Oregon

Download PDF

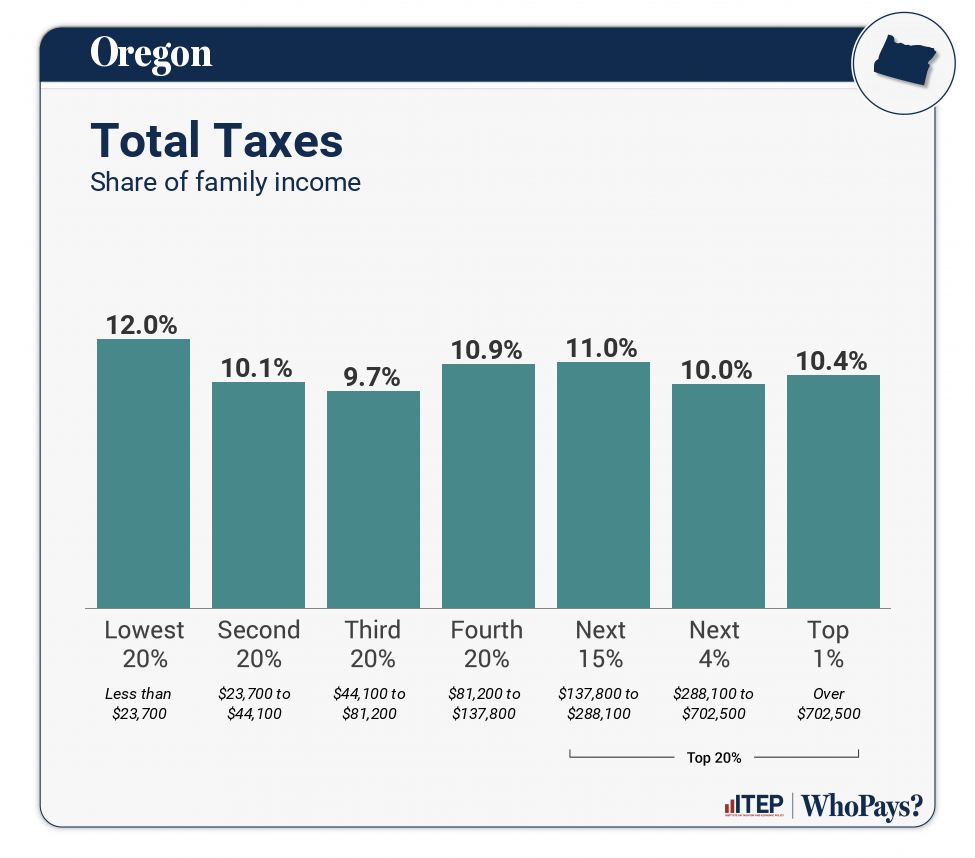

State and local tax shares of family income

| Top 20% | |||||||

| Income Group | Lowest 20% | Second 20% | Middle 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

| Income Range | Less than $23,700 | $23,700 to $44,100 | $44,100 to $81,200 | $81,200 to $137,800 | $137,800 to $288,100 | $288,100 to $702,500 | Over $702,500 |

| Average Income in Group | $12,800 | $34,000 | $61,000 | $110,000 | $182,900 | $410,400 | $1,291,400 |

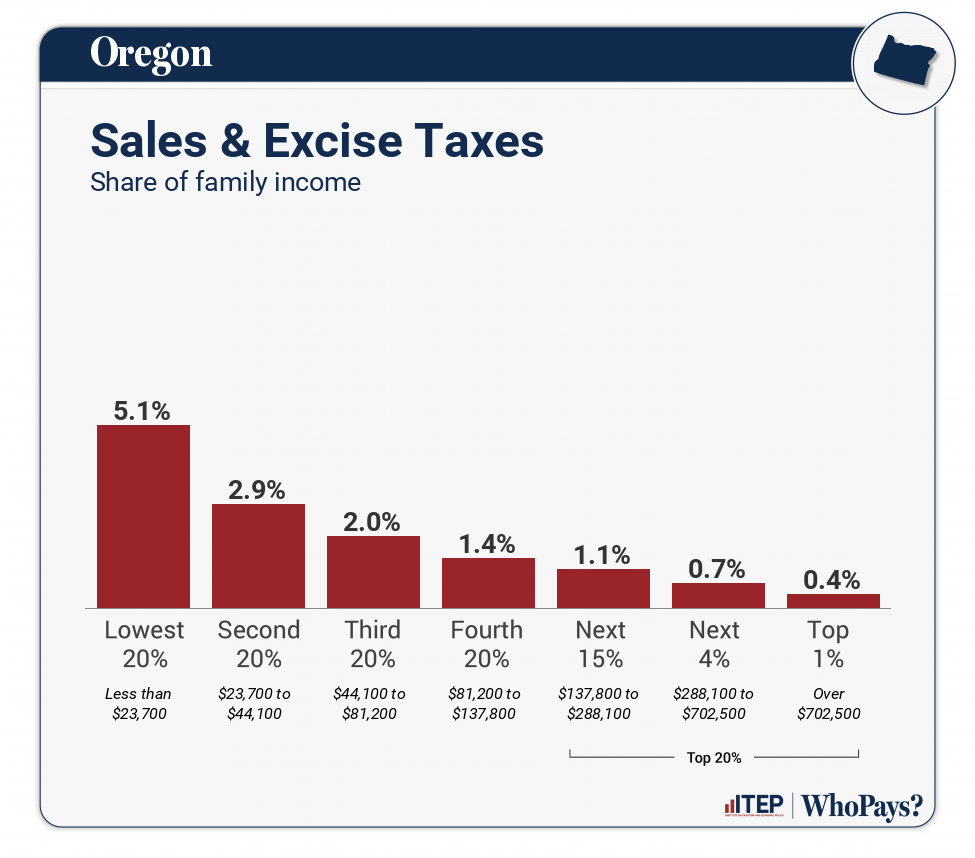

| Sales & Excise Taxes | 5.1% | 2.9% | 2% | 1.4% | 1.1% | 0.7% | 0.4% |

| General Sales–Individuals | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Other Sales & Excise–Ind | 3.9% | 1.8% | 1.1% | 0.7% | 0.5% | 0.2% | 0.1% |

| Sales & Excise–Business | 1.2% | 1% | 0.9% | 0.7% | 0.6% | 0.4% | 0.3% |

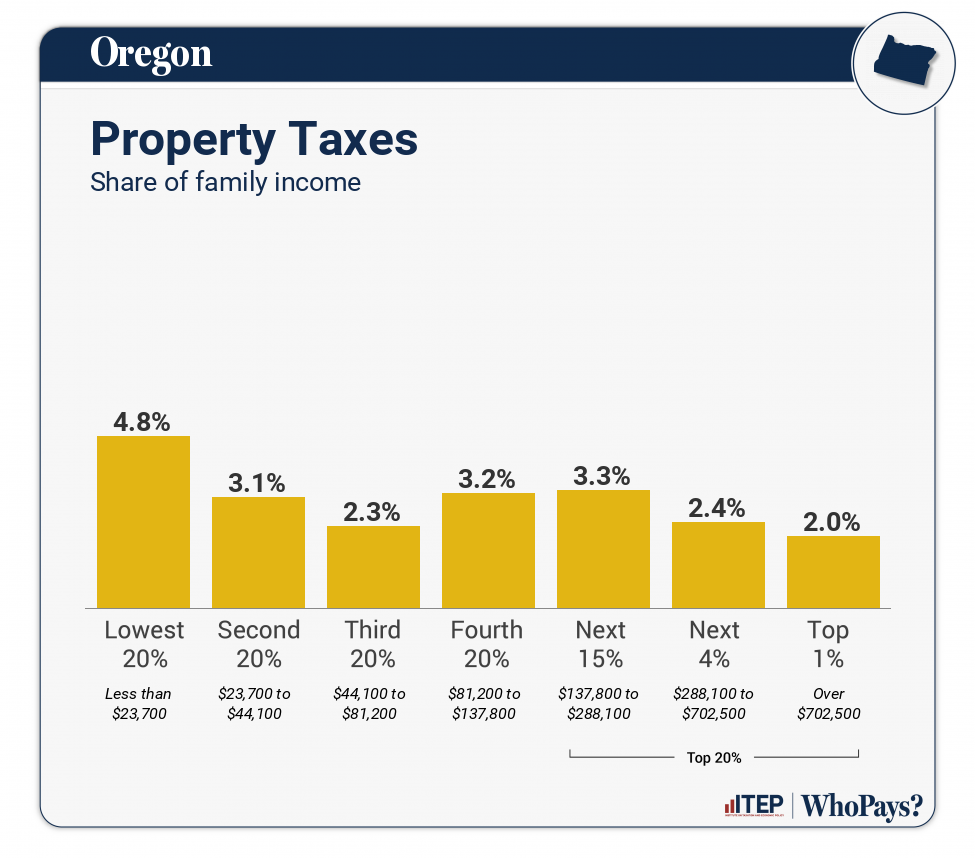

| Property Taxes | 4.8% | 3.1% | 2.3% | 3.2% | 3.3% | 2.4% | 2% |

| Home, Rent, Car–Individuals | 4.4% | 2.8% | 2% | 2.9% | 2.8% | 1.7% | 0.7% |

| Other Property Taxes | 0.4% | 0.3% | 0.4% | 0.4% | 0.5% | 0.7% | 1.3% |

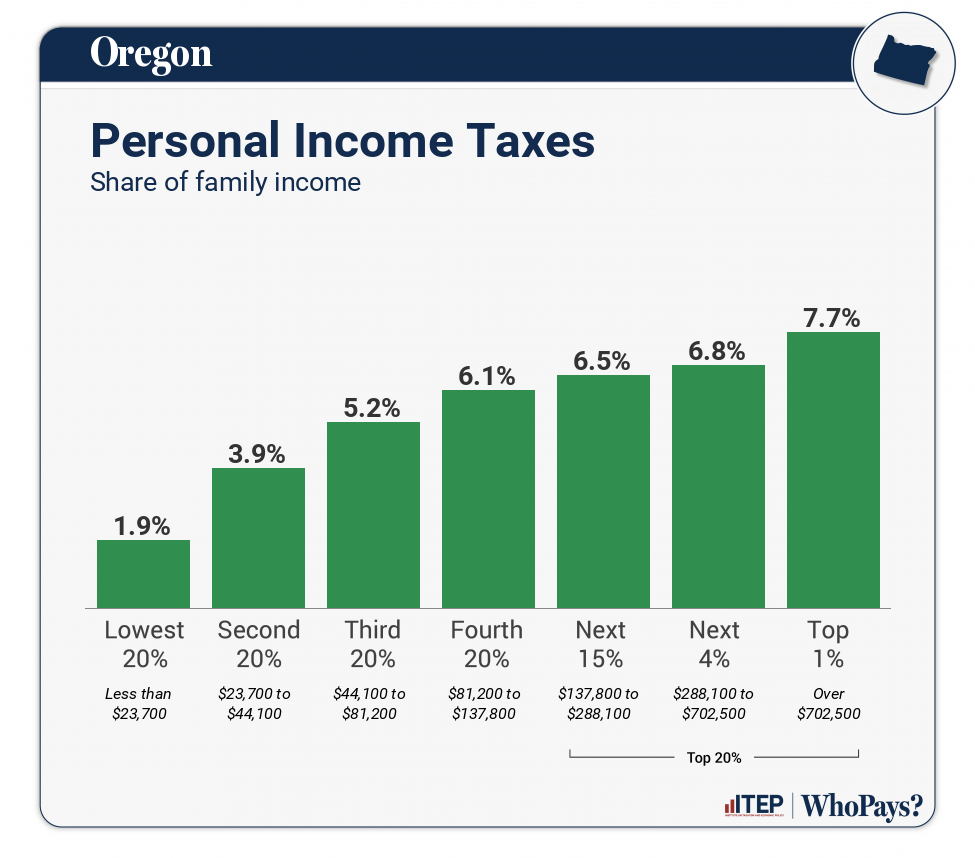

| Income Taxes | 1.9% | 4% | 5.2% | 6.1% | 6.5% | 6.8% | 7.8% |

| Personal Income Taxes | 1.9% | 3.9% | 5.2% | 6.1% | 6.5% | 6.8% | 7.7% |

| Corporate Income Taxes | 0% | 0% | 0% | 0% | 0% | 0.1% | 0.1% |

| Other Taxes | 0.2% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% |

| TOTAL TAXES | 12% | 10.1% | 9.7% | 10.9% | 11% | 10% | 10.4% |

| Individual figures may not sum to totals due to rounding. | |||||||

ITEP Tax Inequality Index

Oregon has a hybrid system that is progressive through some parts of the income distribution and regressive through other parts. On balance, the overall system tilts regressive because low-income families pay the highest tax rates and high-income families pay less than some middle-income groups as well. According to ITEP’s Tax Inequality Index, Oregon has the 42nd most regressive state and local tax system in the country, meaning that eight states and the District of Columbia have more progressive systems. Income disparities among many groups are larger in Oregon after state and local taxes are collected than before. (See Appendix B for state-by-state rankings and the report methodology for additional detail.)

Tax features driving the data in Oregon

|

Requires combined reporting for the corporate income tax; some foreign tax haven income is partially taxed through GILTI inclusion

Refundable Child Tax Credit (CTC) for young children

Refundable Earned Income Tax Credit (EITC)

Graduated personal income tax structure

Refundable dependent care tax credit

Levies a state estate tax

No statewide sales tax

|

|

|

No property tax “circuit breaker” credit for low-income homeowners or non-senior renters

Lower personal income tax rates for pass-through business income

Partial income tax deduction for federal income taxes paid

Comparatively low Earned Income Tax Credit (EITC)

|