As lawmakers and advocates continue to push for restoring the 2021 expansion of the Child Tax Credit (CTC), new Census data for 2023 reinforces the power of that policy to reduce poverty – especially child poverty.

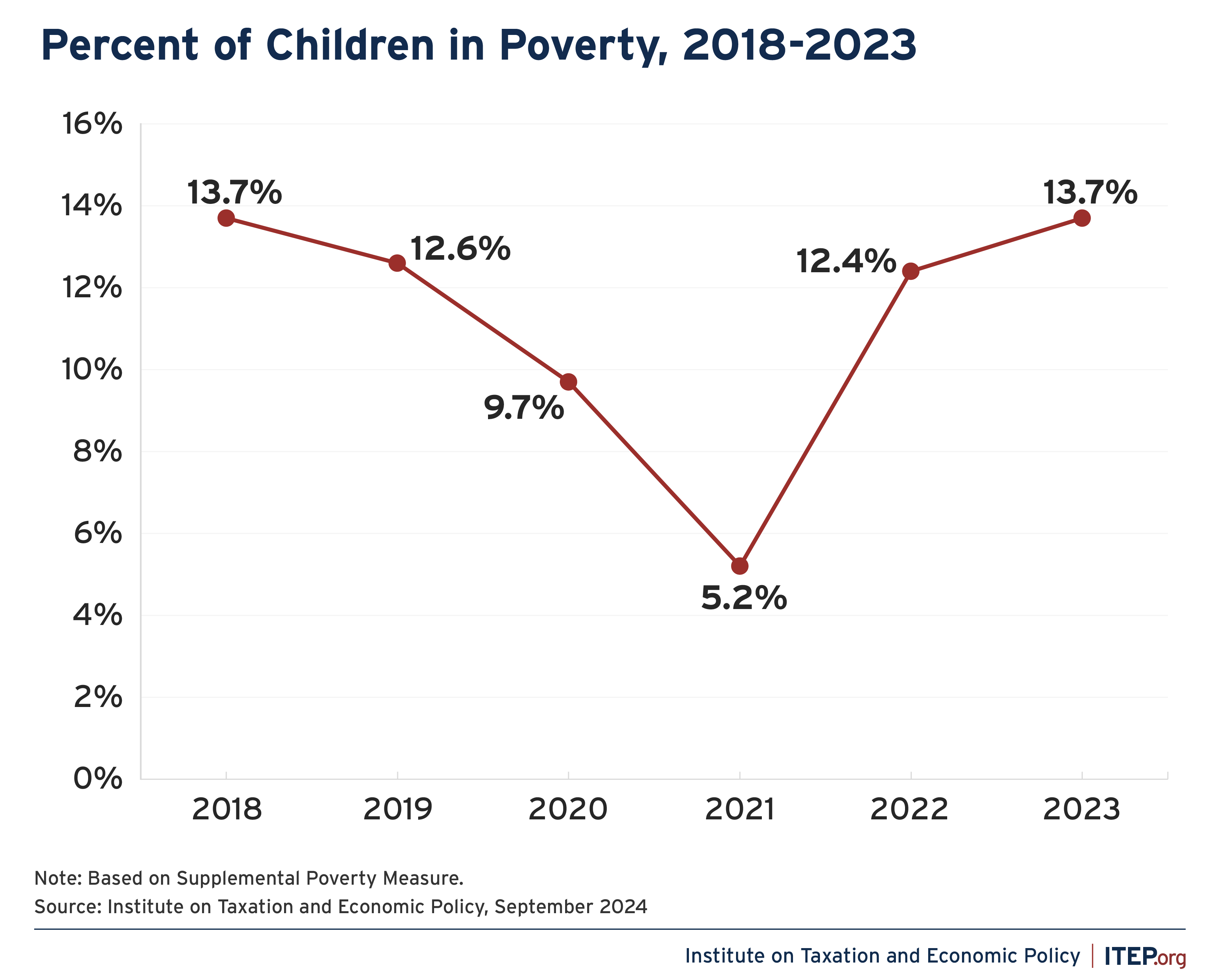

After the temporary CTC expansion cut child poverty in half in 2021 (the largest drop ever recorded), we have essentially lost those dramatic gains made in the fight against child poverty.

What the Census Data Tell Us About Poverty in the U.S.

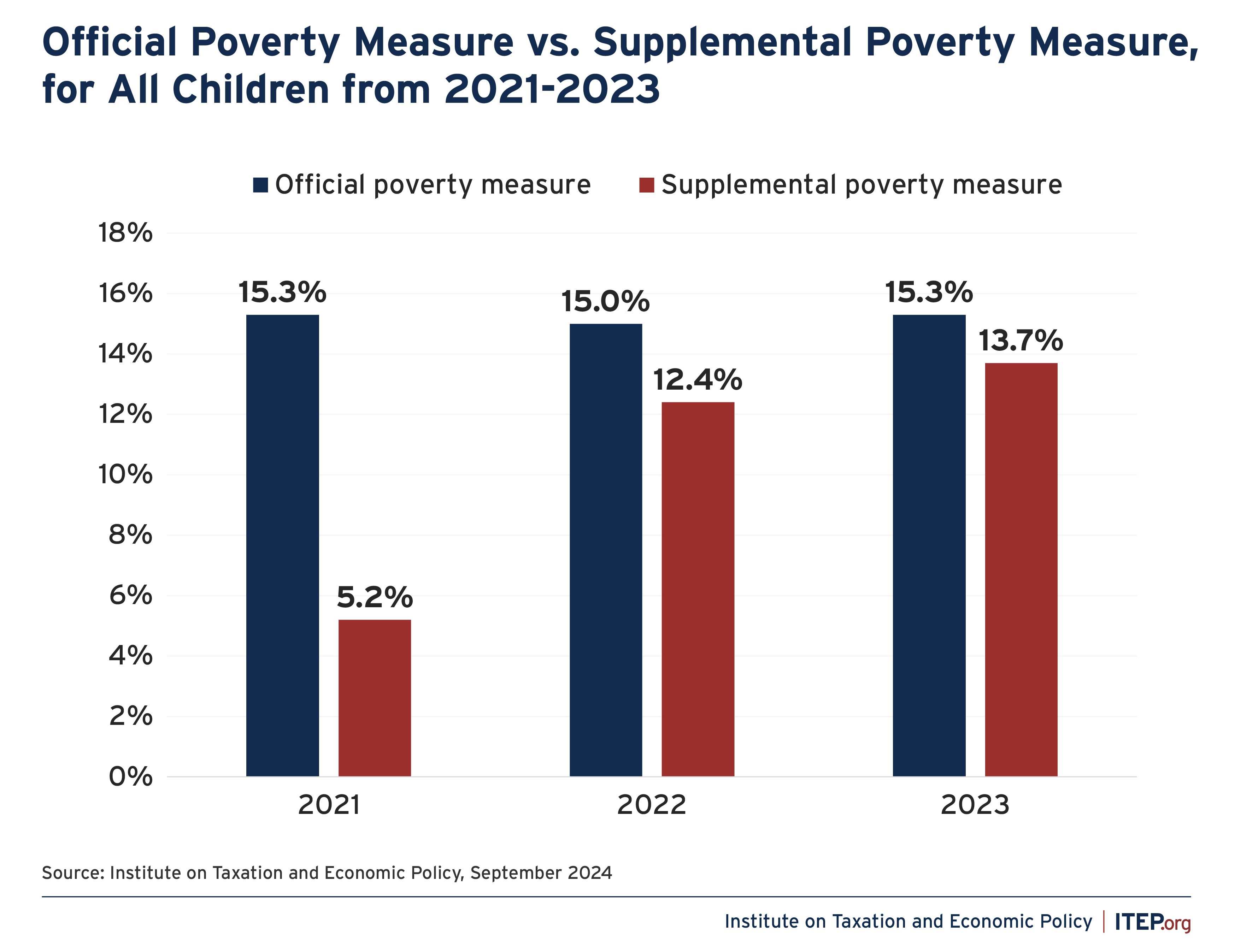

The Census keeps two measures of poverty: the Official Poverty Measure and the Supplemental Poverty Measure. The official rate is calculated without accounting for most of the assistance that families receive, though Social Security income is included, while the supplemental is based on a family’s after-tax income and includes benefits like tax credits and other safety net programs. The supplemental measure is also adjusted for cost of living in different geographic areas and is overall a more comprehensive measure for evaluating the number of people unable to afford basic needs.

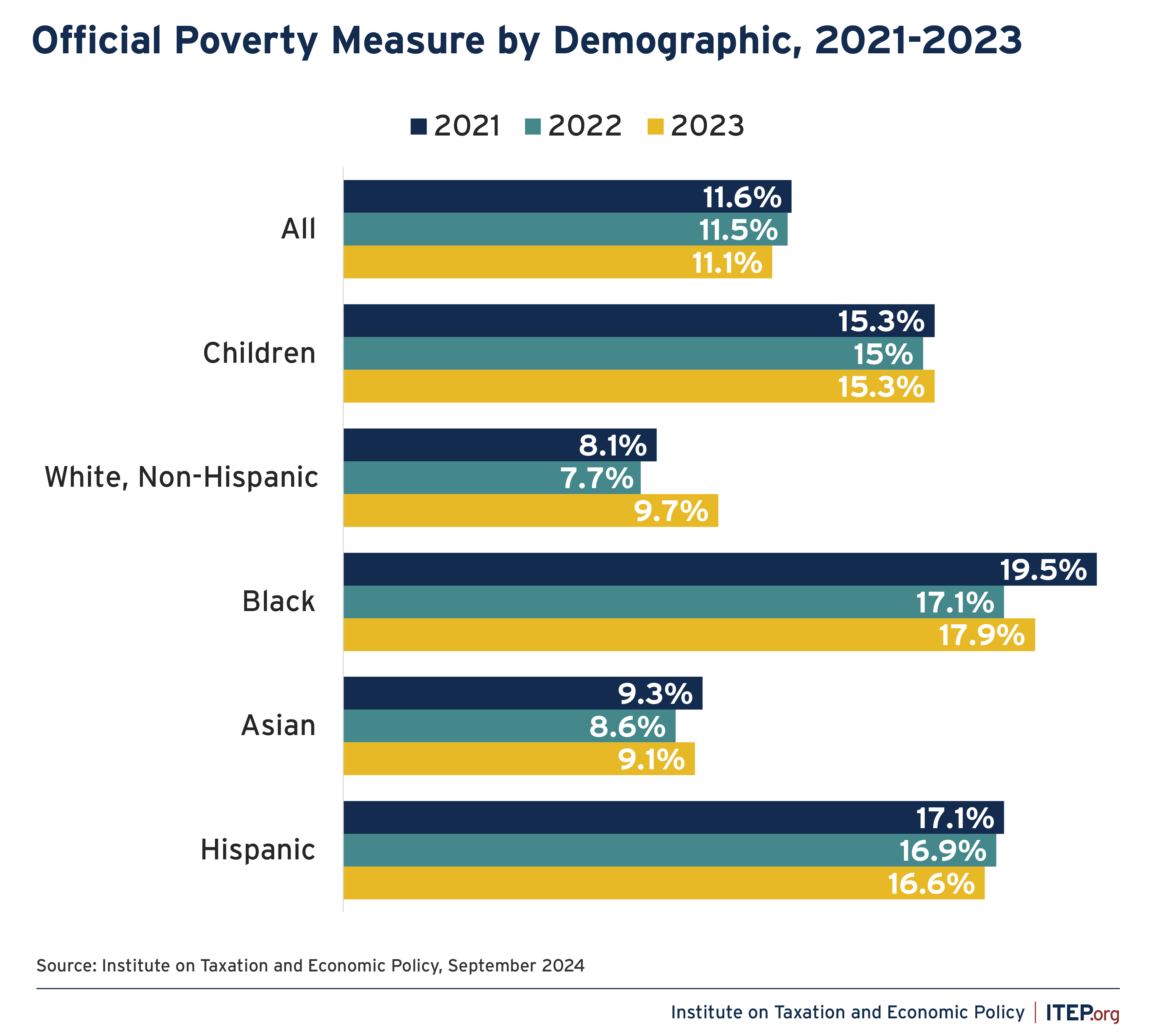

Looking at the simpler measure, poverty dropped last year, from 11.5 percent to 11.1 percent. However, measuring poverty this way does not provide as clear a picture of a family’s resources, because programs like the CTC and food assistance can be quite beneficial to families living below the official poverty line

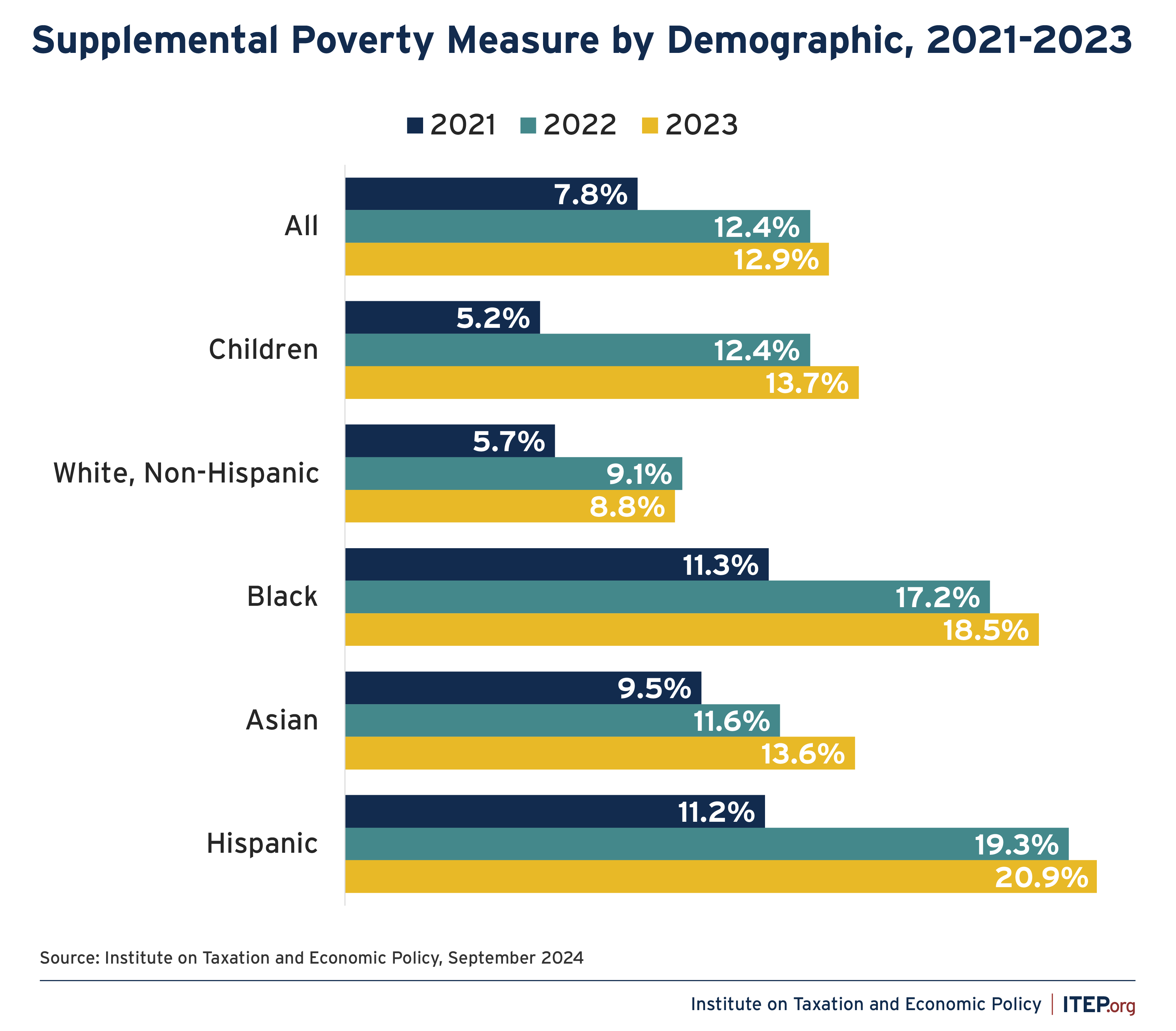

Comparing the official measure to the supplemental measure, however, makes clear that policy interventions can dramatically reduce hardship for many Americans.

Comparing official poverty rates to supplemental rates provides an approximate effect of anti-poverty programs. The official measure was 11.1 percent for all people in 2023 and 15.3 percent for children, not dramatically different from the rates in 2021.

But the supplemental measure shows a continuation of last year’s steep increases in poverty after including all a family’s resources. From 2021 to 2023, poverty has risen from 7.8 to 12.9 percent, and more than doubled from 5.2 to 13.7 percent for children.

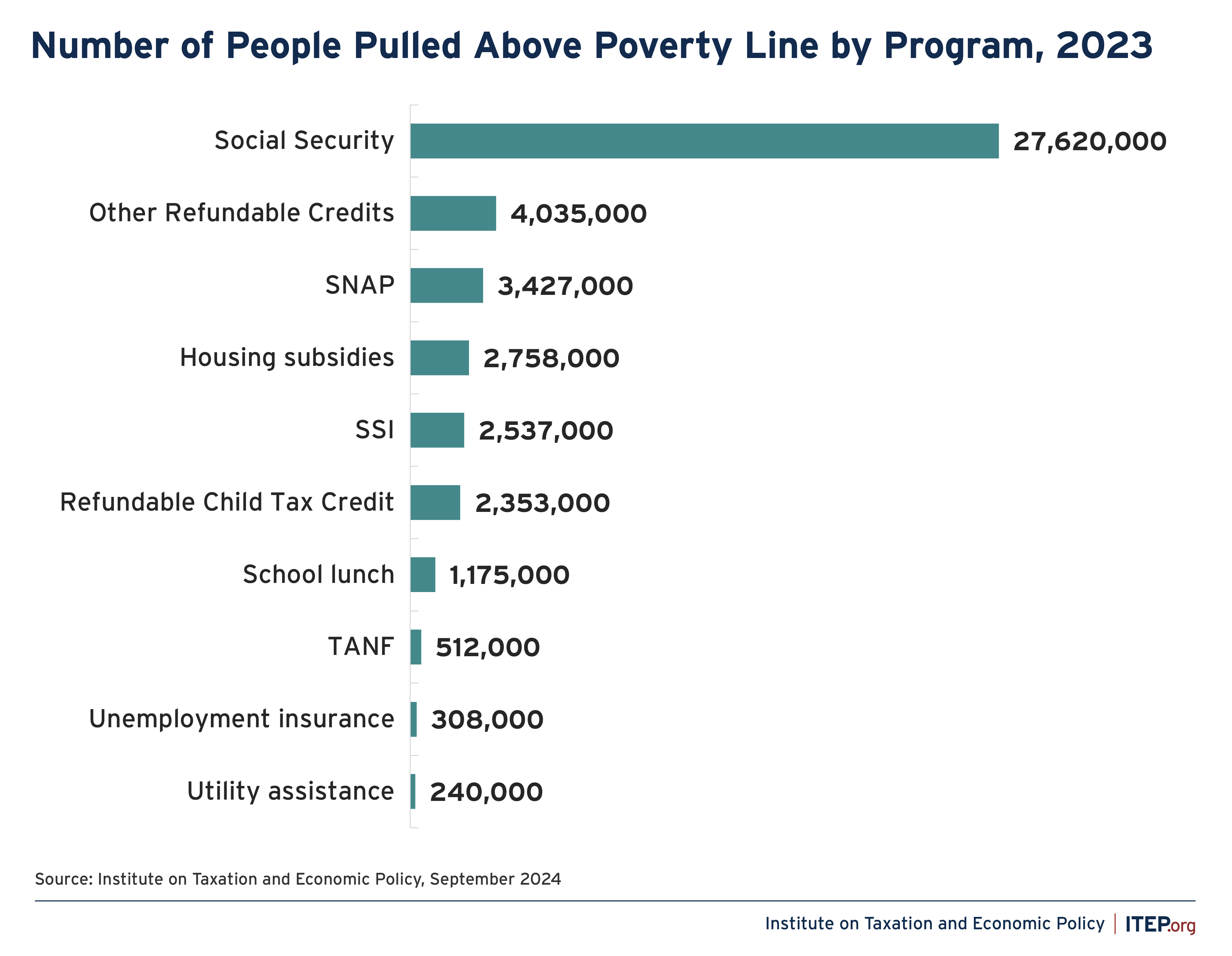

Social Security was the largest anti-poverty program in 2023, lifting 28 million people out of poverty. While Social Security forms the centerpiece of our nation’s safety net, its benefit is mostly limited to retirees, people 65 and older, and people with disabilities in the Census data. Refundable tax credits like the CTC and EITC provide the largest anti-poverty benefit to working people and children. Food assistance through SNAP, housing subsidies, and other programs also offer essential support to families suffering from economic insecurity.

Expanding the Child Tax Credit is Long Overdue

Under permanent law, the Child Tax Credit is lower for families with lower earnings. And for the poorest families, it is entirely unavailable.

The credit has complicated limits on “refundability,” or the amount that families can receive beyond the income taxes that they owe. First, the refundable credit amount is less than the full credit amount, and second, the refundable portion of the credit phases in with a family’s earnings. Together, these limits mean that a married couple with two children needed about $35,900 last year to receive the full credit next year.

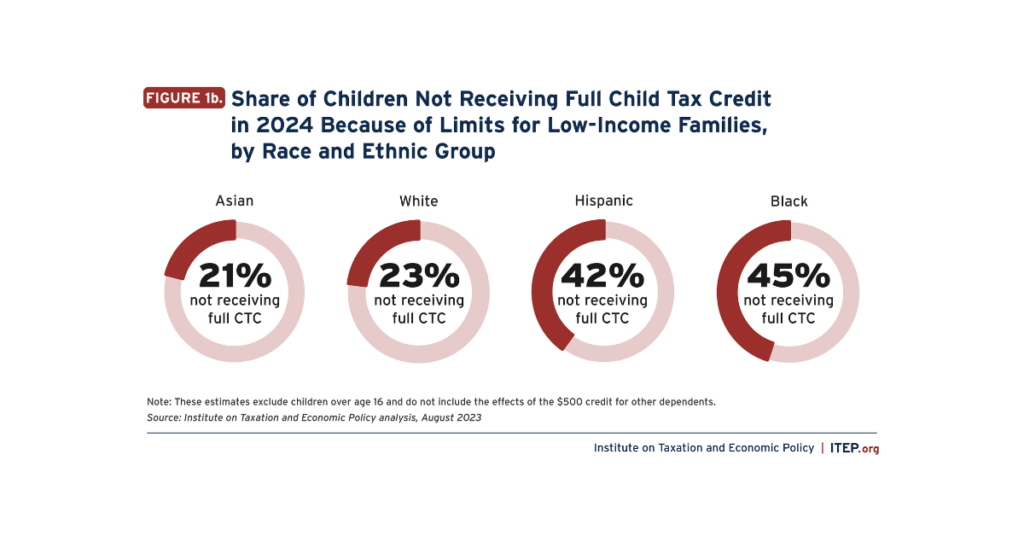

ITEP recently estimated that 99 percent of children in families earning less than $25,000 will receive a reduced credit or no credit at all.

Expanding the federal Child Tax Credit to 2021 levels would reverse this trend, with no children left out of receiving the credit because their families’ earnings are too low. In all, this expansion would have helped nearly 60 million children this year, with the greatest benefits going to the lowest-income children – particularly children and families of color.

Congress had an opportunity to provide the Child Tax Credit to millions more children last month, but that bill – which also included a bevy of unnecessary corporate tax breaks – ultimately failed to pass the Senate. While the proposal would not have been as expansive or inclusive as the 2021 credit, it would have set the stage for lawmakers to provide more support to children in low-income families.

The latest Census data make clear that lawmakers have the tools to help millions of children and their families – and it’s beyond time they take action.