Illinois

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

Most state legislatures have adjourned for 2023, and that means it’s a perfect time to look at the tax policy trends that have formed thus far...

As the sweet days of summer pass, the scent of jasmine isn't the only thing blowing through the minds of state lawmakers, as tax policy discussions remain at the forefront...

Illinois Voucher Tax Credits Don’t ‘Invest in Kids,’ They Invest in Inequality

June 12, 2023 • By Carl Davis

By allowing their school privatization tax credit to expire at the end of the year, Illinois lawmakers can take a meaningful step toward better tax and education policy, and a clear show of support for our nation’s public education system.

Letter to IRS on Section 1001 Regulation in 2023-2024 Priority Guidance Plan

June 9, 2023 • By ITEP Staff

Read as PDF Re: Recommendation for Inclusion of Section 1001 Regulation in 2023-2024 Priority Guidance Plan To Whom It May Concern, We are writing to respectfully urge that the IRS return to the work it left unfinished in 2019 when it issued final regulations on “Contributions in Exchange for State or Local Tax Credits” (RIN: […]

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

From dedicating new taxes to fund climate action and public health to vacancy and “mansion” taxes, many local leaders are already exploring ways to make their tax systems more progressive and sustainable. ITEP is committed to helping local leaders and advocates build on this work by advancing knowledge about local tax solutions.

Contact: Jon Whiten ([email protected]) For decades, the Institute on Taxation and Economic Policy (ITEP) has played a role in shaping equitable and sustainable tax systems at the federal and state level. From the beginning, we have collaborated with advocates, policymakers, and others to advance policies that can foster expansive, inclusionary, and racially equitable tax systems. […]

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

Lawmakers in seven states will introduce legislation this week to tax wealth in a new coordinated effort to combat ever-increasing income and wealth inequality. The bills couldn’t come at a better time, as those at the very top continue to pull apart from the rest of us and far too many states contemplate piling on to this runaway inequality with seemingly endless tax cuts for those at the top.

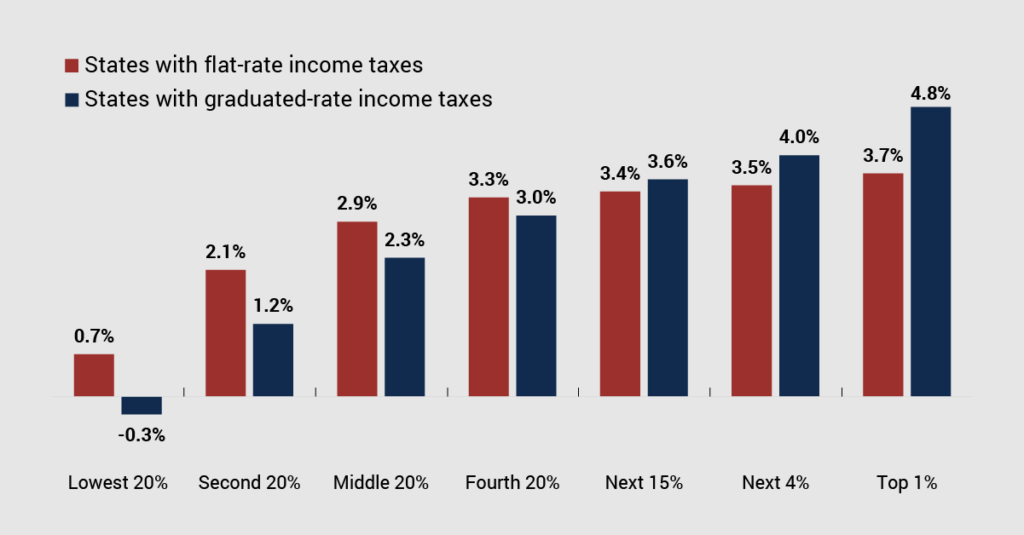

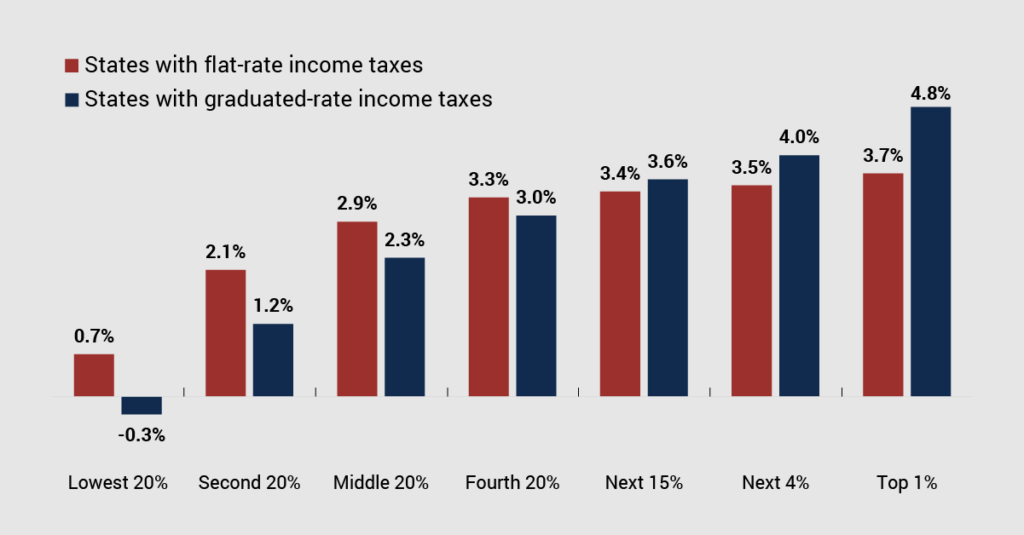

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

Flat taxes have some surface appeal but come with significant disadvantages. Critically, a flat tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Report: Ten States Hold 71 Percent of America’s Extreme Wealth

October 13, 2022 • By ITEP Staff

Tackling wealth inequality through the tax code can boost economic opportunity Washington, DC: Wealth inequality is rampant in every state and particularly concentrated in a handful of states, according to a first-of-its-kind analysis released today by the Institute on Taxation and Economic Policy (ITEP). This extreme wealth hinders economic opportunities for all but the […]

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

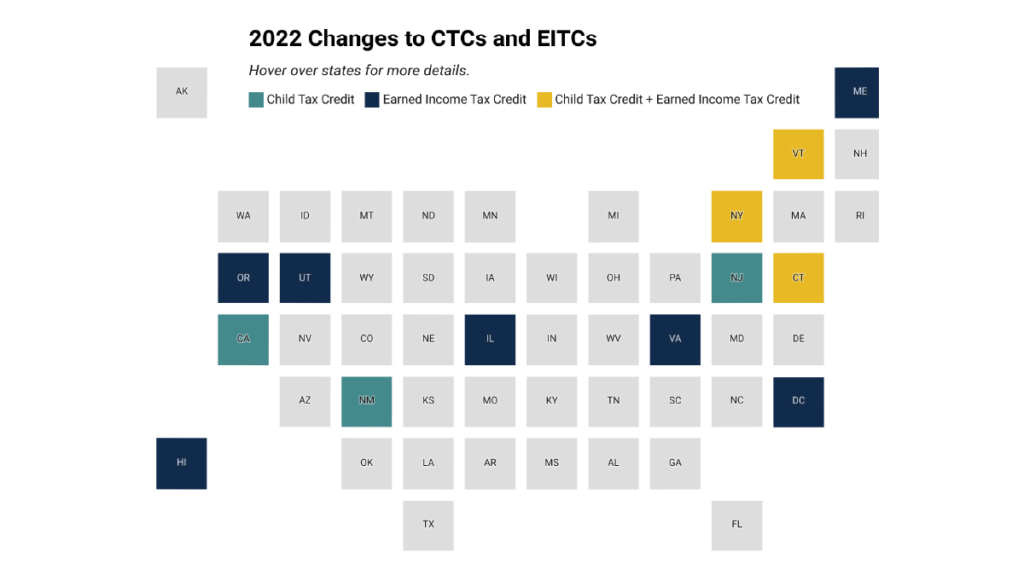

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

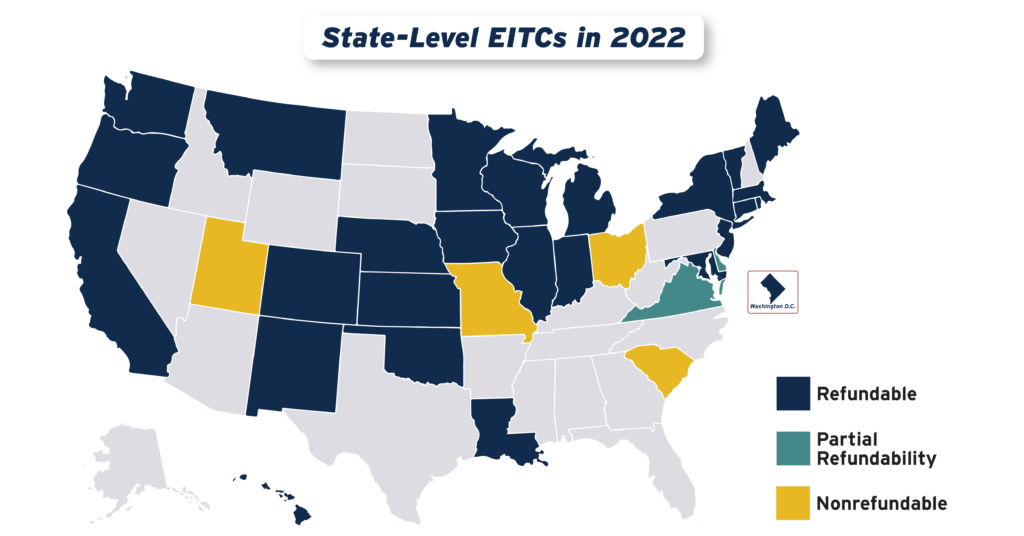

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

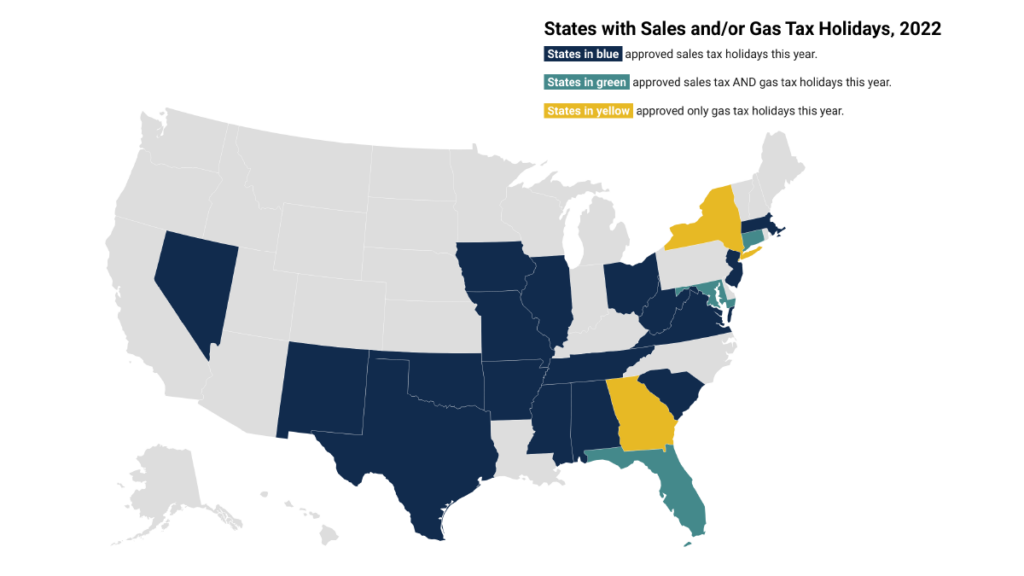

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

WVTF Radio: A gas tax holiday may not lead to savings for Virginia drivers

March 30, 2022

About a third of the savings will go to the oil industry, according to research into how this worked when Indiana and Illinois had a gas tax holiday. But that doesn’t mean Virginians will see the rest of the savings. Carl Davis at the Institute on Taxation and Economic Policy says a quarter of the […]

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...