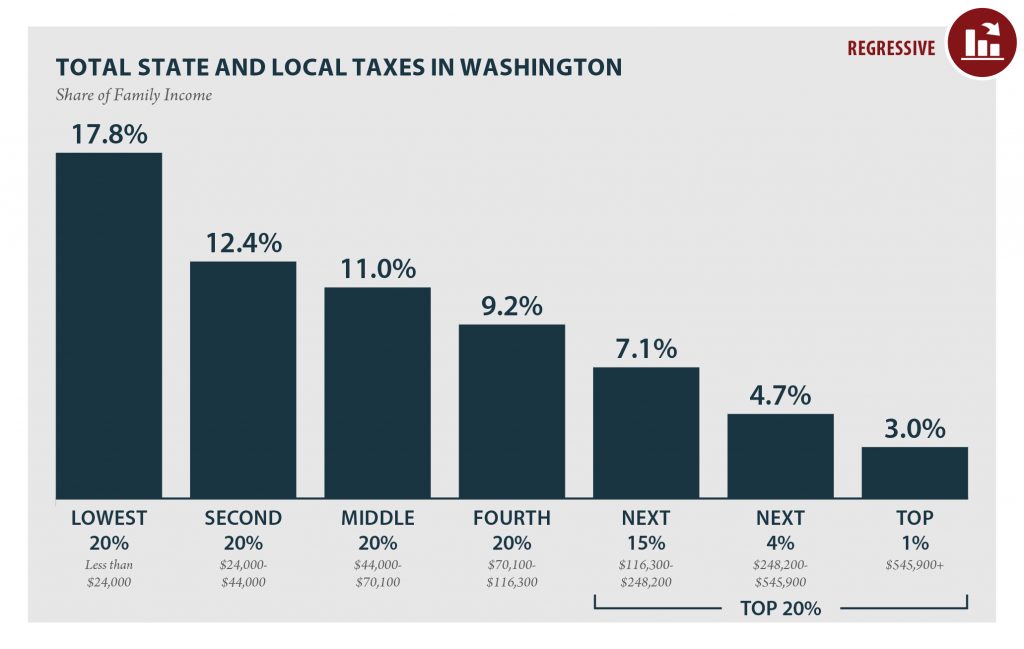

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation. In other words, the imbalance in overall state and local tax rates faced by low-income families (16.8 percent), versus middle-income (10.1 percent), versus high-income (2.4 percent) is larger in Washington than in any other state.

The Tax Foundation, which generally opposes progressive income taxes, recently attempted to cast doubt on this finding by voicing five criticisms of our study—creating the appearance of controversy where there should be none. Our response to each of those criticisms follows.

First, the Tax Foundation argues that because Who Pays? does not include every tax levied at the state and local level, it cannot be trusted to provide an accurate view of the overall distributional effects of state and local tax policies. While we include all the major taxes levied in Washington and elsewhere, it is true that certain smaller taxes are omitted from the study, most often due to a lack of adequate data. Nonetheless, there is no basis for claiming that our findings regarding the regressivity of Washington’s tax code would fundamentally change if these smaller taxes were added to the analysis. The only way this could occur is if the combined effect of Washington State’s miscellaneous smaller taxes were highly progressive in nature, which is exceedingly unlikely and which the Tax Foundation does not argue in its post. In fact, many of the largest revenue sources omitted from our study tend to resemble fees, which are typically regressive in nature.

Second, the Tax Foundation claims that we model the state’s Business and Occupation Tax (B&O tax) in the same manner as a general sales tax. This is inaccurate. While we report our distributional estimates for the B&O tax, along with estimates of the state’s other consumption taxes, under the broad category of “sales and excise taxes,” this does not mean we utilized the same methodology to estimate the distribution of every tax in this category. Because the B&O tax falls on all stages of production, proportionally less of the tax falls on in-state consumers. And because the B&O tax is applied broadly, instead of replete with exemptions and carveouts, its ultimate distributional impact is different from that of general sales taxes. ITEP has always modeled the B&O tax to account for these differences and has found, as the Tax Foundation concedes, that the B&O tax is indeed regressive.

Third, the Tax Foundation takes issue with our inclusion of the federal offset effect in Who Pays?. We include the federal offset not to make the tax situation look more regressive, as the Tax Foundation claims, but to offer a fuller picture of the net tax consequences state and local policymakers’ decisions have on state residents. The federal offset allows taxpayers to deduct from their federal taxable income state and local taxes paid. Accordingly, tax policy decisions made at the state and local level, like whether to levy an income tax or to modify a property tax rate, automatically impact the federal tax deductions taxpayers can receive, and thus the amount of federal taxes they pay. Given the existence of the federal offset, ignoring its impact when reporting the consequences of state and local tax policy decisions would lead to over- or understating the ultimate impact of those decisions on state residents. For a high-income taxpayer, for instance, one-third or more of the state tax impact brought about by changing a state’s top income tax rate may be negated through automatic federal tax interactions. Omitting an interaction of this size from our analysis would make it more difficult for our readers to grasp the actual net impact of state and local tax policy decisions. If other provisions of the federal tax code changed taxpayer liability based solely on the outcome of state and local tax policy debates, we would seek to include them in Who Pays? as well.

It is also worth noting in response to this criticism that we report the numbers both ways: before and after the federal offset effect. The numbers that incorporate the federal offset effect are given more visual prominence in our report because we think they give a more complete picture of the impact of state and local tax policy decisions on state residents. But the distributional consequences of state and local tax policies sans the federal offset are available to readers just an eyeball jot away.

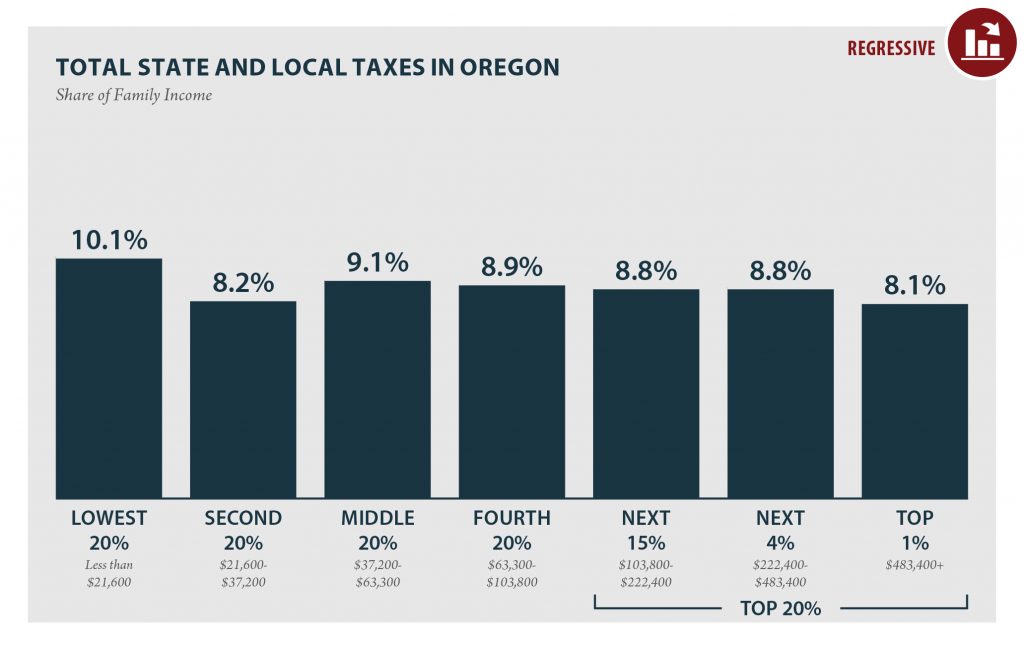

One final note on this point is that in the context of Washington, excluding the federal offset effect only widens the gap in regressivity between Washington and other states. In neighboring Oregon, for instance, the state’s reliance on progressive income taxes plays a major role in providing the top 1 percent of earners with a federal tax cut equal to 1.8 percent of their incomes. In Washington, by contrast, the state’s reliance on consumption taxes makes the federal offset effect much less significant, at just 0.3 percent of income for this group. If the purpose of the Tax Foundation’s criticism is to raise doubts about whether Washington’s tax code is truly more regressive than in other states, omitting the federal offset effect from the comparison will not help its cause.

Fourth, the Tax Foundation paints annual tax incidence analysis as “a controversial approach” that “yields findings of substantially greater regressivity.” Their use of the word “controversial” makes it appear as if ITEP is doing something unusual in looking at taxpayers’ incomes and tax payments over the course of a single year, but this is entirely conventional for tax incidence analysis. The most thorough state-level tax incidence studies in the country (e.g., Colorado, Minnesota, and Texas) use an annual lens, and the Tax Foundation itself appears to perform its own federal tax incidence analyses on an annual basis.

More fundamentally, a focus on taxpayers’ “lifetime” incomes, which the Tax Foundation claims to prefer in its recent blog post, would obscure the damaging effects that regressive taxes have on families during their most vulnerable years. Families need to have enough money to pay the rent, refuel their vehicles, and put food on the table during all stages of their lives, and regressive taxes make those tasks more difficult during the very moments in life that are already the most challenging, such as after being laid off from one’s job. It’s true that there are instances where a lifetime incidence analysis will show a less regressive picture than an annual snapshot (though this isn’t true for the millions of families who will remain trapped in poverty throughout their lives). But telling a family that has fallen on hard times that their tax rate will drop later in life, once their financial situation improves, is cold comfort as they seek to put food on the table today.

Fifth and finally, the Tax Foundation concludes by wondering why our study of state and local tax codes does not also include the entirety of federal tax law. ITEP routinely estimates the distributional consequences of the federal tax system but, much like the Tax Foundation itself, we also see value in providing information to state and local policymakers on the impacts of their policy decisions.

In a tangent to this point, the Tax Foundation wonders “if [ITEP’s] methodology finds that no state is progressive enough, what does the word even mean?” Our finding that every state’s tax code is regressive is not a value judgment, but a mathematical one. We quantify the distribution of every state’s tax code using the ITEP Inequality Index and find all 51 of them (including the District of Columbia) currently exacerbate income inequality. This finding could conceivably change in the years ahead, particularly given how close Delaware comes to achieving a non-regressive (or “proportional”) distribution in its tax system. But as long as high-income taxpayers continue to pay lower effective state and local tax rates than lower- and middle-income families, we will continue to report on the universal regressivity of state and local tax codes.

The Tax Foundation’s lengthy list of criticisms is meant to create the appearance of controversy where there should be none. Washington is one of a small minority of states that has shunned the creation of progressive personal and/or corporate income taxes in favor of a heavy reliance on consumption taxes that are undeniably regressive in nature. The natural consequence of this decision is a regressive tax code that is far more lopsided than those in place in other states.