Missouri

State Rundown 3/10: Federal Pandemic Aid Means States Can Focus on the Big Picture

March 10, 2021 • By ITEP Staff

State and local policymakers will be preoccupied for a short time with celebrating and deciphering the federal pandemic relief package approved today, but ultimately the federal aid should free them to focus on even bigger concerns such as tax codes that often fail to adequately fund core priorities even in good years and exacerbate the economic and racial inequities that this pandemic has laid bare.

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

State Rundown 1/22: Somewhere Between a Flurry and a Blizzard of State Tax Activity So Far

January 22, 2021 • By ITEP Staff

You won’t find any images of Bernie Sanders and his mittens photoshopped into this week’s Rundown, but you will find the latest news on state fiscal debates, including proposals to generate needed funding by raising taxes on high-income households and profiting businesses in California, Delaware, Hawaii, Maryland, and Washington, as well as misguided efforts to slash taxes in Arizona, Iowa, South Carolina, Utah, and West Virginia. Also in the news are thoughtful improvements to targeted tax credits for families in need in Connecticut and Maryland, harmful obstacles to revenue generation proposed in Nebraska and Wyoming, and renewed hope on the…

State Rundown 1/7: State Work Continues in Shadow of National Events

January 7, 2021 • By ITEP Staff

Though most people’s attention is rightly focused on events unfolding in the nation’s capital this week, state legislative debates are also underway or soon to begin in many states, including proposals to tax the rich in New York and Rhode Island, provide a boost to low-income families in California, and legalize and tax cannabis in Missouri and Rhode Island.

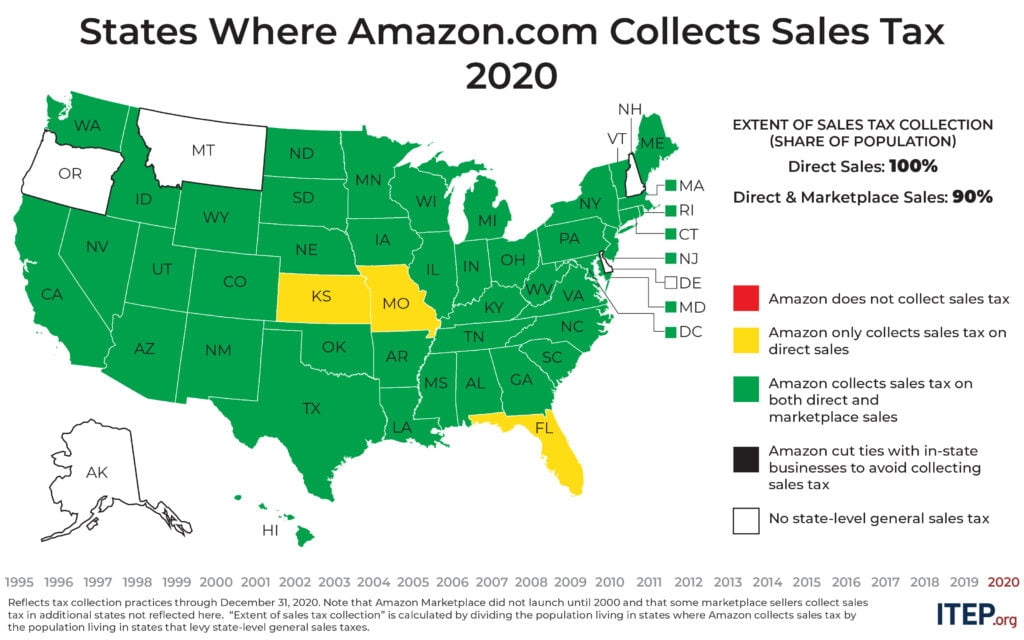

Today, Amazon is collecting state-level sales taxes on all its direct sales but it still usually fails to collect sales tax on the large volume of sales it makes through the Amazon Marketplace. This points to a broader problem in state tax enforcement that lawmakers in many states are moving quickly to address with laws and administrative action requiring tax collection by Amazon and other large online marketplaces such as Etsy and eBay.

State Rundown 12/17: New and Old State Tax Debates Await in 2021

December 17, 2020 • By ITEP Staff

Our last Rundown of 2020 includes news of yet another misguided proposal to eliminate a state income tax, this time in Arkansas. Florida and Missouri, on the other hand, are looking to modernize their tax codes by becoming the last two states to enforce their own sales taxes on online retailers. Leaders in Maryland and Oregon, meanwhile, are working to decouple the state from unnecessary and regressive tax cuts included in the federal CARES Act. And Missouri and Nevada lawmakers both got updated estimates of the revenue shortfalls they will need to resolve when they convene in 2021. The Rundown…

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

This week, voters in Missouri approved Medicaid expansion, Nevada lawmakers moved to amend their Constitution to raise taxes on the state’s mining industry, and leaders in California and New York continued to push for needed revenues through tax increases on their richest households.

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

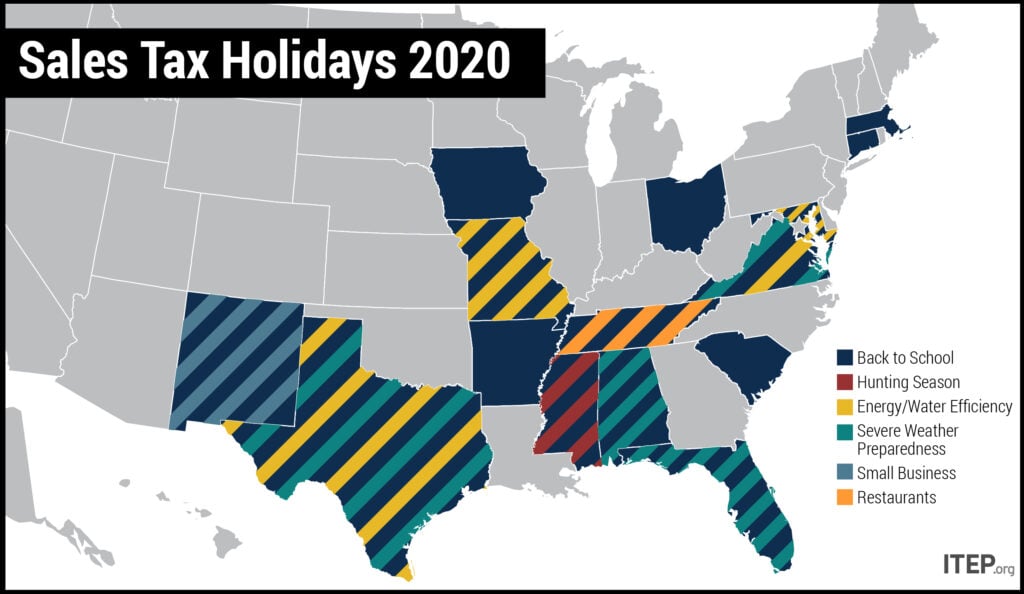

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

A Cautionary Tale on Sales Tax Holidays During a Pandemic

July 29, 2020 • By Dylan Grundman O'Neill

Sixteen U.S. states will hold “sales tax holidays” this year. As ITEP’s newly updated brief explains, these events offer dubious benefits at significant public expense even in normal years, problems which are only amplified in the context of the COVID-19 pandemic.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

State Rundown 4/29: State Responses and Federal Aid Could Be Among “May Flowers” to Come

April 29, 2020 • By ITEP Staff

April has brought relentless showers of troublesome tax and budget news as the COVID-19 pandemic wreaked havoc on communities and the public services and institutions that both support and depend on them. There is hope, however, that these troubles have opened the eyes of policymakers and that May will bring more clarity and strong action in the form of federal fiscal relief as well as home-grown state and local responses.

In different ways, Earth Day and the COVID-19 pandemic convey a similar lesson: people around the world face shared struggles and disparate impacts, which they must work together to overcome through both emergency action and systemic change. In keeping with that lesson, state fiscal policy news this week was strikingly similar around the country, as states take account of the major threat posed by the pandemic to their budgets and attempt to grapple with its disproportionate impacts on communities of color and low-income families.

The full effect of the coronavirus pandemic on state revenue streams remains largely unknown. One key policy option is to reevaluate recent misguided tax cuts—particularly those that have not yet taken full effect and will add to growing revenue shortfalls in the coming years.

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.

State Options to Shore up Revenues and Improve Tax Codes amid Pandemic

April 15, 2020 • By Dylan Grundman O'Neill, Meg Wiehe

The COVID-19 pandemic is an extraordinarily challenging time, as we see harm and struggle affecting the vast majority of our families, businesses, public services, and economic sectors. No one will be unaffected by the crisis, and everyone has a stake in the recovery and faces tough decisions. In the world of state fiscal policy, where revenue shortfalls are likely to be far bigger than can be filled by the initial $150 billion in federal aid or absorbed through funding cuts without causing major harm, tax increases must be among those decisions. Even with more federal support, states will need home-grown…

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

State Rundown 3/26: Pandemic’s Health and Fiscal Fallout Continues to Grow

March 26, 2020 • By ITEP Staff

This week’s Rundown brings you the most useful reading and resources about how states are affected by and responding to the COVID-19 pandemic. These include: landing pages for the most up-to-date lists of state policy responses; ITEP’s own materials on state policy options and the federal response bills; insights on how a race-forward approach can improve these efforts at all levels; updates on state fiscal troubles and legislative postponements; and the developing picture of which states and communities could be affected more than others.

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…