Maine

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…

Maine Free Press: Mills Budget Provides More School Funding, Fails to Fully Fund Revenue Sharing & Keeps LePage’s Tax Cuts

February 14, 2019

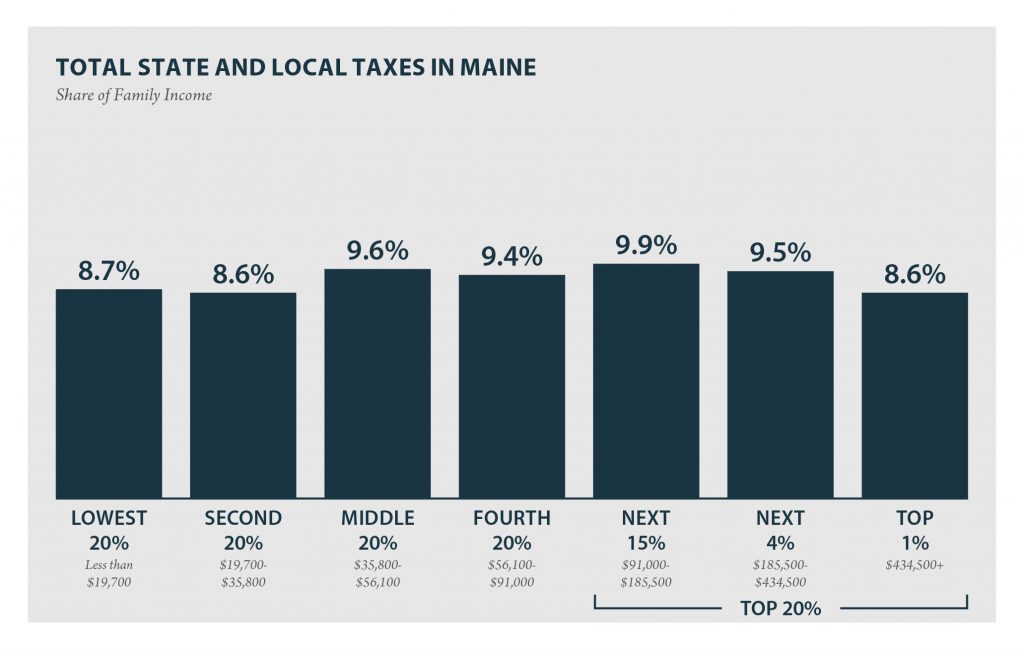

The liberal-leaning Maine Center for Economic Policy (MECEP) praised Mills for her support for Medicaid expansion, but criticized the proposal for failing to reverse LePage’s income tax cuts for the wealthy. Last year, MECEP and the Institute on Taxation and Economic Policy (ITEP) released a report that found that tax cuts passed during the LePage administration will cost the state $864 million in revenue this biennium. About half of the tax breaks went to the top 20 percent of earners while the bottom 20 percent received less than 5 percent of the benefit, the analysis found.

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

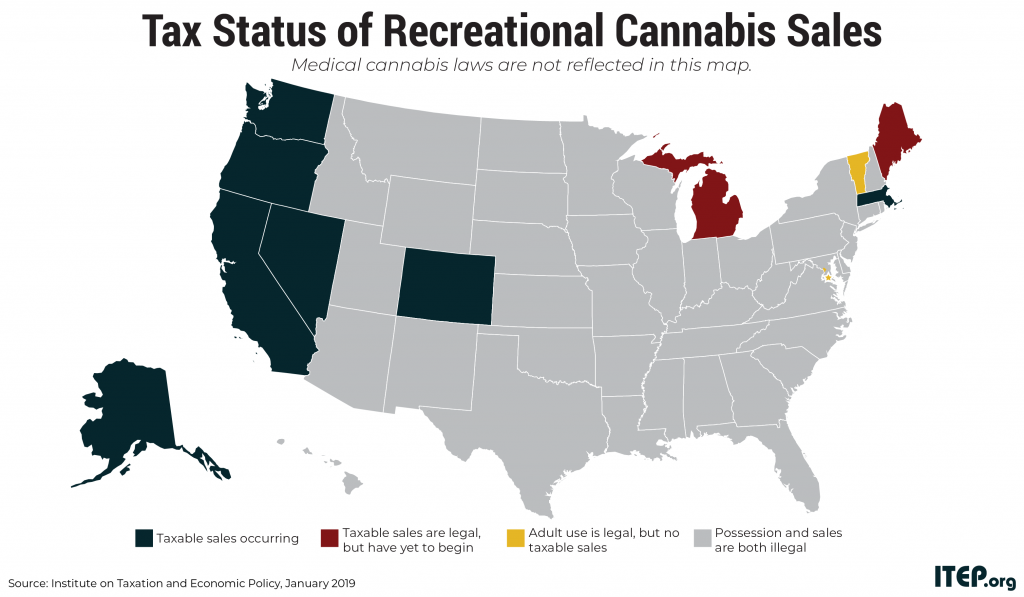

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

Maine Center for Economic Policy: To Fund Shared Prosperity, We Must End LePage-Era Tax Cuts for the Wealthiest

February 6, 2019

For years under Gov. Paul LePage, budget-busting tax cuts robbed our state of the revenue we need to build a stronger, fairer economy. Tax cuts delivered windfalls to the wealthiest households in our state, making it harder for our schools and communities to make ends meet. Read more

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

Maine Center for Economic Policy: The Prosperity Budget

January 15, 2019

Where State of Working Maine 2018 investigated the nature of work in the modern economy and made recommendations to reaffirm our values of fairness and respect in the workplace, the Prosperity Budget examines the opportunity to leverage state budget and tax policy to build a stronger economy where every Mainer has an equal opportunity to […]

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

Maine Center for Economic Policy: Maine Still Has Work to Do in Building a Balanced and Adequate Tax Code

October 17, 2018

Building an inclusive economy requires tax policy that meets two conditions. The first is that those with the most are asked to pay more, or at the very least pay as great a share of their income in taxes as everyone else. The second is that enough shared resources are raised through the tax code to invest adequately in foundations of a strong economy including good schools, access to health care, and safe and modern infrastructure.

Maine: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MAINE Read as PDF MAINE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,700 $19,700 to $35,800 $35,800 to $56,100 $56,100 to $91,000 $91,000 to $185,500 $185,500 to $434,500 over $434,500 […]

Tax Cuts 2.0 – Maine

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

The Free Press: Think Tank Releases Blueprint to Fully Fund Education, Medicaid & Lower Property Taxes

September 20, 2018

Tax cuts passed by the Maine Legislature and Gov. Paul LePage over the past eight years will cost the state $864 million in revenue in the next biennium, according to an analysis by the Maine Center for Economic Policy and the Institute on Taxation and Economic Policy. At the same time the state continues to ignore its legal obligations to fully fund education, Medicaid expansion and revenue sharing.

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

State Rundown 8/22: Wayfair Fallout Could Hit the Pavement Soon

August 22, 2018 • By ITEP Staff

Arizona voters learned this week that they will have an opportunity this fall to restore school funding through a progressive tax measure. The effects of the Supreme Court’s Wayfair decision could soon be seen on Michigan and Mississippi roads, as leaders in both states have proposed devoting new online sales tax revenues to infrastructure needs. And new research highlighted in our “What We’re Reading” section discredits one-size-fits-all prescriptions for state economic growth such as supply-side tax-cut orthodoxy, advocating instead for more nuanced and state-specific policymaking.

Press Herald: Will Maine Referendum On Home Care Result In ‘Marriage Penalty’ Tax?

August 17, 2018

Aidan Davis, senior policy analyst at the nonpartisan Institute on Taxation and Economic Policy, wrote a letter to the Secretary of State’s Office on June 15 stating that the income threshold would be double for married couples filing jointly. “We found the language of the initiative to be clear in describing that individual (not household) […]

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…