Missouri lawmakers have been pushing regressive and shortsighted tax policies that undermine everyday workers and sabotage the Show-Me State’s ability to raise revenue. Within a few months, Missouri ended taxation of capital gains, poised itself to cut property taxes across the state, and reignited the Kansas City border war. To make matters even worse, the governor recently reaffirmed his desire to eliminate income taxes in the state.

This comes at a challenging time, as federal aid to Missouri families was slashed in the president’s new tax and spending law. Missourians depend on responsible economic policy from our state leaders, and needs in Missouri are high: tornado relief efforts are ongoing in St. Louis, many rural school districts cannot afford to operate on a five-day school week, and America is becoming increasingly unaffordable.

Each dollar of unnecessary tax breaks for corporations, millionaires, and billionaires is a dollar that will no longer be spent on healing Missouri’s patients in hospitals, moving Missouri’s people on roads, or educating Missouri’s future in schools.

Eliminating Capital Gains Hurts the State and Helps the Rich

Exempting capital gains from taxation in Missouri handed a massive tax break to wealthy households. This tax cut does nothing for those whose money comes from working. Instead, it only benefits those enriched by passive income realized by selling investments, real estate, business stakes, and other assets that are now free from taxation. In fact, this measure gives a tax cut to the average millionaire that is over 529 times larger than what the majority of Missourians receive. This bill also makes corporations completely exempt from capital gains taxes in the near future, which will only further underfund the state.

Freezing Property Taxes Threatens Critical Public Services

It could get even worse. This past summer, lawmakers passed Senate Bill 3, which could fundamentally inhibit the ability of Missouri counties to generate property tax revenue. This law requires most of the state’s counties (though not the state’s most populous areas, like St. Louis and Kansas City) to hold a vote on limiting the growth of property taxes or freezing them outright. This could constrain the ability of Missouri’s localities to raise enough funds to provide essential services. If SB3 is upheld by courts and county referenda move forward, then the consequences could include funding cuts and instability for schools, firefighters, police, libraries, parks, and other local services that depend on property taxes.

The Only Winners of Another Border War are Corporations

Lawmakers in both Kansas and Missouri have reignited the wasteful economic border war that previously resulted in hundreds of millions of dollars in lost revenue and no meaningful economic growth. From 2009 to 2019, policymakers in both states offered large corporate subsidies in an attempt to convince companies to relocate to the other side of State Line Road in Kansas City. This economic conflict produced two losers: Missouri and Kansas. The only beneficiaries of this conflict were corporations that were given approximately $335 million in tax incentives to do, according to experts, exactly what they would’ve done without $335 million in tax incentives.

In 2024, taxpayers in Jackson County sensibly refused to subsidize new stadiums for the Chiefs and Royals by overwhelmingly voting against a stadium funding proposal, which would’ve required raising billions of dollars in new sales taxes. Soon after, the Kansas legislature passed stadium tax incentives to lure Kansas City’s major league teams across the border. Continuing this race to the bottom, Missouri lawmakers passed their own stadium tax incentive offer this year. Next, the City Council of Kansas City, Missouri, officially repealed the 2019 truce and opened the door to more futile corporate tax breaks.

This border war has now culminated in the largest corporate subsidy in American history for a sports stadium. The Chiefs’ owners have announced they will move to Kansas, thus abandoning their iconic stadium in Missouri for a new stadium built, primarily, by Kansas taxpayers. In fact, Kansas will give the Chiefs’ owners $1.8 billion in public dollars to move the team just roughly 20 miles and create—as economists agree—no new economic activity. The reality of this decision is a cultural loss for Missouri fans, a financial loss for Kansas taxpayers, and a massive gain for the Hunts (the family that owns the Chiefs and is worth $25 billion).

Stadium subsidies put costs on taxpayers and are not the decisive factor that makes a team stay or leave—just ask any former Rams fan in St. Louis. This border war can only provide pointless tax breaks for corporations while straining governmental investment in public resources—like schools and transportation—that actually make a region more inviting to businesses.

Eliminating Income Tax Would Hurt Working People

In November, Gov. Mike Kehoe announced his plans to work with the General Assembly to ask Missourians to do what the state can absolutely not afford to do: eliminate Missouri’s individual income tax. This decision would put funding for public services in jeopardy while ultimately increasing the taxes paid by low- and middle-income households.

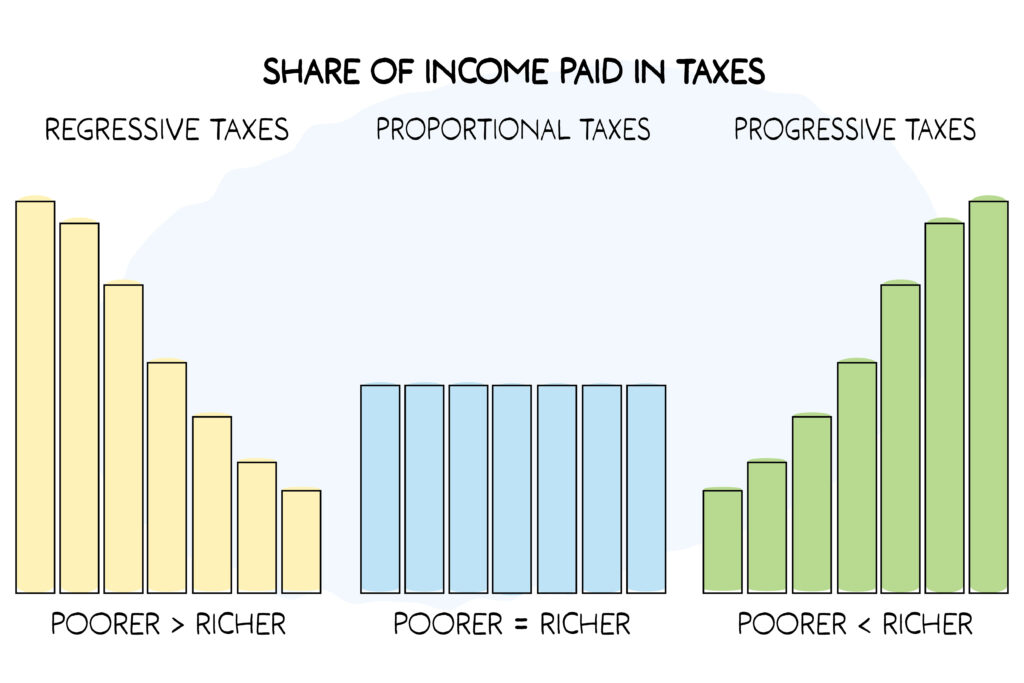

Missouri ostensibly has a progressive income tax structure—meaning that people should pay a gradually larger share of their income as they earn more money. However, over the course of nearly 100 years, Missouri’s income tax has hardly been updated to reflect inflationary trends: its uppermost bracket has hovered around $9,000 since 1931 (in 1931, $9,000 had the purchasing power of nearly $200,000 in 2025). The result is a virtually flat income tax that creates a similar tax level for all income levels—for example, someone earning $9,200 a year pays the same top rate as someone earning $10 million. Missouri’s income tax isn’t perfect, but it is a vital means for lawmakers to fund key services. Instead of destroying the state’s most reasonable source of revenue, which has the ability to levy tax rates based on ability to pay, Missouri lawmakers should focus on reforming the individual income tax by expanding and improving upon its current structure.

These Unaffordable Tax Cuts Are Not for Everyday People

Missouri should choose to invest in its communities by fully funding essential public services instead of giving out regressive tax cuts that will make balancing the budget harder. Missouri invests less in its people than nearly all other states, and that lack of investment in communities was only reinforced when the governor recently vetoed spending on higher education and infrastructure projects.

Missouri is already facing serious budgetary challenges, with an estimated $1 billion revenue shortfall starting in 2027. Lawmakers widened this gap with recent tax cuts, which are already proving to cost the state much more revenue than lawmakers had previously expected. These tax cuts are creating unnecessary problems; in fact, the governor has stated that creating a budget will be notably “challenging” next year. The proposed cuts to come would make it much worse.

For example, the individual income tax accounts for nearly two-thirds of Missouri’s general revenue fund. If it is eliminated, lawmakers would face difficult choices that would certainly involve cutting services and, likely, the need to increase other taxes.

Due to weak income and business taxes, Missouri’s tax system as a whole was already regressive, meaning that lawmakers in Jefferson City demand lower-class and middle-class families pay a larger share of their income in taxes than wealthy families. These new changes made a bad situation worse.

Moreover, these tax cuts do not mean inherently lower taxes. While such policies are sure to reduce taxes paid by wealthier families, the same is not true for working-class Missourians, who could find themselves with a higher effective tax rate after these changes. Public funds need to come from somewhere, and experts agree that eliminating the income tax—one of the state’s largest sources of revenue—creates a funding void that will likely be filled by enacting more regressive taxes. In fact, the governor’s plan could do exactly that by broadening the state’s sales tax base, which means Missourians would then owe more in taxes on the goods and services they purchase in future years. Notably, this hypothetical sales tax increase would come nowhere close to covering the revenue lost from eliminating income taxes. When individual and corporate taxes are abandoned, the data shows an increased reliance on sales and excise taxes, which are overwhelmingly paid by low- and middle-income taxpayers. By pushing the state further down a regressive path, Missouri legislators will provide tax breaks for wealthy families and corporations while possibly raising taxes on everyday working-class families.

Taking a Better Path Forward

Missouri lawmakers can put their residents’ needs first, and they have done so in small but meaningful ways this year. For instance, they created tax credits for those who experienced home damage from natural disasters and expanded circuit breaker property tax credits for senior citizens and disabled veterans. These tax policies work because they offer targeted benefits to those who need it. Unfortunately, this work has been drastically overshadowed by the broad, expensive, and regressive tax changes that likely threaten to underfund valuable services and raise the effective tax rate for the poorest Missourians.

Lawmakers have moved the state further down a road that is becoming increasingly unsustainable and unfair. However, the state’s past does not have to be its future. Missouri’s communities will benefit from preventing and reversing regressive tax changes while seeking policy solutions based on data and economic needs. For example, Missouri could improve its tax system through positive changes, such as undoing the damage of earlier income tax cuts to account for reduced federal funds, creating a refundable child tax credit to combat child poverty, or levying an inheritance tax (or other progressive means) to raise the state revenue needed to meaningfully invest in Missourians. Instead of unnecessary tax cuts, Missouri should consider sensible reforms that have worked across the nation and that will serve all of Missouri’s communities.