Illinois

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

Tax policy results are mixed across the country as many voters weigh in on state and local ballot measures. For example, Washington state voted to maintain its new progressive tax on capital gains; Georgia voters capped growth in property tax assessments; Illinois voters approved a call for a millionaires’ tax; North Dakota voters rejected property […]

2024 State Tax Ballot Questions: Voters to Weigh in on Tax Changes Big and Small

October 17, 2024 • By Jon Whiten

As we approach November’s election, voters in several states will be weighing in on tax policy changes. The outcomes will impact the equity of state and local tax systems and the adequacy of the revenue those systems are able to raise to fund public services.

State Rundown 10/10: More Special Sessions, More Proposed Tax Cuts

October 10, 2024 • By ITEP Staff

This week several states are getting an early start at writing new tax policy in special sessions. In West Virginia, the legislature has come to an agreement with Gov. Justice on an additional tax cut—on top of already-planned cuts. The 2 percent cut will cost the state $49 million a year and come from spending […]

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

State Earned Income Tax Credits Support Families and Workers in 2024

September 12, 2024 • By Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit. These credits boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Rundown 9/5: Property Tax Policy Continues to Make Headlines

September 5, 2024 • By ITEP Staff

Property tax bills are undeniably a concern for many low- and moderate-income households across the nation...

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

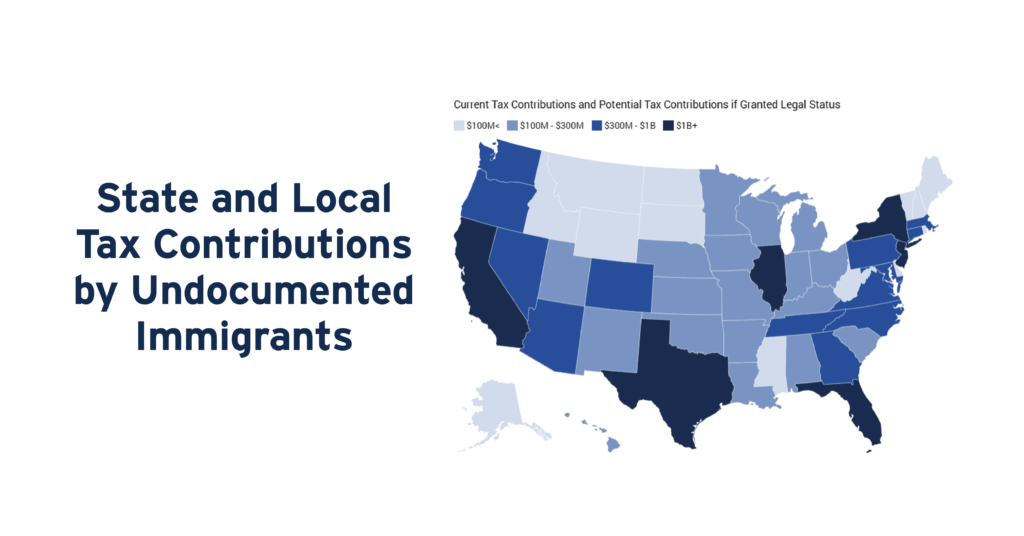

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Study: Undocumented Immigrants Contribute Nearly $100 Billion in Taxes a Year

July 30, 2024 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Immigration policies have taken center stage in public debates this year, but much of the conversation has been driven by emotion, not data. A new in-depth study from the Institute on Taxation and Economic Policy aims to help change that by quantifying how much undocumented immigrants pay in taxes – both […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

State Rundown 6/13: Decisions are falling into place, but some states will come back for more

June 13, 2024 • By ITEP Staff

State budgets are falling into place as lawmakers near the end of their legislative sessions...

Legislative sessions across the country are still very much in for summer, which means more pencils, more budgets, and more tax plans...

Uncertainty abounds in state tax debates lately...

This week, special sessions with major tax implications are in the air...

Illinois Fund Our Futures Coalition: Funding Our Futures: The Equitable Revenue Policies Illinois Families Need to Thrive

April 18, 2024

Read the report here.

State Rundown 4/17: Tax Cut Proposals and the Consequences of Bad Tax Cuts

April 17, 2024 • By ITEP Staff

Happy (belated) Tax Day!

Scholars Strategy Network: Tax Policy as a Potential Tool for Reducing Infant Mortality

April 17, 2024

Increased tax revenues and increased tax progressivity need to be further explored as policy solutions in Illinois. More specifically, the adoption of worldwide combined reporting and a state-level child tax credit, could help prevent infant deaths in our state.

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

Over the past week Utah continued its slow march toward a more inequitable tax code...