Connecticut

Download PDF

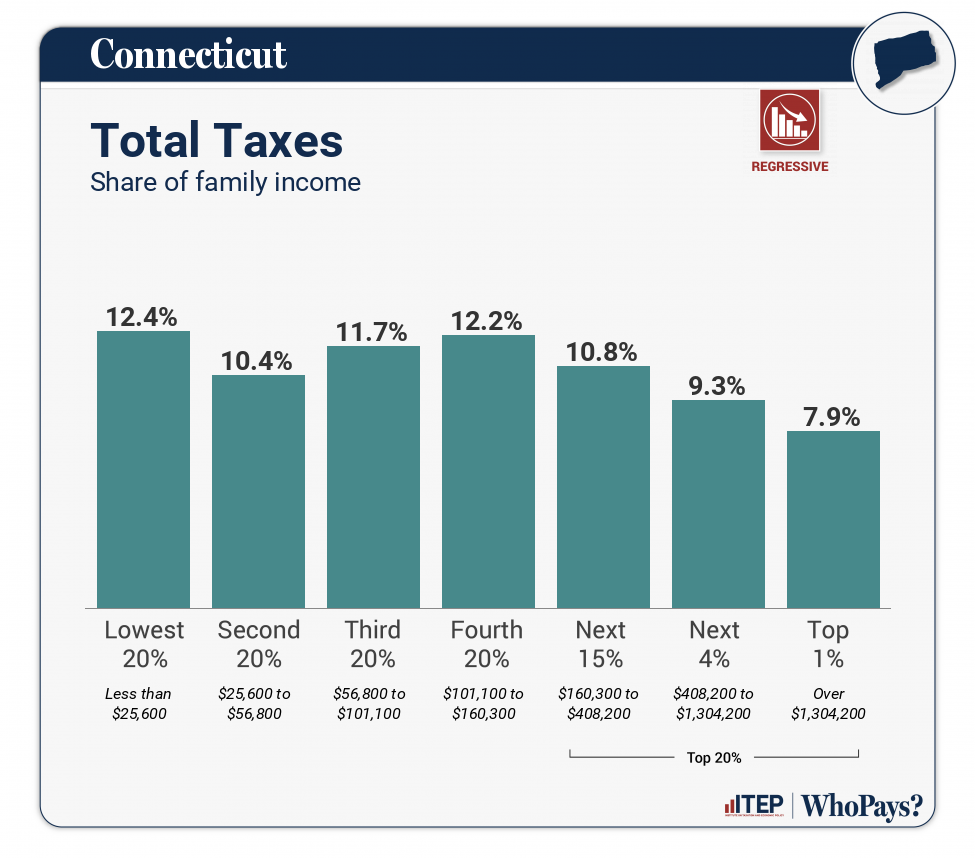

State and local tax shares of family income

| Top 20% | |||||||

| Income Group | Lowest 20% | Second 20% | Middle 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

| Income Range | Less than $25,600 | $25,600 to $56,800 | $56,800 to $101,100 | $101,100 to $160,300 | $160,300 to $408,200 | $408,200 to $1,304,200 | Over $1,304,200 |

| Average Income in Group | $13,900 | $40,600 | $78,000 | $128,400 | $240,800 | $655,800 | $4,050,100 |

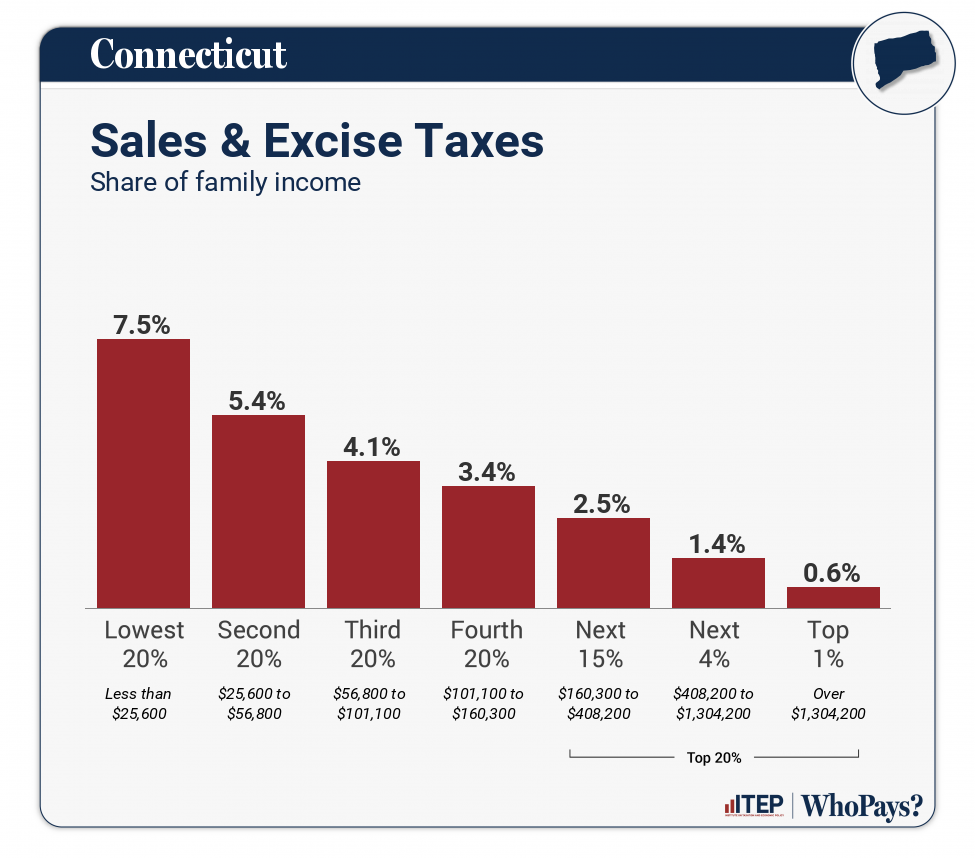

| Sales & Excise Taxes | 7.5% | 5.4% | 4.1% | 3.4% | 2.5% | 1.4% | 0.6% |

| General Sales–Individuals | 3.1% | 2.9% | 2.3% | 1.9% | 1.4% | 0.7% | 0.2% |

| Other Sales & Excise–Ind | 3% | 1.4% | 0.8% | 0.6% | 0.4% | 0.2% | 0% |

| Sales & Excise–Business | 1.3% | 1.2% | 1% | 0.9% | 0.7% | 0.5% | 0.4% |

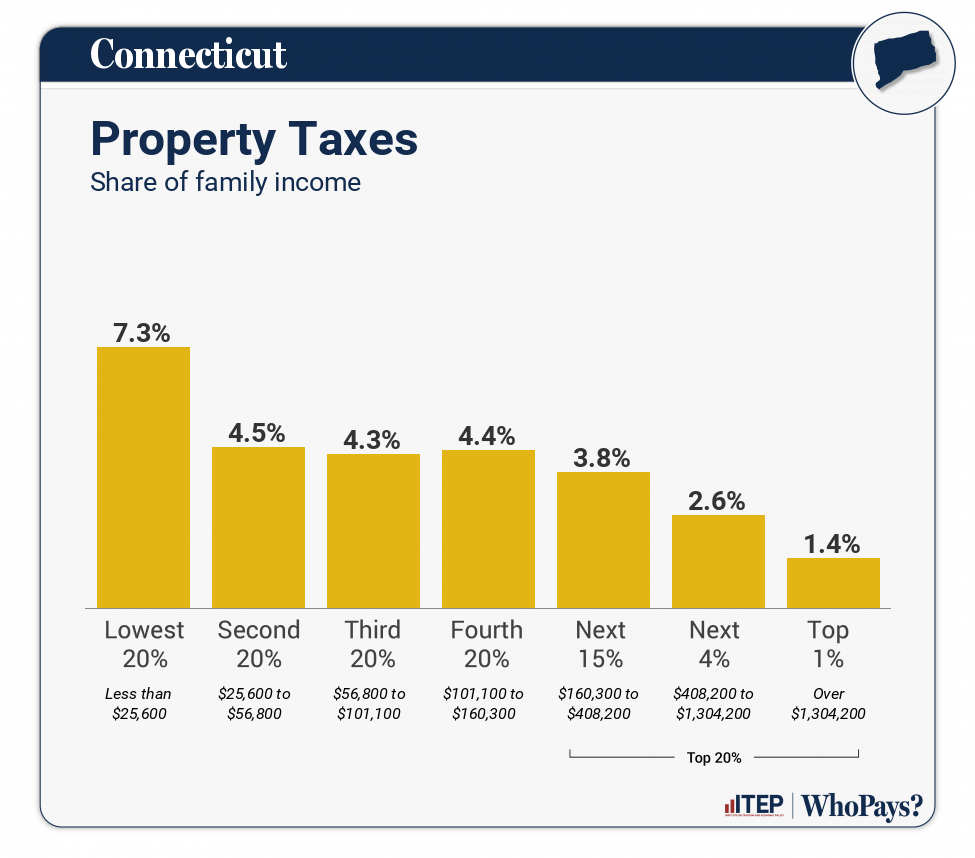

| Property Taxes | 7.3% | 4.5% | 4.3% | 4.4% | 3.8% | 2.6% | 1.4% |

| Home, Rent, Car–Individuals | 6.9% | 4.1% | 4% | 4.1% | 3.4% | 2.1% | 0.4% |

| Other Property Taxes | 0.4% | 0.3% | 0.3% | 0.3% | 0.4% | 0.5% | 1% |

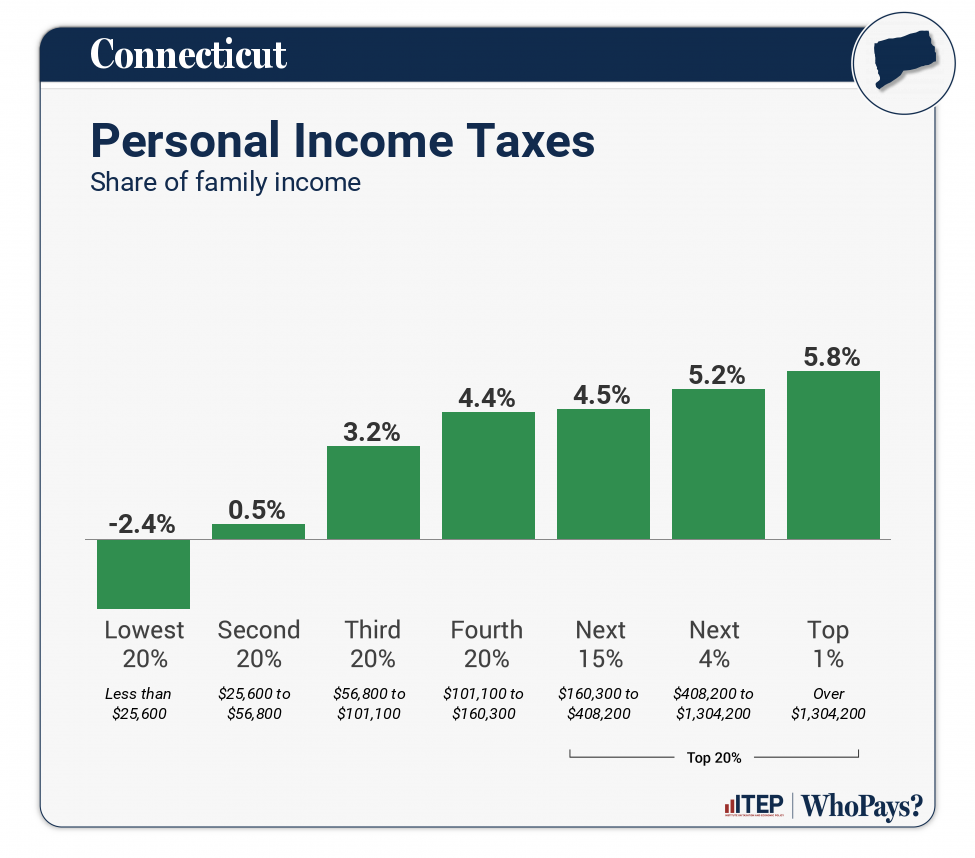

| Income Taxes | -2.4% | 0.5% | 3.2% | 4.4% | 4.5% | 5.2% | 5.8% |

| Personal Income Taxes | -2.4% | 0.5% | 3.2% | 4.4% | 4.5% | 5.2% | 5.8% |

| Corporate Income Taxes | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Other Taxes | 0.1% | 0% | 0% | 0% | 0% | 0% | 0% |

| TOTAL TAXES | 12.4% | 10.4% | 11.7% | 12.2% | 10.8% | 9.3% | 7.9% |

| Individual figures may not sum to totals due to rounding. | |||||||

ITEP Tax Inequality Index

ITEP’s Tax Inequality Index measures the effects of each state’s tax system on income inequality. According to this measure, Connecticut has the 21st most regressive state and local tax system in the country. Income disparities are larger in Connecticut after state and local taxes are collected than before. (See Appendix B for state-by-state rankings and the report methodology for additional detail.)

Tax features driving the data in Connecticut

|

Real estate transfer tax uses a 3-bracket graduated rate structure, though payments under top bracket are later refunded for homeowners who remain in the state

Requires combined reporting for the corporate tax, including some profits booked in tax havens, but $2.5 million cap on policy effect undercuts its impact

Levies a state estate tax, though tax bills are capped for the largest estates

Comparatively large personal exemptions and credits for low-income taxpayers

Refundable Earned Income Tax Credit (EITC)

Graduated personal income tax structure

Sales tax base excludes groceries

|

|

|

Minimal tax credits available for offsetting homeowner property taxes and no tax credits available for offsetting renter taxes

Comparatively high reliance on property taxes

No Child Tax Credit (CTC)

|