Sen. Bernie Sanders’ recently released corporate tax plan would shut down the major breaks and loopholes that allow corporations to dodge taxes. The reforms in his plan that are most likely to get attention are proposals to shut down offshore tax dodging, as ITEP has long called for.

The plan would tax the offshore profits of American corporations the same way domestic profits are taxed. It would limit deductions for interest payments that foreign-owned companies use to strip profits out of the U.S. It would tax any corporation as an American one if it is managed from the U.S. even if it claims to be a foreign entity.

There is one piece of Sanders’ tax plan that may seem more obscure, which the campaign describes as “transitioning to economic depreciation for all investments.” This means that Sanders would end expensing and other forms of accelerated depreciation, the ability to write off the cost of investments in equipment and certain other assets more quickly than they wear out.

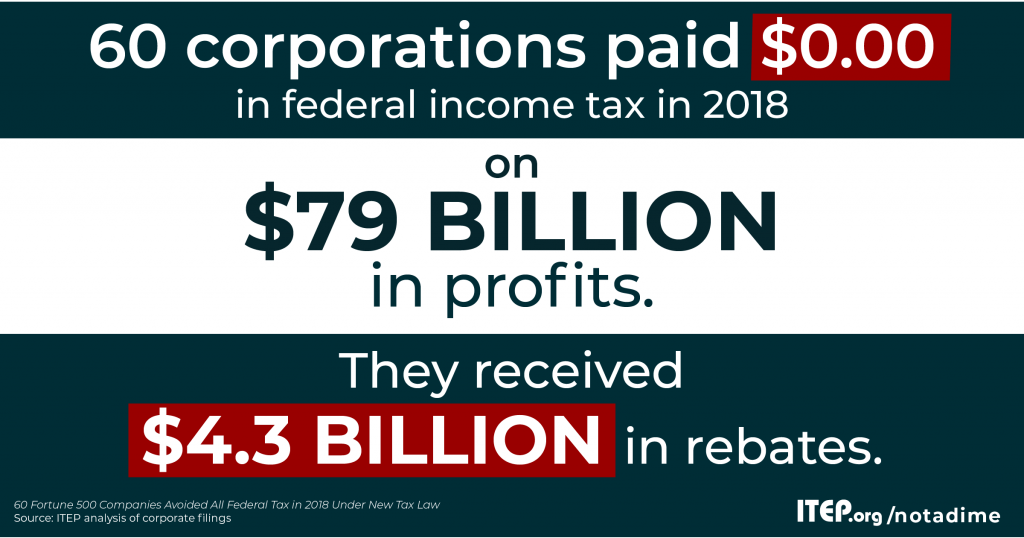

This is one of the most important, but least understood, problems with our tax code. Accelerated depreciation allowed companies like Delta Airlines, Haliburton, JetBlue, Ryder and others to avoid paying federal income taxes last year. Ending this break is key to enacting real tax reform.

Ending Expensing and Other Forms of Accelerated Depreciation Is Key to Real Tax Reform

As ITEP explained in a report last year, proponents of accelerated depreciation claim that it encourages businesses to invest and expand and therefore helps our economy, but there is little evidence of this. Instead, it’s a very costly tax break that rewards companies in return for making investments they would have made anyway. It also fundamentally conflicts with the very notion of taxing income.

What Is Depreciation?

Our tax system is founded on the idea of taxing income. In the case of a business, we can think of income as any increase in the company’s net worth. If a business buys a product from a manufacturer for $10 and sells it to a consumer for $11, then (assuming no other costs) the business’s net worth increased by $1, which is another way to say it has income of $1.

But what if the business buys a machine to help customers check out faster when purchasing a product? Unlike inventory, the value of the machine does not entirely disappear in the first year but declines over several years as it wears out, which is to say it depreciates over several years. For example, if a machine is purchased for $1,000 and loses a tenth of its value each year for a decade, then the company should deduct $100 each year for ten years.

What Is Accelerated Depreciation?

Congress and several presidents of both parties have enacted rules that allow businesses to accelerate deductions for depreciation, to take them sooner than the equipment or other assets they purchase wear out.

Initially, this may seem unimportant. Ultimately, the cost of capital investment will be deducted, and the only question is the timing of that deduction. But altering the timing of deductions can dramatically lower a company’s overall taxes in the long-term because of the time value of money, the idea that a dollar today is worth more than a dollar tomorrow.

Taking deductions earlier allows companies to defer paying some of their taxes, often for many years, which is the equivalent of receiving an interest-free loan from the federal government.

If a company can take deductions sooner and thus defer paying taxes for, say, 10 years, that means it can invest the money saved and generate more profits by the end of that decade.

Conversely, the federal government has less to invest in public goods like infrastructure, health care and education, and society overall must forgo the returns from such investments during those years.

How Has Accelerated Depreciation Expanded Over Time?

Permanent provisions in the tax law allow for accelerated depreciation, meaning companies have long been allowed to write off the costs of their capital investments more quickly than is justified economically.

On top of this, for most years since 2002 Congress and several presidents have enacted “bonus depreciation” which boosts the portion of investment costs deducted in the first year, sometimes even to 100 percent (which is often called “expensing”).

The GOP-Trump Tax Law Expanded Accelerated Depreciation

The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, expanded accelerated depreciation by allowing full expensing from 2018 through 2022 and then gradually reverting to the permanent (still overly generous) rules in 2027.

Republicans in Congress have said they hope to make the expensing provision permanent. As ITEP’s report explains, making this provision permanent would cost hundreds of billions of dollars in the first decade alone.

Ending Accelerated Depreciation

Congress should move in the opposite direction, as Sanders proposes, and repeal the TCJA expensing provision and also repeal the permanent depreciation breaks by requiring economic depreciation. In other words, companies would be allowed to write off the costs of their purchases of equipment and other assets in a way that reflects how those assets actually wear out and lose value.

As the ITEP report explains, this would likely raise hundreds of billions of dollars over the next decade, although the revenue savings would diminish somewhat over time. The reform would be key to ensuring that all corporate profits are taxed, which is itself key to ensuring a fair and functional tax system.