Georgia

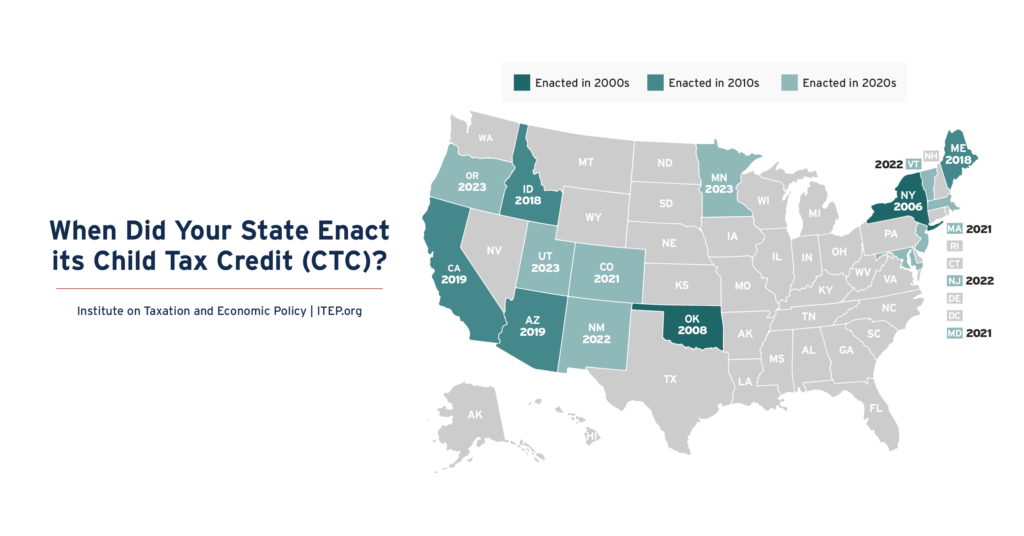

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

State Rundown 7/24: States Begin Preparing for Federal Megabill Fallout

July 24, 2025 • By ITEP Staff

All eyes in statehouses in recent weeks have been on federal budget negotiations, and now that the “megabill” has passed, they are focused in on their own budgets in search of ways to cope with the enormous consequences coming their way. All states will see fewer federal dollars flowing through their coffers, higher needs due […]

Georgia Budget & Policy Institute: Historic Federal Tax Shift Benefits Wealthiest, Grows Deficit and Exacerbates Georgia’s Rural Challenges

July 18, 2025

In H.R. 1, the federal reconciliation bill, the federal government shirks its responsibility to Georgians, leaving the state to continue to support Georgians with fewer resources.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Georgia Budget and Policy Institute: The House-Passed Reconciliation Bill Would Significantly Increase National Debt, Primarily Benefitting Top Earners, While Cutting Health Care and Food Assistance

June 10, 2025

Overall, the budget reconciliation legislation would reduce federal taxes for Georgians by $16.6 billion annually. However, 69% of these savings ($11.5 billion) are directed to the highest-earning 20% of Georgia households, or those making over $153,100 per year.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

State Rundown 4/24: States Push Tax Cuts Despite Fiscal Uncertainty

April 24, 2025 • By ITEP Staff

While some states are preparing for uncertainty – slowing revenue growth, chaos from unpredictable tariffs, cuts to federal programs, etc. – others continue to move forward with plans for deep tax cuts. For instance, Georgia Gov. Brian Kemp signed legislation accelerating the cut to the personal income tax rate, which is currently phasing down. […]

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

State Rundown 4/3: Amidst Tariff Uncertainty, State Lawmakers Talk Taxes

April 3, 2025 • By ITEP Staff

While all eyes are on the Trump administration’s tariffs on foreign imports, state lawmakers are moving forward with a mix of deep, regressive tax cuts and progressive revenue raisers.

State Rundown 3/26: Lawmakers Navigate Shortfalls, Potholes, and Pitfalls

March 26, 2025 • By ITEP Staff

State lawmakers around the country are navigating a range of potential hazards this week. Leaders in Maryland and Washington are facing budget holes but are smartly working to get out of them through progressive taxes on those with the most ability to pay. Both North Dakota and Washington state are looking to fill literal potholes […]

Below is a list of tax expenditure reports published in the states.

State Rundown 2/26: House Budget Plan Could Further Strain State Budgets

February 26, 2025 • By ITEP Staff

States would be wise to keep a close eye on happenings in Washington, D.C. Republicans in the House of Representatives recently passed their budget resolution, which could spell trouble for state budgets. The plan tees up major cuts to Medicaid, SNAP, and college tuition assistance—all likely to allow for tax cuts that will overwhelmingly benefit the wealthy. If approved, trillions of dollars would be cut from programs supported by federal dollars and states and localities could bear the brunt of those shifting costs. Many states are already facing delicate fiscal outlooks and those considering cutting taxes further should seriously reconsider.…

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

States Could Raise $19 Billion a Year with One Policy Change Targeting Corporate Tax Avoidance

February 20, 2025 • By ITEP Staff

Worldwide combined reporting negates the tax benefits of shifting corporate income offshore Public polling has consistently shown for decades that most people believe big multinational corporations are paying too little in taxes. Closing the loopholes these corporations use to avoid taxes is one of the most effective – and popular – solutions to this problem. […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.