Income Taxes

There Were Far Cheaper and Fairer Options Than the Trump Megabill

July 8, 2025 • By Steve Wamhoff, Joe Hughes, Jessica Vela

Congress and the president could have spent less than half that much money on a tax bill that does more for working-class and middle-class households.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade

July 3, 2025 • By Carl Davis

The Trump megabill will give the top 1 percent tax cuts totaling $1.02 trillion over the next decade. For comparison, the bill’s cuts to the Medicaid health care program will total $930 billion over the same period.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

With Fiscal Uncertainty Looming, Louisiana Senate Did the Right Thing on Tax Bills

June 27, 2025 • By Neva Butkus

If you find yourself in a hole, stop digging. This is exactly what Louisiana Senators did when they rejected two tax-cut bills that would have created a billion-dollar shortfall in the coming fiscal years.

Analysis of Tax Provisions in the Senate Reconciliation Bill: National and State Level Estimates

June 25, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

Compared to its House counterpart, the Senate bill makes certain tax provisions more generous, including corporate tax breaks that it makes permanent rather than temporary. But the bottom line for both is the same. Both bills give more tax cuts to the richest 1 percent than to the entire bottom 60 percent of Americans, and both bills particularly favor high-income people living in more conservative states.

Amid Economic Uncertainty, Delaware Lawmakers Should Consider Progressive Revenue Proposals

June 4, 2025 • By Miles Trinidad

Delaware leaders cited the ongoing federal tax debate and economic uncertainty amid the Trump administration's tariffs and trade wars as reasons to delay pursuing some of the progressive tax increases that Gov. Matt Meyers proposed in recent months. But just the opposite is needed. Delaware lawmakers should advance tax policies that can simultaneously protect state revenue to fund important priorities and improve tax equity in the state ahead of the approaching fiscal storm.

Sweeping Federal Tax and Spending Changes Threaten Local Governments

June 3, 2025 • By Kamolika Das

Given this environment, local leaders must do what they can to preserve and strengthen progressive revenue tools, advocate for expanded local taxing authorities and flexibility, and push their state leaders to decouple from harmful federal tax changes.

Five Issues for States to Watch in the Federal Tax Debate

June 3, 2025 • By Dylan Grundman O'Neill, Kamolika Das, Marco Guzman, Miles Trinidad, Neva Butkus

This post covers five particularly notable provisions for states: increasing deductions for state and local taxes (SALT) paid, allowing more generous tax write-offs for businesses, offering new avenues for capital gains tax avoidance to people contributing to private school voucher funds, carving tips and overtime out of the tax base, and re-upping Opportunity Zone tax breaks for wealthy investors.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

The House of Representatives unveiled a sprawling piece of tax legislation earlier this week that would extend temporary tax changes enacted in 2017 and layer various kinds of tax cuts and increases on top. The JCT analysis makes clear that the House tax plan would be regressive, meaning it would offer larger tax cuts as a share of income to high-income taxpayers than to either middle-class or working-class families. It also makes clear that most of the tax cuts would go to families with above-average incomes.

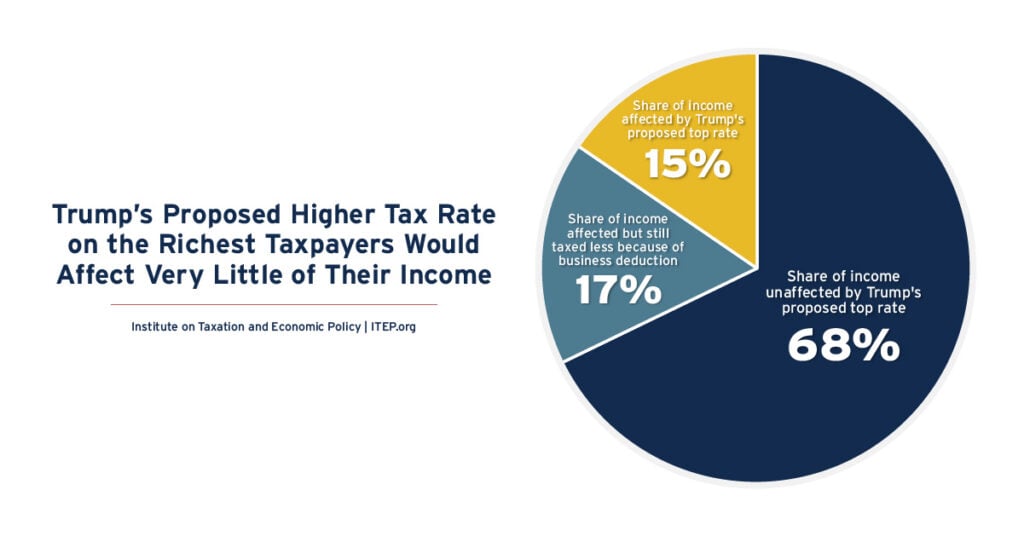

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

The final budget adopted by the Maryland General Assembly shows progress in advancing tax equity in the state while boosting state revenues to address the state’s budget deficit. To help close a $3.3 billion budget deficit, Maryland legislators enacted much-needed tax reforms and progressive revenue raisers that help meet the state’s needs while making the […]

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

Ending Direct File Program is a Gift to the Tax-Prep Industry That Will Cost Taxpayers Time and Money

April 17, 2025 • By Jon Whiten

The Trump administration reportedly plans to shutter the IRS Direct File program before it has a chance to get fully off the ground, taking away a free option for people to file their tax returns directly to the agency. Ending Direct File is another gift from this administration to large corporations, this time to the multibillion-dollar tax prep industry that profits from you filing your taxes.

A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1

April 8, 2025 • By Aidan Davis, Dylan Grundman O'Neill, Neva Butkus

Mississippi lawmakers have approved the most radical and costly change to the state’s personal income tax system to date. House Bill 1 ultimately eliminates the state's personal income tax and cuts state revenues by nearly $2.7 billion a year when fully implemented. This deeply regressive legislation will create a windfall for the wealthiest residents of the poorest state in the nation while simultaneously jeopardizing the state’s ability to fund public services that support Mississippians and the state’s economy.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

Tip Exemptions Have No Place in State Income Tax

March 25, 2025 • By Eli Byerly-Duke, Nick Johnson

Creating a special tax break for tipped income – as at least 20 states are considering this spring – would harm state budgets, encourage tax avoidance, and fail to reach the vast majority of low- and middle-income workers.

Proposed Missouri Tax Shelter Would Aid the Wealthy, Anti-Abortion Centers Alike

March 6, 2025 • By Carl Davis

In Missouri, donations to anti-abortion pregnancy resource centers come with state tax credits valued at 70 cents on the dollar. One bill currently being debated in the state would increase that matching rate to 100 percent—that is a full, state-funded reimbursement of gifts to anti-abortion groups.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

Mississippi Considers Deep Tax Cuts Amidst Budget and Economic Uncertainty

February 26, 2025 • By Neva Butkus

At a time when states across the country are forecasting deficits or anticipating slowing revenue growth, Mississippi lawmakers are debating deeply regressive and expensive tax cuts that would overwhelmingly benefit their state’s richest residents.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Local income taxes can be an important progressive revenue raiser, as they ask more of higher-income households and are connected to ability to pay. They can raise substantial revenue to fund key public services to make cities and regions better off.