This op-ed originally appeared in The Hill.

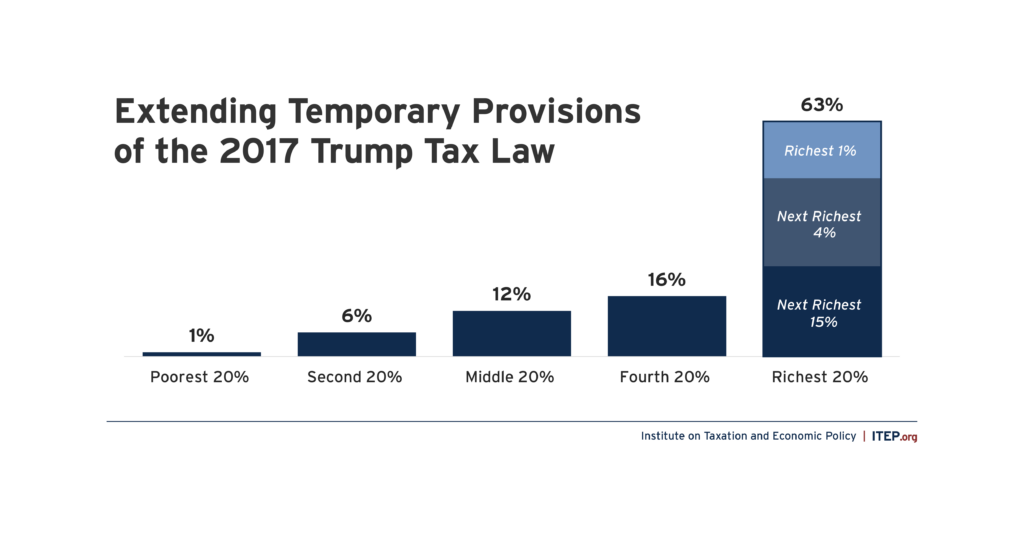

After the dust settles on this year’s election, one of the most pressing issues confronting the next Congress and President will be how to deal with the expiration of the 2017 Trump tax cuts and, more specifically, who will pay for the cost of extending some or all of those cuts. Among the more widely accepted ideas circulating on the right is to raise income taxes on single parents, more than four in five of whom are women and a disproportionate share of whom are people of color. The idea has been lauded by prominent think tanks, Project 2025, U.S. Senators, and, in his 2016 presidential campaign, by Donald Trump himself.

To most people, single parents might seem to be an odd target for higher tax bills. They are far more likely to face financial precarity than other households as they confront the dual challenge of caregiving and providing for their families. Raising this group’s taxes to pay for tax cuts directed largely toward upper-income people, the vast majority of whom are married couples, would exacerbate the negative economic, educational, and health impacts of financial insecurity on children.

But among a large segment of those on the right, single parenthood is seen as an immoral family structure. If life can be made more difficult and expensive for single parents, the thinking goes, more parents will choose to get married or stay married for financial reasons—regardless of whether their marriages are fostering home environments that are healthy and safe for the children and parents.

One of the more candid explanations of this outlook came from Senator JD Vance, the Republican Vice Presidential nominee, who said he thinks choosing to leave an “unhappy” or even “violent” marriage “really didn’t work out for the kids.” While Vance has since tried to walk back those remarks, the fact remains that there is a robust infrastructure on the right pushing to enact policies that would make it more costly to parent outside of marriage.

As the Heritage Foundation’s Project 2025 explains: “It’s time for policymakers to elevate family authority, formation, and cohesion as their top priority and even use government power, including through the tax code, to restore the American family.”

When it comes to tax policy, the most prominent idea for accomplishing this is eliminating the head of household filing status, which offers tailored tax brackets and deductions that recognize the financial challenges faced by single parents. In 2016, then-presidential candidate Donald Trump proposed ending the head of household status as part of a massive $6 trillion tax cut plan that would have actually raised taxes for most single parents with dependent children.

While former President Trump’s current campaign platform does not contain the same level of detail as his 2016 proposal, interest in this idea has not waned on the right. The Tax Foundation, for instance, includes wiping out head of household tax brackets and standard deductions in both of its proposals to pay for the continuation of top-heavy tax cuts that Mr. Trump signed in the Tax Cuts and Jobs Act. The Niskanen Center, meanwhile, has also set its sights on the head of household status and worked with a trio of Republican Senators to craft a tax bill that my organization estimated would have raised federal taxes on two out of every three single-parent households. To make matters worse, many states base their own income tax laws on the federal system and eliminating the federal head of household status would also trigger state tax increases on single parents that would compound the hardship faced by this group.

Until the election is over, proponents of raising taxes on single parents are unlikely to spend much time touting that view publicly on the campaign trail or otherwise. But once campaigning ends and the time for governing begins, lawmakers will embark on a frenzied search for agreement on ways to pay for extending some or all the Trump tax cuts. When that time comes, there’s little doubt that many on the right will have tax hikes on single parents near the top of their list of favored options.