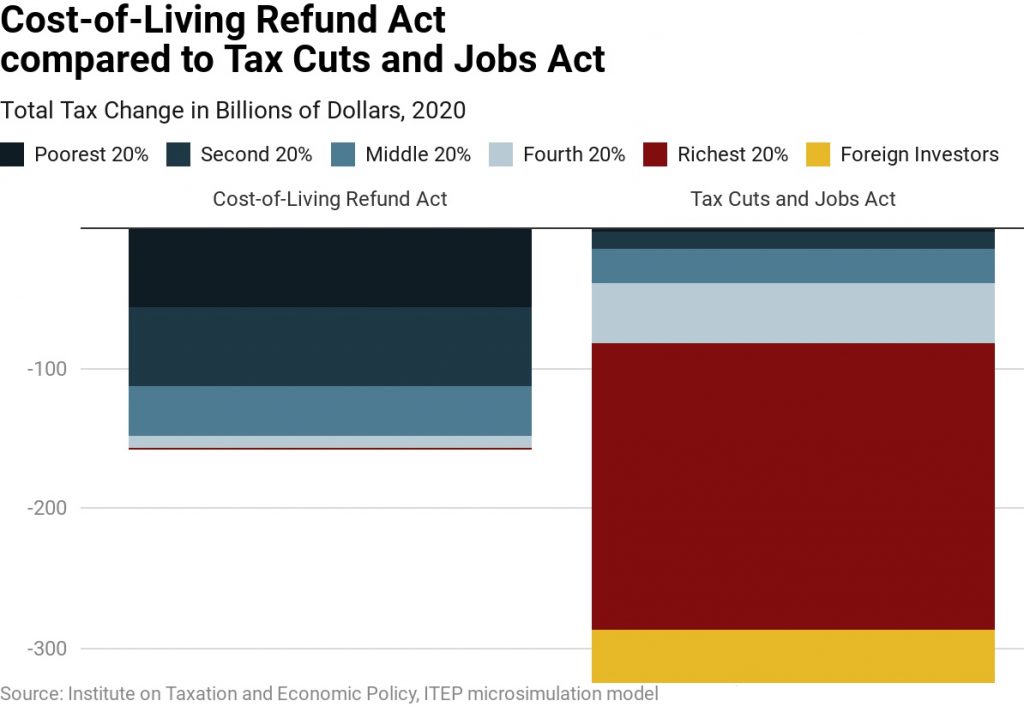

Proposals Provide Little to Nothing for the Top 20 Percent, While Giving Lower-Income Taxpayers Far Larger Cuts than 2017 Tax Law

Five tax proposals announced this year are a radical departure from the top-heavy 2017 Tax Cuts and Jobs Act, targeting their benefits instead to low- and moderate income families while providing no or nominal tax cuts to the highest-earning households, a new Institute on Taxation and Economic Policy analysis of each of the five plans reveals.

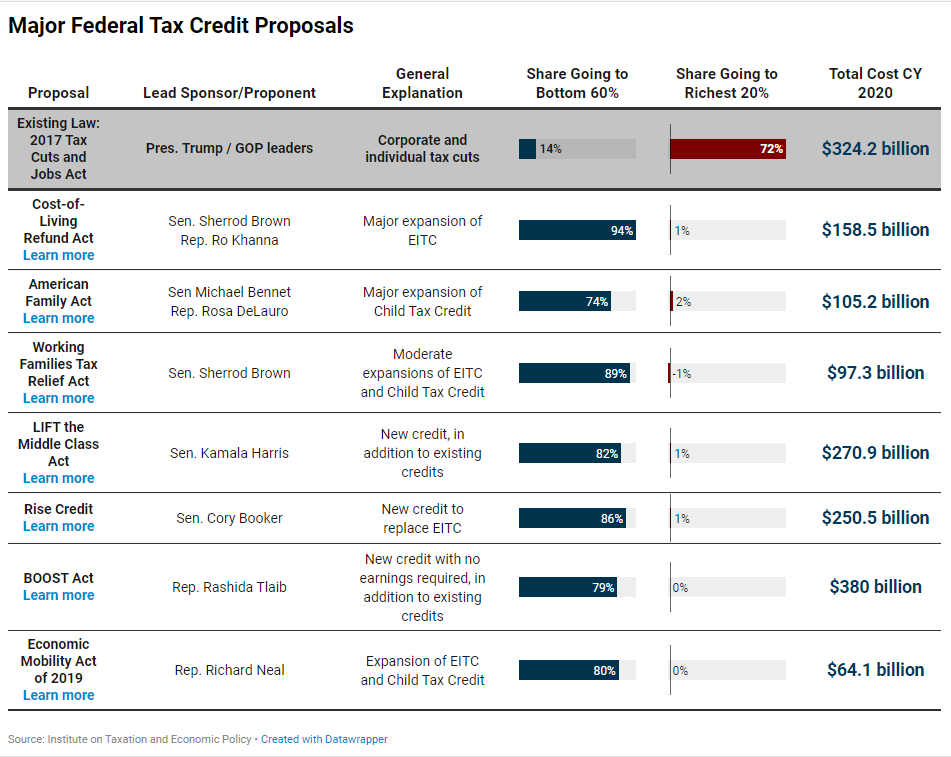

Released today, Understanding Five Major Federal Tax Credit Proposals, provides a distributional analysis and 2020 cost estimate for each plan. The policy ideas vary in scope, approach and cost, but all target their benefits to families in the bottom 60 percent of the income distribution who have annual household income of $70,000 or less.

The Cost-of-Living Refund Act would expand the Earned Income Tax Credit at a cost of $158.5 billion in 2020. The American Family Act would expand the Child Tax Credit at a cost of $105.2 billion in 2020. The Working Families Tax Relief Act would make more moderate expansions of both credits and combine them in one bill, at a cost of $99.2 billion in 2020. The LIFT the Middle Class Act and the Rise Credit would create new credits that are more generous for many taxpayers but also have a higher cost, $270.9 billion and $250.5 billion, respectively, in 2020.

“These proposals are all motivated by the idea that low- and moderate-income taxpayers could use some help more than the richest fifth of taxpayers, who were the main beneficiaries of the Tax Cuts and Jobs Act,” said Steve Wamhoff, ITEP’s federal policy director and an author of the report. “What these proposals have in common is that they are all the opposite of the 2017 law in terms of who they benefit.”

For a complete rundown of the total cost of each proposal, a distributional analysis of how families benefit based on income, and state-by-state breakdowns of the numbers, visit: https://itep.org/taxcreditproposals