Bloomberg Tax originally published this piece here.

Shifts from graduated to single-rate income taxes are designed to benefit higher earners. Different families will still pay different rates, but the rich will pay less.

The shift in Iowa is no different. As Iowa lawmakers change the state’s graduated personal income tax to a single flat rate, they are designing a state tax code where the rich will pay a lower rate overall than families with modest means.

Flat income taxes are a problem anywhere, but the Iowa details are particularly concerning. The state will accelerate and deepen existing cuts to a 3.8% flat rate personal income tax in 2025. (Cuts were already set to hit a 3.9% flat rate personal income tax in 2026.)

This is the third time Iowa’s lawmakers have passed new cuts before existing scheduled cuts took effect. Legislators are also attempting to tie the hands of future lawmakers by enshrining the new flat tax in the state’s constitution. Without the ability to raise progressive revenue in the future, the working class in Iowa will continue to pay more for services all residents rely on.

It’s worth unpacking what a flat income tax is. Like the federal government, most states have a graduated (or progressive) personal income tax where rates are defined by several brackets, with higher rates applied to higher income.

In Minnesota, for example, a single filer will pay 5.35% on their first $31,690 of taxable income over the state’s basic exemption and deduction levels, but more on higher amounts ending at 9.85% on taxable income over $193,240. In contrast, a flat income tax has a single rate regardless of income.

It’s key to differentiate between a single-rate income tax and a flat overall tax structure. No state raises revenue only through an income tax. Other main pillars of state revenue are sales and property taxes. Unfortunately, both are regressive. This is because families with moderate or middle incomes spend more of their income on housing and purchases covered by sales or excise taxes.

When states levy a single-rate income tax alongside other regressive taxes, the result is a tax system that asks more of low- and middle-income families, not a flat system.

Proponents often claim that single-rate income taxes will lead to lower taxes overall. This isn’t true for working class families.

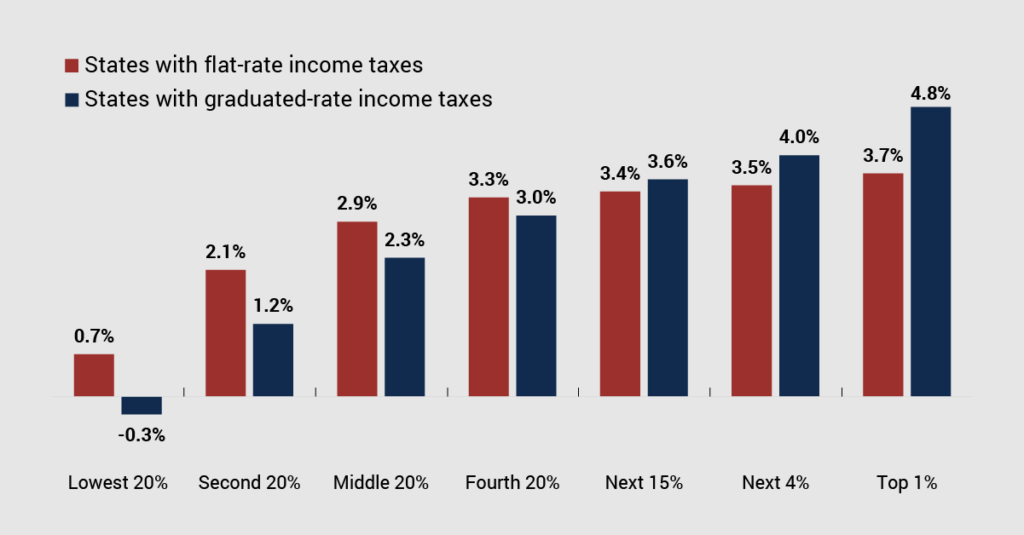

On average, graduated income taxes in the states tend to ask about the same of middle-income families as single-rate taxes do. For low- and moderate-income workers, flat taxes usually result in higher tax bills than graduated taxes.

Of the 10 states that ITEP’s data identifies as the most regressive, eight have either a flat income tax or no income tax at all. A single-rate income tax removes states’ best opportunity to add a progressive element, and the poor end up paying.

The starkest example is Pennsylvania. Including its single-rate personal income tax, the bottom 20% of earners pay 15.1% of their income in total Pennsylvania state and local taxes: the highest in the nation. Meanwhile, the top 1% of earners pay only 6%.

If state and local policymakers want everyone to pay the same rate, they should consider that states with the lowest variance among ITEP’s seven income buckets don’t have single-rate income taxes. All of the top five states—Delaware, California, Massachusetts, Oregon, and Maine—use progressive income taxes to offset other regressive taxes.

To be clear, a single-rate income tax is typically better than no income tax at all. The states whose taxes vary most by income—Florida, Washington, Tennessee, Pennsylvania, and Nevada—mostly have no personal income tax.

Iowa’s move to a single-rate personal income tax will indeed reduce some Iowans’ tax bills. But the tradeoffs are significant.

The state’s taxes will be less flat, state services will suffer, and new revenue raised will likely be regressive. Given that most other state tax codes are currently regressive, flattening state tax codes is a move in the right direction. If policymakers have that goal, then a graduated income tax is essential.