Key Findings

- Michigan’s proposed 5 percent high-income surcharge would raise about $1.7 billion a year for public education while also improving the fairness of the state’s regressive tax system.

- Currently, Michigan’s top 1 percent pay the lowest share of their income towards state and local taxes. The surcharge, if approved, would change that. It would be an important step in reducing (but not eliminating) the gap between tax rates paid by the top 1 percent and middle-income Michiganders.

- Claims that the surcharge would damage small businesses are overblown: the vast majority of Michigan residents with pass-through business income would not be subject to the tax. It only applies to owners who receive over $1 million (for joint filers) in income directly from their businesses, as opposed to reinvesting these profits into their businesses.

- There is no evidence that increasing state income taxes on high-income households leads to substantial outmigration of wealthy taxpayers or net revenue loss. Instead, this surcharge on high earners will increase state revenue.

Introduction

Michigan has a regressive tax system, meaning that low- and moderate-income households pay a higher share of their income in state and local taxes than wealthier households. Michigan’s constitutionally mandated flat-rate individual income tax has been a longstanding obstacle in creating a more equitable state tax system. The proposed Invest in MI Kids ballot initiative would help mitigate this inequity, making Michigan’s unfair tax system less so.

The measure would amend the state’s constitution to create a 5-percentage point surcharge on top earners with taxable incomes over $1 million for joint filers and $500,000 for single filers. We estimate this would raise about $1.7 billion a year, which would be used for public education priorities, including recruiting and retaining teachers, reducing class sizes, and funding career and technical education.

While Michigan has an opportunity to simultaneously make serious investments in public education while creating a fairer tax system, opponents of the measure have argued that raising taxes on high-income households could harm small businesses and lead to a mass exodus of high-income households from the state. These concerns are exaggerated.

Millionaires in Michigan currently pay the lowest share of their income toward taxes

While opponents of the measure currently tout Michigan as a low-tax state given its flat tax, it’s important to ask: a low-tax state for whom?

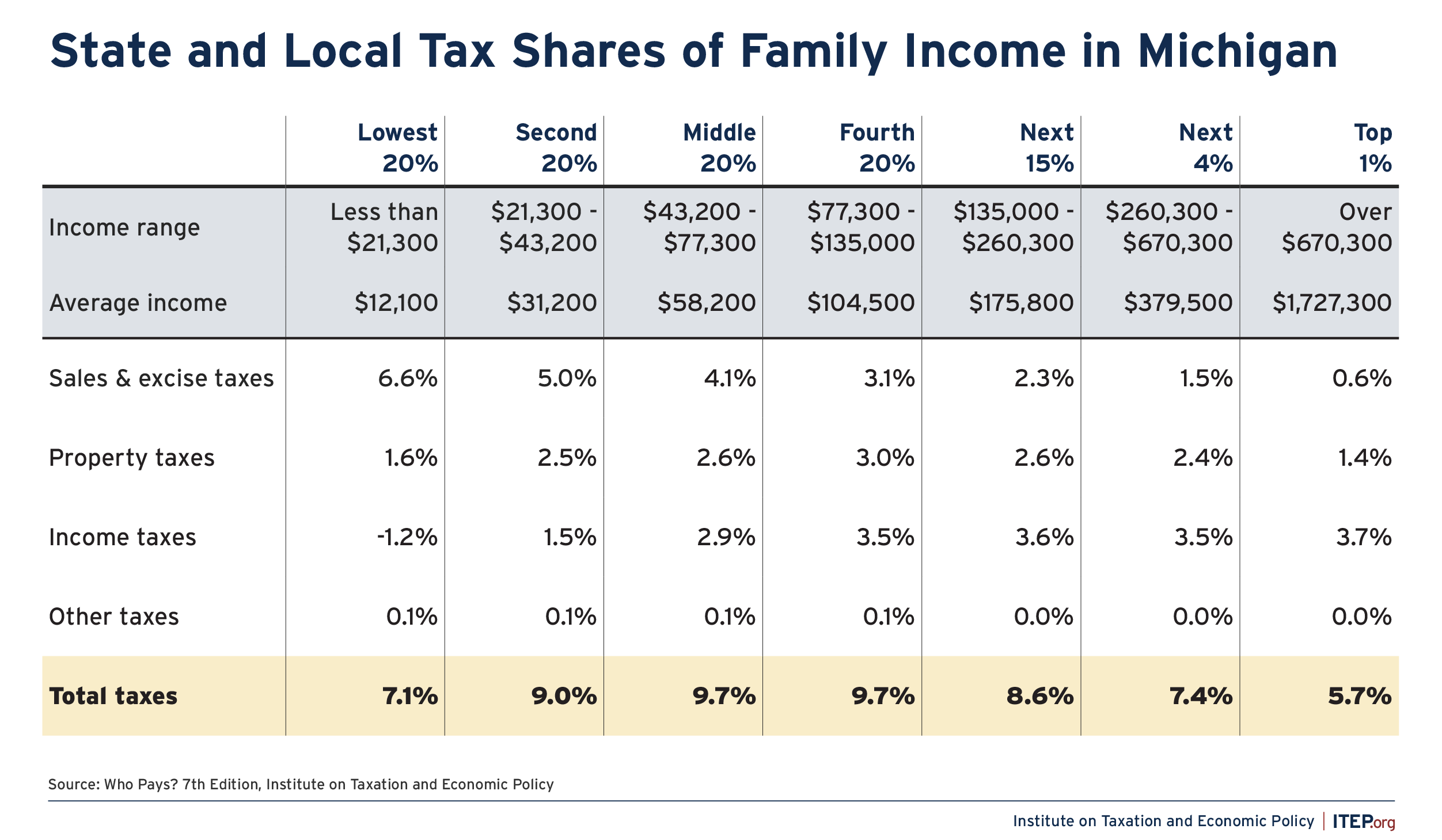

The top 1 percent of Michiganders, those with incomes over $670,300 per year, pay 5.7 percent of their income in state and local taxes—less than any other income group in the state. In comparison, the lowest 20 percent of Michiganders, those with annual incomes of less than $21,300, paid an average of 7.1 percent of their income towards Michigan taxes. The middle 20 percent (with annual incomes between $43,200 and $77,300) paid an average of 9.7 percent.

Figure 1

Along with paying the flat rate income tax, Michigan households pay sales, excise, and property taxes, and these taxes disproportionately ask more from those who earn middle and low-incomes. A flat rate income tax leaves Michigan ill-equipped to offset the regressive effects of these other taxes, which moves the state further away from the “flat tax” ideal that proponents of the tax claim to value.

By adopting the proposed surcharge on high-income earners, Michigan would take a welcome step toward a graduated income tax structure, which would allow the state to collect more of the revenue needed for public education from high-income taxpayers and start asking them to pay their fair share in taxes.

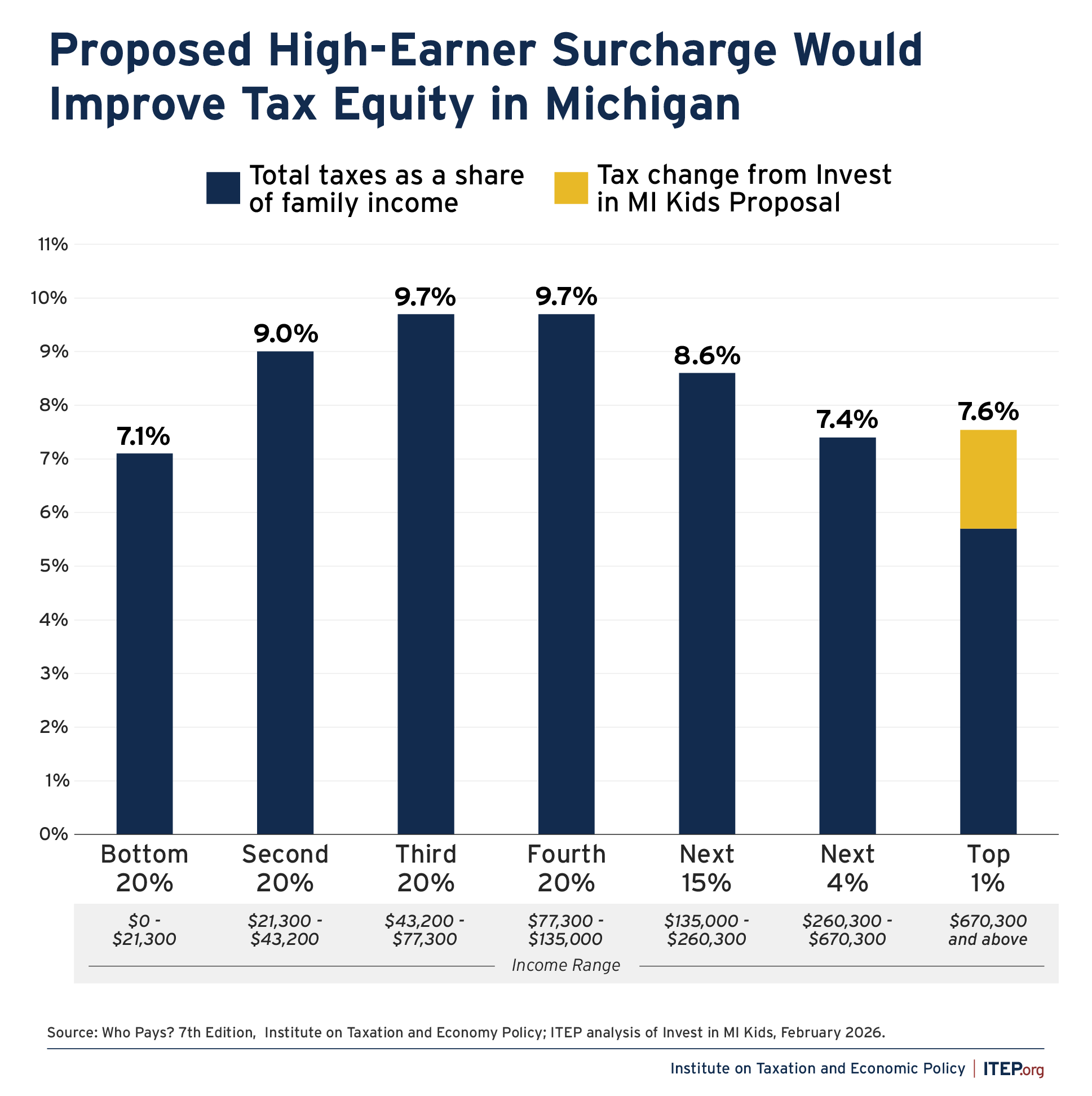

With this proposal, the top 1 percent of Michiganders – those with average incomes exceeding $1.7 billion a year – would be the only group that would see a change in their share of their income paid in taxes. The new surcharge would increase the top 1 percent’s total share of income paid towards taxes from 5.7 to 7.6 percent. With this increase, the gap between the low effective tax rates on the top 1 percent and middle-income Michiganders would be reduced, but not eliminated, and the top 1 percent would no longer be paying the lowest tax rates in the state.

Proposed surcharge would improve tax equity in Michigan

Figure 2

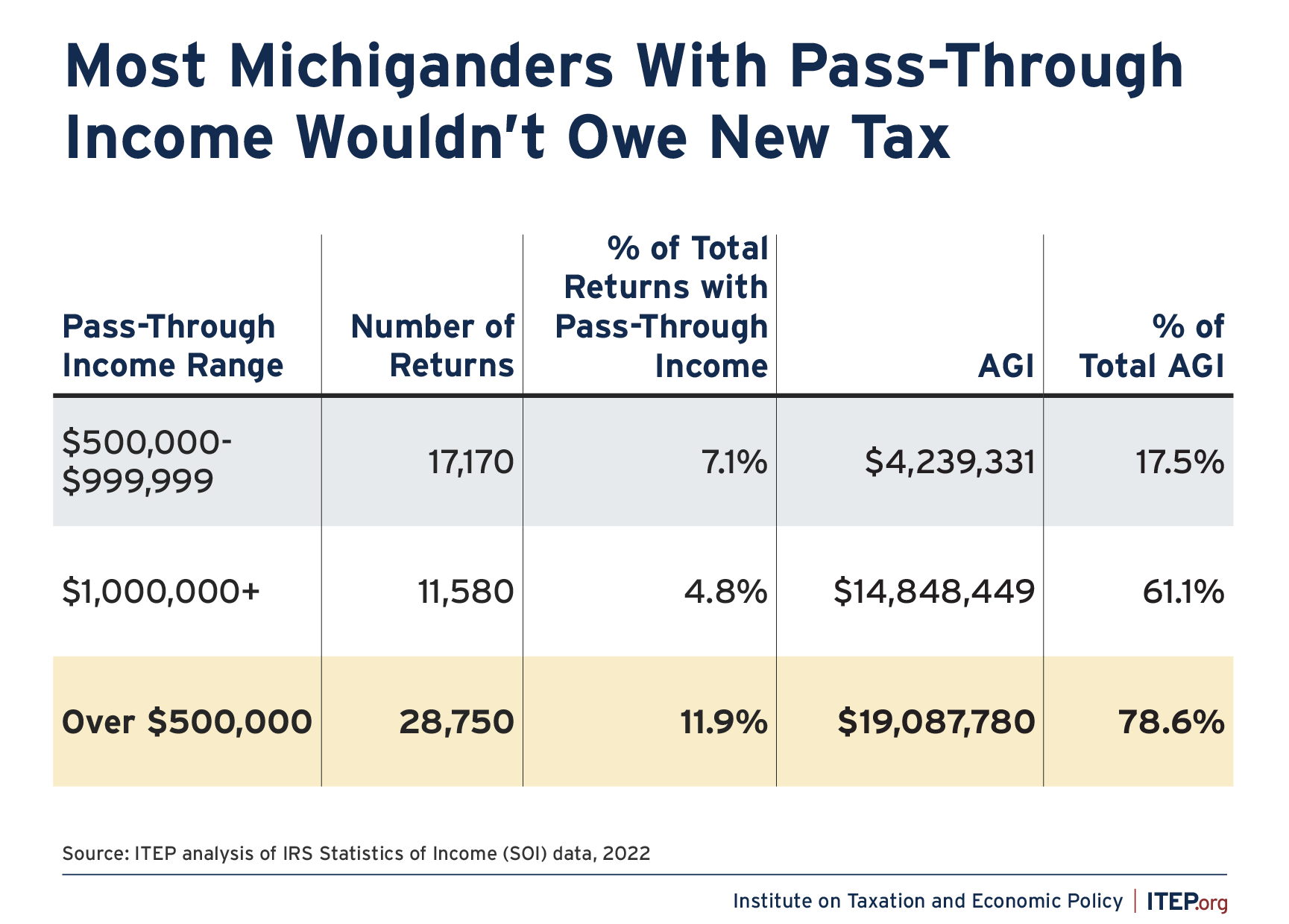

The surcharge would not be a tax on ‘small’ businesses

The Invest in MI Kids proposal is solely a tax on high-income personal income taxpayers and not a direct tax on small businesses. Many Michiganders report income from pass-through businesses on their personal income tax forms each year, but the vast majority of taxpayers with business income of this kind – 88 percent – have incomes far too low to be subject to the proposed surcharge. Less than 12 percent of federal tax returns in Michigan reporting pass-through income in 2022 had federal adjusted gross income above $500,000. And this group of high-income business owners only comprises 0.6 percent of all returns in Michigan.

Figure 3

Taxes on the rich don’t lead to a mass exodus of the wealthy or businesses

Opponents of the measure also make sweeping claims that new taxes would dampen economic growth and lead to a mass exodus of the wealthy from the state. However, there isn’t evidence to suggest that this has happened in other states that made similar changes.

The best research to date on this point has shown that income tax levels have little impact on where the wealthiest taxpayers choose to live. This makes sense because the rich don’t need to consider cost of living and they typically have business and family ties that keep them in a certain area. A report looking at Census and IRS data has shown that higher-tax states that are often cited as key examples of tax flight, such as California and New York, actually have lower out-migration rates than states that are cutting taxes or have no income tax, and large numbers of people move into higher-tax states every year.

State income tax increases on wealthy households lead to more revenue for the state. People are always entering and leaving states, but those departures have not led to enough people leaving the state to erode more than a small fraction of the revenue the tax increases provided.

This pattern can be seen in Massachusetts after recent enactment of a similar surcharge. In 2023, Massachusetts adopted the Fair Share Amendment, which created a 4 percent surcharge on incomes over $1 million, with the revenue earmarked for education and transportation. In the two years since the Fair Share Amendment was adopted, the state has raised $5.7 billion from the measure and research to date has shown that migration patterns in the state were largely unchanged.

While some individuals may move because they think taxes are too high, evidence shows that these cases are rare. This should not dictate tax policy. Instead, states should prioritize raising the revenue needed to enhance public services that make their states attractive places to live and businesses to start – and that is exactly what the Invest in MI Kids proposal would do.

ITEP has calculated that state and local taxes account for just 2.3 percent of the cost of doing business, with the other 98 percent going to areas like payroll, equipment, and real estate costs. Moreover, state personal income taxes make up just 6 percent of the total state and local tax bill falling on business, according to Ernst & Young LLP estimates. The personal income tax is a small fraction of the expenses paid by business owners, suggesting that even dramatic changes in this area will have minimal impact on businesses’ bottom lines.

Anti-tax rhetoric notwithstanding, there’s every reason to believe that irresponsible tax cuts can hurt state economic growth. States enacting unaffordable tax cuts risk damaging critical public services like education, public safety, and infrastructure, which would make these states less desirable places for individuals to move, to raise a family, or start a business.

Conclusion

The Invest in MI Kids ballot measure provides an opportunity for the state to make important investments in public education while improving the state tax system by strengthening the state’s personal income tax. These taxes are essential for adequately funding the public services that help create strong, robust communities that benefit everyone.

Michigan residents should ignore the fearmongering by anti-tax advocates about tax flight and growth. Key research on these issues has shown that inadequate taxes lead to a deteriorating education, public services, infrastructure, and public safety make states less desirable places for families to live and businesses to invest. In the long run, what will make Michigan thrive is robust investments in public infrastructure that provide good schools, effective health care, quality jobs, and functional public transportation. Failing to provide them would likely harm the Michigan economy in a way that a tax hike on millionaires never could. Building and investing in robust communities depends vitally on a state tax system that can fund these needed services going forward – and the Invest in MI Kids proposal would be an important step in the right direction.