Nebraska

State Rundown 7/6: Tax Policy Keeping Governors Busy from Coast to Coast

July 6, 2023 • By ITEP Staff

From coast to coast, state governors have been busy inking their signature on a growing list of consequential budget and tax bills...

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

Across the country, the marathon budget season has held pace, with a steady stream of bills continuing to cross the finish line...

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

States Looking to Make Property Taxes Affordable Should Turn to ‘Circuit Breakers’

May 11, 2023 • By ITEP Staff

Many state legislatures this year have been considering property tax cuts – but too many are ignoring the solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker."

States are Talking About the Wrong Kind of Property Tax Cuts

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Concerns over property tax affordability have been at the forefront this year as housing prices have climbed and property tax bills have often increased along with them. As lawmakers mull a range of property tax cuts, circuit breakers are the best possible approach—and these policies are receiving far too little attention in the states.

OpenSky Policy Institute: Proposed Property Tax Breaks Benefit Wealthy While Restricting School Revenue

May 11, 2023

The Legislature on Wednesday and Thursday will consider property tax breaks and corresponding income tax cuts that together would restrict the revenue that’s available to fund important programs that all Nebraskans rely on for years to come. Read more.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

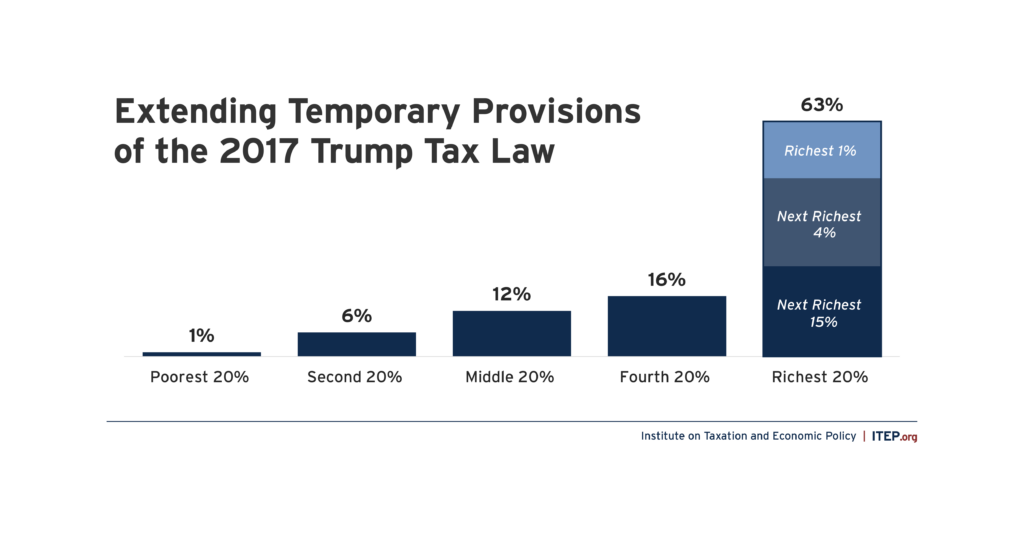

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

This week the importance of state tax policy is center stage once again...

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

OpenSky Policy Institute Webinar: Data Shows Child Tax Credits Benefit Hardworking Families

March 27, 2023

New evidence on child tax credits at the federal level has shown “stunning” results in lifting children out of poverty throughout the country and a state-level policy could continue that momentum, benefiting a broad range of families, panelists including ITEP State Policy Director Aidan Davis said in a February 8 webinar.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

Lured by Promises of Financial Gain, Wealthy Families are Flocking to Voucher Tax Shelters and Eroding Public Education in the Process

March 7, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools, as a new brief released today by the Institute on Taxation and Economic […]

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

OpenSky Policy Institute: Policy Brief: Consumption Tax

March 3, 2023

The consumption tax proposal in LB 79 would require a rate of 22.1 percent to be revenue neutral, OpenSky analysis conducted with the Institute on Taxation and Economic Policy finds. This rate is nearly three times greater than what is proposed in the bill. Further, OpenSky estimates that if the consumption tax were to be […]

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

Yahoo News: Flat Income Taxes: Who Are the Biggest Winners and Losers?

January 25, 2023

From Kansas to Wisconsin to Nebraska, the conversation surrounding a flat tax has picked up as of late, with more state legislators pushing for as much. Read more.