ITEP today released two new briefs that focus on the interaction of federal and state tax policy.

- “What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options” provides a detailed overview of state tax policies that are affected by federal tax changes.

- “Key Lessons for States as They Determine Responses to the Federal Tax Bill” outlines tax policy recommendations for states as they weigh legislative changes in response to the federal tax bill.

As state legislative sessions swing into high gear, the recently enacted Tax Cuts and Jobs Act (TCJA) is figuring prominently in policy discussions with officials examining how the bill affects their states and weighing the necessary policy responses.

Most states piggyback on federal law to some extent for their own taxes, especially personal and corporate income taxes. These states in particular must understand what the federal changes mean for their own tax codes and decide whether to remain “coupled” to changes in the tax bill, decouple from them or take other action in response.

States that are considering workarounds to the tax bill’s $10,000 cap on state and local tax deductions are capturing the bulk of news headlines, but the fact is that the impact of tax bill on state tax systems is more wide reaching. For example, the new federal tax law doubles the standard deduction, meaning fewer taxpayers will itemize. Some states require taxpayers who take the federal standard deduction to also take the state standard deduction. This could raise revenue for states that have less generous standard deductions, but it also means that some taxpayers will be paying higher state taxes as a result.

The new federal bill also removes limits for high-income taxpayers who itemize. This means that while these now have a cap on SALT deduction, there is no ceiling on their other itemized deductions. So if a state with relatively low property taxes chooses to remain coupled to the federal tax system on this provision, higher-income taxpayers would in effect get a sizable state tax cut on top of their already generous federal tax cut.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options outlines other challenges that states must consider, including:

- Elimination of federal and personal dependent exemptions: 16 states may be affected by this because the number of exemptions they allow a taxpayer to take is tied to federal exemptions, even though they do not use the federal exemption amounts.

- 20 Percent deduction for pass-through income: A few states couple to this change. This is a significant tax cut for businesses, and given states’ need for revenue, they should take a look at their tax systems to consider whether there are opportunities to raise revenue/increase taxes.

- State deduction of federal taxes paid: The new federal tax bill will reduce the amount of federal taxes paid in the near future. The six states that allow taxpayers to deduct federal taxes from their state tax bills will receive an influx of revenue if they maintain this policy.

Besides the above, other policy areas in which the federal law will have an effect and states should consider policy changes include the child tax credit, estate tax, chained CPI and corporate taxes.

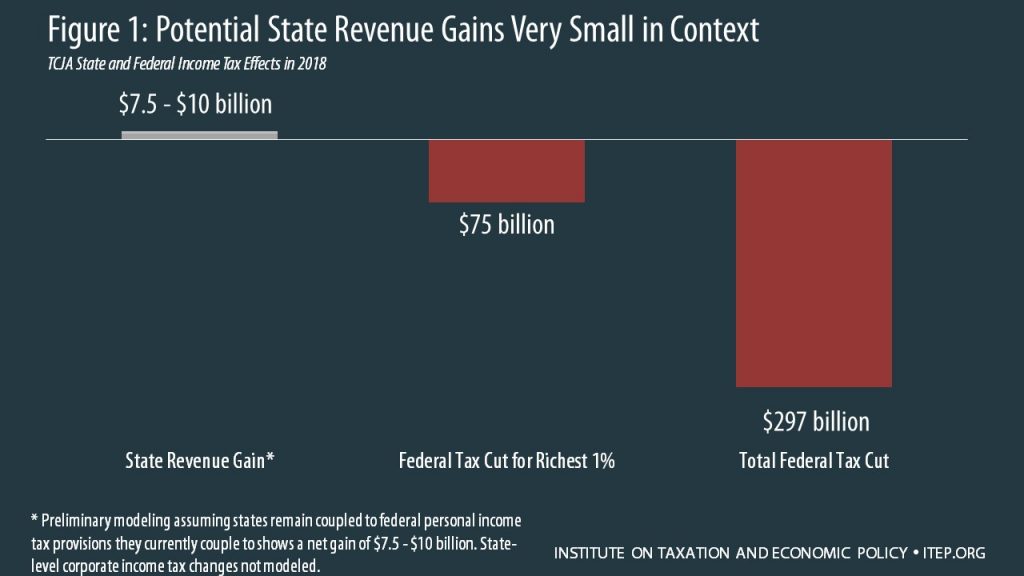

While the effect of the tax bill varies widely across states, all are affected by the federal tax cuts and have important choices to make about funding their own priorities, as Key Lessons for States as They Determine Responses to the Federal Tax Bill outlines. This means deciding whether to adopt the federal tax changes, how much to rely on the federal tax code going forward, and how to maintain adequate services in the face of impending federal funding cuts.

Read: What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

Read: Key Lessons for States as They Determine Responses to the Federal Tax Bill