Trump Tax Policies

State-by-State Estimates of the First Year of Trump’s Tax Policies: All But the Richest Americans Face Higher Taxes

February 23, 2026 • By Steve Wamhoff, Michael Ettlinger

As a result of the tax policies approved by President Trump and the Republican majority in Congress, all but the richest Americans are paying higher taxes on average in 2026 than they did last year.

Despite a Supreme Court Victory for Middle-Class Americans, Trump’s Disastrous Tariff Policies Are Not Over

February 20, 2026 • By Steve Wamhoff

Today the Supreme Court made the right decision in striking down most of the tariffs President Trump has put into motion during his second term.

Trump Administration Provides Biggest Illegal Tax Cuts Yet for Billion-Dollar Corporations

February 20, 2026 • By Amy Hanauer

The Treasury Department is unilaterally cutting corporate taxes with regulations that ignore the statute they claim to implement, disregarding the separation of powers between the branches of government that has defined how America works for more than two centuries.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

IRS Enforcement Boost Was Supposed to Last 10 Years. Congress Killed It in Under Three.

September 16, 2025 • By Sarah C. G. Christopherson

The IRS was set to overhaul how it audits the ultra-rich. Now most of that funding is gone.

The Trump Megabill Hands the Rich a Gift — and Sends the Bill to Young Americans

August 21, 2025 • By ITEP Staff

Trump's megabill directs most benefits to the wealthy, while leaving younger generations with higher taxes, more debt, and fewer opportunities. For Millennials and Gen Z, it means reduced public investment and an economy less likely to work in their favor.

Trump Administration’s English-Only IRS Would Undermine Public Trust and Boost Budget Deficits

August 19, 2025 • By Matthew Gardner

The Trump administration’s push to make English the official U.S. language threatens decades of progress in taxpayer services for non-English speakers, risking cuts to IRS multilingual support, harder tax filing, lower compliance, and an undermined agency mission.

How Will the Trump Megabill Change Americans’ Taxes in 2026?

July 22, 2025 • By Steve Wamhoff, Michael Ettlinger, Carl Davis, Jon Whiten

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

This country’s biggest historical challenge has been delivering this progress to all Americans, but Republicans have cut it back for everyone, retreating from many 20th century achievements in ways that will slam doors, rather than opening them, for the next generation.

There Were Far Cheaper and Fairer Options Than the Trump Megabill

July 8, 2025 • By Steve Wamhoff, Joe Hughes, Jessica Vela

Congress and the president could have spent less than half that much money on a tax bill that does more for working-class and middle-class households.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade

July 3, 2025 • By Carl Davis

The Trump megabill will give the top 1 percent tax cuts totaling $1.02 trillion over the next decade. For comparison, the bill’s cuts to the Medicaid health care program will total $930 billion over the same period.

The endlessly debated cap on deductions for state and local taxes (SALT) has emerged in the GOP megabill largely unscathed—despite the efforts of Republican lawmakers from “blue” states. Those lawmakers are correct that the cap reduces the bill’s tax cuts for their wealthy constituents more than for those in other states. The megabill, however, is so loaded up with other provisions that result in a dramatic tax cut for the richest 1 percent in every state.

Megabill Takes Cap Off Unprecedented Private School Voucher Tax Credit, Potentially Raising Cost by Tens of Billions Relative to Earlier Version

July 2, 2025 • By Carl Davis

It is clear that this tax credit has the potential to come with an enormous cost if private school groups are successful in convincing their supporters to participate. In these times of very high debt and deficits, this is reason for all of us to be uneasy.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Analysis of Tax Provisions in the Senate Reconciliation Bill: National and State Level Estimates

June 25, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

Compared to its House counterpart, the Senate bill makes certain tax provisions more generous, including corporate tax breaks that it makes permanent rather than temporary. But the bottom line for both is the same. Both bills give more tax cuts to the richest 1 percent than to the entire bottom 60 percent of Americans, and both bills particularly favor high-income people living in more conservative states.

Trump Megabill’s Deduction for Car Loan Interest Would Not Offset Tariff-Related Auto Price Increases for Most Buyers

June 12, 2025 • By Carl Davis, Sarah Austin

The auto loan interest deduction that recently passed the House is designed, at least in part, to mitigate the impact of tariff-induced price increases on vehicles assembled in America. But the deduction is incapable of offsetting even small-scale price increases, especially for working-class families and others with moderate incomes.

Our tax policies enable people like Elon Musk and Donald Trump to accumulate more wealth than anyone could ever use in a lifetime. They then use it to steer elections and shape public policy to further enrich themselves and others like them. We should defeat the enormously destructive tax bill in Congress and instead craft tax policy that taxes the rich, makes our democracy more fair, and returns resources to the rest of the country.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

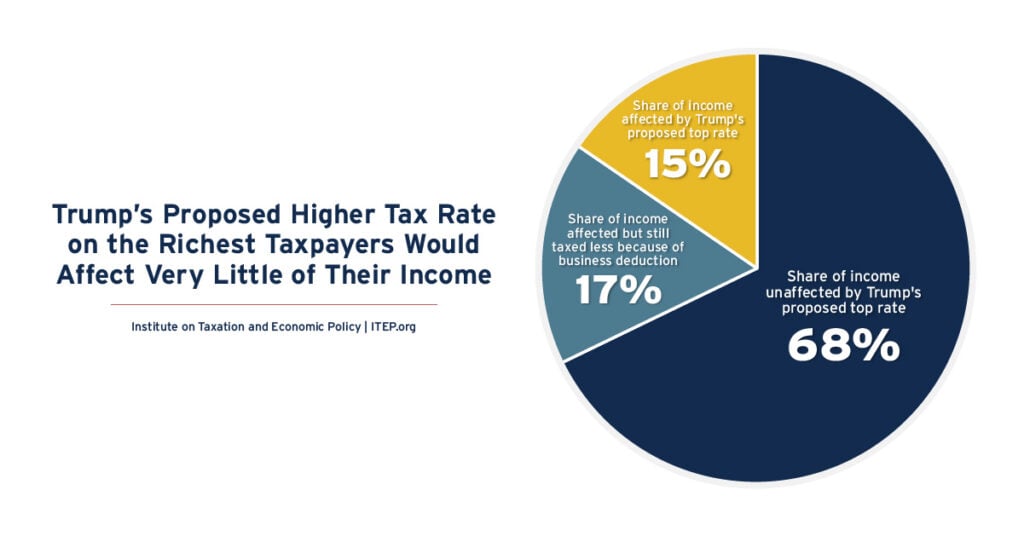

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

ITEP research is pivotal in explaining the effect of the 2017 Tax Cuts and Jobs Act and other Trump administration tax policy proposals at both the state and national levels, including how current law contributes to regressivity in the tax code and rising inequality.