Child Tax Credit

Washington Millionaires’ Tax, Expanded Working Families Tax Credit Make Tax Code Fairer

March 12, 2026 • By Marco Guzman, Dylan Grundman O'Neill

The Washington legislature has approved a new "millionaires' tax," a 9.9 percent tax on income over $1 million. The bill, which makes significant investments in public education and child care, will also expand the Working Families Tax Credit – the state’s EITC – to reach an additional 460,000 households.

The Child Tax Credit Leaves Out Millions of Children in 2026. There Are Better Alternatives.

March 10, 2026 • By Joe Hughes

The 2025 Trump tax law slightly increased the Child Tax Credit in a way that benefits virtually none of the children who most need help.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

D.C.’s Fiscal Autonomy is at Stake, District’s Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Federal lawmakers passed a bill along party lines that would force the District of Columbia to override the decision of local elected officials and implement all of the costly and inequitable federal tax cuts passed under the “One Big Beautiful Bill Act” (OBBBA).

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

In the same way states are building upon federal tax credits, localities should consider building on state tax credits.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Many states already recognize the potential of these credits to boost low- and moderate-income households. Other states should follow suit.

The Potential of Local Child Tax Credits to Reduce Child Poverty

October 8, 2025 • By Kamolika Das, Aidan Davis, Galen Hendricks, Rita Jefferson

Local governments have a critical role to play in reducing child poverty. Local Child Tax Credits could provide large tax cuts to families at the bottom of the income scale, lessening the overall regressivity of state and local tax systems.

Child Poverty Remains Unacceptably High, New Federal Changes Unlikely to Move Needle

September 16, 2025 • By Neva Butkus

By not extending the 2021 temporary Child Tax Credit expansion, federal lawmakers have allowed the number of children and families in poverty to increase and remain unnecessarily high.

State Child Tax Credits Boosted Financial Security for Families and Children in 2025

September 11, 2025 • By Neva Butkus

Child Tax Credits (CTCs) are effective tools to bolster the economic security of low- and middle-income families and position the next generation for success.

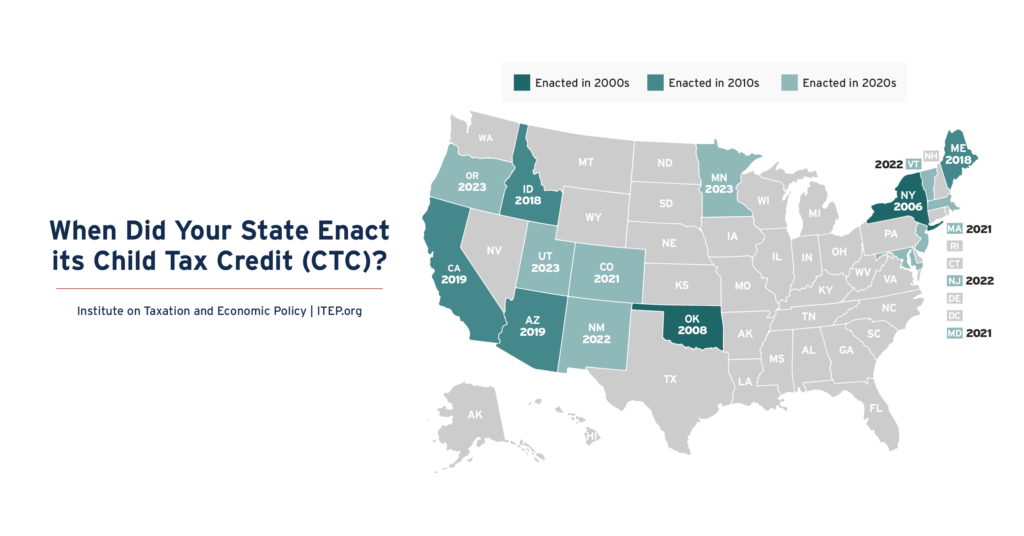

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

Millions of Citizen Children Would be Harmed by Proposal Billed as Targeting Immigrant Tax Filers

April 24, 2025 • By Emma Sifre, Joe Hughes

Congressional Republicans have floated a proposal to strip the Child Tax Credit from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers. Approximately 4.5 million citizen children with Social Security numbers would lose access to the credit under this proposal.

State Tax Policy Should Adopt the Principles of ‘Black Women Best’

November 20, 2024 • By Brakeyshia Samms

Focusing policy analysis on Black women illustrates how Black women have long shouldered the shortcomings of the economy and clearly points to solutions that work for all. Black women are at their best when they are financially secure, healthy, and free – and our economy is at its best when all people can thrive and benefit.

State Child Tax Credits Boosted Financial Security for Families and Children in 2024

September 12, 2024 • By Neva Butkus

Fifteen states plus the District of Columbia provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states – Colorado, New York, and Utah – expanded their Child Tax Credits while lawmakers in the District of Columbia created a new credit that will take effect in 2025.

Expanded Child Tax Credit is Key to Reducing Child Poverty, New Census Data Illustrate

September 10, 2024 • By Jon Whiten

From 2021-2023, child poverty has more than doubled from 5.2 to 13.7 percent. The latest Census data make clear that lawmakers have the tools to help millions of children and their families – and it’s beyond time they take action.

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Every child deserves the opportunity to succeed in society – and tax policy has a huge role to play in making that happen. Better tax policy can help prepare our young children with skills to become successful and thriving adults.

Impacts of the Tax Relief for American Families and Workers Act

February 2, 2024 • By Joe Hughes, Steve Wamhoff

The Tax Relief for American Families and Workers Act passed by the House of Representatives on January 31 is a compromise between lawmakers who want to address child poverty and lawmakers who want to expand the Trump tax cuts for corporations and therefore includes provisions that do both. It also offsets the costs of those […]