avoid $126 Billion in State Corporate Taxes Over Eight Years

April 27, 2017 • By ITEP Staff

The Effective State Tax Rate Paid by Profitable Fortune 500 Corporations Is Declining,Yet States Continue to Actively Dismantle Their Corporate Income Taxes (Washington, D.C.) As states struggle with tough budget decisions about funding essential public services, the average effective state tax rate paid by profitable Fortunate 500 companies continues to drop due to copious loopholes […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

The Louisiana Legislature has been in session for two weeks now. The stage has been set for fiscal reform and the stakes are high. The state faces a $1.3 billion loss of revenue starting July 1, 2018 when the temporary sales tax base expansion and rate increase expires if lawmakers fail to close the gap […]

U.S. Collects Smaller Share of Corporate Taxes Than Developed Country Average

April 10, 2017 • By Richard Phillips

Corporate income taxes in the United States as a share of the economy are well below the average among developed nations, according to an analysis of the most recent data from the Organization for Economic Cooperation and Development (OECD). Data from the OECD show that U.S. corporate taxes as a percentage of GDP are 2.2 percent, which is 24 percent less than the 2.9 percent weighted average among the 34 other OECD countries for which data were available.

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

Corporations’ Offshore Cash Hoard Grew to $2.6 Trillion in 2016

March 28, 2017 • By ITEP Staff

U.S. corporations now hold a record $2.6 trillion offshore, a sum that ballooned by more than $200 billion over the last year as companies moved more aggressively to shift their profits offshore, according to a new report, Fortune 500 Companies Hold a Record $2.6 Trillion Offshore, released today by the Institute on Taxation and Economic Policy (ITEP).

States Should Require Combined Reporting of Corporate Income

February 27, 2017 • By Dylan Grundman O'Neill

An important aspect of a 21st century tax code is ensuring that corporate income taxes are easy for corporations to follow, but not easy for them to avoid. As our newly updated policy brief on Combined Reporting of State Corporate Income Taxes explains, “combined reporting” remains an essential tool for states to achieve these goals. […]

Combined Reporting of State Corporate Income Taxes: A Primer

February 24, 2017 • By Dylan Grundman O'Neill, Meg Wiehe

Over the past several decades, state corporate income taxes have declined markedly. One of the factors contributing to this decline has been aggressive tax avoidance on the part of large, multi-state corporations, costing states billions of dollars. The most effective approach to combating corporate tax avoidance is combined reporting, a method of taxation currently employed in more than half of the states that tax corporate income. The two most recent states to enact combined reporting are Rhode Island in 2014 and Connecticut in 2015. In several states, including Connecticut, Illinois, Massachusetts, Rhode Island, and Vermont, lawmakers adopted the policy after…

We appreciate the Financial Accounting Standards Board's (FASB) ongoing review of its accounting standards to ensure that financial statements are "facilitating clear communication of information that is important to financial statement users." Overall, the changes to disclosure requirements proposed by FASB in the exposure draft would represent a significant step forward toward providing users of financial statements the clarity that they need. We believe, however, that the exposure draft does not go far enough in providing the clarity needed and sought by investors and the public alike.

Few state tax trends are as striking as the rapid decline of state corporate income tax revenues. As recently as 1986, state corporate income taxes equaled 0.5 percent of nationwide Gross State Product (GSP) (a measure of statewide economic activity). But in fiscal year 2013 (the last year for which data are available), state and local corporate income taxes were just 0.33 percent of nationwide GSP--representing a decline of over 30 percent.

When thinking of tax havens, one generally pictures notorious zero-tax Caribbean islands like the Cayman Islands and Bermuda. However, we can also find a tax haven a lot closer to home in the state of Delaware - a choice location for U.S. business formation. A loophole in Delaware's tax code is responsible for the loss of billions of dollars in revenue in other U.S. states, and its lack of incorporation transparency makes it a magnet for people looking to create anonymous shell companies, which individuals and corporations can use to evade an inestimable amount in federal and foreign taxes. The…

Major tax overhauls are on the agenda in a record number of states, and “Who Pays?” documents in state-by-state detail the precise distribution of state income taxes, sales and excise taxes and property taxes paid by each income group as of January 2013. It is a critical baseline against which future proposals can be measured. […]

Read the Report in PDF The 2015 Who Pays: A Distributional Analysis of the Tax Systems in All Fifty States (the fifth edition of the report) assesses the fairness of state and local tax systems by measuring the state and local taxes that will be paid in 2015 by different income groups as a share […]

90 Reasons We Need State Corporate Tax Reform

March 19, 2014 • By Matthew Gardner, Richard Phillips

As states struggle with tough budget decisions about funding essential public services, profitable Fortunate 500 companies are paying little or nothing in state income taxes thanks to copious loopholes, lavish giveaways and crafty accounting, a new study by Citizens for Tax Justice and the Institute for Taxation and Economic Policy reveals.

Proposal to Eliminate Income Taxes Amounts to a Tax Increase on Bottom 80 Percent of Louisianans

January 11, 2013 • By Meg Wiehe

Louisiana Governor Bobby Jindal has said that he supports the elimination of the state's personal and corporate income taxes. In fiscal year 2012, Louisiana collected nearly $3 billion in revenues from its personal and corporate income taxes.

Corporate Income Tax Apportionment and the “Single Sales Factor”

August 1, 2012 • By Meg Wiehe

One of the thorniest problems in administering state corporate income taxes is how to distribute the profits of multi-state corporations among the states in which they operate. Ultimately, each corporation's profits should be taxed in their entirety, but some corporations pay no tax at all on a portion of their profits. This problem has emerged, in part, due to recent state efforts to manipulate the "apportionment rules" that distribute such profits. This policy brief explains how apportionment rules work and assesses the effectiveness of special apportionment rules such as "single sales factor" as economic development tools.

In October, South Carolina Governor Nikki Haley suggested that gradually repealing the state’s corporate income tax should be a priority for lawmakers in 2012. Haley’s idea was alarming, but hardly surprising: in the past year, governors in Arizona and Florida have proposed similar plans, and lawmakers in a number of other states have moved to […]

A robust corporate income ensures that profitable corporations that benefit from public services pay their fair share towards the maintenance of those services, just as working people do.. More than forty states currently levy a corporate income tax. This policy brief explains why corporations should be taxed and the basic workings of the corporate tax.

The “QPAI” Corporate Tax Break: How it Works and How States Can Respond

August 1, 2011 • By ITEP Staff

The past quarter century has seen a dramatic decline in the yield of corporate income taxes at both the federal and state levels. Major federal corporate tax legislation enacted in 2004 created a new tax break, known as the "Qualified Production Activities Income" (QPAI) deduction that has further accelerated the decline of the corporate tax. This policy brief evaluates the QPAI deduction and discusses possible state policy responses.

ITEP’s state corporate tax work examines the tax-paying habits of Fortune 500 corporations and corporate contributions to state revenue. It occasionally releases a comprehensive state corporate tax study as a companion to its national report on federal taxes paid (or not paid) by profitable corporations. ITEP also examines state tax incentives provided to corporations in exchange for the promise of economic growth.